Summary of the Article: Credit Scores

1. How rare is a 810 credit score?

An 810 credit score is considered very good. Only 21% of U.S. consumers have a credit score of 800 or higher, while the national average credit score is 714 (Experian).

2. What will an 810 credit score get me?

Having a credit score of 810 will generally qualify you for a lender’s best interest rates. For example, the average 30-year fixed mortgage interest rate was 6.583% for homebuyers with a FICO credit score of 760 or higher (late October 2022).

3. How rare is a 800 credit score?

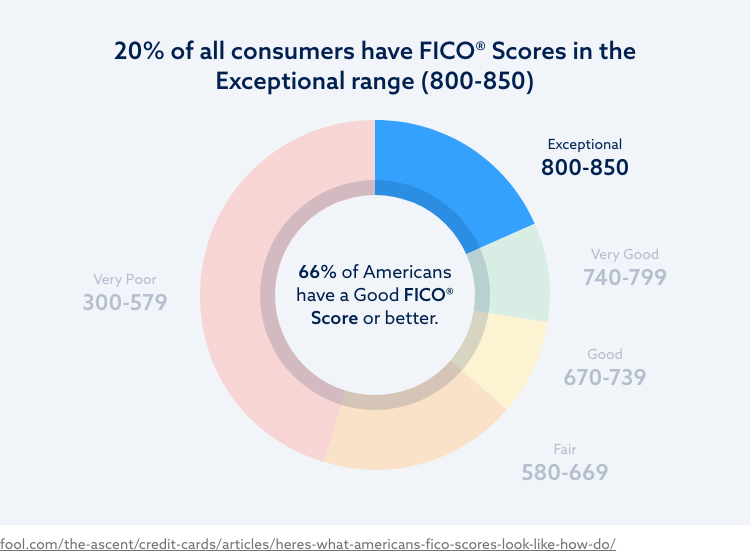

Only 23% of the scorable population has a credit score of 800 or above (FICO).

4. How much of the population has a 850 credit score?

Achieving a perfect 850 credit score is rare but not impossible. Approximately 1.3% of consumers have a credit score of 850 (Experian).

5. How rare is a 900 credit score?

Having a credit score of 900 is extremely rare. Only about 1% of people have a credit score of 850, so a 900 credit score is considered fairly unrealistic.

6. Does anyone have an 840 credit score?

An 840 FICO® Score is categorized as “Exceptional” within the range of scores from 800 to 850. This score is well above the average credit score, and approximately 21% of all consumers have FICO® Scores in the Exceptional range.

7. How rare is an 840 credit score?

Similar to the previous question, an 840 FICO® Score is classified as “Exceptional.” Approximately 21% of all consumers have FICO® Scores in the Exceptional range.

8. Why is it so hard to get an 800 credit score?

Having a long credit history accounts for 15% of your credit score. Negative, minimal, or no credit history can make it difficult to reach an 800 credit score. To address this issue, focus on building your credit by obtaining a credit-builder loan or applying for your first credit card.

9. Question:

Answer.

10. Question:

Answer.

11. Question:

Answer.

12. Question:

Answer.

13. Question:

Answer.

14. Question:

Answer.

15. Question:

Answer.

How rare is a 810 credit score

An 810 credit score is considered very good. In fact, just 21% of consumers in the U.S. have a credit score of 800 or higher. By comparison, the national average credit score is 714, according to Experian.

What will an 810 credit score get me

A credit score of 810 will generally qualify you for a lender's best interest rates. As a real-world example, the average 30-year fixed mortgage interest rate was just over 7% as of late October 2022. However, the average rate paid by a homebuyer whose FICO credit score was 760 or higher was 6.583%.

Cached

How rare is a 800 credit score

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

How much of the population has 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

Does anyone have an 840 credit score

Your 840 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is an 840 credit score

Your 840 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Why is it so hard to get a 800 credit score

Since the length of your credit history accounts for 15% of your credit score, negative, minimal or no credit history can stop you from reaching an 800 credit score. To solve this problem, focus on building your credit. You can do this by taking out a credit-builder loan or applying for your first credit card.

Why is it so hard to get a credit score of 850

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How hard is it to get a 850 FICO score

According to FICO, about 98% of “FICO High Achievers” have zero missed payments. And for the small 2% who do, the missed payment happened, on average, approximately four years ago. So while missing a credit card payment can be easy to do, staying on top of your payments is the only way you will one day reach 850.

How many people have an 825 credit score

21% of all consumers have FICO® Scores in the Exceptional range.

How rare is 830 credit score

Your score falls in the range of scores, from 800 to 850, that is considered Exceptional. Your FICO® Score and is well above the average credit score. Consumers with scores in this range may expect easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What will an 800 credit score get me

An 800-plus credit score shows lenders you are an exceptional borrower. You may qualify for better mortgage and auto loan terms with a high credit score. You may also qualify for credit cards with better rewards and perks, such as access to airport lounges and free hotel breakfasts.

How to go from 850 to 900 credit score

7 ways to achieve a perfect credit scoreMaintain a consistent payment history.Monitor your credit score regularly.Keep old accounts open and use them sporadically.Report your on-time rent and utility payments.Increase your credit limit when possible.Avoid maxing out your credit cards.Balance your credit utilization.

Is there a difference between 800 and 850 credit score

A Perfect Credit Score Might Not Offer Any Extra Benefits

Still, the higher your credit score, the better your chances of locking in lower interest rates – with one caveat. Lenders generally don't distinguish between a score of 800 and 850.

Is it hard to get 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

Does anyone have a 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

Will I ever get an 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”

How powerful is a 800 credit score

Your 800 FICO® Score falls in the range of scores, from 800 to 850, that is categorized as Exceptional. Your FICO® Score is well above the average credit score, and you are likely to receive easy approvals when applying for new credit. 21% of all consumers have FICO® Scores in the Exceptional range.

How rare is an 820 credit score

Membership in the 800+ credit score club is quite exclusive, with fewer than 1 in 6 people boasting a score that high, according to WalletHub data.

Has anyone got 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

What is the highest credit score ever recorded

850

If you've ever wondered what the highest credit score that you can have is, it's 850. That's at the top end of the most common FICO® and VantageScore® credit scores.