Summary of the Article

Social Security theft refers to the unauthorized use of an individual’s Social Security Number (SSN) by someone else. This can lead to various types of identity theft, including tax identity theft and financial fraud.

Key points:

- Tax identity theft: A thief can use your SSN to file a tax return in your name and claim a fraudulent refund. If you notice unexpected tax returns or suspicious activity on your tax account, contact the IRS immediately.

- How to find out if someone is using your SSN: Review the earnings posted on your Social Security Statement and report any inconsistencies. Contact the IRS at 1-800-908-4490 or visit their website if you suspect SSN misuse.

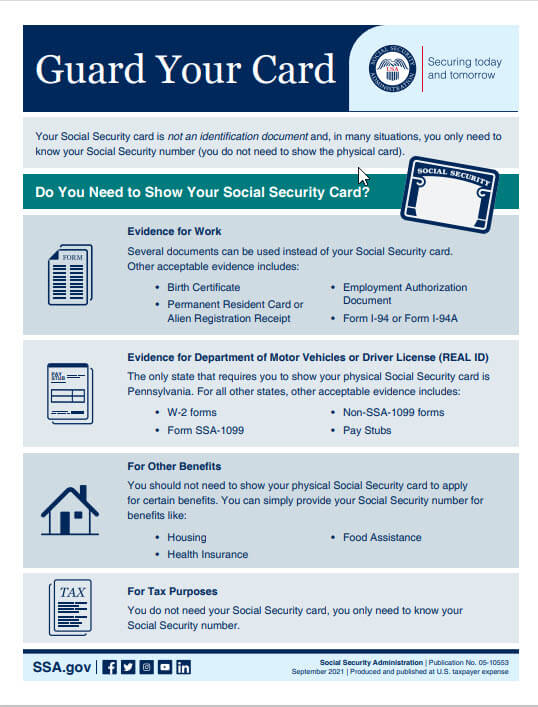

- Protecting your SSN: You can lock your SSN by contacting the Social Security Administration or creating an E-Verify account. Additionally, place a credit freeze with all three nationwide credit reporting agencies (CRAs).

- Example of identity theft: Once thieves have your personal information, they may engage in spending sprees using your credit and debit account numbers.

- Blocking access to compromised SSN: If your SSN has been compromised, call the National 800 number (1-800-772-1213) or TTY number (1-800-325-0778) to request Block Electronic Access.

- Types of identity theft: The most common types of identity theft are financial, medical, and online.

- Examples of identity theft: Stolen checks, fraudulent bank accounts, fraudulent change of address, misuse of Social Security number, passports, phone service, driver’s license number misuse, and false civil and criminal judgments are some common examples.

Questions and Answers

- What are some examples of Social Security theft?

Examples include tax identity theft, fraudulent refund claims, and unauthorized use for employment purposes. - How can I protect my SSN from theft?

You can protect your SSN by locking it, creating an E-Verify account, and placing credit freezes with CRAs. - What should I do if I suspect someone is using my SSN?

Review your Social Security Statement for inconsistencies and report them. Contact the IRS or visit their website for further assistance. - What actions can identity thieves take once they have your information?

Identity thieves may go on spending sprees using your credit and debit account numbers, make fraudulent purchases, or engage in other financial fraud activities. - Can I freeze my Social Security number?

If your SSN has been compromised, you can request to block electronic access by calling the National 800 number or TTY number provided. - What are the different types of identity theft?

The three main types are financial, medical, and online identity theft. - What are some common examples of identity theft?

Some common examples include stolen checks, fraudulent bank accounts, fraudulent change of address, misuse of Social Security number, passports, phone service, driver’s license number misuse, and false civil and criminal judgments.

What is Social Security theft examples

A thief can use your SSN to commit tax identity theft — filing a tax return in your name and claiming a fraudulent refund. If you receive unexpected tax returns or discover any suspicious activity on your tax account like a CP301 notice, contact the IRS right away.

What is a tax identity theft

Tax-related identity theft occurs when someone uses your stolen personal information, including your Social Security number, to file a tax return claiming a fraudulent refund.

Cached

How can I find out if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do I protect my SSN from identity theft

There are measures you can take to help prevent further unauthorized use of your SSN and other personal information. You can lock your SSN by calling the Social Security Administration or by creating an E-Verify account. Also, you can contact all three of the nationwide CRAs to place a freeze on your credit reports.

What is 1 example of identity theft

Once identity thieves have your personal information they may: Go on spending sprees using your credit and debit account numbers to buy “big ticket” items like computers or televisions that they can easily re-sell.

Can you put a freeze on your Social Security number

If you know your Social Security information has been compromised, you can request to Block Electronic Access. This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778).

What are the 3 types of identity theft

The three most common types of identity theft are financial, medical and online.

What are some examples of identity theft

Examples of Identity TheftStolen Checks. If you have had checks stolen or bank accounts set up fraudulently, report it to the check verification companies.ATM Cards.Fraudulent Change of Address.Social Security Number Misuse.Passports.Phone Service.Driver License Number Misuse.False Civil and Criminal Judgements.

How do I put a lock on my social security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

How can I find out if someone is using my identity

Warning signs of ID theftBills for items you did not buy.Debt collection calls for accounts you did not open.Information on your credit report for accounts you did not open.Denials for loan applications.Mail stops coming to – or is missing from – your mailbox.

How do you check if your SSN is compromised

Check Your Credit Report.

If someone has used your SSN to apply for a credit card or a loan or open other accounts in your name, your credit report is the first place the activity can appear. Look for accounts you don't recognize or credit applications you never submitted.

Can you change your SSN

Is it possible to get a new Social Security number Yes, but it is not easy. If you can show that you are in danger due to domestic violence or other abuse, or you are experiencing significant, ongoing financial harm due to identity theft, Social Security can assign you a different number.

What are 3 ways identity theft can happen

This can happen through a variety of means, including hacking, fraud and trickery, phishing scams, mail theft, and data breaches.

What are the 4 types of identity theft

The four types of identity theft include medical, criminal, financial and child identity theft.

Can you turn off your Social Security number

People generally cannot voluntarily withdraw or stop participating in the Social Security program. You must pay Social Security taxes, regardless of you or your employer's citizenship or place of residence.

How do I put a watch on my Social Security number

Contact one of the three credit reporting agencies (Transunion, Equifax, or Experian). You can call or email, but we recommend you use the online reporting options each service makes available. After a few days, check with the other two credit bureaus to verify that they've received the fraud alert as well.

What are three 3 warning signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What is the most common way of identity theft

Financial identity theft

Financial identity theft

This is the most common form of identity theft (including the credit card example described above). Financial identity theft can take multiple forms, including: Fraudsters may use your credit card information to buy things. We all love to shop online — even criminals.

What are the first signs of identity theft

8 Warning Signs of Identity TheftUnrecognized bank or credit card transactions.Unfamiliar inquiries on your credit report.Unexpected bills or statements.Unexpected lack of bills or statements.Surprise credit score drop.Denial of loan or credit applications.Calls from debt collectors.

What are the four 4 types of identity theft

The four types of identity theft include medical, criminal, financial and child identity theft.

What are the benefits of locking your Social Security number

Benefits of Social Security Lock

By preventing fraudulent use of your number, Self Lock keeps someone else's earnings from being reported as part of your employment record. The user of the false ID will have payroll taxes withheld, but won't be able to later receive any Social Security benefits.

Can someone open a credit card in my name without my Social Security number

An identity thief would have to obtain personal details such as your name, birthdate and Social Security number in order to open a credit card in your name. However, it is a federal crime to do this, and it can result in jail time when the thief is caught for their behavior.

What are 10 signs that your identity has been stolen

Time to ReadUnexplained charges or withdrawals.Medical bills for doctors you haven't visited.New credit cards you didn't apply for.Errors on your credit report.Collection notices or calls for unknown debt.Denial on application for credit card or application for credit.Missing mail or email.

How can I find out if someone opened an account in my name

The best way to find out if someone has opened an account in your name is to pull your own credit reports to check. Note that you'll need to pull your credit reports from all three bureaus — Experian, Equifax and TransUnion — to check for fraud since each report may have different information and reporting.

Can you get a new SSN after identity theft

Acceptable reasons for obtaining a new number include ongoing identity theft or threat of personal harm, such as from domestic abuse. Receiving a new number doesn't erase the old one, which will remain on file at government agencies and some businesses.