Summary of the Article

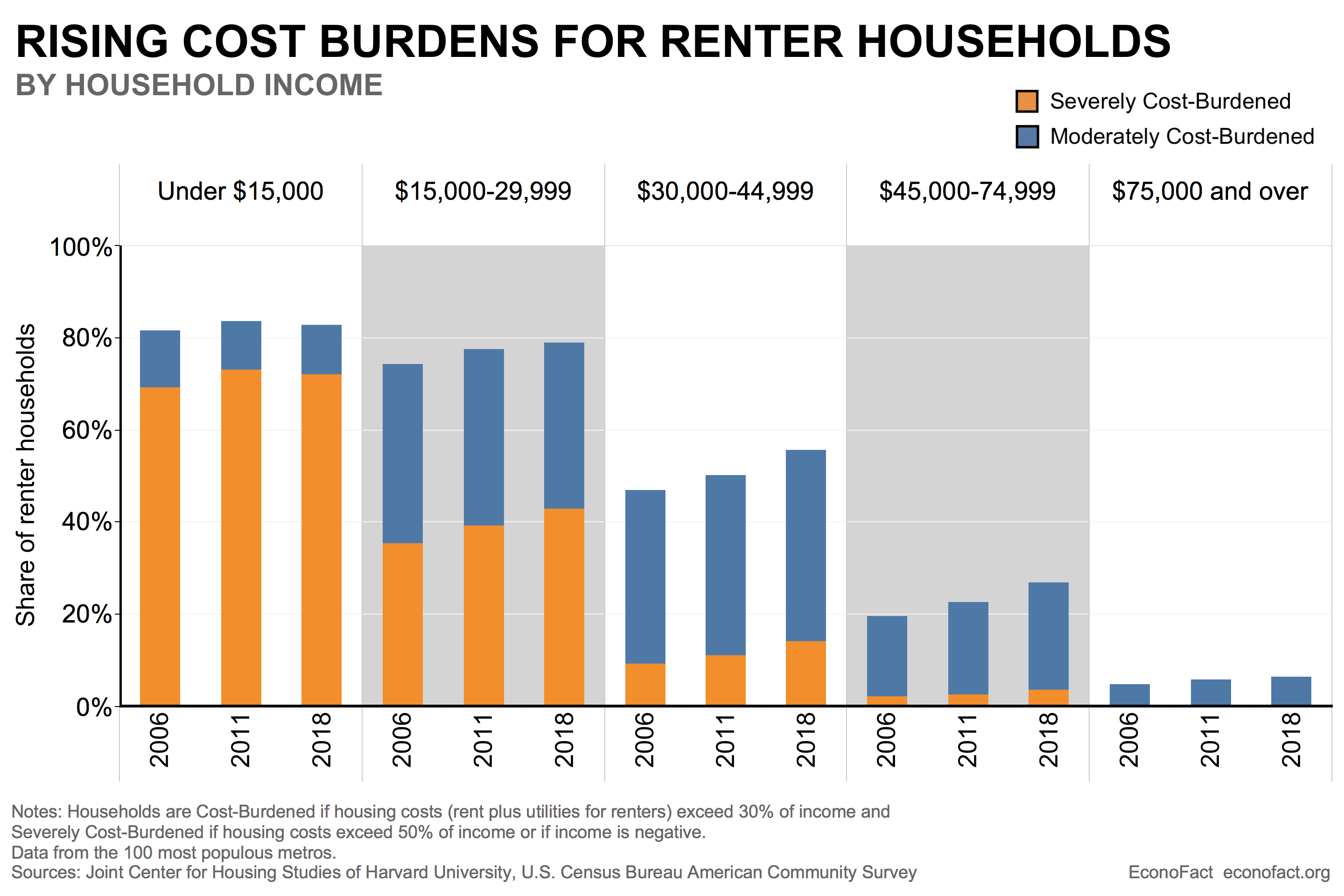

Cost burden refers to the financial strain experienced by households due to low wages and the lack of affordable rental homes. A household is considered cost burdened when it spends more than 30% of its income on rent and utilities. When this percentage exceeds 50%, the household is considered severely cost burdened.

In the US, cost-burdened households are those that allocate more than 30% of their income towards housing expenses. This includes both renters and homeowners. Even households with zero or negative income are assumed to have burdens, while those paying no cash rent are considered without burdens.

When a person is cost burdened by housing, they spend more than 30% of their income on rent and utilities each month. This impacts renters significantly, as they have to allocate a substantial portion of their earnings towards housing expenses.

California faces a significant housing burden, with a higher percentage of residents spending a disproportionate share of their income on housing. In California, 55% of renters are considered cost burdened compared to 50% in the rest of the US. Additionally, 38% of homeowners in California face cost burdens, compared to 28% in the rest of the country.

According to the Department of Housing and Urban Development, households spending more than 30% of their income on housing costs, which include rent or mortgage payments, utilities, and other fees, are considered housing cost-burdened.

Rent burden refers to the percentage of renters who pay more than 30% of their monthly income towards rent and utilities. This indicates the financial strain experienced by renters when a significant portion of their income goes towards housing expenses.

A common rule of thumb for housing costs is for individuals to spend no more than 30% of their gross monthly income towards housing. Gross monthly income refers to the income before taxes and other deductions are taken out of the monthly paycheck.

California has the highest rent burden in the United States. A report by the O.C. Register reveals that California has a greater number of rent-burdened tenants when compared to any other state in the country.

Questions and Detailed Answers

1. What is the definition of cost burdened?

Cost burdens result from low wages and the lack of affordable rental homes. A household is deemed cost burdened when it spends more than 30% of its income on rent and utilities. If this percentage exceeds 50%, the household is classified as severely cost burdened.

2. What is a cost burdened household in the US?

A cost-burdened household in the US is one that dedicates more than 30% of its income to housing expenses. If the percentage exceeds 50%, the household is considered severely cost burdened. Even households with zero or negative income are assumed to have cost burdens, while those paying no cash rent are considered to be without burdens.

3. When a person is cost burdened by housing, how much of their income do they spend on housing?

A person who is cost burdened by housing spends more than 30% of their income on rent and utilities each month.

4. What is the housing burden in California?

In California, a higher percentage of residents allocate a disproportionate share of their income towards housing. 55% of renters in California are considered cost burdened, compared to 50% in the rest of the US. Additionally, 38% of homeowners in California face cost burdens, compared to 28% in the rest of the country.

5. Is a family considered housing cost burdened when more than 30% of their income goes to mortgage or rent?

A household that spends more than 30% of its income on housing costs, including rent or mortgage payments, utilities, and other fees, is considered to be housing cost burdened according to the Department of Housing and Urban Development’s definition of affordable housing.

6. What does it mean to be rent burdened?

Rent burden refers to the percentage of renters who pay more than 30% of their monthly income on rent and utilities. It signifies the financial strain experienced by renters when a significant portion of their income goes towards housing expenses.

7. What is the rule of thumb for housing costs?

A common rule of thumb for housing costs is for individuals to spend no more than 30% of their gross monthly income, which is their income before taxes and other deductions are taken out of their monthly paycheck.

8. What state has the highest rent burden?

California has the highest rent burden in the United States. A report by the O.C. Register reveals that California has a greater number of rent-burdened tenants compared to any other state in the country.

What is the definition of cost burdened

Cost burdens are a direct result of low wages and the shortage of affordable and available rental homes. A household is cost-burdened when it spends more than 30% of its income on rent and utilities and severely cost-burdened when it spends more than 50% of its income on these expenses.

Cached

What is a cost burdened household in the US

Notes: Cost-burdened (severely cost-burdened) households pay more than 30% (more than 50%) of their income on housing. Households with zero or negative income are assumed to have burdens, while households paying no cash rent are assumed to be without burdens.

Cached

When a person is cost burdened by housing they spend more than ____% of their income on housing

30 percent

Cost-burdened renters spend more than 30 percent of their incomes on rent and utilities each month.

What is the housing burden in California

Californians spend disproportionate shares of their income on housing … 55% of renters in California are cost burdened, compared to 50% in the US; 38% of homeowners in California are cost burdened, compared to 28% in the US.

Cached

Is a family considered housing cost burdened when more than 30% of their income goes to mortgage or rent

Households spending more than 30% on housing costs, including rent or mortgage payments, utilities, and other fees, are considered housing cost burdens according to the Department of Housing and Urban Development's definition of affordable housing.

What does it mean to be rent burdened

Rent Burden: The percentage of renters paying more than 30 percent of their monthly income on rent and utilities.

What is the rule of thumb for housing costs

What's a healthy amount of your monthly budget to spend on housing A common rule of thumb when it comes to your housing budget is to spend no more than 30% of your gross monthly income, which is your income before taxes and other deductions are taken out of your monthly paycheck.

What state has the highest rent burden

We Need Rent Control. California has more rent-burdened tenants than anywhere in the United States, according to a new report by the O.C. Register.

Can California raise rent by 10%

Landlords must also give tenants sufficient warning before increasing rent. If the rent increase is less than 10%, landlords must provide notice 30 days before the increase can take effect. If the rent increase is more than 10%, the landlord must provide notice 90 days before it can take effect.

How much house can I afford if I make $70,000 a year

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*. That's a monthly house payment between $2,000 and $2,500 a month, depending on your personal finances.

What percentage of income should housing cost

28%

The most common rule for housing payments states that you shouldn't spend more than 28% of your gross income on your housing payment, and this should account for every element of your home loan (e.g., principal, interest, taxes, and insurance).

How much house can I afford on $48,000 a year

It's possible to afford a house worth anywhere from about $190,000–$260,000 on a $48,000 a year salary. But income isn't the only detail to consider when buying a home. Factors such as the location of your home, the size of your down payment, and your interest rate will determine what you can afford.

Where can I live for $500 a month in the US

Without further ado – and in no particular order – here's what $500 per month can get you in ten affordable U.S. cities:Greenville, OH. Listing: Wayne Crossing.Wichita, KS. Listing: Eagle Creek.Lawton, OK. Listing: Sheridan Square Apartments.Amarillo, TX.Indianapolis, IN.Searcy, AR.Shreveport, LA.Jackson, MS.

What state has the most unaffordable housing

According to worldpopulationreview.com, Hawaii is the most expensive state to live in, with its housing costing three times the national average. New York and California rank as the second and third most expensive states in which to live, respectively.

Can my landlord raise my rent 20% in California

The Tenant Protection Act caps rent increases for most tenants in California. Landlords cannot raise rent annually more than 5% plus inflation according to the regional Consumer Price Index, for a maximum increase of 10% each year.

How much can a landlord raise rent in California in 2023

For rent-controlled units, the annual allowable increase amount effective March 1, 2023 through February 29, 2024 is 3.6%. This amount is based on 60% of the increase in the Consumer Price Index for All Urban Consumers in the Bay Area, which was 6% as posted in November 2022 by the Bureau of Labor Statistics.

Can I afford a 300K house on a $60 K salary

The usual rule of thumb is that you can afford a mortgage two to 2.5 times your annual income. That's a $120,000 to $150,000 mortgage at $60,000.

Can I buy a 300K house with 60k salary

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

How much income do you need to buy a $650000 house

Based on the current average for a down payment, and the current U.S. average interest rate on a 30-year fixed mortgage you would need to be earning $126,479 per year before taxes to be able to afford a $650,000 home.

Can I afford a 300k house on a 50k salary

A person who makes $50,000 a year might be able to afford a house worth anywhere from $180,000 to nearly $300,000. That's because annual salary isn't the only variable that determines your home buying budget. You also have to consider your credit score, current debts, mortgage rates, and many other factors.

Is $1,000 a month livable

Bottom Line. Living on $1,000 per month is a challenge. From the high costs of housing, transportation and food, plus trying to keep your bills to a minimum, it would be difficult for anyone living alone to make this work. But with some creativity, roommates and strategy, you might be able to pull it off.

Where can I live on $1,500 a month in the US

Here's the list of the 10 Cheapest Places To Live In Florida, To see how you can live for $1,500 month, find the full list below.Best Cities to Live on $1,500 or Less a Month (via Mind Your Dollars):Davenport, Iowa.Lawton, Oklahoma.Tallahassee, Florida.El Paso, Texas.Lansing, Michigan.Fort Wayne, Indiana.Odessa, Texas.

What state is least affordable to live in

Hawaii and California are the LEAST affordable places to live in the U.S as incomes fail to keep up with soaring property prices.

What is the most unaffordable city in America

1. Manhattan, New York

| Cost of living: | 127.7% above U.S. average |

|---|---|

| Borough population: | 1,576,876 |

| Median household income: | $84,435 |

| Median home value: | $940,900 |

| Unemployment rate: | 4.8% |

Apr 15, 2023

Can my landlord raise my rent 300 dollars in California

Under the provisions of the TPA, landlords are allowed to increase rents each year by 5% plus the applicable average increase in the cost of living in order to allow for inflation. There is a maximum increase of 10% allowed in any given year, thus the Act's provision is often referred to as a “rent cap.”