ispute a credit report If you falsely dispute a credit report, you could potentially face legal consequences. Intentionally providing false information or making false claims about your credit can be considered fraudulent activity. It is important to only dispute inaccurate information on your credit report and provide truthful documentation to support your claims. Any false disputes can damage your credibility and may result in legal actions against you.

What happens when you dispute a charge on Experian

What Happens After You Submit Your Dispute After you've submitted a dispute, Experian goes to work to resolve the issue. The data furnisher (for example, your bank or a credit card issuer) will be asked to check their records.

Cached

Does an account in dispute affect credit score

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

Cached

How long does a dispute take with Experian

30 to 45 days

How long will it take to complete the investigation You will need to allow up to 30 to 45 days for the investigation of your dispute to be completed by the credit reporting companies. The Consumer Financial Protection Bureau has additional information regarding the length of a dispute investigation.

Cached

Who pays when you dispute a charge

Who pays when you dispute a charge Your issuing bank will cover the cost initially by providing you with a provisional credit for the original transaction amount. After filing the dispute, though, they will immediately recover those funds (plus fees) from the merchant's account.

What is the best reason to dispute on Experian

Successful disputes typically involve inaccurate or incomplete information, including items such as: Account information, such as closed accounts reported as open, timely payments incorrectly reported as delinquent, and inaccurate credit limits or account balances.

Will I get my money back if I dispute a charge

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

Is it a good idea to dispute credit report

If you find mistakes on your credit reports, you should dispute them. Here's how you can dispute errors you find. Errors can appear on one or more of your credit reports due to an error in the information provided about you or as the result of fraud or identity theft.

What happens if you falsely dispute a credit report

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

What happens if a credit dispute is denied

In case the card issuer denies your dispute, you still have options. You should follow up with the lender to ask for an explanation and any supporting documentation. If you think your dispute was incorrectly denied given that reasoning, you can file a complaint with the FTC, the CFPB or your state authorities.

What is the best way to dispute a collection on Experian

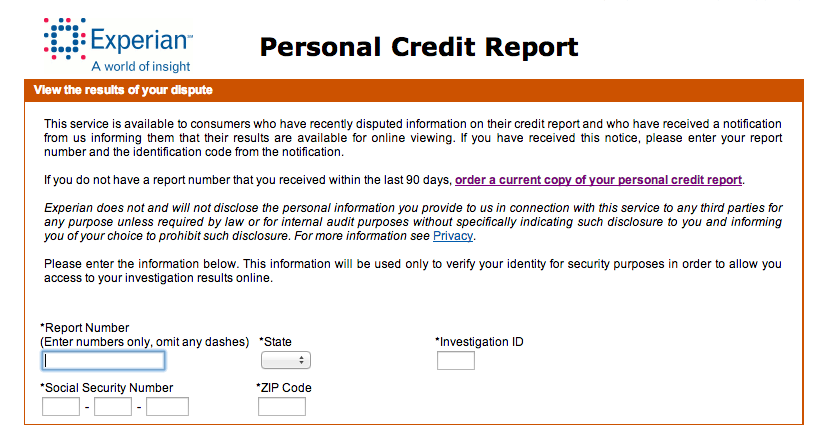

The fastest way to dispute inaccurate information is through Experian's online Dispute Center. Be specific about why the item is inaccurate and include any documentation you may have that supports your dispute. You can submit documents online or send them by mail.

What happens if I dispute a charge and get a refund

A chargeback takes place when you contact your credit card issuer and dispute a charge. In this case, the money you paid is refunded back to you temporarily, at which point your card issuer will conduct an investigation to determine who is liable for the transaction.

Can disputing charges get you in trouble

You cannot go to jail for filing credit card disputes. The Fair Credit Billing Act directly protects consumers from incorrect and fraudulent charges.

Can you get in trouble for disputing items on your credit report

Can I get in trouble” Answer: First things first, the Fair Credit Reporting Act gives each of us the right to challenge information on our credit reports with which we don't agree. There's nothing in that law that prohibits consumers from disputing information on their credit reports for any reason.

What happens when you win a credit dispute

The act of disputing items on your credit report does not hurt your score. However, the outcome of the dispute could cause your score to adjust. If the “negative” item is verified to be correct, for example, your score might take a dip.

How often are credit card disputes successful

This can't always be helped. You might not always get a fair outcome when you dispute a chargeback, but you can increase your chances of winning by providing the right documents. Per our experience, if you do everything right, you can expect a 65% to 75% success rate.

Can you get in trouble for disputing transactions

Can you go to jail for disputing charges It's technically possible, as friendly fraud can be considered a form of wire fraud. However, this only happens in extreme cases. In general terms, it's practically unheard of for cardholders to end up behind bars for committing friendly fraud.

Can you be sued for disputing credit report

Consumers sometimes file multiple disputes, and even bring lawsuits, to get inaccurate information corrected in their credit reports.

Can you get in trouble for falsely disputing credit

What happens if you falsely dispute a credit card charge Purposely making a false dispute is punishable by law and could lead to fines or imprisonment. You could face legal action by a credit card issuer or the merchant.

Can you get in trouble for disputing something

Can you go to jail for disputing charges It's technically possible, as friendly fraud can be considered a form of wire fraud. However, this only happens in extreme cases. In general terms, it's practically unheard of for cardholders to end up behind bars for committing friendly fraud.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Can I get in trouble if I dispute a charge

You cannot go to jail for filing credit card disputes. The Fair Credit Billing Act directly protects consumers from incorrect and fraudulent charges. But if you file fraudulent chargebacks, you risk lawsuits and criminal charges. A fraudulent chargeback is a false dispute made by a consumer to secure a refund.

Does disputing a charge remove it

Your credit card company will likely remove the charge from your statement during the dispute process. You won't need to pay it until a decision is reached regarding the dispute, and if you win, you won't need to pay it at all.

What is a good excuse to dispute a charge

We can divide all valid disputes into one of five basic categories: criminal fraud, authorization errors, processing errors, fulfillment errors, or merchant abuse.

Can you go to jail for false chargebacks

Not only can chargeback fraud lead to lawsuits, but depending on the circumstances a customer who engages in chargeback-related fraud can face criminal charges and jail time.

Why you should never dispute negative items on your credit report online

If you dispute your credit reports online, you make it difficult to enforce the law, and it slows you down. Eventually, if you are correct, it will require filing a claim to make the credit bureaus correct the problem, especially if it was not fixed the first time.