Summary of the Article: What it Means When Your Credit is Locked

A security freeze prevents prospective creditors from accessing your credit file. This freeze, also known as a credit freeze, protects you from others opening accounts in your name.

Creditors are unlikely to offer credit if they cannot access your credit report, so a security freeze is an effective way to prevent unauthorized accounts.

A security freeze can be removed by contacting the credit bureau(s) by mail, phone, or online. It is the quickest and easiest way to unfreeze your credit report.

For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

If you don’t plan on applying for any new credit in the near future and your state doesn’t charge credit freeze fees, a freeze may be a suitable option.

A credit freeze does not impact your credit score or current credit accounts. However, it will affect your ability to qualify for new credit if not thawed before submitting your application.

Keeping an eye on your credit report is a good practice even if you haven’t been a victim of identity theft or fraud.

Questions:

1. What does it mean when your credit is locked?

A security freeze prevents prospective creditors from accessing your credit file, inhibiting the ability to open accounts in your name.

2. How do I remove a lock from my credit report?

To unfreeze your credit report, contact the credit bureau(s) through mail, phone, or online.

3. How long does a credit lock last?

A credit lock remains in place until you request the credit bureaus to remove it, temporarily or permanently. It’s advisable to keep it locked until you plan to apply for credit.

4. Is it beneficial to have your credit file locked?

Locking your credit file can help prevent fraudulent accounts from being opened in your name, particularly if you don’t foresee applying for new credit soon and your state does not charge fees for credit freezes.

5. Does locking your credit hurt your credit score?

A credit freeze has no impact on your credit score or existing credit accounts. However, it may affect your ability to qualify for loans or credit cards if not thawed before applying.

6. Can you be denied if your credit is locked?

A credit freeze prevents lenders from approving credit applications until it is lifted, providing a safe way to protect your credit. However, it is essential to monitor your credit report even if you haven’t been a victim of identity theft or fraud.

What does it mean when your credit is locked

A security freeze prevents prospective creditors from accessing your credit file. Creditors typically won't offer you credit if they can't access your credit reporting file, so a security freeze, also called a credit freeze, prevents you or others from opening accounts in your name.

Cached

How do I remove a lock from my credit report

The quickest and easiest way to unfreeze your credit report is to contact the credit bureau (or bureaus) you used to freeze your credit either online or by phone. But you also have the option to contact them by mail.

How long is a credit lock

How long does a credit lock last As with a credit freeze, your credit lock will remain until you ask the credit bureaus to remove it, either temporarily or permanently. For the best protection, keep your credit lock in place until you are ready to apply for a credit card or loan.

Is it good to have your credit file locked

Locking or freezing your credit file may help prevent criminals from opening fraudulent accounts in your name. If you don't plan on applying for any new credit in the near future and your state doesn't allow credit freezing fees, a freeze may be the way to go.

Cached

Does locking your credit hurt your credit score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Can you get denied if your credit is locked

The Bottom Line

While a credit freeze will prevent lenders from approving your credit applications until you lift it, it's a safe way to protect your credit, particularly if you've been the victim of identity theft or fraud. Even if you haven't, it's still a good idea to keep an eye on your credit report.

Does locking your credit drop your score

A credit freeze won't have any impact on your credit score, nor will it impact your current credit accounts. While a credit freeze won't affect your credit score in any way, it will impact your ability to qualify for a loan or credit card unless you thaw your credit file before submitting your application.

Does locking your credit affect your credit score

You must contact all three credit bureaus to freeze your credit. However, credit freezes are free, you can lift them at any time, and they don't affect your credit score.

What is a major downside of locking your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

What’s the difference between locking and freezing your credit

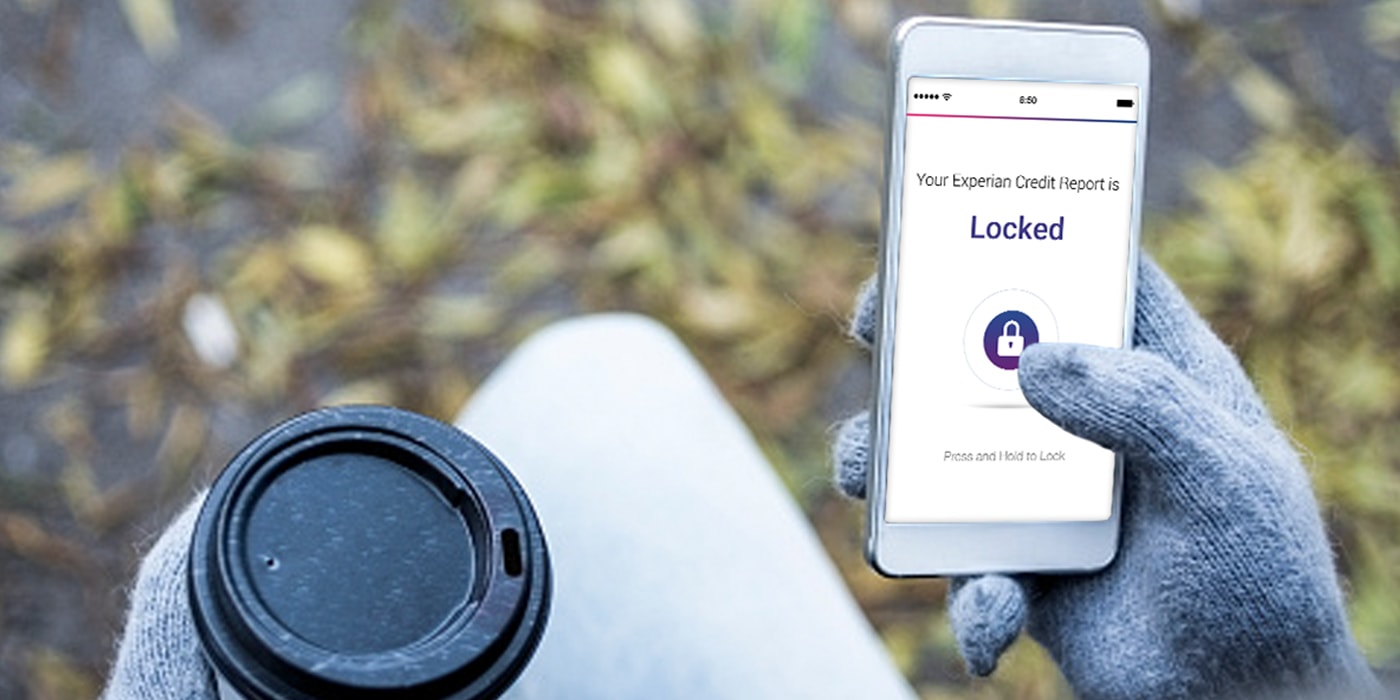

Freezes are free, while CreditLock is part of paid subscriptions. CreditLock can be managed instantly, but security freeze changes could take longer. Unlike a freeze, CreditLock alerts you of attempts to access your locked Experian credit report.

Does it hurt your credit to lock your credit card

Like a credit freeze, a credit lock doesn't hurt your credit. It restricts access to your credit files so no one, including you, can open a new credit account before unlocking them. You'll also need to place locks with each of the three credit-reporting agencies for full protection.

Does locking credit affect score

A credit freeze does not affect your credit score, and it's free. The three major U.S. credit bureaus — Equifax, Experian, and TransUnion — are a source of credit information for other companies.