by certified mail? While sending a dispute letter by certified mail is not mandatory, it is highly recommended. Certified mail provides proof of delivery, ensuring that the credit bureaus receive your letter. It is also advisable to request a “return receipt,” which serves as further evidence that your letter was received. Although certified mail can be more costly and time-consuming, it can potentially lead to better results in resolving your dispute.

How do I file a dispute with TransUnion by mail

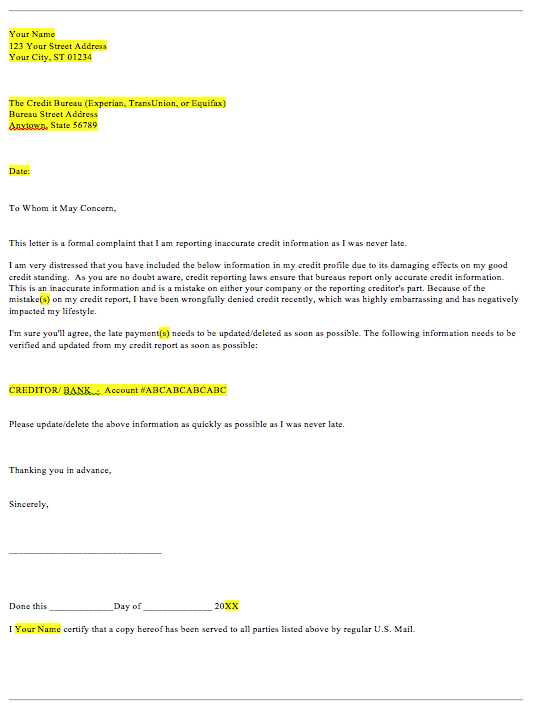

To complete a dispute by mail, provide as much of the following information as possible:Personal Information: Name, DOB, Address, SSN.Name of company that reported the item you're disputing and the partial account number (from your credit report)Reason for your dispute.

Cached

Where do I send my credit dispute letter

Here are the mailing addresses for each credit bureau:Equifax. P.O. Box 7404256. Atlanta, GA 30374-0256.Experian. Dispute Department. P.O. Box 9701. Allen, TX 75013.TransUnion. Consumer Solutions. P.O. Box 2000. Chester, PA 19022-2000.

Cached

How do I send a dispute letter in the mail

Send your letter by certified mail with “return receipt requested,” so you can document that the credit bureaus got it. Keep your original documents. Include copies of the documents that support your request and save copies for your files. I am writing to dispute the following information in my file.

Who do I mail my dispute letter to

Where to mail your dispute letter. You'll need to send a dispute letter to the credit bureau whose credit report shows the error or issue in question. Not every issue appears on all three credit reports because not every lender reports to all three bureaus.

What is the mailing address for TransUnion credit bureau

The address for TransUnion is P.O. Box 1000, Chester, PA 19022. Under federal law, consumers are entitled to receive a copy of their credit report from all three agencies every 12 months, and can obtain a free copy by calling 877-322-8228.

How long does TransUnion take to resolve a dispute

Once your mail is received, it can take up to 30 days to resolve your dispute.

Do sending dispute letters work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Do you have to send dispute letters certified mail

Okay can you send every dispute letter by certified mail. Yes is certified mail expensive. And time consuming yes will you get better results by sending every letter by certified mail. No not even a

How do I send a dispute to the credit bureau

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

How do I dispute an inquiry on TransUnion

What do I do if I see an inquiry I don't recognize on my credit reportContact the lender directly to ask them about the inquiry. If they find it was made in error, ask them to inform the credit reporting agencies.If the lender finds the inquiry was made fraudulently, report it to the FTC.

What happens when you raise a dispute with TransUnion

Once we have received your dispute, along with any supporting evidence we've requested*, we'll begin our investigation and make any amendments where found necessary. You will receive an outcome within 28 days of the dispute being raised.

Does raising a dispute with TransUnion affect credit score

Disputing credit report inaccuracies doesn't affect your credit, but some changes made in response to disputes can help your credit scores. The removal of inaccurate late payments, new-credit inquiries or bankruptcies could result in credit score increases.

Is it better to dispute by phone or by mail

Each of the major credit bureaus (Experian, Equifax, and Trans Union) allow consumers to dispute information on their credit report by phone. Disputing by phone has the advantage of being a quicker and sometimes easier process than writing a dispute letter.

Is it better to dispute online or by mail

Ultimately, online disputes are fine for supplementing the credit repair process but, they should not be used as the cornerstone of your credit repair strategy. Make sure that you mail dispute letters detailing the incorrect information and the reasons for the removals.

Is it better to dispute by mail

Reminder: When they don't fix the error and you have the proof, you need to force them to fix it and pay you damages IF you send your dispute certified mail. If you dispute your credit reports online, you make it difficult to enforce the law, and it slows you down.

Can you put a certified letter in the mailbox

Do I have to be present at a Post Office to send Certified Mail No, as long as you affix the proper Certified Mail Forms and the correct amount of postage, you can have a USPS mail carrier pick up your Certified Mail mailpiece or drop it in a mailbox.

What happens after you send a dispute letter to credit bureau

After completing its investigation, the lender or creditor may provide its response, along with any information updates, to the credit bureau with which you initiated your dispute. That bureau will then notify you of the investigation response within 30 days of your dispute request.

How long does TransUnion dispute processing take

30 days

Once your mail is received, it can take up to 30 days to resolve your dispute.

How long does a TransUnion dispute take

Most dispute investigations at TransUnion are complete within two weeks, but some may take up to 30 days. If you don't agree with the results, it may be a good idea to contact the lender directly and provide any documentation you have to support your claim.

What is the most effective way to dispute a credit report

Dispute the information with the credit reporting companyContact information for you including complete name, address, and telephone number.Report confirmation number, if available.Clearly identify each mistake, such as an account number for any account you may be disputing.Explain why you are disputing the information.

How much does it cost to mail a certified letter through USPS

$3.30 with the USPS, and $8.99 with Mailform. Once you've decided to send USPS Certified Mail, you have a couple of ways to send it: You can head to the post office, and select Certified Mail as an option for your letter or package. Done this way, it costs about $3.35.

Does certified mail have to be picked up at the post office

What Happens If You Don't Pick Up Certified Mail Failing to pick up certified mail after the first and second warning is not a crime. However, your item will be sent back to the sender so, if you want it, you should pick it up as soon as humanly possible.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

How do I file a credit dispute and win

You'll likely need to fill out a dispute form and provide supporting documentation that helps prove an error was made. If your dispute is accepted, follow up to make sure the credit bureau and the business that supplied the incorrect information update their records accordingly.

What is the cheapest way to send a certified letter

You can head to the post office, and select Certified Mail as an option for your letter or package. Done this way, it costs about $3.35. You can use Mailform, and send USPS Certified Mail from the comfort of your home.