Is it worth getting identity theft protection?

According to the FTC, there were $5.9 billion in losses due to fraud in 2021, with identity theft being the most common type of fraud. Identity theft protection and insurance can protect you from this costly fraud. It is especially worth considering if you want to ensure your accounts are well-monitored.

How much does LifeLock cost after 1 year?

After the first year, LifeLock plans cost $124.99 per year. If you choose to pay monthly, it is $8.99 per month for the first year and renews at $11.99 per month. To get the best value for identity theft protection services, it is recommended to compare plans.

How much does LifeLock really cost?

The cost of LifeLock depends on the plan you choose. Here are the pricing details:

– Individual (Ultimate Plus): $34.99 per month or $339.99 per year

– Couple (Ultimate Plus): $69.99 per month or $679.99 per year

– Family (Ultimate Plus): $79.99 per month or $799.99 per year

Is Norton 360 with LifeLock worth it?

Norton 360 with LifeLock is considered the best overall identity theft protection suite. While it may seem expensive, especially at higher tiers, its comprehensive protection and time-tested track record make it worth considering. The prices are comparable to similar services, which is why it is our Editors’ Choice for identity theft protection.

What is the average cost of identity theft protection?

The average cost of identity theft protection varies depending on the provider, level of protection, and plan type. Generally, these services range from around $10 to $30 per month. Annual plans for individuals and families can cost between $150 and $350 per year.

Does identity theft ruin your credit?

Unfortunately, being a victim of identity theft can negatively impact your credit scores. This is because thieves may open new lines of credit or credit cards in your name and fail to pay the bills, leading to damage to your credit.

What is the downside of LifeLock?

One downside of LifeLock is that only one credit bureau is monitored with the first three plans. To monitor all three credit bureaus, you will need to subscribe to the most expensive plan. Additionally, not all companies report to all three bureaus, which means there could be fraud that you’re not made aware of.

Is LifeLock good or bad?

LifeLock is not the most affordable identity theft protection service on the market. However, it offers a range of features and has a history of providing protection. Ultimately, whether LifeLock is good or bad depends on your individual needs and budget. It is recommended to compare different services before making a decision.

Is it worth getting identity theft protection

The FTC reported $5.9 billion in losses due to fraud in 2021, and the most common type of fraud was identity theft. Identity theft protection and insurance can protect you from this common, costly type of fraud, and it makes even more sense if: You want to make sure your accounts are well-monitored.

How much does LifeLock cost after 1 year

After the first year, your plan will cost $124.99 per year. If you choose to pay monthly for your subscription, it is $8.99 per month for the first year and renews at $11.99 per month. Money Saving Tip: Get the best value for identity theft protection services by comparing plans.

How much does LifeLock really cost

How Much Does LifeLock Cost

| Individual – Ultimate Plus » Couple – Ultimate Plus » Family – Ultimate Plus » | ||

|---|---|---|

| Monthly Cost | ||

| $34.99 | $69.99 | $79.99 |

| Annual Price | ||

| $339.99 | $679.99 | $799.99 |

Cached

Is Norton 360 with LifeLock worth it

Best Overall Identity Theft Protection

It looks expensive, especially at the higher tiers, but its identity theft protection is comprehensive and time-tested, and its prices are in line with similar services. That makes Norton 360 With LifeLock Select our Editors' Choice suite for identity theft protection.

Cached

What is the average cost of identity theft protection

The average cost of identity theft protection hinges on the provider, level of protection, and plan type. Generally, these services range from around $10 to $30 per month. Annual plans for both individuals and families may cost $150–$350 per year.

Does identity theft ruin your credit

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills.

What is the downside of LifeLock

Downsides. Only one credit bureau is monitored with the first three plans. You have to pony up and pay for the most expensive plan to monitor all three credit bureaus. Since not all companies report to all three bureaus, there could be fraud that you're not made aware of.

Is LifeLock good or bad

Here's the bottom line: LifeLock certainly isn't the most affordable identity theft protection service on the market and its history is far from clean. However, if you are willing to spend the money and let the past go, LifeLock offers a comprehensive monitoring service as well as identity theft insurance.

What is the LifeLock controversy

LifeLock was fined $12 million by the Federal Trade Commission in March 2010 for deceptive advertising. The FTC called the company's prior marketing claims misleading to consumers by claiming to be a 100% guarantee against all forms of identity theft.

What are the pros and cons LifeLock

LifeLock Pros & ConsPROS:CONS:Standard: $8.99/mo. As the cheapest plan available, this plan monitors one credit bureau and provides up to $25,000 reimbursement for stolen funds.Advantage: $17.99/mo.Ultimate Plus: $23.99/mo.Not comprehensive credit monitoring.Cost is expensive.No family plan.

Who does Dave Ramsey recommend for identity theft protection

Zander Insurance

Zander Insurance is RamseyTrusted.

It means that they're the only company Dave and the entire Ramsey team recommend for identity theft protection. Zander has faithfully served our fans for over two decades and will do whatever it takes to help you win. They offer the coverage you need and nothing you don't.

What is not covered in an identity theft policy

What does identity theft insurance not cover It's important to note that these insurance policies typically don't cover stolen money or direct financial losses from fraudulent purchases and other unauthorized use of credit accounts. They typically reimburse you only for the costs of the reporting and recovery process.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do I lock my Social Security number

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).

Is LifeLock really worth it

There are a few areas where LifeLock stands out among its competitors, but there are also some areas where its products are lacking. LifeLock has one of the best money-back guarantees that we have found in the business, with a full 60 days to try their annual plans before you commit to an entire year of service.

Is there a better option than LifeLock

myFICO. myFICO is a credit and identity monitoring solution that allows you to monitor credit reports from all three bureaus and view your FICO scores. With three-bureau reports, you can view side-by-side comparisons of your credit reports from each credit provider, helping you identify any suspicious activity.

What insurance company does Dave Ramsey endorse

Zander Insurance

Zander Insurance Is RamseyTrusted

That's right—RamseyTrusted. And it's a big deal. It means that Zander is the only company Dave and the entire Ramsey team recommend for term life insurance.

What is the best defense against identity theft

11 ways to prevent identity theftFreeze your credit.Safeguard your Social Security number.Be alert to phishing and spoofing.Use strong passwords and add an authentication step.Use alerts.Watch your mailbox.Shred, shred, shred.Use a digital wallet.

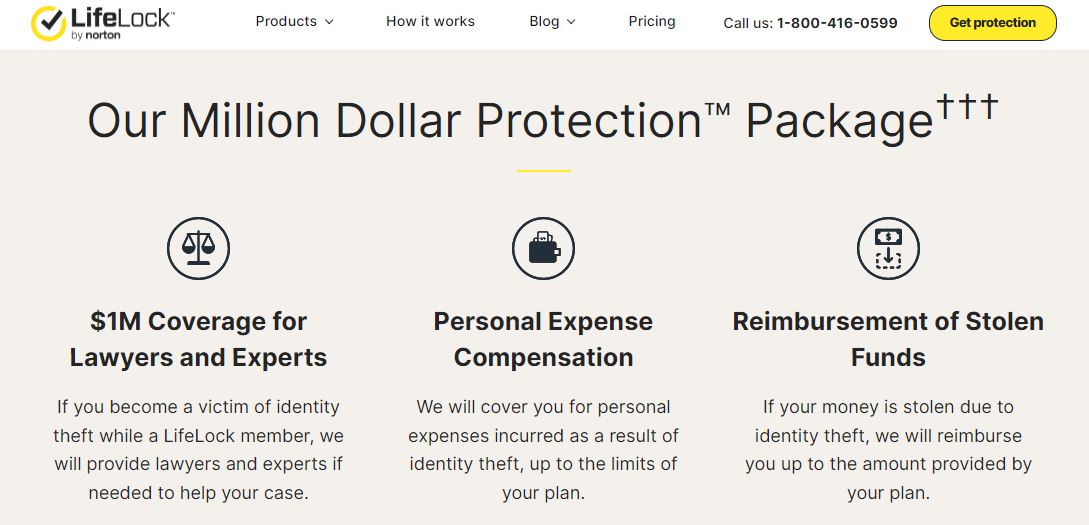

What is a 1000000 insurance reimbursement policy

If you do become a victim of identity theft, the $1 Million Identity Theft Insurance policy will reimburse you for covered expenses associated with restoring your identity.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

How do I protect my social security number from being used

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

Does locking your SSN prevent identity theft

Self Lock helps protect you from employment-related identity fraud. Self Lock is the unique feature that lets you protect your identity in E-Verify and Self Check by placing a "lock" in E-Verify on your Social Security number (SSN). This helps prevent anyone else from using your SSN for an E-Verify case.

How to know if someone is using your Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

Is LifeLock being sued

Under the terms of the FTC's 2015 settlement with the company, LifeLock agreed to pay $100 million—$68 million of which was set aside to provide refunds to consumers who were part of a class action lawsuit that made similar allegations to the ones outlined in the FTC's complaint.

What life insurance does Dave Ramsey not like

When it comes to whole life insurance, “It's not a mild dislike,” said Dave Ramsey in a recent episode of “The Ramsey Show,” where he's offered financial advice since 1992. “I hate it.” Why the disdain for whole life when so many Americans invest in it