Which of the following is not covered by renters insurance quizlet

Pay for temporary housing while your home is repaired from covered damage. Which of the following is not covered by renters insurance cost of legal action due to personal liability claims.

Which of the following is typically not covered by standard renter’s insuranceRenters insurance won’t cover car accidents or car theft, even if it happens at your home, nor will it cover liability expenses such as medical bills or repair costs related to a car accident. These will be covered by your auto insurance policy. Cached

Which of the following are covered by renters insuranceRenters insurance typically includes three types of coverage: Personal property, liability, and additional living expenses. Personal property coverage can help pay to replace your belongings if they’re stolen or damaged by a covered risk. Cached

What are 3 examples of things that could occur that renter’s insurance would not coverRenters insurance does not cover: Floods, earthquakes, sinkholes, bed bugs and other pests, damage to your car, your roommate’s possessions.

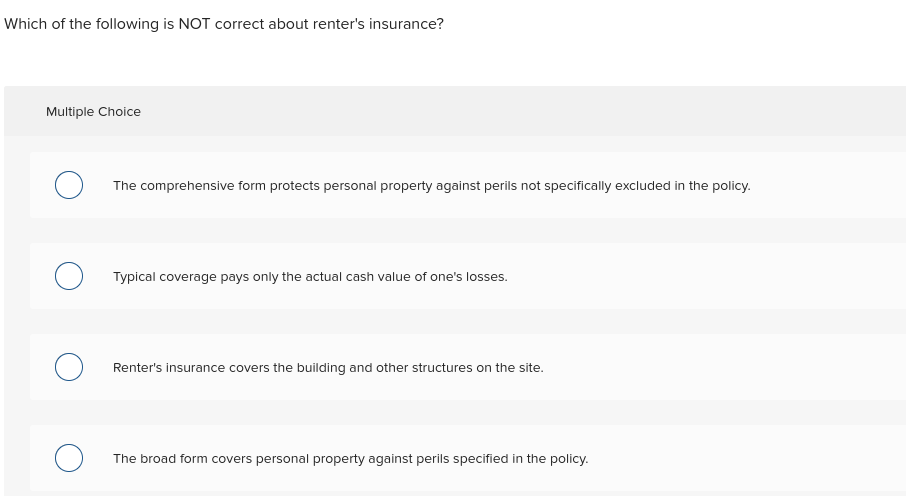

Which of the following is covered by renter’s insurance quizletRenters insurance provides liability insurance and the tenant’s personal property is covered against named perils such as fire, theft, and vandalism.

What is not included in insuranceHealth insurance typically covers most doctor and hospital visits, prescription drugs, wellness care, and medical devices. Most health insurance will not cover elective or cosmetic procedures, beauty treatments, off-label drug use, or brand-new technologies.

Which of the following is not included in property insurance coverageWhat Standard Homeowner Insurance Policies Don’t Cover. Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

What is renters insurance an example ofRenter’s insurance is a form of property insurance that protects tenants who live in a rented dwelling. Policies cover personal property, liability claims, and additional living expenses when a unit is damaged.

What are five things that renters insurance coversWhat renters insurance will cover: Theft and disasters. This is the thing that most people are concerned with. Your expensive collection. Accidents that are your fault. Hotel stays during repairs. Incidents that happen when you’re not home. Floods and earthquakes. Pests. Your car.

What is not insured by property insuranceTermites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won’t be covered.

What type of expense is renters insuranceIf you’re using the standard method, you will be completing Form 8829, “Business Use of Your Home.” Report your renters insurance on line 18 under “indirect expenses.” Then after filling out your form, take the total home office deduction and enter it on line 30 of Schedule C, “Profit or Loss From Business.”

Which of the following is not covered by renters insurance quizlet

pay for temporary housing while your home is repaired from covered damage. Which of the following is not covered by renters insurance cost of legal action due to personal liability claims.

Which of the following is typically not covered by standard renter’s insurance

Renters insurance won't cover car accidents or car theft, even if it happens at your home, nor will it cover liability expenses such as medical bills or repair costs related to a car accident. These will be covered by your auto insurance policy.

Cached

Which of the following are covered by renters insurance

Renters insurance typically includes three types of coverage: Personal property, liability and additional living expenses. Personal property coverage can help pay to replace your belongings if they're stolen or damaged by a covered risk.

Cached

What are 3 examples of things that could occur that renter’s insurance would not cover

Renters insurance does not cover:Floods.Earthquakes.Sinkholes.Bed bugs and other pests.Damage to your car.Your roommate's possessions.

Which of the following is covered by renter’s insurance quizlet

Renters insurance provides liability insurance and the tenant's personal property is covered against named perils such as fire, theft, and vandalism.

What is not included in insurance

Health insurance typically covers most doctor and hospital visits, prescription drugs, wellness care, and medical devices. Most health insurance will not cover elective or cosmetic procedures, beauty treatments, off-label drug use, or brand-new technologies.

Which of the following is not included in property insurance coverage

What Standard Homeowner Insurance Policies Don't Cover. Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

What is renters insurance an example of

Renter's insurance is a form of property insurance that protects tenants who live in a rented dwelling. Policies cover personal property, liability claims, and additional living expenses when a unit is damaged.

What are five things that renters insurance covers

What renters insurance will coverTheft and disasters. This is the thing that most people are concerned with.Your expensive collection.Accidents that are your fault.Hotel stays during repairs.Incidents that happen when you're not home.Floods and earthquakes.Pests.Your car.

What is not insured by property insurance

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered.

What type of expense is renters insurance

If you're using the standard method, you will be completing Form 8829, "Business Use of Your Home." Report your renters insurance on line 18 under "indirect expenses." Then after filling out your form, take the total home office deduction amount to your schedule C.

Which of the following is included in a standard homeowners or renters policy

Both homeowners and renters insurance include personal property, personal liability, additional living expenses and medical payments coverage. Four other types of coverage are included in both homeowners and renters insurance and operate identically for each policy.

Which of the following is not considered to be an insurance expense

Which of the following is NOT considered to be insurer expenses All of these are insurer expenses EXCEPT policy premiums.

What is not a covered benefit

Both private and public health insurance plans can deny coverage for a service on the grounds that it is “not a covered benefit.” This type of denial means that, according to your health insurance plan, your member benefits do not include the requested service and you are responsible to pay for the service.

Which of the following is not an insurance

Lending of funds is not a function of insurance. It is a function of banks. Was this answer helpful

Which of the following would be covered under a renters insurance policy quizlet

Renters insurance provides liability insurance and the tenant's personal property is covered against named perils such as fire, theft, and vandalism.

What is renters insurance property

Renters insurance protects your personal property in a rented apartment, condo or home from unexpected circumstances such as theft, a fire or sewer backup damage – and will pay you for lost or damaged possessions. It can also help protect you from liability if someone is injured on your property.

What are four things not covered by homeowners insurance

Standard homeowners insurance policies typically do not include coverage for valuable jewelry, artwork, other collectibles, identity theft protection, or damage caused by an earthquake or a flood.

What are exclusions in property insurance

A property insurance policy exclusion is a provision contained within your policy language that explicitly declares that certain types of loss will not be covered by your policy. Essentially, the “exclusions” contained within your policy are the exceptions to the general statement of property insurance coverage.

What is included in insurance expense

What is Insurance Expense Insurance expense is that amount of expenditure paid to acquire an insurance contract. This expense is incurred for all insurance contracts, including property, liability, and medical insurance.

What is deductible for renters insurance

Your renters insurance deductible is the amount of money you pay to repair or replace your possessions before your insurance funds kick in. If you ever file a claim for your belongings, your insurance company subtracts your deductible from the amount of money it pays to cover these expenses.

What are 2 things not covered in homeowners insurance

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered.

What is amount not covered on insurance

Charge (Also Known as Billed Charges): The amount your provider billed your insurance company for the service. Not Covered Amount: The amount of money that your insurance company did not pay your provider.

What are non covered services

Definition of Non-covered Charges

In medical billing, the term non-covered charges refer to the billed amount/charges that are not paid by Medicare or any other insurance company for certain medical services depending on various conditions. Filing claims for non-covered charges are likely to result in denial of claims.

Which of the following is not part of an insurance contract quizlet

The issuance of a policy is not part of the consideration of an insurance contract.