Fannie Mae and Freddie Mac are government-sponsored enterprises (GSEs) that were created by Congress to provide liquidity, stability, and affordability to the mortgage market.

To determine if your loan is owned or guaranteed by Fannie Mae or Freddie Mac, you can contact your servicer (usually your bank or lender) or visit their respective websites: Fannie Mae’s loan lookup website is www.KnowYourOptions.com/loanlookup, and Freddie Mac’s website is www.freddiemac.com/mymortgage.

The requirements for a loan to be eligible for Fannie Mae or Freddie Mac include a debt-to-income (DTI) ratio of up to 43% or 50% in some cases, a credit score of at least 640 or 620 in some cases, and a down payment as low as 3%. Additionally, there should be no recent major derogatory credit factors, such as foreclosure, short sale, bankruptcy, or repossession.

Fannie Mae does not originate mortgage loans or lend money directly to borrowers. Instead, it purchases mortgage loans made by lenders, which allows those lenders to offer more mortgage loans to people.

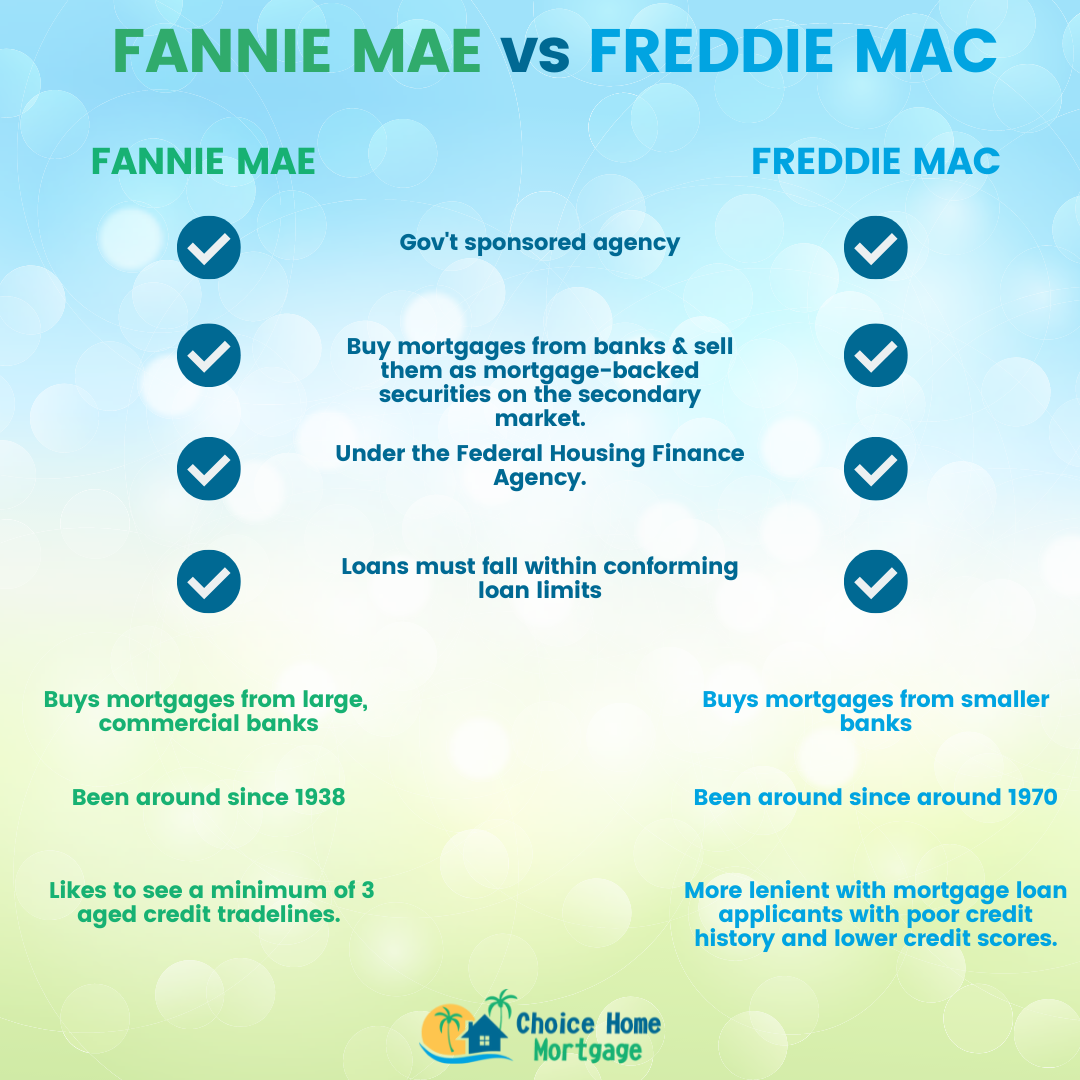

The primary difference between Freddie Mac and Fannie Mae is the types of lenders they source their mortgages from. Fannie Mae buys mortgages from larger, commercial banks, while Freddie Mac buys them from smaller banks.

To qualify for a Freddie Mac loan, the owner/investor of your loan must be Fannie Mae or Freddie Mac, it is for low-income borrowers, your DTI ratio must be 65% or less, you have to be current on your mortgage, it must be a 1-unit primary residence, and your loan must be a certain age.

Not all loans go through Fannie Mae. For Fannie Mae and Freddie Mac to be able to resell loans, they need to meet certain requirements or “guidelines” to be considered safe investments.

The purpose of Freddie Mac is to provide stability and liquidity to the mortgage market, primarily by purchasing mortgage loans from lenders and packaging them into mortgage-backed securities for investors.

Who or what are Fannie Mae and Freddie Mac and why are they so important

Fannie Mae and Freddie Mac were created by Congress. They perform an important role in the nation's housing finance system – to provide liquidity, stability and affordability to the mortgage market.

Cached

How do I know if my loan is Fannie Mae or Freddie Mac

We encourage you to contact your servicer (often your bank or lender) to verify that your mortgage loan is owned or guaranteed by Fannie Mae or Freddie Mac, or you may verify it yourself by accessing the following websites: Fannie Mae www.KnowYourOptions.com/loanlookup, Freddie Mac www.freddiemac.com/mymortgage.

What are requirements for Fannie Mae or Freddie Mac

Fannie Mae and Freddie Mac RequirementsDebt-to-income (DTI) ratio as high as 43% or 50% in some cases.Credit score of at least 640 or 620 in some cases.Down payment as low as 3%No recent major derogatory credit factors, such as foreclosure, short sale, bankruptcy or repossession.

Cached

What exactly does Fannie Mae do

Fannie Mae is a leading source of mortgage financing in the United States. We don't originate mortgage loans or lend money directly to borrowers. Instead, we purchase mortgage loans made by lenders, who are then able to use those funds to offer mortgage loans to more people.

Why choose Freddie Mac over Fannie Mae

The primary difference between Freddie Mac and Fannie Mae is the types of lenders they source their mortgages from. Fannie Mae buys mortgages from larger, commercial banks, while Freddie Mac buys them from much smaller banks.

Who qualifies for a Freddie Mac loan

There are several requirements:The owner/investor of your loan has to be Fannie Mae or Freddie Mac.This is for low-income borrowers.You need to have a DTI ratio of 65% or less.You have to be current on your mortgage.This must be a 1-unit primary residence.Your loan has to be a certain age.

Do all loans go through Fannie Mae

Fannie Mae is happy to buy mortgages from lenders — but not every mortgage. For Fannie Mae and Freddie Mac to be able to re-sell loans, they need to be considered safe investments. That means each mortgage must meet certain requirements or “guidelines.”

What is the purpose of Freddie Mac

Freddie Mac was chartered by Congress in 1970 to keep money flowing to mortgage lenders in support of homeownership and rental housing. Our statutory mission is to provide liquidity, stability and affordability to the U.S. housing market.

What is the minimum income for Fannie Mae

Fannie Mae sets the HomeReady income limits for borrowers nationwide. To qualify, you can't make more than 80% of your area's median income (AMI). That means if your area has a median yearly income of $100,000, you must make $80,000 or less to qualify for the HomeReady program.

What credit score do you need for Fannie Freddie

The minimum representative credit score is 620. Manually underwritten loans: Higher of 620 representative credit score or average median credit score, as applicable, or the minimum representative credit score required by the variance.

What are the benefits of a Fannie Mae loan

Pros of Fannie Mae Loans ExplainedQualification Guidelines Designed To Help More People Buy Homes.Low Down Payment Loan Options.Accepts Nontraditional Income Sources.Offers Different Types of Loans To Meet Your Needs.Mortgage Insurance Can Be Canceled.Possible Mortgage Insurance.Possible Income Limits.

Why did Fannie Mae fail

They loaded up on subprime, interest-only, or negative amortization mortgages—loans more typical of banks and unregulated mortgage brokers. Fannie and Freddie made things worse by their use of derivatives to hedge the interest-rate risk of their portfolios.

What are the benefits of a Freddie Mac loan

Advantages of the Freddie Mac SBL ProgramFlexible loan sizes, starting at just $750,000 and going up to $7.5 million.Low interest rates, starting from just 4.51%High leverage, up to 80% LTV.Generous DSCR minimums, as low as 1.20x.30-year amortizations, keeping payments low for borrowers.

What credit score do you need for Freddie Mac

620

The Mortgage must have a minimum Indicator Score of 620. If no Borrower has a usable Credit Score, then the Mortgage does not have an Indicator Score and is not eligible for delivery to Freddie Mac.

What credit score do you need for Fannie Mae

620

The minimum representative credit score is 620. Manually underwritten loans: Higher of 620 representative credit score or average median credit score, as applicable, or the minimum representative credit score required by the variance.

What is the minimum credit score for Fannie Mae Freddie Mac

620

Because Fannie Mae has a minimum qualifying credit score of 620, this should help more clients qualify together on the loan, allowing for the use of all incomes to determine what they can afford. This also helps clients who are still working on their credit but may be applying with a co-signer.

What is the max loan amount for Fannie Freddie

Maximum Baseline Loan Amount for 2023

| Units | Contiguous States, District of Columbia, and Puerto Rico | Alaska, Guam, Hawaii, and the U.S. Virgin Islands |

|---|---|---|

| 1 | $726,200 | $1,089,300 |

| 2 | $929,850 | $1,394,775 |

| 3 | $1,123,900 | $1,685,850 |

| 4 | $1,396,800 | $2,095,200 |

How much of a down payment do I need for a Fannie Mae loan

Down payment.

You'll need at least a 3% down payment for Fannie Mae's HomeReady® and standard loan programs for a single-family home, as long as it's a primary residence. The programs allow gift funds from family members if you don't have the money saved up.

Why do lenders sell loans to Fannie Mae

It provides liquidity to the mortgage market by buying loans conforming to certain standards from banks and other loan originators, thus enabling lenders to make new loans with the proceeds from the sale. Fannie Mae then issues securities backed by pools of these mortgages that it sells to capital markets.

Is Fannie Mae for poor people

What Is Fannie Mae Fannie Mae is a government-sponsored enterprise (GSE) that purchases mortgage loans from smaller banks or credit unions and guarantees, or backs, these loans on the mortgage market for low-to-median income borrowers.

What is the minimum credit score for Freddie Mac

620

The Mortgage must have a minimum Indicator Score of 620. If no Borrower has a usable Credit Score, then the Mortgage does not have an Indicator Score and is not eligible for delivery to Freddie Mac.

What is the minimum credit score for Fannie Mae

620

Because Fannie Mae has a minimum qualifying credit score of 620, this should help more clients qualify together on the loan, allowing for the use of all incomes to determine what they can afford.

What is the minimum mortgage amount for Fannie Mae

Fannie Mae does not have a minimum original loan amount requirement for either whole loan mortgages or MBS mortgages. For additional information, see B2-1.5-01, Loan Limits.

What is the Fannie Mae income limit

Fannie Mae sets the HomeReady income limits for borrowers nationwide. To qualify, you can't make more than 80% of your area's median income (AMI).

What is the minimum house size for Fannie Mae

Fannie Mae does not specify minimum size or living area requirements for properties with the exception of manufactured housing (see B4-1.4-01, Factory-Built Housing: Manufactured Housing).