Summary of the article:

If your car is totaled but you still owe on it:

- Contact the at-fault driver’s insurance company with your lender information.

- Continue to make your loan or lease payments until the insurance company issues payment to your lender to maintain your good credit.

If you owe more than your car’s worth when it’s totaled:

- The insurance company will not necessarily pay off your loan balance.

- The insurer will pay the actual cash value of your vehicle up to the policy limits, minus the deductible, depending on the terms of your policy.

Gap Insurance:

- Gap insurance is an optional coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than its depreciated value.

- It may also be called “loan/lease gap coverage.”

Selling a car to CarMax when you still owe money on it:

- CarMax will buy your car even if you still owe on it.

- You’ll need to provide loan information so CarMax can pay off the lender.

- If you owe more than the offer, you will need to cover the difference.

Impact on credit scores:

- A totaled car won’t directly impact your credit scores.

- Credit scores are based solely on the information in your credit report and don’t include things like your driving record or insurance claims.

Calculating totaled car value:

Actual cash value (ACV) is used to determine the payout for a totaled vehicle.

It is determined by the replacement cost of your vehicle minus depreciation, which considers things like age and wear and tear.

Negotiating the value of a totaled car:

- Yes, you can negotiate the value of a totaled car with your insurance company.

- Research the actual cash value (ACV) of your car and learn about your state’s total loss threshold.

- You can negotiate a total loss claim just like any other claim.

Questions:

- What happens if your car is totaled but still making payments?

- What happens when you total your car and you owe more than its worth?

- Will Gap Insurance pay off my loan?

- Will CarMax buy my car if I still owe money on it?

- Does a totaled car affect credit?

- How do you calculate the value of a totaled car?

- Can you negotiate for more money when your car is totaled?

If your car is totaled and you still owe on it but the accident was not your fault, contact the at-fault driver’s insurance company with your lender information. To maintain your good credit, you should continue to make your loan or lease payments until the insurance company issues payment to your lender.

If you have not paid off your loan and your car is totaled in an accident, the insurance company will not necessarily pay off your loan balance. Rather, the insurer will pay the actual cash value of your vehicle up to the policy limits, minus the deductible depending on the terms of your policy.

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value. Gap insurance may also be called “loan/lease gap coverage.”

Yes, CarMax will buy your car if you owe on it. You’ll need to provide loan information so CarMax can pay off the lender. If you owe more than your offer, you will need to cover the difference.

A totaled car, even one that is financed, won’t directly impact your credit scores. Credit scores are based solely on the information in your credit report and don’t include things like your driving record or previous insurance claims.

The value of a totaled car is calculated using the actual cash value (ACV) method. ACV is determined by the replacement cost of your vehicle minus depreciation, which takes into account factors such as age and wear and tear.

Yes, you can negotiate the value of a totaled car with your insurance company. Research the actual cash value (ACV) of your car and familiarize yourself with your state’s total loss threshold. Just like any other claim, you can negotiate a total loss claim.

What happens if your car is totaled but still making payments

If your car is totaled and you still owe on it but the accident was not your fault, contact the at-fault driver's insurance company with your lender information. To maintain your good credit, you should to continue to make your loan or lease payments until the insurance company issues payment to your lender.

Cached

What happens when you total your car and you owe more than it’s worth

If you have not paid off your loan and your car is totaled in an accident, the insurance company will not necessarily pay off your loan balance; rather, the insurer will pay the actual cash value of your vehicle up to the policy limits, minus the deductible depending on the terms of your policy.

Cached

Will Gap Insurance pay off my loan

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance may also be called "loan/lease gap coverage."

Will CarMax buy my car if I still owe money on it

Will CarMax buy my car if I owe on it Yes. You'll need to provide loan information so CarMax can pay off the lender. If you owe more than your offer, you will need to cover the difference.

Does totaled car affect credit

How Can a Totaled Car Affect Your Credit Scores Car accidents, even those that result in a financed car being totaled, won't directly impact your credit scores. Credit scores are based solely on the information in your credit report and don't include things like your driving record or previous insurance claims.

How do you calculate totaled car value

Actual cash value (ACV)

ACV is used to determine how much of a payout you will receive for a totaled vehicle. It is determined by the replacement cost of your vehicle minus depreciation, which considers things like age and wear and tear.

Can you ask for more money when your car is totaled

Yes, you can negotiate the value of a totaled car with your insurance company. You'll need to do some research on the actual cash value (ACV) of your car and learn about your state's total loss threshold, but you can negotiate a total loss claim just like you can negotiate any other claim.

Do banks refund gap insurance

If you paid for your GAP insurance monthly, you may still qualify for a refund, but it will likely be much smaller than if you paid upfront. How much money you end up getting back through a refund varies, but the amount is usually based on the following factors: The value of the vehicle. The amount of auto loan.

Does gap cover negative equity

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it's worth, that negative equity is rolled into your new loan.

How much negative equity is too much

How much negative equity is too much The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

How do you sell your car to CarMax if you still owe on it

If the amount you owe is less than $250, we will accept a personal check. Our written offers are good for seven days, giving you time to get any necessary funds to settle your transaction.

Does your credit go up if your insurance pays for a totaled car

Car accidents, even those that result in a financed car being totaled, won't directly impact your credit scores. Credit scores are based solely on the information in your credit report and don't include things like your driving record or previous insurance claims.

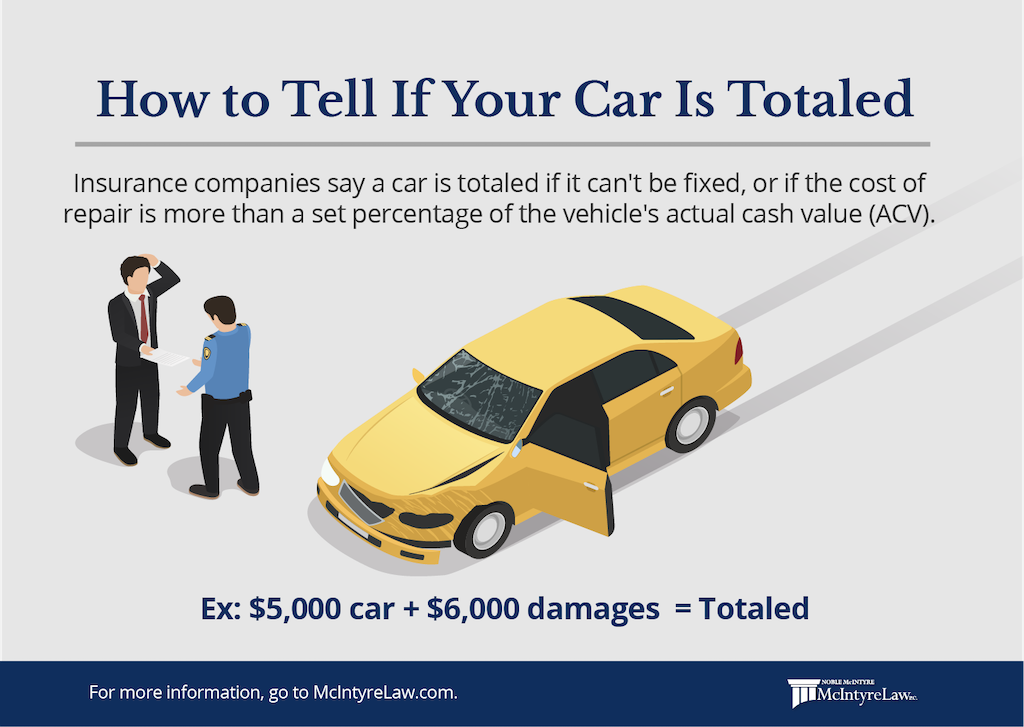

What makes a car automatically totaled

A car is generally considered totaled when the cost to repair the car exceeds the value of the car. Depending on your coverage, your auto insurance company may reimburse you for the current market value of your vehicle.

What not to say to insurance adjuster

That means knowing what not to say during a conversation with an insurance adjuster.Never Admit Fault.Don't Answer Questions About the Incident.Don't Give Information about Your Physical or Emotional Condition.Don't Accept the Initial Settlement Offer.Contact a Florida Car Accident Attorney Today.

How do you negotiate with a total loss adjuster

How to negotiate with an insurance adjusterFigure out what your vehicle is worth. Whether your car was totaled in an accident or just needs minor repairs, it is important to know what your vehicle is worth.Determine if the initial offer is too low.Argue your side of the case.

How long does gap insurance refund take

between four and six weeks

Once you cancel your policy and request a refund, it typically takes between four and six weeks to receive the money. You have to ask for a GAP insurance refund.

How does gap insurance work through bank

Gap insurance is an optional auto insurance coverage that applies if your car is stolen or deemed a total loss. When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference.

How much is too much negative equity on a car

How much negative equity is too much The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

How do I get out of paying negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

How do I get out of a car with negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

Does negative equity go away

The faster you pay down your loan, the faster you'll eliminate the negative equity. This can also reduce the amount you pay in interest. Just make sure extra payments go toward your principal. Refinance with a shorter loan term.

Can I sell my car to CarMax with negative equity

If your pay-off amount is more than our offer for your car, the difference is called “negative equity.” In some cases, the negative equity can be included in your financing when you buy a car from CarMax. If not, we'll calculate the difference between your pay-off and our offer to you and you can pay CarMax directly.

Does a totaled car hurt my credit

The short answer is no, totaling your car does not your credit score directly. People often make payments on their cars because it's a great way to build good credit.

Is a car totaled if the airbags go off

Many people believe, and have likely been told, that if the airbags go off after a crash, the vehicle is automatically considered a total loss. This is not true. While a crash that is severe enough to set off the airbags will usually cause enough damage to total the car, it doesn't always.

How long does it take for an adjuster to make a decision

Usually, you'll hear from an insurance adjuster within three days of making the claim to discuss matters. If they need to survey the damage, it can be a few more days. If you use a repair garage that is affiliated with (or at least approved by) your insurance company, the process can speed up a bit.