How late can you be on AT&T payment?

There is no grace period related to billing. You can setup a payment arrangement that can help if you need extra time.

What happens if I pay my phone bill a few days late?

With most credit scoring models, late mobile payments won’t have an impact on your credit score unless the account goes to collections or the service provider charges off the debt. Depending on the provider, this likely won’t happen if you miss just one payment.

How many days late can your phone bill be?

Before scrambling or worrying about making a payment on time, Virji said consumers should know a late payment can’t be reported to the credit bureaus until it’s at least 30 days past due.

What time is AT&T payment cut off?

Your payment is due by 11:59 PM today. It sounds like what you’re really asking is when your service be suspended, and your service can be suspended any time after that. There have been people who had their service suspended at 12:00 AM midnight the following day.

What happens if I pay my AT&T bill 3 days late?

We may charge a late fee and suspend your service until your balance is paid.

Does AT&T give payment extensions?

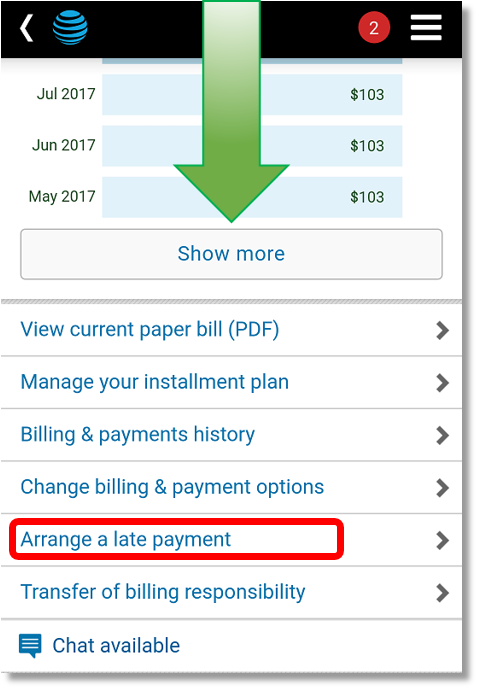

To arrange a late payment you must login to your online account yourself. Select billing and then select late payment arrangement.

Will 1 late payment affect credit?

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won’t end up on your credit reports for at least 30 days after you miss the payment. Late fees may quickly be applied after the payment due date.

Can I pay half of my ATT bill?

However, you can make separate partial payments. Sign in with your User ID and Password. Once signed in, select view profile from the Top Nav Profile at the top of the page. Select Billing and Payment options.

Does AT&T do extension?

A payment arrangement (PA) is a way to delay your payment if you can’t pay your bill on time. You can do this by logging in to your online account and selecting the billing and then late payment arrangement option.

How late can you be on AT&T payment

There is no grace period related to billing. You can setup a payment arrangement that can help if you need extra time. Please let us know if that helps.

What happens if I pay my phone bill a few days late

Can a Late Mobile Phone Payment Hurt My Credit Score With most credit scoring models, late mobile payments won't have an impact on your credit score unless the account goes to collections or the service provider charges off the debt. Depending on the provider, this likely won't happen if you miss just one payment.

Cached

How many days late can your phone bill be

Before scrambling or worrying about making a payment on time, Virji said consumers should know a late payment can't be reported to the credit bureaus until it's at least 30 days past due.

Cached

What time is AT&T payment cut off

Your payment is due by 11:59 PM today. It sounds like what you're really asking is when your service be suspended, and your service can be suspended any time after that. There have been people who had their service suspended at 12:00 AM midnight the following day.

What happens if I pay my AT&T bill 3 days late

We may charge a late fee and suspend your service until your balance is paid.

Does AT&T give payment extensions

To arrange a late payment you must login to your online account yourself. Select billing and then select late payment arrangement.

Will 1 late payment affect credit

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won't end up on your credit reports for at least 30 days after you miss the payment. Late fees may quickly be applied after the payment due date.

Can I pay half of my ATT bill

However, you can make separate partial payments. Sign in with your User ID and Password. Once signed in, select view profile from the Top Nav Profile at the top of the page. Select Billing and Payment options.

Does AT&T do extension

A payment arrangement (PA) is a way to delay your payment if you can't pay your bill by your due date. A payment arrangement keeps your service active while letting us know when and how you'll pay your balance. To make a payment arrangement: Log into your account with myAT&T app or at att.com.

What to do if I can’t pay my phone bill on time

I can't pay my mobile phone bill, what can I doChanging your bill date to a more affordable date.Moving from 'pay monthly' to pay-as-you-go.Staying on 'pay monthly' but moving you onto a lower tariff.Delaying payments for a period of time depending on your circumstances.

Does AT&T disconnect on weekends

No problem. If you cancel on a holiday, we'll take care of it the next regular business day. If you cancel during the weekend, we'll take care of it during our weekend operation hours that vary by region.

How long does a 1 day late payment stay on credit report

Late payments remain on a credit report for up to seven years from the original delinquency date — the date of the missed payment.

How do I get a late payment removed

To get an incorrect late payment removed from your credit report, you need to file a dispute with the credit bureau that issued the report containing the error. Setting up automatic payments and regularly monitoring your credit can help you avoid late payments and spot any that were inaccurately reported.

Will AT&T let you skip a payment

The amount you commit to pay must be posted to your account by the agreed-upon date. If you don't pay on the date you've agreed, your service may be suspended immediately, and a reconnection or restoral fee may be charged. Depending on your payment history, some payment methods may not be available.

How do I get an extended payment arrangement with ATT

How to make a payment arrangementSign in to your account.Go to Make a Payment.The payment calendar displays options based on your eligibility.Review payment details and select Submit to schedule your payment.The payment status screen includes your confirmation number and account balance.

How does ATT extended payment arrangement work

When making a payment arrangement, you commit to pay with the selected payment method on the chosen date. Payments start to process at 12 a.m. ET on the scheduled payment date. Payment arrangements, or payments scheduled to post after your original bill due date, can't be changed or canceled.

How bad can 1 late payment affect credit score

Once a late payment hits your credit reports, your credit score can drop as much as 180 points. Consumers with high credit scores may see a bigger drop than those with low scores. Some lenders don't report a payment late until it's 60 days past due, but you shouldn't count on this when planning your payment.

Is it negative to be 1 day late on a credit card payment

If you missed a credit card payment by one day, it's not the end of the world. Credit card issuers don't report payments that are less than 30 days late to the credit bureaus. If your payment is 30 or more days late, then the penalties can add up.

Does a 7 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How bad will a late payment affect credit

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days.

How many payments can you miss before

And here, the answer is more complex, as it hangs on your relationship building with the lender. Most won't begin repossession until you miss three or more payments, but, as mentioned, they have the right to act after the first instance.

Does AT&T do phone bill extensions

A payment arrangement (PA) is a way to delay your payment if you can't pay your bill by your due date. A payment arrangement keeps your service active while letting us know when and how you'll pay your balance. To make a payment arrangement: Log into your account with myAT&T app or at att.com.

Does a 3 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How many late payments is considered bad

Anything more than 30 days will likely cause a dip in your credit score that can be as much as 180 points. Here are more details on what to expect based on how late your payment is: Payments less than 30 days late: If you miss your due date but make a payment before it's 30 days past due, you're in luck.

Will a 2 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.