Summary of the article:

How do credit monitoring services work?

Answer: A credit monitoring service charges you a fee to watch your credit reports and alert you to changes in your accounts. They notify you through email, text message, or phone call.

What service does credit monitoring provide?

Answer: Credit monitoring keeps track of your credit file and alerts you to key changes such as new accounts opened in your name or negative information reported by creditors. It helps you stay informed and maintain a healthy credit score.

What are the benefits of credit monitoring?

Answer: Credit monitoring provides access to your credit report and helps you with information about your new credit inquiries. It protects against identity theft and helps maintain a good credit score.

What are the cons of credit monitoring services?

Answer: Paid credit monitoring can be costly, between $10 and $30 per month. It does not prevent fraud or identity theft entirely, nor does it provide comprehensive information. It is also unable to fix mistakes.

Does credit monitoring lower your credit score?

Answer: No, credit monitoring does not affect your credit scores as you do not incur hard inquiries. Accessing your own credit report is considered a soft inquiry and does not lower your credit score.

How is credit monitoring done?

Answer: Credit monitoring involves various techniques such as phishing, catfishing, tailgating, and baiting. It allows you to plan ahead and address any issues that may hinder credit-based activities like applying for loans or mortgages.

How do credit monitoring services make money?

Answer: Credit bureaus make money by selling credit reports and data analytics to other companies. Your credit report contains personal information like your name, birthdate, address, and Social Security Number.

Is credit monitoring service necessary?

Answer: The necessity of credit monitoring depends on individual circumstances and preferences. It can provide peace of mind and help detect any suspicious activity or errors in your credit report.

Question 9…

Answer: Answer 9…

Question 10…

Answer: Answer 10…

Question 11…

Answer: Answer 11…

Question 12…

Answer: Answer 12…

Question 13…

Answer: Answer 13…

Question 14…

Answer: Answer 14…

Question 15…

Answer: Answer 15…

How do credit monitoring services work

A credit monitoring service is a commercial service that charges you a fee to watch your credit reports and alert you to changes to the accounts listed on your credit report. Services usually alert you of changes to your accounts by email, text message, or phone. Warning: Prices and services vary widely.

What service does credit monitoring provide

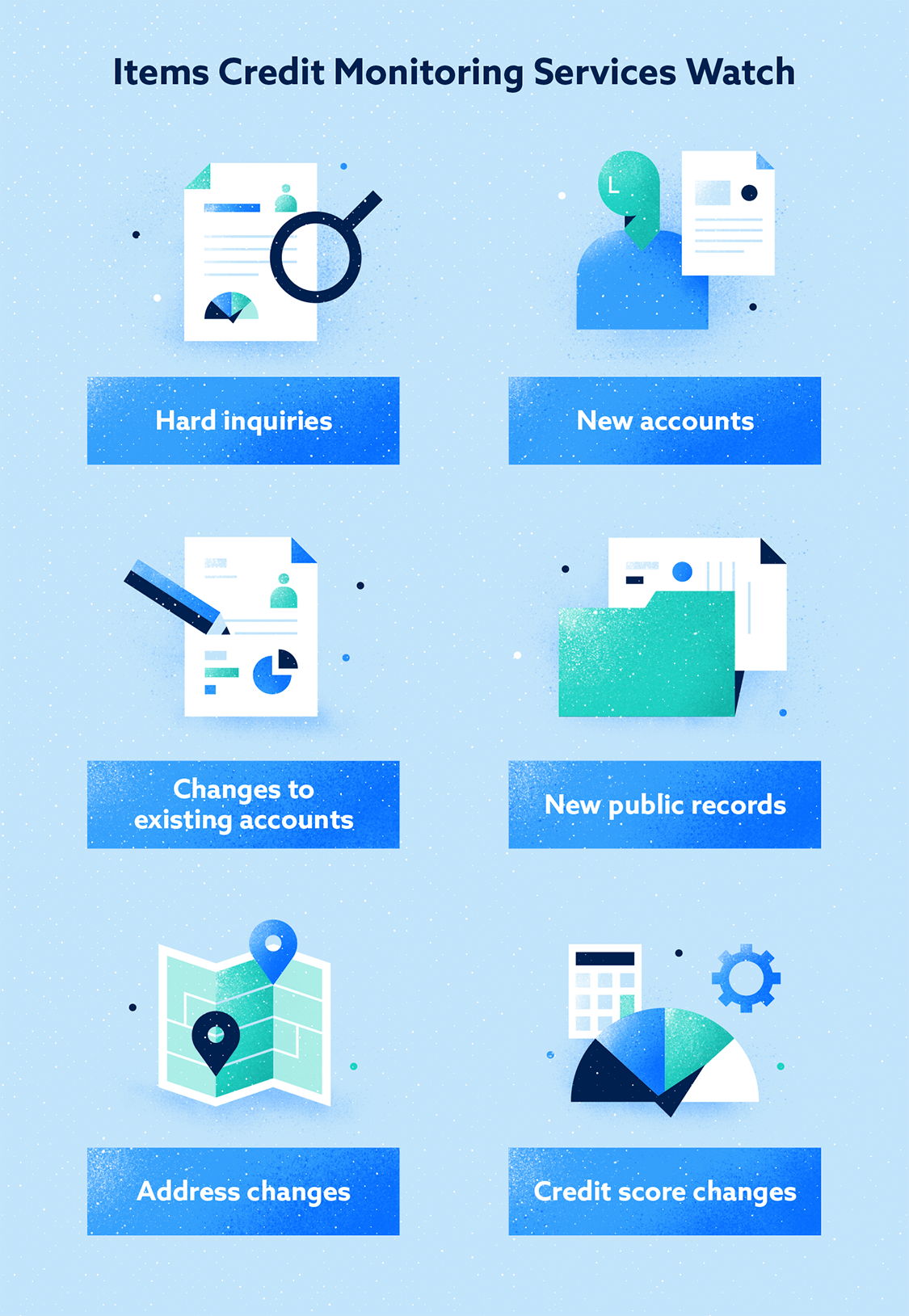

It monitors your credit file and alerts you to key changes such as a new account opened in your name or negative information like a late payment reported by one of your creditors. Credit monitoring keeps you informed, helps you stay on track and is a great way to maintain a healthy credit score.

What are the benefits of credit monitoring

Credit monitoring is a service that shows your credit report and helps you with information regarding your new credit inquiries. It is an important tool that ensures protection against identity theft and allows you to maintain a good credit score.

What are the cons of credit monitoring services

Cons of paid credit monitoringIt costs money. Paid credit monitoring often costs between $10 and $30 a month—money that you'd probably prefer to save or spend on take-out or a streaming service subscription.It doesn't stop fraud or identity theft.It won't tell you everything.It can't fix mistakes.

Cached

Does credit monitoring lower your credit score

Credit monitoring will not affect your credit scores because you won't incur hard inquiries. When you access your own credit report, it's considered a soft inquiry which doesn't lower your credit score as it's not a scoring factor.

How is credit monitoring done

These techniques include phishing, cat fishing, tailgating, and baiting. This type of monitoring allows the account holder to plan ahead and repair any issues that might inhibit major credit-based activities, such as applying for an automobile loan or a mortgage.

How do credit monitoring services make money

Credit bureaus make money by selling information like consumer credit reports and data analytics to other companies. Your credit report also includes personal information like your name, birthdate, address, Social Security Number (SSN).

Is credit monitoring service necessary

If you pay for a credit monitoring service

The cost makes sense if: You're already the victim of identity theft or at high risk of it, for instance, if your Social Security number already has been disclosed in a data breach or you've lost your Social Security card. You don't want to freeze your credit reports.

Does credit monitoring hurt your score

Credit Monitoring Doesn't Affect Credit Scores

Credit scoring systems such as the FICO® Score☉ and VantageScore® use credit report data for their calculations but ignore soft inquiries, which means they have no effect on your scores.

Is Credit Karma a credit monitoring service

Yes! Credit Karma's free credit monitoring is available through the Credit Karma app. With alerts and push notifications enabled on your app, you'll have the option to get credit alerts whenever we see important changes on your credit reports.

What brings your credit score down the most

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

What information is needed for credit monitoring

You will need to provide your name, address, Social Security number, and date of birth.

Can you write off credit monitoring services

Offering free identity theft protection and credit-monitoring services is a standard part of breach responses from compromised organizations, but some organizations have been providing such benefits on their own. The IRS now says the cost of those services is a deductible one for these companies.

What are the three major credit monitoring services

Three-bureau credit monitoring alerts you of changes on credit reports from all three credit bureaus — Experian, Equifax and TransUnion.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What are 3 things that hurt your credit score

5 Things That May Hurt Your Credit ScoresHighlights:Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

How do I remove credit monitoring

If you want to remove a fraud alert before it expires, you can generally do so online or over the phone with each credit bureau. Requesting removal by mail may be an option, as well. The alert should be removed within a few minutes if you make the request online.

Why did my credit score drop 40 points after paying off debt

It's possible that you could see your credit scores drop after fulfilling your payment obligations on a loan or credit card debt. Paying off debt might lower your credit scores if removing the debt affects certain factors like your credit mix, the length of your credit history or your credit utilization ratio.

Why is my credit score going down if I pay everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.

Is FICO a credit monitoring service

While there are free credit monitoring services available, FICO charges for each of its plans. Here are the costs: Basic: $19.95 per month. Advanced: $29.95 per month.

Is 500 a really bad credit score

Your score falls within the range of scores, from 300 to 579, considered Very Poor. A 500 FICO® Score is significantly below the average credit score. Many lenders choose not to do business with borrowers whose scores fall in the Very Poor range, on grounds they have unfavorable credit.

What is the most average credit score

Credit scores help lenders decide whether to grant you credit. The average credit score in the United States is 698, based on VantageScore® data from February 2021. It's a myth that you only have one credit score. In fact, you have many credit scores.

What three moves can sabotage your credit score

3 Ways People Destroy Their Credit ScoreMaking Late Payments That Show For Years On Your Credit Report.Maxing Out Your Credit Cards.Not Paying Your Debts or Declaring Bankruptcy.

How fast can I add 100 points to my credit score

For most people, increasing a credit score by 100 points in a month isn't going to happen. But if you pay your bills on time, eliminate your consumer debt, don't run large balances on your cards and maintain a mix of both consumer and secured borrowing, an increase in your credit could happen within months.

Why is my credit score dropping if I m paying everything on time

A short credit history gives less to base a judgment on about how you manage your credit, and can cause your credit score to be lower. A combination of these and other issues can add up to high credit risk and poor credit scores even when all of your payments have been on time.