The article discusses various aspects of credit reports and identity theft. Here is a summary of the key points:

1. D on Experian credit report: D represents ‘Default,’ which is recorded when a credit agreement breaks down due to sustained arrears. Defaulted accounts are removed from the Credit Report after six years.

2. Impact of reporting identity theft on credit score: Being a victim of identity theft can negatively impact credit scores. Thieves may open new lines of credit in your name and fail to pay the bills.

3. Time to fix credit after identity theft: It can take days, months, or even years to untangle identity theft. The recovery timeline depends on various factors, including the type of identity theft.

4. Information included in a credit report: Credit reports contain personal information, credit account history, credit inquiries, and public records. This information is reported by lenders and creditors.

5. Definition of D credit rating: A D credit rating is given to borrowers who are not of investment grade and indicates a high degree of risk. It implies that the company has already defaulted on its debts.

6. Meaning of credit class D: A credit score between 550 and 629 falls under subprime credit, categorized as grade D.

7. Security measures and credit freeze: While a credit freeze can provide some protection, it cannot safeguard against all forms of identity theft. Criminals can still obtain personal information and engage in various fraudulent activities.

8. Reporting identity theft on Experian: Experian will work with you to investigate fraudulent information on your credit report. A 7-year fraud victim alert, requiring a police report, can be issued.

Now, here are some unique questions based on the text:

1. How long does it take for a default to be removed from a credit report?

2. Can identity theft affect your ability to get loans or credit cards in the future?

3. What are some common signs that someone may be a victim of identity theft?

4. How can credit card companies and lenders help in resolving identity theft cases?

5. Are there any legal consequences for the perpetrators of identity theft?

6. Is it possible to prevent identity theft completely?

7. What steps can I take to protect my credit after experiencing identity theft?

8. Can a credit monitoring service help in detecting identity theft?

9. What are the potential financial implications of identity theft?

10. Are there any government agencies or organizations that provide assistance to identity theft victims?

Now, let’s provide detailed answers for each question:

1. The default will be removed from the credit report after six years from the date of default.

2. Yes, identity theft can have a significant impact on your ability to obtain loans or credit cards in the future. It can damage your credit history and make lenders hesitant to approve your applications.

3. Some common signs of identity theft include unauthorized charges on your credit cards, unfamiliar accounts or loans in your name, receiving bills or collection notices for debts you don’t owe, and unusual activity on your bank statements.

4. Credit card companies and lenders play a crucial role in resolving identity theft cases. They can help investigate fraudulent activities, close compromised accounts, and assist in recovering stolen funds.

5. Perpetrators of identity theft can face legal consequences, including criminal charges and imprisonment, depending on the severity of the offense and local laws.

6. While it may not be possible to prevent identity theft completely, you can take preventive measures such as safeguarding personal information, using secure online practices, regularly monitoring your credit reports, and employing identity theft protection services.

7. To protect your credit after experiencing identity theft, you should report the incident to the relevant authorities, contact the credit bureaus to place fraud alerts or freezes on your credit reports, monitor your accounts and credit reports regularly, and update your passwords and security measures.

8. Yes, credit monitoring services can help detect potential instances of identity theft. They provide real-time alerts for any changes or suspicious activities on your credit reports.

9. The financial implications of identity theft can be severe. It can result in monetary losses, damage to your credit score and history, increased interest rates on loans, difficulty in obtaining new credit, and the need for legal assistance to resolve the issues.

10. Yes, there are various government agencies and organizations that provide assistance to identity theft victims. Examples include the Federal Trade Commission (FTC), which offers resources and support through their IdentityTheft.gov website, and local law enforcement agencies that can help investigate the crime.

This summarizes the key points of the article and provides detailed answers to the unique questions.

What does D mean on Experian credit report

D represents 'Default', which is recorded once the lender believes that the credit agreement has broken down, usually due to a sustained period of arrears. A default is also a form of account closure, meaning that defaulted accounts will be removed from your Credit Report once six years pass from date of default.

Does reporting identity theft hurt your credit score

Could it hurt my credit scores Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills.

Cached

How long does it take to fix credit after identity theft

"It can take days, months, or even years to untangle identity theft," says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

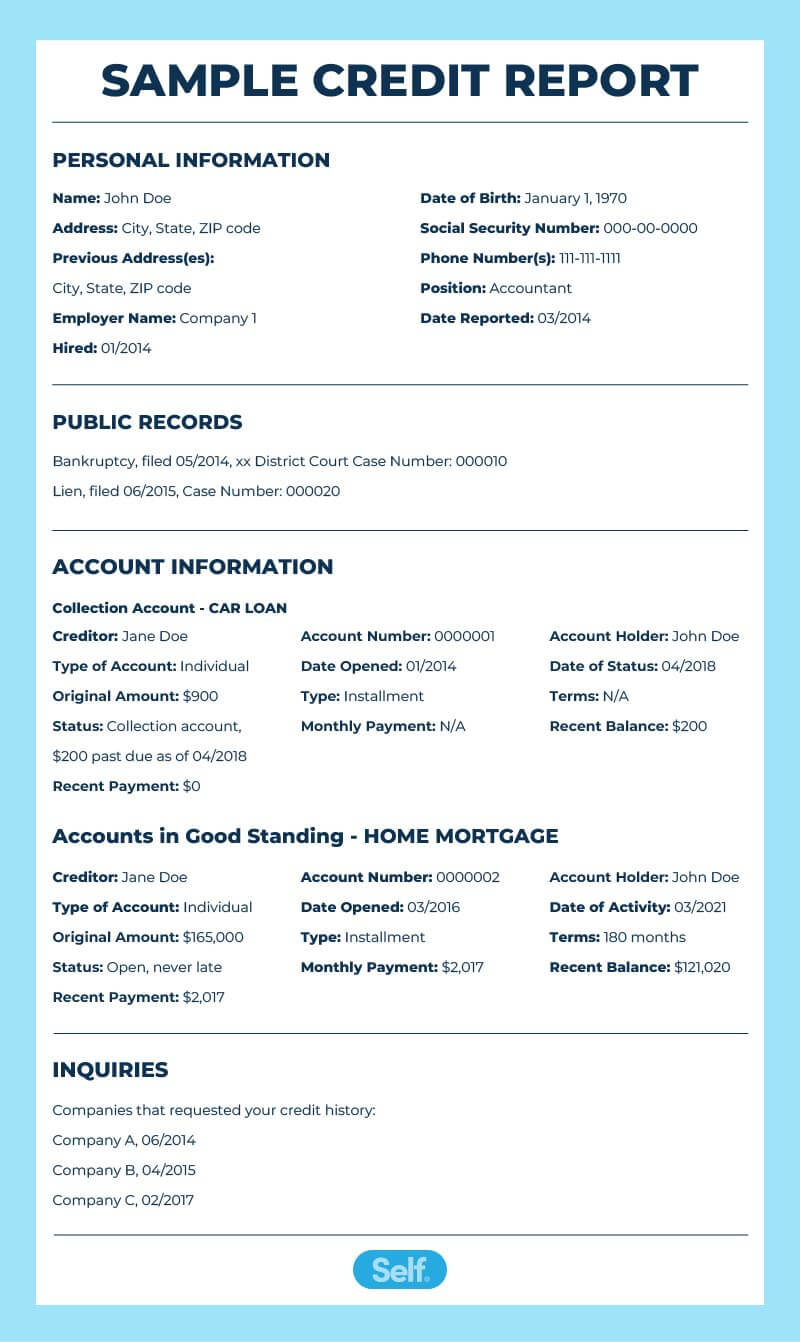

What 3 types of information would be included on a credit report

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus.

Cached

What is D credit rating

What is a D credit rating A credit rating given to a prospective borrower that's not of investment grade and implies the highest degree of risk, since the company in question has already defaulted on its debts.

What is credit class D

Grade D. If have a credit score between 550 and 629, you have subprime credit.

Can someone steal your identity if your credit is locked

But a credit freeze alone can't protect you from everything. A criminal could still obtain your Social Security number or driver's license information, steal your tax refund, take out loans in your name, or hijack other accounts. Scammers may also reach out by email, calls, and texts.

What happens when you report identity theft on Experian

Experian will work with you to investigate the fraudulent information on your credit report. Also known as an extended fraud victim alert, a 7-year fraud victim alert requires that you must be a victim and provide a police report.

Do you have to pay back debt from identity theft

Identity Theft. If you've been the victim of identity theft, you can take steps to reclaim your good name and restore your credit. To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt.

What to do immediately after identity theft

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts. The fraud department at your credit card issuers, bank, and other places where you have accounts.

What are 2 things that are not included on a credit report

Your credit report does not include your marital status, medical information, buying habits or transactional data, income, bank account balances, criminal records or level of education. It also doesn't include your credit score.

What are the five kinds of information found on a credit report

Information about credit that you have, such as your credit card accounts, mortgages, car loans, and student loans. It may also include the terms of your credit, how much you owe your creditors, and your history of making payments.

Is D on a report card bad

D – this is still a passing grade, and it's between 59% and 69% F – this is a failing grade.

What does D rating mean

TV Parental Guidelines may have one or more letters added to the basic rating to let parents know when a show may contain violence, sex, adult language, or suggestive dialogue. D – suggestive dialogue (usually means talks about sex) L – coarse or crude language. S – sexual situations. V – violence.

What is credit score D and B

This information is represented by a rating known as the Dun and Bradstreet credit rating or D&B rating. A D&B rating is broken down into two segments to provide accurate and fair information on companies. These two parts indicate the financial strength of the company and the company's composite credit appraisal.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do I clear my credit report after identity theft

If you've been a victim of identity theft, you can also get credit reporting companies to remove fraudulent information and debts from your credit report, which is called blocking. To do this, you must send the credit reporting companies: An identity theft report, which can be done through IdentityTheft.gov.

How can I find out if someone is using my identity

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

How do you check if your identity has been stolen

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

How do I get rid of collections due to identity theft

The best way to do this is to go to the police with an "identity theft report" that you have already prepared. You can create an identity theft report through the FTC's website. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports.

How do you repair your credit after identity theft

Fix any records of criminal activity or bankruptcy.Call any affected companies where fraud has occurred.Contact your credit card company and cancel all affected cards.Place a fraud alert with all three credit bureaus.Dispute incorrect information on your credit report.Close any other new accounts opened in your name.

What are 3 steps to take after identity has been stolen

If you suspect you may be a victim of identity theft, complete these tasks as soon as possible and document everything you do.Call your bank and other companies where fraud occurred.Contact a credit agency to place a fraud alert.Create an Identity Theft Affidavit.File a report with your local police department.

What are 2 things that hurt your credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

What are the three most common credit reporting errors

Here are three of the most common types of credit report errors and the steps you should take to address them.Incorrect Accounts.Account Reporting Mistakes.Inaccurate Personal Information.What to Do When You Discover a Credit Report Error.Get Help From a Credit Report Lawyer Today.

What are 4 types of common information on your credit report

Each credit report has four basic categories: identity, existing credit information, public records and recent inquiries.