Summary of the Article: SOX Compliance

1. SOX compliance applies to all publicly-traded companies in the U.S., including wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. It also regulates accounting firms auditing companies subject to SOX compliance.

2. SOX compliance is an annual obligation derived from the Sarbanes-Oxley Act (SOX). Publicly traded companies doing business in the U.S. are required to establish financial reporting standards, safeguard data, track attempted breaches, log electronic records for auditing, and prove compliance.

3. Privately-held companies are not obligated to comply with SOX reporting requirements. However, they are subject to the penalty and liability provisions.

4. Organizations must conduct a yearly audit of financial statements to comply with the Sarbanes-Oxley Act of 2002 (SOX).

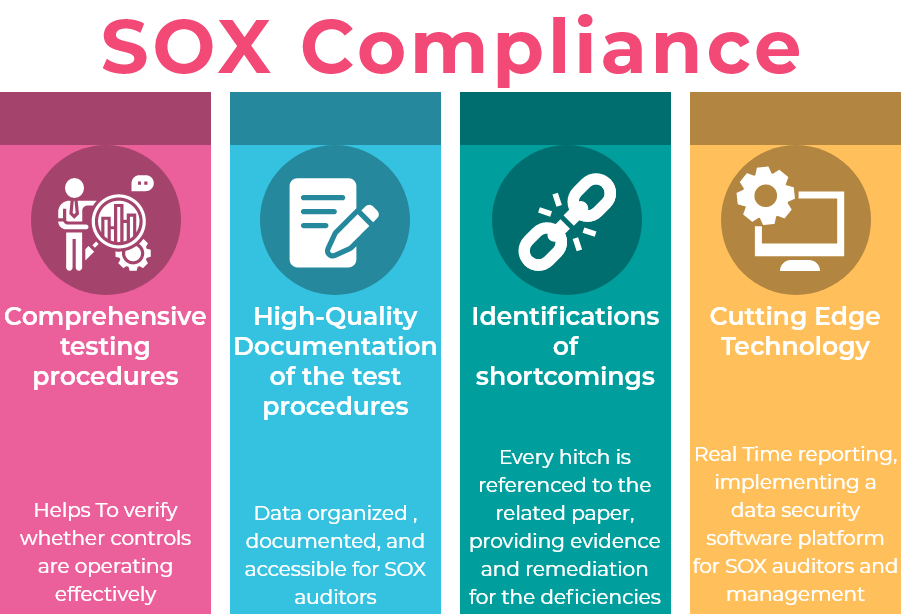

5. SOX control testing can be performed by management, internal audit, external auditors from a public accounting firm, or a combination of these parties. The purpose of control testing is to ensure that controls are working effectively and identify any gaps in the internal control process.

6. The Sarbanes-Oxley Act primarily regulates financial reporting, internal audits, and other business practices at publicly traded companies. However, certain provisions also apply to all enterprises, including private companies and nonprofit organizations.

7. SOX provides exemptions for certain companies, such as nonaccelerated filers or companies with a public float of less than $75 million and emerging growth companies or companies with total annual gross revenues of less than $1 billion in the most recent fiscal year.

8. The Sarbanes-Oxley Act applies to all public companies, regardless of their size. Small companies are not exempt from compliance requirements.

Questions and Answers:

1. Who must comply with SOX compliance?

SOX compliance applies to all publicly-traded companies in the U.S., as well as wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. It also regulates accounting firms auditing companies subject to SOX compliance.

2. Who is SOX a requirement by?

SOX compliance is an annual obligation derived from the Sarbanes-Oxley Act (SOX). It requires publicly traded companies doing business in the U.S. to establish financial reporting standards, safeguard data, track attempted breaches, log electronic records for auditing, and prove compliance.

3. Is SOX compliance mandatory for private companies?

Privately-held companies are not obligated to comply with SOX reporting requirements. However, they are subject to the penalty and liability provisions.

4. Is SOX audit mandatory?

To comply with the Sarbanes-Oxley Act of 2002 (SOX), organizations are required to conduct a yearly audit of financial statements.

5. Who should perform SOX testing?

SOX control testing is typically performed by management, internal audit, external auditors from a public accounting firm, or a combination of these parties. The purpose of control testing is to ensure that controls are working effectively and identify any gaps in the internal control process.

6. What does Sarbanes Oxley apply to?

The Sarbanes-Oxley Act primarily regulates financial reporting, internal audits, and other business practices at publicly traded companies. However, certain provisions also apply to all enterprises, including private companies and nonprofit organizations.

7. Who is exempt from SOX?

SOX provides exemptions for certain companies, including nonaccelerated filers or companies with a public float of less than $75 million, and emerging growth companies or companies with total annual gross revenues of less than $1 billion in the most recent fiscal year.

8. Does SOX apply to small companies?

Yes, the Sarbanes-Oxley Act applies to any public company, regardless of size. Small companies are not exempt from compliance requirements.

Click here for remaining questions and answers

9. Is SOX compliance required outside of the U.S.?

SOX compliance applies to foreign companies that are publicly traded and do business in the United States.

10. What are the consequences of non-compliance with SOX?

Non-compliance with SOX can result in penalties, legal liabilities, reputational damage, and potential loss of investors’ trust.

11. How often should SOX testing be performed?

SOX control testing is typically performed on an annual basis. However, organizations may choose to conduct testing more frequently to ensure continuous compliance.

12. Are there any specific guidelines or frameworks for SOX compliance?

While there are no specific guidelines or frameworks outlined in the Sarbanes-Oxley Act, organizations often refer to industry best practices, such as the COSO framework and COBIT, to guide their SOX compliance efforts.

13. How can companies ensure SOX compliance?

Companies can ensure SOX compliance by implementing robust internal controls, conducting regular audits, maintaining accurate and transparent financial records, and continuously monitoring and evaluating their compliance efforts.

14. Can SOX compliance help prevent financial fraud?

Yes, SOX compliance requirements, such as the establishment of strong internal controls and financial reporting standards, can help detect and prevent financial fraud by promoting transparency and accountability within organizations.

15. Are there any limitations or criticisms of SOX?

Some criticisms of SOX include the perceived high costs of compliance, especially for smaller companies, and the argument that it may stifle innovation and business growth. However, proponents argue that the Act has helped restore investor confidence and improve corporate governance practices.

Who must comply with SOX compliance

Who does SOX compliance apply to SOX applies to all publicly-traded companies in the U.S., in addition to any wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. SOX also regulates accounting firms that audit companies subject to SOX compliance.

Cached

Who is SOX a requirement by

SOX compliance is an annual obligation derived from the Sarbanes-Oxley Act (SOX) that requires publicly traded companies doing business in the U.S. to establish financial reporting standards, including safeguarding data, tracking attempted breaches, logging electronic records for auditing, and proving compliance.

Cached

Is SOX compliance mandatory for private companies

Which Companies Does SOX Apply To All SOX provisions apply to publicly-traded U.S. companies and their auditors. Privately-held companies don't need to comply with the reporting requirements, but they are subject to the penalty and liability provisions.

Is SOX audit mandatory

To comply with the Sarbanes-Oxley Act of 2002 (SOX), organizations are required to conduct a yearly audit of financial statements.

Who should perform SOX testing

SOX control testing is a function performed by either management or internal audit or both, as well as by external auditors from a public accounting firm. SOX control testing is performed to find out if the controls are working as intended or if there are any gaps in the internal control process.

What does Sarbanes Oxley apply to

The Act primarily sought to regulate financial reporting, internal audits and other business practices at publicly traded companies. However, some provisions apply to all enterprises, including private companies and nonprofit organizations.

Who is exempt from SOX

SOX 404 exemption

Recognizing this, SOX provides certain expectations: nonaccelerated filers or companies with a public float of less than $75 million; and. emerging growth companies or companies with total annual gross revenues of less than $1 billion in the most recent fiscal year.

Does SOX apply to small companies

Effect on Small Companies

The Sarbanes-Oxley Act applies to any public company, no matter the size. Because the Act requires a high level of financial reporting and internal auditing, it can place a burden on smaller companies to make sure they are in compliance.

What is the threshold for SOX audit

minimum public float of $75 million. annual revenues of $100 million or more.

Who must comply with SOX 404

all publicly-traded companies

SOX 404 compliance is a necessity for all publicly-traded companies in the United States, in addition to whole-owned subsidiaries and publicly-traded foreign companies that do business in the US.

Why is SOX compliance needed

Making sure that your business is in full SOX compliance should be part of your regular compliance management program. You should have internal control systems in place that will alert you to any mismanagement, just like you have systems in place that alert to data breaches and other data security issues.

Does the Sarbanes-Oxley Act apply to all businesses

All provisions of SOX apply to publicly traded companies headquartered in the United States, as well as wholly-owned subsidiaries and foreign companies that are publicly traded and do business in the United States. SOX also applies to any third parties that a publicly traded company outsource financial work to.

Does the Sarbanes-Oxley Act apply to all companies that

The Sarbanes-Oxley Act applies to publicly traded companies, including both domestic and foreign companies, that are listed on U.S. stock exchanges. It also applies to the accounting firms that audit these companies.

What companies have to follow SOX

Who Must Comply With SOX All publicly-traded companies, wholly-owned subsidiaries, and foreign companies that are publicly traded and do business in the United States must comply with SOX.

Are all public companies required to comply with SOX regulations

SOX compliance refers to annual audits that take place within public companies, within which they are bound by law to show evidence of accurate, secured financial reporting. Public companies are required to comply with SOX both financially and in IT.

What is the applicability of SOX audit

A SOX compliance audit is intended to verify the financial statements of the company, and the processes involved in creating them. During the audit, the financial statements and management of internal controls are analyzed and assessed by an external auditor.

Is SOX compliance mandatory or voluntary

All public companies now must comply with SOX, both on the financial side and on the IT side. The way in which IT departments store corporate electronic records changed as a result of SOX.

What happens if you don’t comply with SOX

Criminal Penalties

Sarbanes-Oxley makes it a crime to defraud shareholders of publicly traded companies through the filing of misleading financial reports. Executives face fines of up to $1 million and ten years imprisonment for knowingly certifying financial reports that don't comply with the SOX's requirements.

What are the 3 types of internal controls in SOX

Internal controls fall into three broad categories: detective, preventative, and corrective.

Does Sarbanes-Oxley only apply to private companies

Since its enactment in 2002, the Sarbanes-Oxley Act (“SOX”) has been widely perceived to regulate only publicly held companies. That perception is not, and has never been, correct. There are some provisions of SOX that expressly apply to privately held companies.

Does Sarbanes-Oxley apply to small companies

Effect on Small Companies

The Sarbanes-Oxley Act applies to any public company, no matter the size. Because the Act requires a high level of financial reporting and internal auditing, it can place a burden on smaller companies to make sure they are in compliance.

Does SOX apply to small public companies

Effect on Small Companies

The Sarbanes-Oxley Act applies to any public company, no matter the size. Because the Act requires a high level of financial reporting and internal auditing, it can place a burden on smaller companies to make sure they are in compliance.

What type of organizations are required to comply with the Sarbanes-Oxley SOX Act

Sarbanes-Oxley Act (SOX) Section 404 mandates that all publicly traded companies must establish internal controls and procedures for financial reporting and must document, test, and maintain those controls and procedures to ensure their effectiveness.

What is the difference between SOX and internal controls

SOX controls, also known as SOX 404 controls, are rules that can prevent and detect errors in a company's financial reporting process. Internal controls are used to prevent or discover problems in organizational processes, ensuring the organization achieves its goals.

What are some SOX controls examples

Following are some examples of commonly performed SOX control activities:Segregation of duties.Authorizations and approvals.Reviews and reconciliations.Safeguarding of assets.Training and supervision.