An example of a lockbox is a bank-operated mailing address that a company directs its customers to send their payments to. The bank then opens the incoming mail, deposits the funds in the company’s bank account, and scans the payments and any remittance information. This ensures quick payment processing and eliminates the need for the company to physically go to the bank to deposit checks.

Some key points about lockbox payments are:

1. A lockbox is a bank-operated mailing address used by companies to receive payments from customers.

2. Payments made by customers are directed to the lockbox instead of going directly to the company.

3. Lockbox services are designed to expedite the collection of paper-based payments and provide timely payment information.

4. Lockbox services are usually provided by a third-party processor, such as a bank.

5. Using a lockbox shortens the time between receiving, processing, and depositing each check.

6. Lockbox payments can be processed multiple times a day, depending on the lockbox plan chosen.

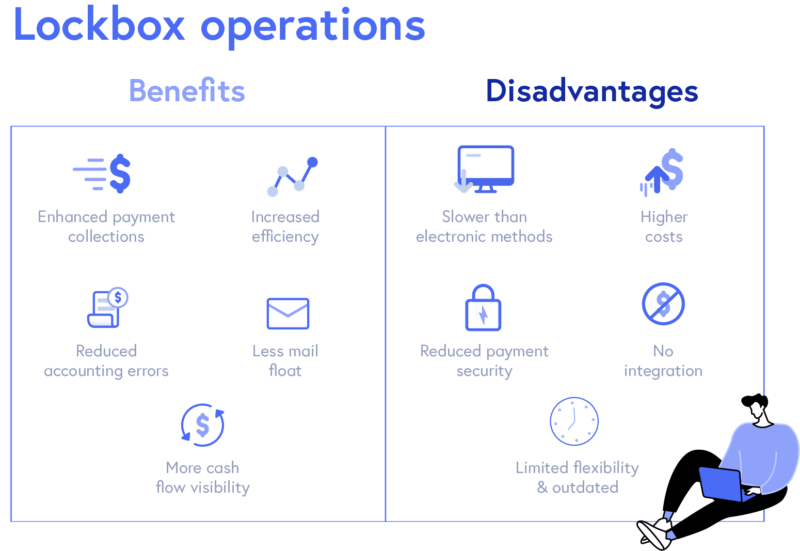

7. One disadvantage of lockbox payments is that they are slower compared to other electronic means of transfer.

8. Payments still need to be processed and may need to travel through the mail before they are available for accounts receivable.

9. Lockbox services come with monthly fees and additional charges per check deposit and handling of non-typical items.

10. While lockboxes are often advertised as key safes, they do not provide a high level of security and are not recommended for storing valuable items.

Now, let’s move on to some unique questions based on the text.

1. How does a lockbox work for payments?

– A lockbox is a bank-operated mailing address where customers send their payments. The bank opens the mail, deposits the funds, and scans the payments and remittance information.

2. What is the purpose of a lockbox payment on a credit card?

– A lockbox payment on a credit card means that the payments made by customers are directed to a special post office box instead of going directly to the company.

3. How do lockbox services work in banking?

– Lockbox services are provided by a third-party processor, usually a bank, to expedite the collection of paper-based payments. The processor receives, opens, and processes payments for a government or business.

4. Why would a business choose to use a lockbox for receiving payments?

– Businesses use lockboxes to enable quick payment processing and shorten the time between receiving, processing, and depositing each check. It eliminates the need to physically go to the bank and allows for multiple daily check processing.

5. What are the disadvantages of using a lockbox for payments?

– One disadvantage is that lockbox payments are slower compared to other electronic transfer methods. Payments must still travel through the mail and be processed before they are available for accounts receivable.

6. What is a disadvantage of the lockbox system?

– A disadvantage of the lockbox system is the cost associated with lockbox services. These include monthly fees and additional charges per check deposit, check imaging, and handling non-typical items.

7. Is a lockbox a good idea for securing valuable items?

– No, lockboxes are not recommended for securing valuable items. They are often advertised as key safes but do not provide a high level of security. They are more suitable for low-value items in sheds.

8. Can you provide an example of a lockbox?

– An example of a lockbox is a bank-operated mailing address where customers send their payments. The bank processes the payments and deposits the funds into the company’s bank account.

These are some questions and answers based on the information provided.

How does a lockbox work for payments

A lockbox is a bank-operated mailing address to which a company directs its customers to send their payments. The bank opens the incoming mail, deposits all received funds in the company's bank account, and scans the payments and any remittance information.

Cached

What is a lockbox payment on a credit card

Lockbox banking is a service provided by banks to companies for the receipt of payment from customers. Under the service, the payments made by customers are directed to a special post office box instead of going to the company.

Cached

What is a lockbox in banking

Lockbox services are designed to expedite the collection of paper-based payments and provide timely payment information to update accounts receivable records. Lockbox services are usually provided by a third-party processor (usually a bank) that receives, opens, and processes payments for a government or business.

Cached

Why would a business use a lockbox to receive payments

Quick payment – When a company uses a lockbox, it shortens the time between receiving, mail, processing, and then depositing each check. You no longer have to make time to get to the bank. Frequency – A lockbox allows for your checks to be processed several times a day depending on the lockbox plan you choose.

Cached

What are the disadvantages of lockbox

Cons Explained

They're faster than accepting checks at the office, but they're still slower than other electronic means of transfer. Payments must still travel through the mail. They must still be processed before they're available to accounts receivable.

What is a disadvantage of the lockbox system

Con: Cost of Lockbox Services

Bank lockboxes come with monthly fees and additional charges per check deposit, check imaging, and the handling of non-typical items (think: if your customer mails you a letter along with the check).

Is lockbox a good idea

Often advertised as key safes, these lock boxes are very easy to break into and do not provide any level of proven security. They can be used for storing keys to a shed that has low-value items in it. However, for homes and other high-risk properties, we suggest opting for higher security products such as key safes.

What is an example of lockbox

Definition and Example of a Lockbox Payment

Suppose you receive a bill from your electric company. It arrives in the mail with a remittance slip. You fill out the slip, enclose your check, and mail it off to a post office box in a nearby city. That post office box is your electric company's lockbox.

What is Wells Fargo lockbox

Our lockbox services deliver comprehensive, flexible remittance processing that can substantially streamline your accounts receivable function. In addition, our lockbox services can help you to: Reduce mail float by taking advantage of faster mail delivery. Reduce day's sales outstanding.

What is the benefit of locked box

The mechanism is often used in auction situations because it offers the advantage of price certainty for the seller in that it eliminates the requirement for a post-completion price adjustments and so reduces the time and resources that are often dedicated to a more lengthy closing accounts process.

What are the benefits of a lockbox

Benefits of lockbox services

Faster payment processing: In order to minimize mail, processing and deposit time, a lockbox may be the right service to meet your needs. Lockbox services are specifically designed to compress the amount of time a check is in the mail and ultimately deposited into your business' account.

What are the disadvantages of lockbox services

According to Paychex, one of the biggest cons to a lockbox system is the exorbitant cost. Bank lockboxes come with monthly fees and additional charges per check deposit, check imaging, and the handling of non-typical items (think: if your customer mails you a letter along with the check).

What do you use a lockbox for

The lockbox holds the keys to the home and is typically found at the front guarded by a security lock. Agents can open the security lock, access the keys and guide prospective buyers on a tour of the property. You can attach the lockbox to a door handle or other objects on the exterior of a house.

Why do I need a lockbox

The main purpose of a lockbox is to save time. Without a lockbox, agents would have to get the keys to a property from the house owner, their office, or colleagues.

What are the disadvantages of locked box

The pros and cons of a locked box mechanism:

Cons for seller: Does not get full benefit from continued operation of business in the interim period, and post-locked box interest, if any, is not enough to compensate the seller for the loss of earnings.

What is the difference between locked box and closing accounts

Unlike the closing accounts mechanism, a locked box SPA provides for a fixed price which can be adjusted only in the case the seller allows certain values to leak out of the target between the locked box date and completion of the transaction.

Who uses lockbox

commercial banks

In banking, a lockbox is a service offered to organizations by commercial banks to simplify collection and processing of accounts receivable by having those organizations' customers' payments mailed directly to a location accessible by the bank.