Can I use gap insurance to pay off my loan?

Yes, you can use gap insurance to pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value.

Why didn’t Gap pay off my car?

The most common reasons are a loss that isn’t covered by the policy or that the policy has lapsed. Gap insurance only pays in one situation: After an accident, your car is a total loss and you owe more than it’s worth.

Does gap cover negative equity?

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it’s worth, that negative equity is rolled into your new loan.

How to calculate gap insurance refund?

To calculate how much of a refund you’ll get if you paid for the GAP policy upfront, you divide the total cost of the insurance by the number of months you had coverage—this gives you your monthly premium. Once you know the monthly premium, you can multiply it by the number of months you have left on your policy.

How does gap work after total loss?

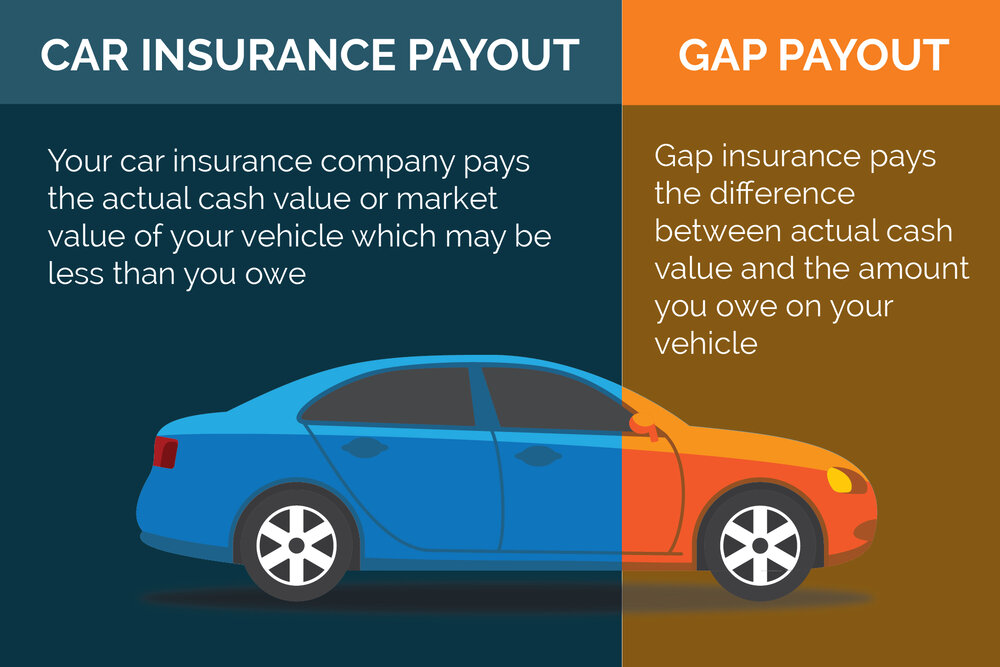

Remember, the answer to how does GAP insurance work after a car is totaled is that it just covers the difference in costs. It doesn’t cover anything else.

What payment does Gap accept?

Mastercard® Credit Card through PayPal or Apple Pay. Rewards Cardmembers with a Gap Inc.

Why would gap insurance deny a claim?

Yes, gap insurance can deny a claim if the claim is for something that is not covered by your gap insurance policy or you’ve missed recent insurance payments. Gap insurance pays for the “gap” between a car’s actual cash value (ACV) and the remaining balance on a loan or lease if the car is stolen or totaled.

Does Gap have a limit?

Some gap insurance policies limit the total amount you can receive. For example, Progressive’s gap insurance policy covers up to 25% of the vehicle’s ACV. It’s possible this gap payout wouldn’t cover the whole loan if your car had depreciated significantly.

Can I use gap insurance to pay off my loan

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance may also be called "loan/lease gap coverage."

Cached

Why didn t Gap pay off my car

The most common reasons are a loss that isn't covered by the policy or that the policy has lapsed. Gap insurance only pays in one situation: After an accident, your car is a total loss and you owe more than it's worth.

Does gap cover negative equity

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it's worth, that negative equity is rolled into your new loan.

How to calculate gap insurance refund

To calculate how much of a refund you'll get if you paid for the GAP policy upfront, you divide the total cost of the insurance by the number of months you had coverage—this gives you your monthly premium. Once you know the monthly premium, you can multiply it by the number of months you have left on your policy.

Cached

How does gap work after total loss

Remember, the answer to how does GAP insurance work after a car is totaled is that it just covers the difference in costs. It doesn't cover anything else.

What payment does Gap accept

Mastercard® Credit Card through PayPal or Apple Pay. Rewards Cardmembers with a Gap Inc.

Why would gap insurance deny a claim

Yes, gap insurance can deny a claim if the claim is for something that is not covered by your gap insurance policy or you've missed recent insurance payments. Gap insurance pays for the “gap” between a car's actual cash value (ACV) and the remaining balance on a loan or lease if the car is stolen or totaled.

Does Gap have a limit

Some gap insurance policies limit the total amount you can receive. For example, Progressive's gap insurance policy covers up to 25% of the vehicle's ACV. It's possible this gap payout wouldn't cover the whole loan if your car had depreciated significantly.

How much is too much negative equity on a car

How much negative equity is too much The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

How do I get out of paying negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

How much refund should I expect from gap insurance

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

How much is the gap refund settlement

Atticus sent Notice of a $59 million class action lawsuit settlement yesterday to more than 654,000 consumers nationwide who entered into Guaranteed Asset Protection or “GAP” agreements with Toyota Motor Corporation (TMCC) from January 1, 2016 through October 25, 2021.

How does gap payment work

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

Can I use all my Gap cash

You can use one GapCash coupon with a single transaction, but there is no limit to how many GapCash coupons you can redeem overall. GapCash is not valid at other Gap Inc. brands, or at our clearance centers.

What credit score do you need for Gap

Although you might qualify for the Gap store card with a credit score in the lower 600s, a higher credit score near the 700s will be required to get approved for the Gap Visa. In comparison, most other rewards credit cards require higher credit scores around the 700s as well.

Which insurance company denies the most claims

WHICH INSURANCE COMPANIES ARE CONSIDERED THE WORSTALLSTATE. Allstate CEO Thomas Wilson admits that his priority is the shareholders—not the insured parties who have claims.PROGRESSIVE.UNITEDHEALTH.STATE FARM.ANTHEM.UNUM.FEDERAL EMPLOYEE BENEFITS.FARMERS.

Why would a gap claim be denied

Yes, gap insurance can deny a claim if the claim is for something that is not covered by your gap insurance policy or you've missed recent insurance payments. Gap insurance pays for the “gap” between a car's actual cash value (ACV) and the remaining balance on a loan or lease if the car is stolen or totaled.

What is the best way to get rid of a car with negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

Does negative equity hurt your credit score

What happens when you have negative equity If you're going to stay in your home long-term and can keep making on-time mortgage payments, negative equity shouldn't impact your credit or affect your finances in any way, really. But if you need to sell your home, it could put you at an economic disadvantage.

Is it possible to get out of an upside down car loan

Refinancing an Upside-Down Loan

Refinancing with a new loan can also get you out of an upside-down car loan. If interest rates are lower than what they were when you took out the original loan, refinancing allows you to pay off the car faster, or at least get some equity.

What is an example of gap insurance refund

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

How does Gap refund work

You'll only receive a refund for the GAP insurance that you haven't used. For example, if you cancel your policy after three months of coverage, you'll only get a refund for the remaining nine months (if you paid for a year of coverage). The amount of your refund is based on how you pay your insurance bill.

Is gap insurance automatically refunded

While you won't get a full refund on your gap insurance policy once your car is paid off, you can get a portion back.

Is Gap Insurance a lump sum

This is typically a lump-sum premium. The dealer pays it for you, and then rolls the premium price into your loan, at your normal rate of interest. Buy it from your own auto insurance company.

How much do I have to spend to redeem Gap cash

Redeem GapCash

| REDEEM OF STORE EARNED GAPCASH IN STORE OR ONLINE | |

|---|---|

| Spend | Redeem |

| $50 – $99.99 | $20 Store Earned GapCash |

| $100 – $149.99 | $40 Store Earned GapCash |

| $150 or more | 40 Store Earned GapCash |