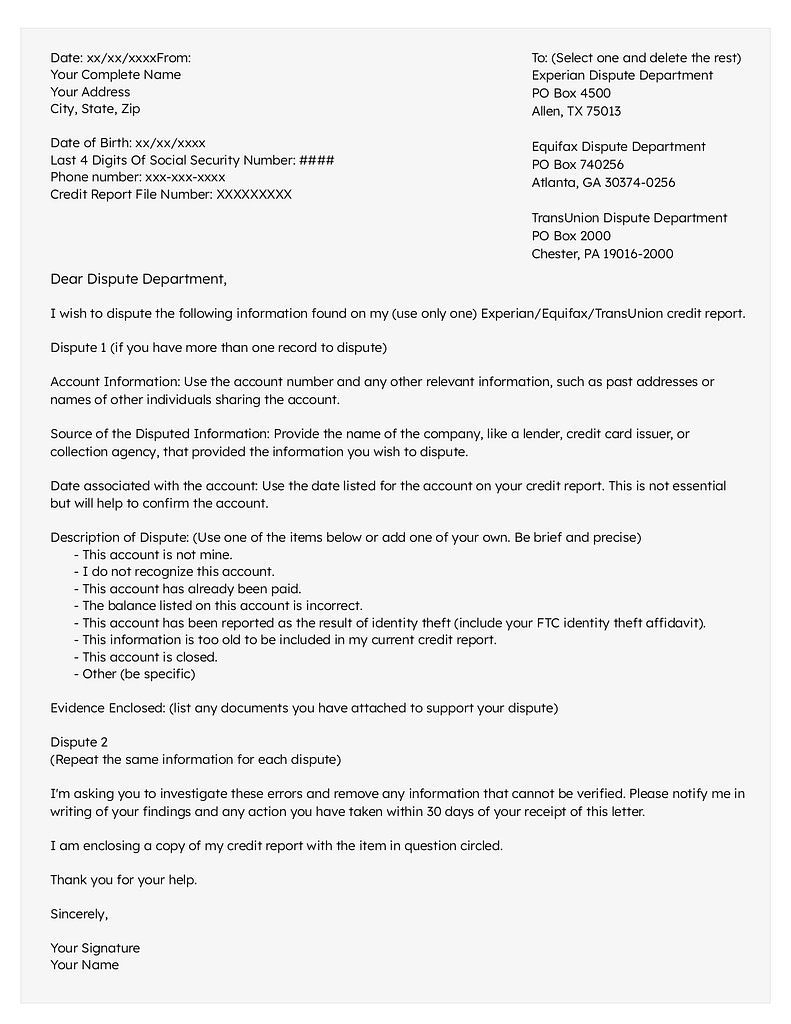

A 609 letter is a method of disputing an error on your credit report and requesting the credit bureaus to remove inaccurate negative entries. It gets its name from section 609 of the Fair Credit Reporting Act (FCRA), which is a federal law that protects consumers from unfair credit and collection practices. The letter is a way for consumers to gather information and seek verification of the accuracy of their credit report. While there is no concrete evidence to suggest that a 609 letter is more effective than the regular process of disputing errors, it can potentially lead to the removal of negative items if the disputes are successful.

In addition to disputing errors, a 609 letter can also help uncover hidden details that may not show up in your free credit report. The letter can assist in verifying information and identifying any inaccuracies on your credit report. It works in conjunction with section 604 of the FCRA, which outlines the circumstances in which credit bureaus can release your credit information to various entities. By utilizing a 609 letter, you can gain a better understanding of your credit history and ensure its accuracy.

Some people refer to a 609 Dispute Letter as a “credit repair secret” or a “legal loophole.” The letter is said to force the credit reporting agencies to remove certain negative information from your credit reports. However, it’s important to understand that there is no guaranteed outcome when using a 609 letter. The effectiveness of the letter may vary depending on individual circumstances, and results cannot be guaranteed.

While a credit score of 609 is considered fair, it may still qualify you for certain financial options. For example, with a credit score of 580 or higher, you can potentially qualify for an FHA loan to buy a home with a down payment of just 3.5%. However, it’s important to note that individual lenders may have their own credit score requirements, and a higher credit score is generally recommended for more favorable borrowing terms.

When it comes to dealing with debt collectors, there is often mention of an “11-word phrase” that can supposedly stop their calls and contact. The phrase is “Please cease and desist all calls and contact with me immediately.” While this phrase can be used as a request, it does not guarantee that debt collectors will comply. It’s important to understand your rights and consult with legal professionals if you are facing harassment or unfair collection practices.

Raising your credit score overnight by 100 points is not a realistic expectation. Improving your credit score takes time and consistent effort. Here are some steps you can take to gradually raise your credit score: get your free credit report, understand how your credit score is calculated, improve your debt-to-income ratio, keep your credit information up to date, avoid closing old credit accounts, make payments on time, monitor your credit report regularly, and keep your credit balances low. By implementing these strategies, you can gradually improve your creditworthiness.

A 623 dispute letter is used by businesses when other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to provide proof that a debt belongs to the company. This type of dispute letter is typically used as a last resort when other methods have been unsuccessful.

The “609 credit repair loophole” refers to a section of the Fair Credit Reporting Act that allows consumers to dispute incorrect information on their credit reports. According to this loophole, if something is incorrect on your credit report, you have the right to write a letter disputing it. It’s important to note that this is not a guaranteed way to remove accurate negative information from your credit reports and individual results may vary.

The “11-word phrase” in credit secrets is the same phrase mentioned earlier to stop debt collectors from contacting you. Again, it’s important to understand that while this phrase can be used as a request, compliance from debt collectors is not guaranteed. It’s advisable to consult with legal professionals and understand your rights when dealing with debt collection practices.

When it comes to buying a house with a 609 credit score, it’s recommended to have a credit score of 620 or higher when applying for a conventional loan. Having a lower credit score may make it more challenging to secure a loan, and lenders may have stricter requirements or offer less favorable terms. It’s important to work on improving your credit score before applying for a mortgage to increase your chances of approval and better loan options.

Does 609 letter really work

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Cached

What is a 609 dispute letter and does it work

A 609 letter is a credit repair method that requests credit bureaus to remove erroneous negative entries from your credit report. It's named after section 609 of the Fair Credit Reporting Act (FCRA), a federal law that protects consumers from unfair credit and collection practices.

Cached

What is the difference between a 609 and 604 dispute letter

A 609 letter can help you verify information and identify errors on your credit report. It can also uncover “hidden” details that don't show up in your free credit report. Section 604 explains the circumstances in which the credit bureaus can release your credit information to various entities.

Cached

What is the credit secret loophole

A 609 Dispute Letter is often billed as a credit repair secret or legal loophole that forces the credit reporting agencies to remove certain negative information from your credit reports.

Cached

What can a 609 credit score get you

Yes, your 609 credit score can qualify you for a mortgage. And you have a couple of main options. With a credit score of 580 or higher, you can qualify for an FHA loan to buy a home with a down payment of just 3.5%.

What is the 11 word credit loophole

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.

What is a 623 dispute letter

A business uses a 623 credit dispute letter when all other attempts to remove dispute information have failed. It refers to Section 623 of the Fair Credit Reporting Act and contacts the data furnisher to prove that a debt belongs to the company.

What is Section 609 credit repair loophole

"The 609 loophole is a section of the Fair Credit Reporting Act that says that if something is incorrect on your credit report, you have the right to write a letter disputing it," said Robin Saks Frankel, a personal finance expert with Forbes Advisor.

What is the 11 word phrase in credit secrets

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

Can I buy a house with a 609 credit score

It's recommended you have a credit score of 620 or higher when you apply for a conventional loan. If your score is below 620, lenders either won't be able to approve your loan or may be required to offer you a higher interest rate, which can result in higher monthly payments.

How to go from 600 to 700 credit score

How To Get A 700 Credit ScoreLower Your Credit Utilization.Limit New Credit Applications.Diversify Your Credit Mix.Keep Old Credit Cards Open.Make On-Time Payments.

What is the 11 word phrase to stop creditors

In case you are wondering what the 11 word phrase to stop debt collectors is supposed to be its “Please cease and desist all calls and contact with me immediately.”

What is the 15 and 3 credit card hack

The 15/3 credit card hack is a payment plan that involves making two payments during each billing cycle instead of only one. Anyone can follow the 15/3 plan but it takes some personal management and discipline. The goal is to reduce your credit utilization rate and increase your credit score.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

What is a 611 credit letter

The 611 credit dispute letter is a follow-up letter when a credit agency replies that they have verified the mentioned information. It requests the agency's verification method of the disputed information and refers 611 Section of the Fair Credit Reporting Act.

What is a 604 Act dispute letter

What is a 604 Dispute Letter A 604 dispute letter is a great way to get inaccurate information off your credit report. Writing this type of letter can help you ensure that any negative items on your credit report are accurate, which in turn can have a substantial impact on your credit score.

What is the 11 word phrase credit loophole

Summary: “Please cease and desist all calls and contact with me, immediately.” These are 11 words that can stop debt collectors in their tracks. If you're being sued by a debt collector, SoloSuit can help you respond and win in court. How does the 11-word credit loophole actually work

How does the 11 word credit loophole actually work

What is the 11-word phrase credit loophole You can say a number of things to stop debt collectors from phoning you. You have the right to instruct a debt collector to stop calling, even if the debt they are contacting you about is yours.

What credit score is needed to buy a 300k house

620-660

Additionally, you'll need to maintain an “acceptable” credit history. Some mortgage lenders are happy with a credit score of 580, but many prefer 620-660 or higher.

How long does it take to go from 600 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

What is a drop dead letter

You have the right to send what's referred to as a “drop dead letter. '' It's a cease-and-desist motion that will prevent the collector from contacting you again about the debt. Be aware that you still owe the money, and you can be sued for the debt.

What do I say to creditors if I can’t pay

Explain your current situation. Tell them your family income is reduced and you are not able to keep up with your payments. Frankly discuss your future income prospects so you and your creditors can figure out solutions to the problem.

How to raise a 480 credit score

Paying bills consistently and on time is the single best thing you can do to promote a good credit score. This can account for more than a third (35%) of your FICO® Score. Length of credit history. All other things being equal, a longer credit history will tend to yield a higher credit score than a shorter history.