h2 style=”font-size: 24px; font-weight: bold; margin-bottom: 10px; line-height: 1.5;”>Summary of the Article

Experian security alerts can be removed either online or through mail. To remove a fraud alert, visit Experian’s Fraud Alert Center, verify your identity, and submit a written request. Real-time alerts from Experian notify users about new inquiries, changes in personal information, and suspicious activity on their credit report. A credit freeze aims to prevent unauthorized credit opening, while a fraud alert requires lenders to take extra precautions when granting credit. Placing an alert on your credit is useful if you suspect fraud or identity theft, and it remains on file for one year. Experian alerts are sent to individuals who have reported themselves as identity theft victims. To check if someone is using your Social Security number, review your Social Security Statement and contact the IRS if needed. Experian credit reports include personal information, accounts, collections, public records, credit inquiries, and medical information. Freezing your credit is generally a good idea to prevent unauthorized account openings.

Key Points:

- Experian security alert removal: You can remove an Experian fraud alert online or by mail. Visit the Experian Fraud Alert Center, verify your identity, and submit a written request.

- Experian alerts: Real-time alerts notify users about new inquiries, changes in personal information, and suspicious activity detected on their Experian credit report.

- Difference between freeze and alert: A credit freeze prevents unauthorized credit openings, while a fraud alert asks lenders to verify identity before granting credit.

- Effect of placing an alert on credit: Placing an initial fraud alert on your credit report alerts credit reporting companies of potential fraud or identity theft. It remains on file for one year.

- Receiving Experian alerts: You receive Experian alerts if you have reported yourself as an identity theft victim.

- Checking SSN usage: Review your Social Security Statement for any inconsistencies in earnings and report them. Contact the IRS if you suspect improper usage of your SSN.

- Items reported to Experian: Experian credit reports include personal information, accounts, collections, public records, credit inquiries, medical information, and disputing rights.

- Security freeze and its benefits: Freezing your credit is generally recommended to prevent criminals from opening new accounts.

Questions and Answers:

- How do I get rid of an Experian security alert?

To remove an Experian fraud alert, you can submit a request online through the Experian Fraud Alert Center or by mail. Visit the center, verify your identity, and provide a written request to remove the fraud alert from your credit report. - Does Experian send alerts?

Yes, Experian sends real-time alerts to notify users about new inquiries, changes in personal information, and suspicious activity detected on their credit report. - What’s the difference between a freeze and an alert?

A credit freeze is designed to prevent unauthorized credit openings, while a fraud alert asks potential lenders to take extra precautions and verify your identity before granting credit. - What happens when you put an alert on your credit?

Placing an initial fraud alert on your credit report alerts credit reporting companies that you may be a victim of fraud or identity theft. The alert remains on your file for one year and then expires. - Why am I getting Experian alerts?

You may be receiving Experian alerts because you have reported yourself as a victim of identity theft. These alerts are sent when someone has used your personal information without authorization to commit fraud. - How do I check to see if someone is using my Social Security number?

Review the earnings posted on your Social Security Statement and report any inconsistencies. If you suspect someone is using your Social Security number for employment or tax-related abuses, contact the IRS. - What gets reported to Experian?

Experian credit reports include personal information, accounts, collections, public records, credit inquiries, medical information, and details on disputing rights. - Is a security freeze a good idea?

Yes, in general, it’s recommended to freeze your credit to prevent criminals from opening new accounts in your name.

How do I get rid of Experian security alert

You have the option to remove an Experian fraud alert by either submitting your request online or by mail. Go to Experian's Fraud Alert Center and choose “Remove a fraud alert.” You'll be directed to this form to verify your identity and provide a written request to have the fraud alert removed from your credit report.

Cached

Does Experian send alerts

Real-time alerts

Get customized alerts about new inquiries and accounts, changes in personal information and suspicious activity detected on your Experian credit report.

What’s the difference between a freeze and an alert

A credit freeze is designed to prevent a bad actor from opening credit in your name. A fraud alert asks potential lenders to take extra precautions verifying your identity before granting credit in your name.

Cached

What happens when you put an alert on your credit

You can place an initial fraud alert on your credit report if you believe you are, or are about to become, a victim of fraud or identity theft. Credit reporting companies will keep that alert on your file for one year. After one year, the initial fraud alert will expire and be removed.

Cached

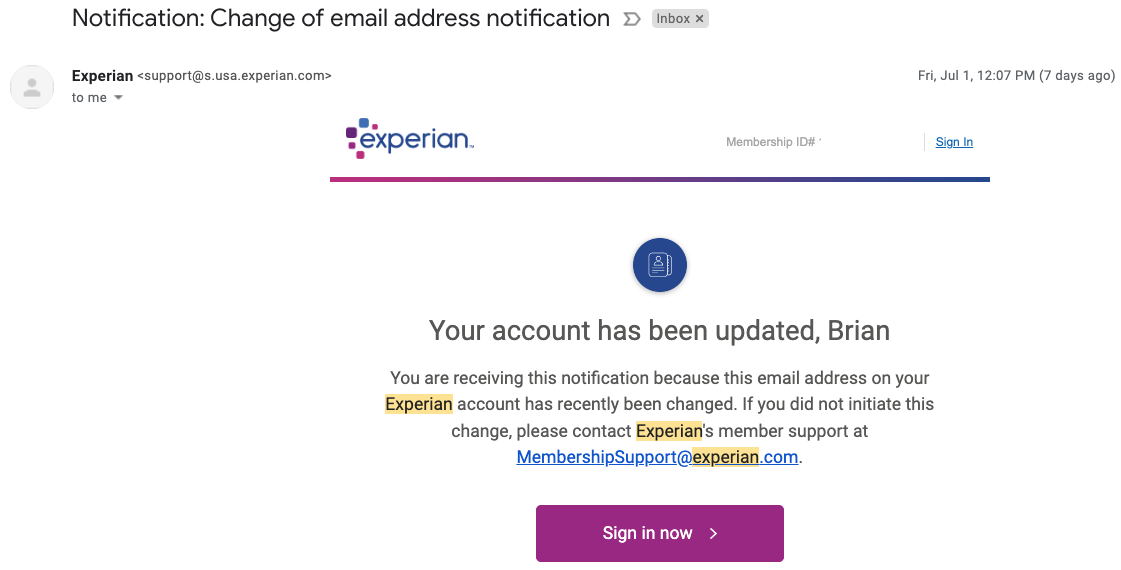

Why am I getting Experian alerts

You are receiving this information because you have notified a consumer reporting agency that you believe that you are a victim of identity theft. Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without authority, to commit fraud.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

What gets reported to Experian

Understanding Your Experian Credit ReportPersonal Information.Accounts.Collections.Public Records.Credit Inquiries.Medical Information, Disputing and Your Rights.

Is a security freeze a good idea

When should I freeze my credit In general, it's worth freezing your credit today to prevent criminals from opening new accounts in your name. Even though it's a hassle to unfreeze it when you want to apply for credit, it's the easiest and cheapest way to protect yourself from identity theft.

How long does a security freeze last

Duration: A fraud alert lasts one year. After a year, you can renew it. How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion.

Will security alert affect credit score

Does placing a fraud alert hurt my credit scores Placing a fraud alert does not affect your credit scores.

What triggers credit alert

Changing Spending Habits Frequently

“Any form of irregularity in the spending pattern of the account holder will trigger a bank fraud alert consequently. Even small purchases that you don't buy regularly can cause the alarm to trip off surprisingly.”

When did Experian get hacked

On Dec. 23, 2022, KrebsOnSecurity alerted big-three consumer credit reporting bureau Experian that identity thieves had worked out how to bypass its security and access any consumer's full credit report — armed with nothing more than a person's name, address, date of birth, and Social Security number.

Can I check to see if my SSN has been compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Is Experian a credit karma

Credit Karma is different from Experian. While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Does everyone have an Experian credit report

It's possible to not have an Experian credit report if you have not opened a credit account or if none of your accounts are reported to Experian. Because credit reports record your history managing credit, you won't have one if you've never had a credit account.

Can someone steal your identity if your credit is frozen

But a credit freeze alone can't protect you from everything. A criminal could still obtain your Social Security number or driver's license information, steal your tax refund, take out loans in your name, or hijack other accounts. Scammers may also reach out by email, calls, and texts.

What is the downside of freezing your credit

A freeze can give you a false sense of security — you may still be susceptible to credit fraud or other fraud involving your Social Security number. A credit freeze won't affect your current accounts, but if a thief steals the information on an existing account, your credit may be used without your permission.

What 3 things can hurt your credit score without you knowing it

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

How long does a credit alert last

How long an initial fraud alert on your credit report lasts. An initial fraud alert will last for one year. If you're not sure you've been a victim, but are concerned about identity theft, an initial fraud alert is a good option.

What does it mean to receive a credit alert

A credit fraud alert is a notice sent to a credit reporting bureau that a consumer's identity may have been stolen, and a request for new credit in that consumer's name may not be legitimate. A credit fraud alert can protect you and your credit from someone opening fraudulent credit accounts under your name.

Can someone hack your Experian account

According to an article by KrebsonSecurity, hackers are able to take over an individual's Experian account simply by changing the email address of the existing account. In 2021, KrebsOnSecurity carried out an experiment to show how a hacker can gain access to individuals' credit information.

How do you check if my credit has been hacked

Check your credit reports.

Request copies of your credit report from all three nationwide credit bureaus – Equifax, Experian and TransUnion — and keep an eye out for any information that's inaccurate or incomplete, or unfamiliar accounts and addresses.

Can someone access my bank account with my social security number

Can someone access my bank account with my Social Security number No, because you would have to provide even more personal details to authenticate your identity like physical evidence of your passport, ID, driver's license, etc.

What happens if your SSN is compromised

A dishonest person who has your Social Security number can use it to get other personal information about you. Identity thieves can use your number and your good credit to apply for more credit in your name. Then, when they use the credit cards and don't pay the bills, it damages your credit.