Summary of the Article: Excellent FICO Scores and their Benefits

A FICO score between 580-669 is considered fair, 670-739 is good, 740-799 is very good, and 800 and above is excellent. An excellent credit score of 810 allows you to qualify for various financial products such as credit cards, personal loans, auto loans, and mortgages. With an 810 credit score, you have a higher chance of approval but other factors like income and debt obligations are considered as well.

Individuals with an 810 credit score can benefit from credit cards with no annual fees, no foreign transaction fees, sign-up bonuses, and 0 percent financing offers. Additionally, they are more likely to be approved for high credit limits. The average interest rate for credit cards with an 810 credit score is around 13.5 percent.

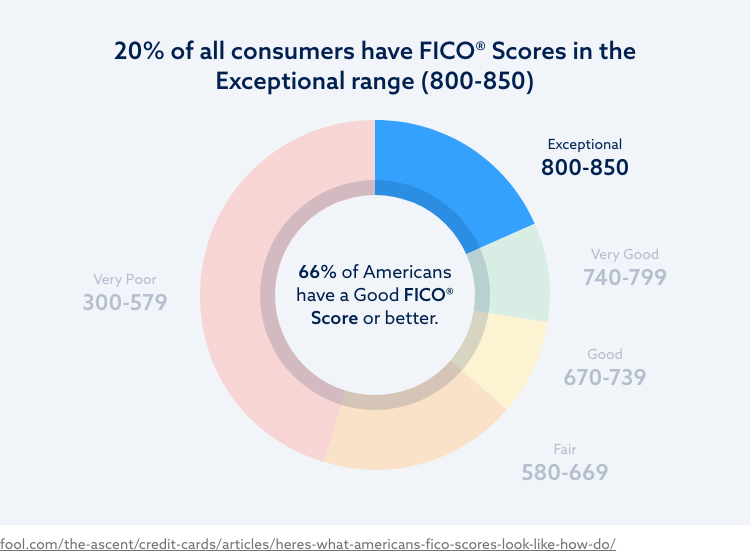

An 800 credit score is considered excellent, offering the same advantages as a perfect credit score. Approximately 21 percent of all consumers have achieved an excellent credit score, compared to only 1.6 percent with a perfect 850 credit score.

While it is rare, about 1.3% of consumers have achieved a perfect 850 credit score. The average credit score was 714 as of 2021. An 800 credit score falls within the exceptional range, with 21% of all consumers having FICO Scores in this range. Only 23% of the scorable population has a credit score of 800 or above.

To increase a credit score from 810 to 850, it is suggested to pay credit card bills frequently and maintain a low credit utilization ratio. Additionally, it is important to avoid opening new credit accounts unnecessarily and consistently monitor credit reports for any inaccuracies.

10 Key Points:

- A FICO score from 800 to 850 is considered excellent.

- An excellent credit score allows you to qualify for various financial products.

- With an 810 credit score, you are likely to receive credit cards with no annual fees and high credit limits, as well as lower interest rates.

- An 800 credit score offers the same advantages as a perfect credit score.

- About 1.3% of consumers have a perfect 850 credit score.

- Approximately 21% of all consumers have achieved an excellent credit score.

- An 800 credit score falls within the exceptional range.

- Only 23% of the scorable population has a credit score of 800 or above.

- To increase a credit score from 810 to 850, it is suggested to pay credit card bills frequently and maintain a low credit utilization ratio.

- Consistently monitoring credit reports for any inaccuracies is important.

15 Unique Questions:

1. What is considered an excellent FICO score?

Generally, a FICO score between 800 and 850 is considered excellent.

2. What are the benefits of having an 810 credit score?

With an 810 credit score, you can qualify for the best credit cards, personal loans, auto loans, and mortgages.

3. What interest rate can you expect with an 810 credit score?

On average, you can expect an interest rate of 13.5 percent on credit cards with an 810 credit score.

4. What is considered a FICO score of 800?

A FICO score of 800 is considered excellent and offers the same advantages as a perfect credit score.

5. How rare is an 850 FICO score?

Approximately 1.3% of consumers have a perfect 850 credit score.

6. What percentage of the population has an 800+ credit score?

About 23% of the scorable population has a credit score of 800 or above.

7. How can you increase a credit score from 810 to 850?

To increase your credit score, it is recommended to pay credit card bills frequently and maintain a low credit utilization ratio.

8. What factors contribute to a credit score?

Factors such as payment history, credit utilization, length of credit history, types of credit, and new credit applications contribute to a credit score.

9. Is it possible to have a credit score higher than 850?

No, the maximum credit score is 850.

10. Can an 810 credit score guarantee approval for all financial products?

While an 810 credit score increases your chances of approval, other factors such as income and debt obligations are also considered.

11. What are some advantages of a high credit limit?

A high credit limit allows for greater purchasing power and can help with emergencies or large expenses.

12. Does having an excellent credit score mean lower interest rates on all loans?

While an excellent credit score can result in lower interest rates, other factors like the specific loan and lender’s terms also come into play.

13. What are the potential benefits of no annual fee credit cards?

No annual fee credit cards help save money as you won’t have to pay an annual fee for using the credit card each year.

14. Why is it important to monitor credit reports for inaccuracies?

Monitoring credit reports helps identify any errors or fraudulent activity that may negatively impact your credit score and financial well-being.

15. Can a person with an 800 credit score still be denied credit?

Yes, other factors such as income, debt obligations, and the lender’s specific requirements can still lead to a credit application being denied, even with an 800 credit score.

What is considered an excellent FICO score

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Cached

What is the benefit of having a 810 credit score

With an 810 credit score, you are well-positioned to qualify for any financial product, from the best credit cards and personal loans to the best auto loans and mortgages. An 810 credit score doesn't guarantee you approval, however, because your income and existing debt obligations matter, too.

Cached

What interest rate can you get with 810 credit score

810 credit score credit card options

You may be approved for cards with no annual fees, no foreign transaction fees, sign-up bonuses and even 0 percent financing. Additionally, you'll be approved for incredibly high credit limits. On average, you can expect to have an interest rate of 13.5 percent on your credit card.

Cached

What would a FICO score of 800 be considered *

Just getting your credit score over 800, officially an excellent credit score, gives you the same advantages and benefits that come with a perfect credit score. Experian reports that 21 percent of all consumers have achieved excellent credit, compared to just 1.6 percent with a perfect 850 credit score.

Does anyone get an 850 FICO score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

What percentage of population has over 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How to increase credit score from 810 to 850

Tips to Perfect Your Credit ScorePay your credit card bills often.Keep a solid payment history.Consider your credit mix.Increase your credit limit.Don't close old accounts.Regularly monitor your credit report.Only apply for credit when you really need it.

What percentage of the population has a FICO score over 810

Your 810 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

What percentage of people have a credit score of 800

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How common is an 850 FICO score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

What percentage of people have FICO score above 800

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

What will an 800 credit score get me

An 800-plus credit score shows lenders you are an exceptional borrower. You may qualify for better mortgage and auto loan terms with a high credit score. You may also qualify for credit cards with better rewards and perks, such as access to airport lounges and free hotel breakfasts.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

How to go from 850 to 900 credit score

7 ways to achieve a perfect credit scoreMaintain a consistent payment history.Monitor your credit score regularly.Keep old accounts open and use them sporadically.Report your on-time rent and utility payments.Increase your credit limit when possible.Avoid maxing out your credit cards.Balance your credit utilization.

Why is it so hard to get a credit score of 850

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How rare is an 850 FICO score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

Is it rare to have an 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How hard is it to get a 850 FICO score

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

How rare is a 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Do people actually have a 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

How to go from 800 to 900 credit score

7 ways to achieve a perfect credit scoreMaintain a consistent payment history.Monitor your credit score regularly.Keep old accounts open and use them sporadically.Report your on-time rent and utility payments.Increase your credit limit when possible.Avoid maxing out your credit cards.Balance your credit utilization.

What percentage of the population has a credit score over 800

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.