Summary of the Article: Why Did My Car Insurance Go Up When Nothing Changed?

1. Insurance risk: Insurance companies calculate premiums based on insurance risk. A policy price increase can be due to factors you can or cannot control.

2. Traffic violation: If you have committed a traffic violation, it can result in an increase in your car insurance rates.

3. Auto accident: Being involved in an auto accident can also lead to higher insurance premiums.

4. Ways to Avoid High Car Insurance Premiums:

- Choose car safety and security features.

- Set higher deductibles on your auto insurance.

- Take a defensive driving course.

- Park your car in a garage.

- Compare auto insurance quotes.

- Bundle insurance policies.

- Get good grades.

5. Why Are Michigan Auto Insurance Rates So High?

Michigan is a no-fault state, which means drivers must have personal injury protection (PIP) coverage. This additional required coverage is one of the main reasons insurance premiums in the state are high.

6. Why Did My Auto Insurance Go Up in 2023?

An analysis showed that auto and homeowners insurance premiums in the US lagged behind the inflation rate in 2020 and 2021. This laid the groundwork for the premium increases in 2023.

7. Is It Normal for Car Insurance to Increase Every Year?

It is common for car insurance rates to increase slightly each year, even if you haven’t made any claims or logged any traffic violations.

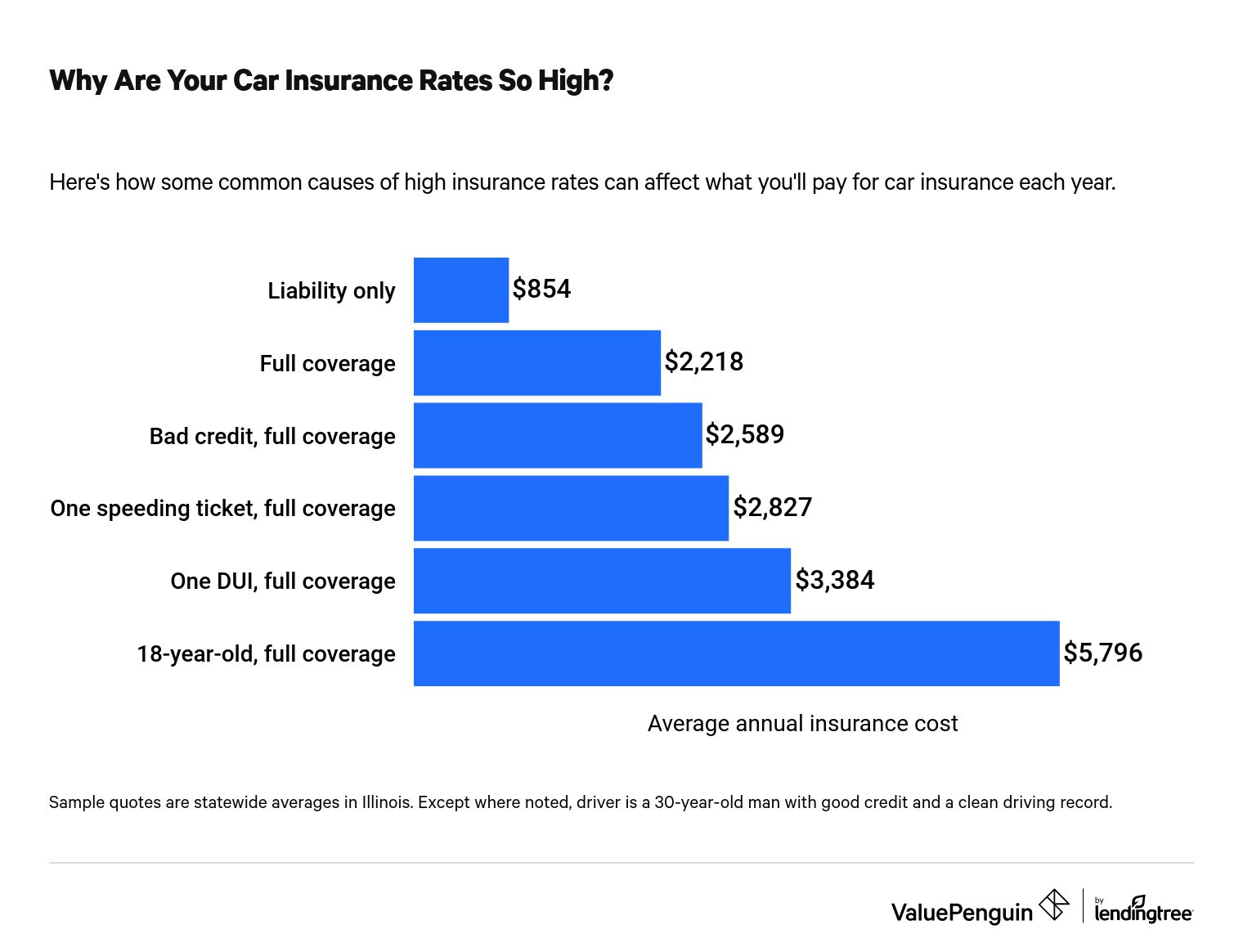

8. Does Credit Score Affect Insurance Rates?

A higher credit score can significantly decrease your car insurance rate. Getting a quote does not affect your credit.

9. Fastest Ways to Lower Car Insurance:

- Increase your deductible.

- Check for discounts you qualify for.

- Compare auto insurance quotes.

- Maintain a good driving record.

- Participate in a safe driving program.

- Take a defensive driving course.

- Explore payment options.

- Improve your credit score.

10. Three Factors That Lower Your Cost for Car Insurance:

- Good driving record

- Vehicle safety features

- Bundling insurance policies

Questions and Answers:

1. Why did my car insurance go up when nothing changed?

Insurance companies determine premiums based on various factors, including your driving history and risks associated with your policy. It’s possible that your car insurance went up due to a traffic violation or previous accidents.

2. How can I avoid high car insurance premiums?

To lower your car insurance premiums, you can choose car safety and security features, set higher deductibles, take a defensive driving course, park your car in a garage, compare quotes, bundle insurance policies, and maintain good grades.

3. Why are auto insurance rates high in Michigan?

Michigan is a no-fault state, which requires drivers to have personal injury protection (PIP) coverage. This additional coverage contributes to higher insurance rates in the state.

4. Why did auto insurance rates increase in 2023?

An analysis by the Insurance Information Institute showed that auto and homeowners insurance premiums were lagging behind the inflation rate in 2020 and 2021. Thus, premium increases occurred in 2023.

5. Is it normal for car insurance to increase every year?

Yes, it is common for car insurance rates to increase slightly each year, even if you haven’t made any claims or had traffic violations. Insurance companies adjust rates based on overall market conditions and other risk factors.

6. Does my credit score affect my insurance rate?

Yes, your credit score can have an impact on your insurance rate. Higher credit scores generally result in lower car insurance rates. However, requesting a quote doesn’t affect your credit.

7. What is the fastest way to lower car insurance?

Some ways to save on car insurance include increasing your deductible, checking for discounts, comparing quotes, maintaining a good driving record, participating in safe driving programs, taking defensive driving courses, exploring payment options, and improving your credit score.

8. What are three factors that lower the cost of car insurance?

A good driving record, vehicle safety features, and bundling insurance policies are three factors that can help lower car insurance costs.

Why did my car insurance go up when nothing changed

Insurance companies calculate premiums based on insurance risk. That means insurance rates do not increase suddenly without reason. A policy price increase can be due to factors you can or cannot control. For instance, you may have committed a traffic violation, or maybe you were involved in an auto accident.

How can you avoid high car insurance premiums

7 easy ways to help lower your car insurance premiumsChoose car safety and security features.Set higher deductibles on your auto insurance.Take a defensive driving course.Park your car in a garage.Compare auto insurance quotes.Bundle insurance policies.Get good grades.

Why are Michigan auto insurance rates so high

Because Michigan is a no-fault state, drivers must have personal injury protection (PIP) coverage, which covers financial losses regardless of who is at fault in an accident. This additional required coverage is one of the main reasons insurance premiums in the state are so high.

Why did my auto insurance go up in 2023

A recent analysis by the Insurance Information Institute (Triple-I) showed that U.S. auto and homeowners insurance premiums lagged behind the inflation rate in 2020 and 2021, laying the groundwork for the premium increases which occurred last year and will continue into 2023.

Is it normal for car insurance to increase every year

If the price you pay for car insurance goes up every year, or even every six months, you're not alone. Even when you haven't made any claims or logged any traffic violations, there's a good likelihood that you are seeing at least a slight increase each year.

Does credit score affect insurance rate

A higher credit score decreases your car insurance rate, often significantly, with almost every insurance company and in most states. Getting a quote, however, does not affect your credit.

What is the fastest way to lower car insurance

Here are some ways to save on car insurance1Increase your deductible.Check for discounts you qualify for.Compare auto insurance quotes.Maintain a good driving record.Participate in a safe driving program.Take a defensive driving course.Explore payment options.Improve your credit score.

What are 3 factors that lower your cost for car insurance

Some factors that may affect your auto insurance premiums are your car, your driving habits, demographic factors and the coverages, limits and deductibles you choose. These factors may include things such as your age, anti-theft features in your car and your driving record.

Is Michigan the highest state for car insurance

Which states have the most expensive car insurance rates Michigan, Rhode Island, Nevada, Florida and New Jersey have the highest car insurance rates. Michigan: Michigan has by far the most expensive car insurance rates in the country. Drivers in Michigan pay an average of $196 a month for minimum coverage.

Why is Michigan a no-fault state

Started in 1973, Michigan's no-fault insurance system was designed to lower costs and speed up payments to doctors by eliminating the need for accident victims to sue the other driver after a crash to get payment for injuries.

Is car insurance going up due to inflation

Inflation drives higher insurance costs

Inflation is a primary culprit in escalating prices or premiums for auto coverage as costs rise for mechanics, other types of labor, repair parts and more. "Really, the numbers come down to inflation," Deventer said.

Is it better to pay car insurance monthly or every 6 months

In general, paying your car insurance premium annually rather than monthly is the cheapest option. Providers incur processing costs if you pay your premium in installments, and those costs get folded into your monthly payment. Most insurers offer a discount if you pay in full because it keeps their costs down.

What is a good credit score for car insurance

A good insurance score is roughly 700 or higher, though it differs by company. You can improve your auto insurance score by checking your credit reports for errors, managing credit responsibly, and building a long credit history.

Does car insurance price depend on credit score

If you've ever applied for a credit card, leased a car or gotten a mortgage for a home, you know that credit scores count. You may be surprised to find out they can also affect your car insurance premiums much the same way your driving record, marital status and payment history can.

Can I ask to lower my car insurance

Auto insurance prices are non-negotiable, so you can't ask your car insurance company to lower your rates. However, there are several ways to find more affordable premiums. Compare quotes from multiple insurers. Although states regulate the cost of car insurance, different companies offer varying rates.

What is one way to lower your insurance costs

Increase your deductible

Depending on your insurance provider, paying a higher deductible (the amount you pay out of pocket before your insurance coverage kicks in, in the event of an incident) is typically a quick and easy way you can make your car insurance payments less expensive.

What are 4 ways to cut your costs for insurance

Listed below are other things you can do to lower your insurance costs.Shop around.Before you buy a car, compare insurance costs.Ask for higher deductibles.Reduce coverage on older cars.Buy your homeowners and auto coverage from the same insurer.Maintain a good credit record.Take advantage of low mileage discounts.

What age does car insurance go down in Michigan

Michigan residents with a good driving record generally see their car insurance premiums drop around age 25, and average rates continue to fall as policyholders age. However, around age 65, you will likely start to see your rates increase again.

What affects car insurance rates in Michigan

Top 8 Factors That Affect Your Auto Insurance In MichiganYour Location. Your location is one of the most important factors that affect your auto insurance.Your Age.Marital Status.Credit History.Vehicle Type.Frequent Use of Car.Your Driving Record.Car Insurance Coverages (and deductibles)

Who pays for car damage in a no-fault state Michigan

1. Collision and Comprehensive Insurance Your no-fault insurance DOES NOT pay for repairs to your car if it is damaged in an accident. If your car is properly parked and hit by another car, the other driver's no-fault coverage will pay for the damage to your car.

Did Michigan get rid of no-fault insurance

Yes, Michigan is still a no-fault state in 2022. The Michigan no-fault law changed initially in July of 2020 and again in July of 2021.

Why did my car insurance go up $100

Auto accidents and traffic violations are common explanations for an insurance rate increasing, but there are other reasons why car insurance premiums go up including an address change, new vehicle, and claims in your zip code.

What is the best way to pay car insurance

Setting up an electronic funds transfer (EFT) is the easiest way to make your car insurance payments. You can also pay with your credit or debit card, or by mailing a check.

Why is Geico only 6 months

The shorter half-year terms allow car insurance companies to re-examine the cost of your coverage and raise it accordingly if you had a vehicle related injury or accident. Basically, they don't want to take the risk and cost of covering for an injury or accident with the possibility of being shortchanged.

What is the highest insurance score

According to Progressive, insurance scores range from 200 to 997, with everything below 500 considered a poor score, and everything from 776 to 997 considered a good score.