Will a fraud alert hurt my credit?

Placing a fraud alert does not affect your credit scores. It does not lower your credit score or impact your ability to obtain credit. Instead, it is a precautionary measure to protect your credit and alert potential lenders to take extra steps to verify your identity before opening any new accounts in your name. By placing a fraud alert, you can have peace of mind knowing that your credit is being monitored for any suspicious activity.

How do I get my TransUnion fraud alert off?

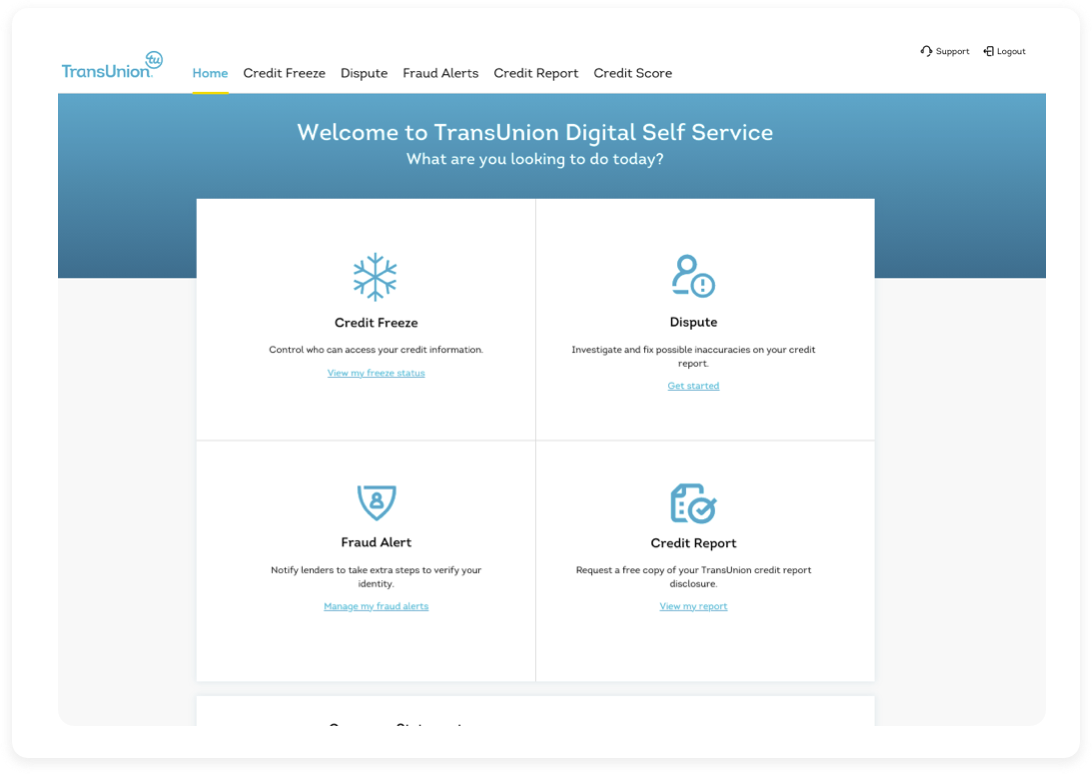

If you want to remove your fraud alert, the fastest way to do so is through the TransUnion Service Center. You can access the Service Center online and follow the steps to remove the fraud alert. Alternatively, you can also remove the fraud alert over the phone by calling TransUnion directly at their toll-free number, 800-916-8800. Keep in mind that you will need to provide some personal identification information to confirm your identity before the fraud alert can be removed.

What is the difference between a credit alert and a fraud alert?

A credit alert and a fraud alert serve similar purposes in terms of protecting your credit, but there are slight differences between the two. A credit freeze, also known as a credit alert or security freeze, restricts access to your credit report and makes it harder for anyone to open new accounts in your name. On the other hand, a fraud alert is a notification that is placed on your credit file to alert potential lenders and creditors to take extra precautions to verify your identity before granting credit. Both are effective in preventing identity theft, but a fraud alert allows some access to your credit report while a credit freeze completely restricts access.

What is the purpose of placing fraud alerts on credit reports?

The purpose of placing fraud alerts on credit reports is to provide an extra layer of security and protection against identity theft. When you place a fraud alert, potential lenders and creditors are required to take additional steps to verify your identity before granting credit in your name. This can include contacting you directly to confirm the legitimacy of the credit application or requesting additional documentation. By placing a fraud alert, you can minimize the risk of unauthorized accounts being opened in your name and protect your creditworthiness.

What happens if I place a fraud alert?

When you place a fraud alert on your credit report, creditors who check your report are required to take additional steps to verify your identity before opening any new accounts or making changes to existing accounts based on your request. This means that if someone tries to open a new credit account in your name, the creditor will need to confirm your identity before proceeding. This additional verification process adds an extra layer of security and helps protect you from fraudulent activity. It is a proactive step you can take to safeguard your financial well-being.

Is it good to have a fraud alert?

Having a fraud alert on your credit report is generally a good idea if you are concerned about identity theft or fraud. It serves as a preventive measure and encourages lenders and creditors to take extra precautions to verify your identity before issuing credit in your name. Placing a fraud alert is a simple process, and you only need to contact one of the three nationwide credit bureaus to request it. The bureau you contact will notify the other two bureaus about the fraud alert, ensuring that your credit is well-protected.

How do I check to see if someone is using my Social Security number?

To check if someone is using your Social Security number, you can start by reviewing the earnings posted to your record on your Social Security Statement. If you notice any inconsistencies or if there are earnings attributed to your Social Security number that you did not earn, you should report it to the Social Security Administration. Additionally, you can contact the Internal Revenue Service (IRS) if you suspect that someone is using your SSN for tax-related purposes, such as obtaining a tax refund or committing other tax-related fraud. They will be able to provide further guidance on how to address the situation.

How can I find out if someone is using my identity?

There are several warning signs that can indicate if someone is using your identity. These include receiving bills for items you did not purchase, receiving debt collection calls for accounts you did not open, noticing information on your credit report for accounts you did not open, experiencing denials for loan applications you did not make, and missing mail from your mailbox. If you notice any of these signs, it is important to take immediate action by contacting the appropriate authorities and credit bureaus to report the suspected identity theft.

Is placing a fraud alert a good idea?

Placing a fraud alert on your credit report is generally a good idea if you want to protect yourself against identity theft and unauthorized credit activity. It serves as a warning to lenders and creditors that they should take extra steps to verify your identity before granting credit in your name. By placing a fraud alert, you can actively monitor your credit and ensure that any suspicious activity is detected and addressed promptly. Keep in mind that a fraud alert is temporary and typically lasts for one year, so you may need to renew it periodically if you wish to continue the added protection.

How long does a fraud alert last with TransUnion?

A fraud alert placed with TransUnion typically lasts for a duration of one year. It is an effective preventive measure if you are concerned about becoming a victim of fraud or identity theft. You can request a fraud alert online through the TransUnion Service Center. Once the fraud alert is in place, creditors and lenders will be notified to take extra steps to verify your identity before granting credit. Keeping the fraud alert active ensures that your credit is continuously monitored and protected against unauthorized activity.

What are the disadvantages of fraud alerts?

While fraud alerts are effective in adding an extra layer of protection to your credit, they do have certain limitations. One of the main disadvantages is that they are not guaranteed to prevent identity theft completely. Some businesses may not adhere to the additional identity verification steps required by a fraud alert. Additionally, fraud alerts are temporary and typically last for a limited period, usually one year. This means that you will need to renew the fraud alert periodically if you wish to continue the added protection. Despite these limitations, placing a fraud alert is still a prudent measure to protect your credit and identity.

[/wpremark>

Will a fraud alert hurt my credit

Does placing a fraud alert hurt my credit scores Placing a fraud alert does not affect your credit scores.

How do I get my TransUnion fraud alert off

If you want to remove your fraud alert, the fastest way to do so if through the TransUnion Service Center. You can also remove your fraud alert over the phone by calling TransUnion at 800-916-8800.

Cached

What is the difference between a credit alert and a fraud alert

A credit freeze is designed to prevent a bad actor from opening credit in your name. A fraud alert asks potential lenders to take extra precautions verifying your identity before granting credit in your name.

What is the purpose of placing fraud alerts on credit reports

A fraud alert can make it harder for someone to open unauthorized accounts in your name. It encourages or requires lenders and creditors to take extra steps to verify your identity, such as contacting you by phone, before opening a new credit account in your name or making changes to existing accounts.

Cached

What happens if I place a fraud alert

A fraud alert requires creditors, who check your credit report, to take steps to verify your identity before opening a new account, issuing an additional card, or increasing the credit limit on an existing account based on a consumer's request.

Is it good to have a fraud alert

A fraud alert encourages lenders and creditors to take extra steps to verify your identity before issuing credit. You only need to contact one of the three nationwide credit bureaus to place a fraud alert – that bureau will transmit your request to the other two.

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How can I find out if someone is using my identity

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

Is placing a fraud alert a good idea

Highlights: A fraud alert encourages lenders and creditors to take extra steps to verify your identity before issuing credit. You only need to contact one of the three nationwide credit bureaus to place a fraud alert – that bureau will transmit your request to the other two.

How long does a fraud alert last with TransUnion

for 1 year

A good option if you're concerned about becoming a victim of fraud or ID theft, an initial fraud alert lasts for 1 year. You can request one online through the TransUnion Service Center.

What are the disadvantages of fraud alerts

Fraud alerts aren't guaranteed to prevent identity theft because some businesses may not take the additional identity verification steps they are supposed to. When lenders do take the additional steps to verify your identity, it may cause minor delays to the transaction.

Is fraud alert worth it

If you learn that your personal information has been exposed in a breach, a fraud alert is a helpful tool to protect against potential identity theft.

What happens after a fraud alert

A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a victim of fraud, including identity theft. Think of it as a “red flag” to potential lenders and creditors.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Can I check if someone is using my Social Security number

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes. Order free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion).

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

What is better fraud alert or freeze

Fraud alerts are less secure than security freezes because lenders aren't actually required to verify your identity when they see a fraud alert on your account. If you'd like to place an initial one-year fraud alert on your Equifax credit report, you can do so online by creating a myEquifax™ account.

What are red flags in fraud detection

There are four elements that must be present for a person or employee to commit fraud: • Opportunity • Low chance of getting caught • Rationalization in the fraudsters mind, and • Justification that results from the rationalization.

What is the most common fraud detection

Fraud Detection by Tip Lines

One of the most successful ways to identify fraud in businesses is to use an anonymous tip line (or website or hotline). According to the Association of Certified Fraud Examiners (ACF), tips are by far the most prevalent technique of first fraud detection (40 percent of instances).

What happens if you don’t respond to a fraud alert

If you just ignore the messages, Ulzheimer says, "the issuer will likely disallow recent charges and suspend your credit line." One factor to consider: whether the charge is in fact fraudulent.

How can I check to see if someone is using my Social Security number

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

Can someone open a credit card in my name without my social security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

What is the most common red flag observed regarding a fraud suspect

Fraudsters' common behavioral red flags

Management and co-workers may see warning signs of “fraudsters.” According to the ACFE reports, the two most common red flags continue to include living beyond one's means and financial difficulties. Other warning signs include: Getting too close to vendors or customers.

What is the most common behavioral red flag for fraud

7 Behavioral Red Flags for Internal FraudEmployees living above their means.Employees with financial difficulties.Unusually close association with a vendor or customer.Employees who resist sharing control.Divorce or family problems.Disgruntled employees.