a prime credit score, which shows that you are less of a risk to lenders and can potentially lead to better credit opportunities in the future. Cons. There may be higher fees associated with a prime credit card, such as an annual fee or balance transfer fee. Additionally, if you are not responsible with your credit card usage, it could negatively impact your credit score. Overall, a prime credit card can be beneficial if used responsibly and can help improve your credit over time.[/wpremark]

What credit score is needed to get a car loan The credit score needed to get a car loan will vary depending on the lender and the type of loan you are applying for. In general, a credit score of 660 or above is considered prime and will increase your chances of getting approved for a car loan with favorable terms. However, some lenders may offer loans to borrowers with lower credit scores, but the interest rates and requirements may be less favorable. It is always a good idea to shop around and compare offers from different lenders to find the best option for your specific situation.

between 661-780

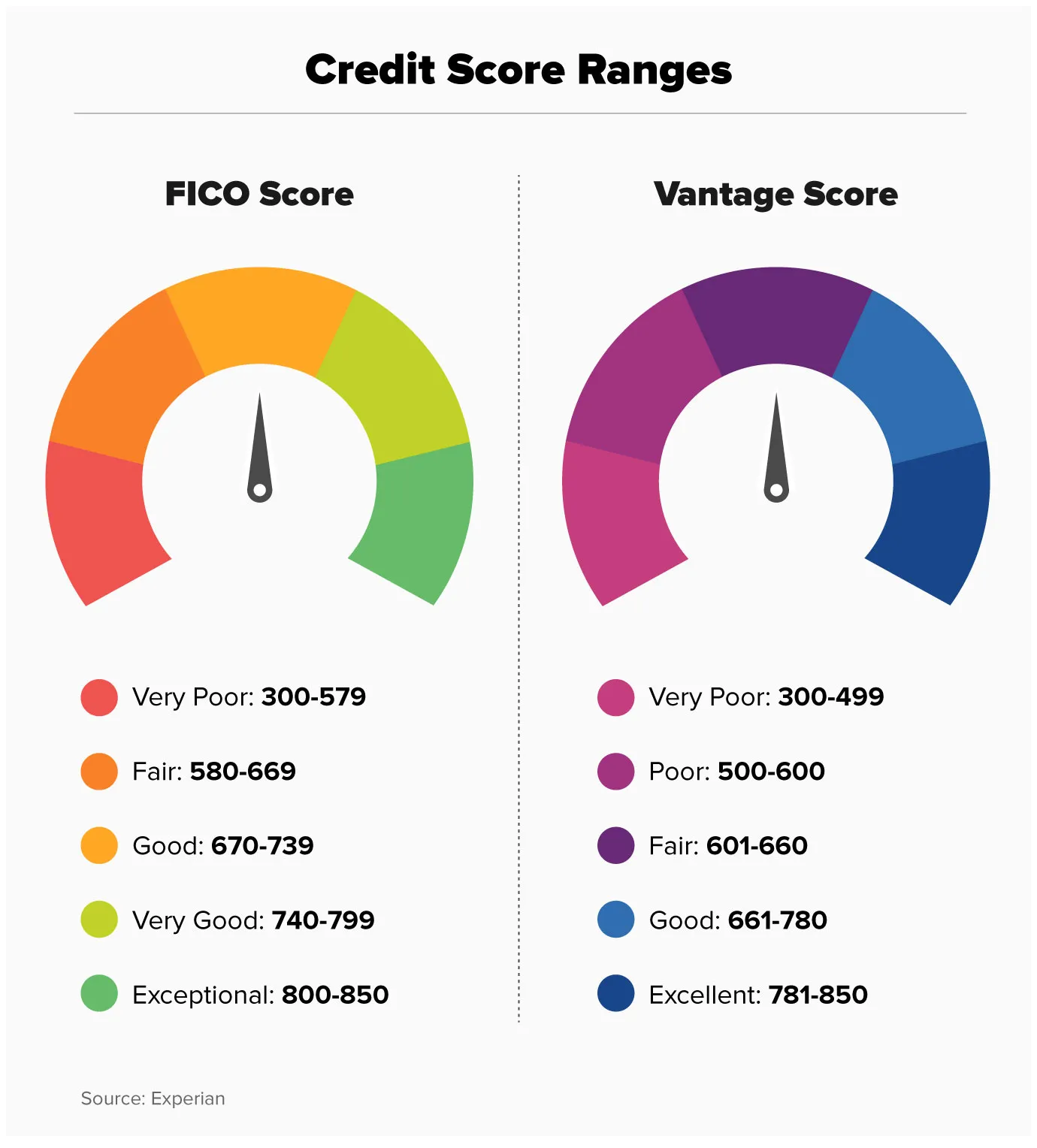

Prime rates are for those with a FICO auto score between 661-780. Nonprime rates are for those with a credit score between 600-660. Subprime rates are for those with a credit score between 600-500. Deep subprime rates are for those with scores between 300-500.

Cached

Why is it good to have a prime credit score

What it means to have prime credit. If you have prime credit, lenders see you as more likely to pay your monthly loan and credit card bills on time and in full than someone who is subprime. They have a greater confidence in lending you credit because they think you pose less of a risk of defaulting.

What are the 5 levels of credit scores

Credit scores typically range from 300 to 850. Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and excellent.

Cached

Is 750 a prime credit score

If your credit score is above 680, congratulations! You're considered a “prime” customer, and you can typically expect lower interest rates and fewer requirements or documentation to get financed. Rates vary, but prime customers can look forward to interest rates in the single digits.

Cached

What credit score is needed to buy a 40000 car

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

What is an OK credit score to buy a car

In general, you'll need a credit score of at least 600 to qualify for a traditional auto loan, but the minimum credit score required to finance a car loan varies by lender. If your credit score falls into the subprime category, you may need to look for a bad credit car loan.

Which credit score is most important

FICO® Scores☉

FICO® Scores☉ are used by 90% of top lenders, but even so, there's no single credit score or scoring system that's most important. In a very real way, the score that matters most is the one used by the lender willing to offer you the best lending terms.

Does a prime credit card help your credit

Pros. You can report your credit balances and payments to the three credit bureaus, which will help you build credit and improve your score with time. This card has low rates and fees — there is no annual fee, only a $5 late payment fee and a 10 percent fixed APR.

How to get 850 credit score

I achieved a perfect 850 credit score, says finance coach: How I got there in 5 stepsPay all your bills on time. One of the easiest ways to boost your credit is to simply never miss a payment.Avoid excessive credit inquiries.Minimize how much debt you carry.Have a long credit history.Have a good mix of credit.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

What credit score do I need to buy a $70000 car

To get an auto loan without a high interest rate, our research shows you'll want a credit score of 700 or above on the 300- to 850-point scale. That's considered prime credit, and lenders don't have to price much risk into their rates.

What credit score do I need to buy a $30 000 car

There's no set minimum credit score required to get an auto loan. It's possible to get approved for an auto loan with just about any credit score, but the better your credit history, the bigger your chances of getting approved with favorable terms.

What credit score do you need to buy a 50k car

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better, or a used-car loan around 8.75% or lower.

Can I get a Tesla with a 650 credit score

The company doesn't list a minimum credit score requirement for a Tesla auto loan or lease. However, borrowers with good or excellent credit have a higher chance of qualifying and getting a lower interest rate.

What is the best credit score to look at

Lenders generally see those with credit scores 670 and up as acceptable or lower-risk borrowers. Those with credit scores from 580 to 669 are generally seen as “subprime borrowers,” meaning they may find it more difficult to qualify for better loan terms.

What is the lowest credit score for Amazon credit card

700 or better

The Amazon.com Credit Card credit score requirement is 700 or better. That means people with at least good credit have a shot at getting approved for this card. The Amazon.com Store Card, on the other hand, requires a 640+ credit score (fair credit).

How much does the Amazon Prime credit card give you

5% back or 3% back at Amazon.com, Whole Foods Markets and the participating Amazon stores and sites: You'll earn 5% back with an eligible Prime membership or 3% back without an eligible Prime membership for each $1 of eligible purchases made using your card account at Amazon.com (including digital downloads, Amazon.com …

How hard is it to get a 800 credit score

But exceptional credit is largely based on how well you manage debt and for how long. Earning an 800-plus credit score isn't easy, he said, but “it's definitely attainable.”

Can you get a 900 credit score

FICO® score ranges vary — either from 300 to 850 or 250 to 900, depending on the scoring model. The higher the score, the better your credit.

Does anyone have a 900 credit score

Depending on the type of scoring model, a 900 credit score is possible. While the most common FICO and VantageScore models only go up to 850, the FICO Auto Score and FICO Bankcard Score models range from 250 to 900.

Does anyone have an 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

How rare is a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

How rare is an 800 credit score

23%

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.