“`html

If SafePay balance is $50 or less, we waive our fee and the balance is distributed equally between the Employer and the Freelancer. Funds can be added by the Employer, based on the Agreement or a request to fund sent by the Freelancer. We offer Arbitration services only for funds in SafePay.

Normally, you only need to follow these steps to complete your transaction using Safepay Checkout from your merchant’s website:

Step 1: Click on the Safepay Checkout button.

Step 2: Choose which payment channel to use.

Step 3: Click on the payment method you want to carry out transaction with.

Select SafePay as your payment method at Checkout. You will be safely redirected to Safepay’s secure payment gateway. Your total transaction value will include shipping charges calculated at checkout if applicable.

Safe Pay uses the secured funds in your Varo Believe Secured Account to pay your statement balance automatically each month at the close of your billing cycle, so you won’t miss a payment. Cached

In case you wish to cancel SAFE PAY LITE (Free Early Repayment + Insurance) only, you may do so by requesting for cancellation of SAFE PAY LITE (Free Early Repayment + Insurance).

Manage your financial and health emergencies with Safe Pay HealthLife Insurance to cover loan outstanding in case of untimely demise. In case of an emergency postpone EMI payment by a month. Unlimited Doctor Consultation and Free Health check-up voucher.

To release funds from SafePay: Select the job under the “Manage” section. Select the appropriate Freelancer to enter the WorkRoom. Go to the “SafePay” tab and click on “Release Funds.” Enter the amount you want to release to either yourself and/or to the Freelancer. Check the box agreeing to the terms of the release.

Customers can request a withdrawal to their paysafecard account by simply entering their registered email address. As soon as the operator carries out the withdrawal, the funds will be instantly credited to the balance of the customer’s paysafecard account.

Generally, it’s best to pay off your credit card balance before its due date to avoid interest charges that get tacked onto the balance month to month.

When you qualify for Varo Advance, you’ll be eligible to borrow an amount between $20 and $250. A $20 Advance is free! You can see the Advance amounts available to you at any time by tapping on Varo Advance on the home screen of your Varo app.

You cannot overdraft your Varo Bank account (except for a few uncommon situations where it’s required by law). That means that if you don’t have enough money in your checking account to cover a debit card purchase, ATM withdraw, bill payment, or check, the transaction will not go through.

“`

What is a safe pay balance

If SafePay balance is $50 or less, we waive our fee and the balance is distributed equally between the Employer and the Freelancer. Funds can be added by the Employer, based on the Agreement or a request to fund sent by the Freelancer. We offer Arbitration services only for funds in SafePay.

How do I pay with Safepay

Normally, you only need to follow these steps to complete your transaction using Safepay Checkout from your merchant's website:Step 1: Click on the Safepay Checkout button.Step 2: Choose which payment channel to use.Step 3: Click on the payment method you want to carry out transaction with.

What is safe pay on Sapphire

Select SafePay as your payment method at Checkout. You will be safely redirected to Safepay's secure payment gateway. Your total transaction value will include shipping charges calculated at checkout if applicable.

What is safe pay on Varo

Safe Pay uses the secured funds in your Varo Believe Secured Account to pay your statement balance automatically each month at the close of your billing cycle, so you won't miss a payment.

Cached

How do I remove safe pay

In case you wish to cancel SAFE PAY LITE (Free Early Repayment + Insurance) only, you may do so by requesting for cancellation of SAFE PAY LITE (Free Early Repayment + Insurance).

What is the benefit of safe pay

Manage your financial and health emergencies with Safe Pay HealthLife Insurance to cover loan outstanding in case of untimely demise.In case of an emergency postpone EMI payment by a month.Unlimited Doctor Consultation and Free Health check-up voucher.

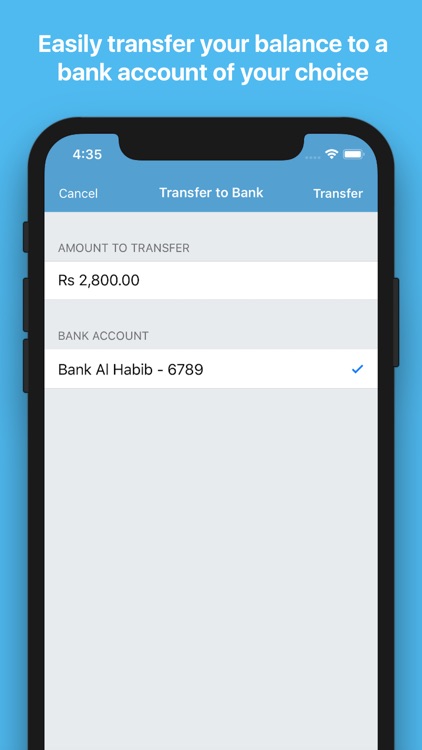

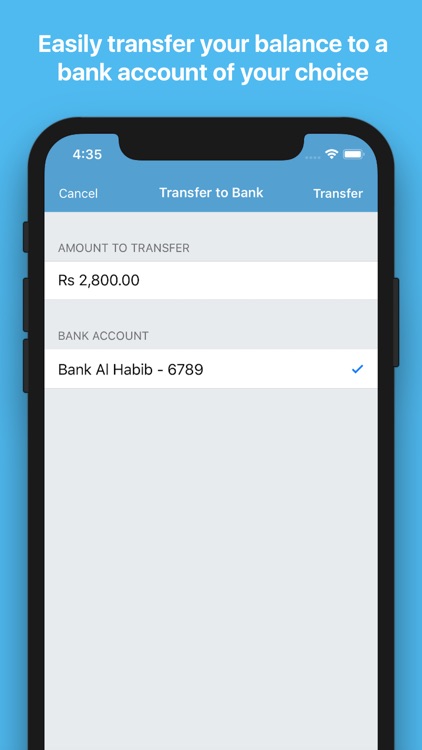

How do I withdraw money from SafePay

To release funds from SafePaySelect the job under the “Manage” section.Select the appropriate Freelancer to enter the WorkRoom.Go to the “SafePay” tab and click on “Release Funds.”Enter the amount you want to release to either yourself and/or to the Freelancer.Check the box agreeing to the terms of the release.

How do I withdraw money from my paysafe account

Customers can request a withdrawal to their paysafecard account by simply entering their registered email address. As soon as the operator carries out the withdrawal, the funds will be instantly credited to the balance of the customers paysafecard account.

Should I pay off Chase Sapphire immediately

Generally, it's best to pay off your credit card balance before its due date to avoid interest charges that get tacked onto the balance month to month.

Does Varo lend money

When you qualify for Varo Advance, you'll be eligible to borrow an amount between $20 and $250. A $20 Advance is free! You can see the Advance amounts available to you at any time by tapping on Varo Advance on the home screen of your Varo app.

Does Varo let you overdraft

You cannot overdraft your Varo Bank account (except for a few uncommon situations where it's required by law.) That means that if you don't have enough money in your checking account to cover a debit card purchase, ATM withdraw, bill payment, or check, the transaction will not go through.

How do I remove an app from safe

How to delete an app's storage to get out of Safe Mode:Open Settings.Tap Apps, then tap See all apps.Select the offending app.Tap Storage & cache.Hit Clear storage.

Can I pay early on home credit

You can repay your loan early at any time, in full or part, and you'll be entitled to a rebate of future interest charges.

How do I integrate Safepay in WordPress

After you have installed the plugin, you need to go to the WooCommerce Plugin Settings on the menu tab of your WordPress site and click the Payment tab. This will show a tab containing all the Payment options on your site. If you have installed the plugin correctly, you should see Safepay on that list.

Is Safepay available in Pakistan

Safepay provides a single integrated payments solution that interoperates with local and international payment options. Our current focus is to serve businesses and individuals in Pakistan and neighboring economies.

How do I withdraw my money

Every ATM is slightly different but you simply insert your debit card, enter your PIN (personal identification number), select the account you wish to withdraw money from (if you have more than one), enter the amount and then wait for the ATM to give you your cash and a receipt.

How do I withdraw money from my virtual bank account

Here are five common options for getting cash from an online bank:Debit card.ATM transaction.Paper check.Account transfer.Wire transfer.

Does paysafe money expire

You can find the expiry date on the back of the paysafecard that you won or in the e-mail in which you received the paysafecard PIN.

How long does it take to transfer from paysafe to bank account

Payments Explained

Payouts are made on the 5th day so long as that day falls on a USA business day, if it doesn't it will be paid on the next available business day. Payouts are made by ACH (for USA) and EFT (for Canada). These payment methods can take up to 3 days to be deposited into the bank account.

How to get out of 30K credit card debt

4 ways to pay off $30K in credit card debtFocus on one debt at a time.Consolidate your debts.Use a balance transfer credit card.Make a budget to prevent future overspending.

Is it better to pay off a credit card completely or leave a small balance

It's a good idea to pay off your credit card balance in full whenever you're able. Carrying a monthly credit card balance can cost you in interest and increase your credit utilization rate, which is one factor used to calculate your credit scores.

How do I borrow $100 from cash App

How To Borrow Money on Cash AppOpen Cash App.Tap on the home screen icon, if necessary, to navigate to the “Banking” header.Check for the word “Borrow.”If you see “Borrow,” you can take out a Cash App loan.Tap on “Borrow.”Tap “Unlock.”Cash App will tell you how much you'll be able to borrow.

How to borrow $20 from Varo

How to get a quick cash advance.Choose the amount. Open up the Varo app and select an amount of cash that's within your current advance limit.Get your cash. In just a couple taps, you'll get your cash.Pay us back. You've got 30 days to pay us back—in as many payments as you want, when you want.

Can you borrow money from Varo

Borrow fast

If you're running low on cash or need a little extra cushion when bills are due, just spot yourself the money you need with Varo Advance. The cash will land in your account—immediately.

Can you take money out of an ATM with no money in your account

If you choose to opt in to debit card and ATM overdraft, you are usually allowed to make ATM withdrawals and debit card purchases even if you do not have enough funds at the time of the transaction. However, you will generally incur fees on transactions that settle against a negative balance later.