Summary of the Article: Gap Insurance

1. Gap insurance covers negative equity: Some gap insurance policies will cover the total loan balance, including negative equity rolled into a new car loan. For instance, if you trade in a car with negative equity, that amount is added to the new loan.

2. Gap insurance is not full coverage: While gap insurance is not considered full coverage on its own, it can be included as part of a full coverage insurance policy. Full coverage typically includes a state’s minimum required insurance, comprehensive insurance, and collision insurance, with gap coverage added if required by a lender or lessor.

3. Gap insurance does not cover motor damage: Gap insurance does not pay for mechanical breakdowns such as engine failure or a broken transmission. It only covers the difference between the car’s value and the amount owed if the vehicle is totaled in an accident or stolen.

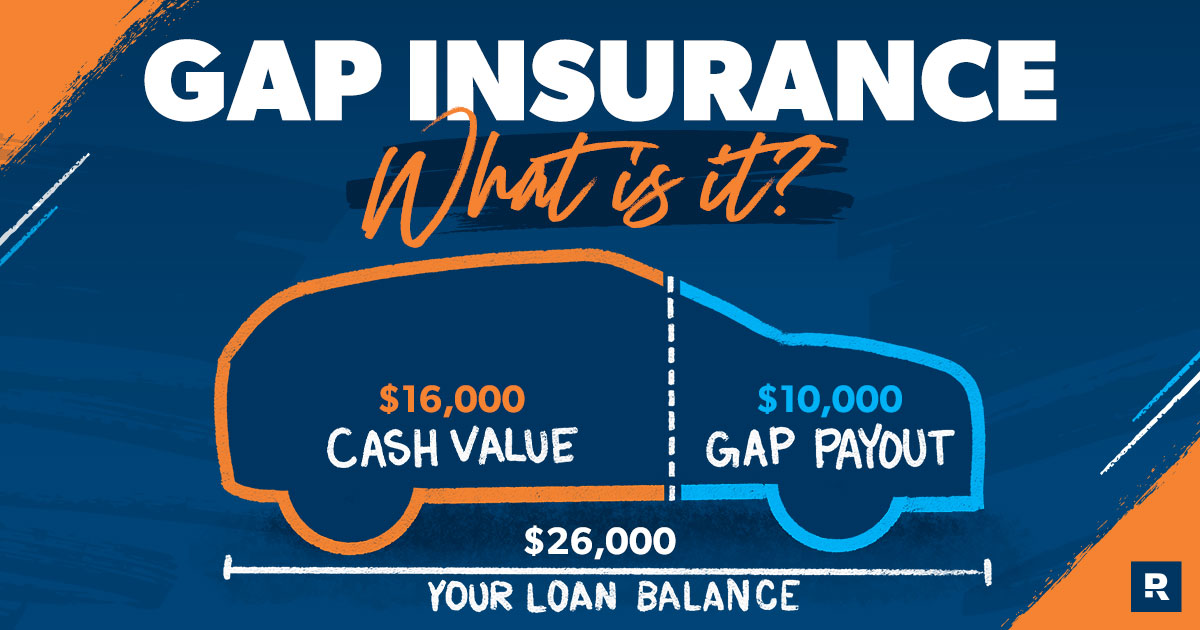

4. Example of gap insurance: Gap insurance comes into play when the loan amount is higher than the vehicle’s worth. For example, if you owe $25,000 on your loan but your car is valued at only $20,000, gap coverage will cover the $5,000 difference (minus the deductible).

5. Gap insurance pays off loans: Gap insurance is an optional coverage that pays off your auto loan if your car is totaled or stolen, and the amount owed exceeds the depreciated value of the car. It is also known as “loan/lease gap coverage.”

6. Determining excessive negative equity: It is best to calculate the Loan-to-Value ratio (LTV) to determine if the negative equity is too much. Ideally, the loan amount should not exceed 125% of the resale value.

7. Worth of gap insurance warranty: If your vehicle is not financed, there is no need to purchase gap coverage. However, if you do finance your vehicle, the value of gap coverage depends on your driving habits and how quickly your car depreciates.

8. Gap insurance does not cover transmission failure: Gap insurance does not cover transmission failure. It only pays the difference on your loan in the event of theft or total loss of the vehicle.

Unique Questions

1. Does gap insurance cover negative equity?

Gap insurance policies can cover negative equity, including any rolled-in amounts from a previous loan.

2. Is gap insurance considered full coverage?

No, gap insurance is not full coverage by itself, but it can be part of a full coverage policy that includes comprehensive and collision insurance.

3. Does gap insurance cover motor damage?

No, gap insurance does not cover mechanical damages like a broken transmission or engine failure. It only covers the difference between the car’s value and the loan amount if the car is totaled or stolen.

4. Can you provide an example of gap insurance?

Gap insurance comes into play when the loan amount exceeds the car’s value, covering the difference between the two.

5. Will gap insurance pay off my loan?

Yes, gap insurance will pay off your loan if your car is totaled or stolen, and the amount owed exceeds the car’s depreciated value.

6. How much negative equity is too much on a car?

To determine if negative equity is excessive, calculate the Loan-to-Value ratio (LTV), ensuring it does not exceed 125% of the resale value.

7. Is gap warranty worth it?

If your vehicle is not financed, gap coverage is unnecessary. However, if you finance your vehicle, the value of gap coverage depends on factors like your driving habits and the rate of depreciation.

8. Does gap insurance cover a blown transmission?

No, gap insurance does not cover transmission failure. It only covers the difference on your loan in the event of theft or total loss of the vehicle.

Does gap insurance cover negative equity

Some gap insurance policies might cover you for the total loan balance, including negative equity rolled into your new car loan. For example, if you trade in a car on which you owe more than it's worth, that negative equity is rolled into your new loan.

Is Gap considered full coverage

No, gap insurance is not the same as full coverage, but it can be part of full coverage. Full coverage is commonly defined as the combination of a state's minimum required insurance, comprehensive insurance, and collision insurance, though gap coverage is included if required by a lender or lessor.

Does gap insurance cover motor damage

The short answer is no, gap insurance does not pay for a mechanical breakdown like a seized engine or broken transmission. Gap insurance pays the difference between your car's value and what you owe on it if the vehicle is totaled in a crash or stolen.

What is an example of a gap insurance

When your loan amount is more than your vehicle is worth, gap insurance coverage pays the difference. For example, if you owe $25,000 on your loan and your car is only worth $20,000, your gap coverage covers the $5,000 gap, minus your deductible.

Cached

Will gap insurance pay off my loan

Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car's depreciated value. Gap insurance may also be called "loan/lease gap coverage."

How much is too much negative equity on a car

How much negative equity is too much The best way to determine if the negative equity is too much is to calculate the Loan-to-Value ratio (LTV). Ideally, the loan amount should not exceed 125% of the resale value.

Is Gap warranty worth it

Do You Need Gap Insurance Coverage If your vehicle is not financed, there is no reason to purchase gap coverage. If you do finance your vehicle, gap coverage can be a good idea, but it depends on how much you drive and how quickly your car depreciates. Keep in mind that cars can depreciate rapidly.

Does gap insurance cover blown transmission

Does gap insurance cover transmission failure No. Gap insurance may pay the difference on your loan if your car gets stolen or totaled in an accident and you still owe more than the vehicle is worth.

What’s the difference between gap insurance and regular insurance

In the event of an accident in which you've badly damaged or totaled your car, gap insurance covers the difference between what a vehicle is currently worth (which your standard insurance will pay) and the amount you actually owe on it.

What happens to gap insurance when you payoff your car

When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

Is gap insurance on a car loan worth it

Gap coverage is worth it only as long as you are leasing a car or if you owe more on a loan than your car is worth. You don't need gap insurance if you don't have a car loan or lease. You won't need gap insurance forever. Drop gap insurance once your car loan is less than the value of your vehicle.

What is the best way to get rid of a car with negative equity

Refinancing the loan or selling the vehicle are two of the most commonly used ways to deal with negative equity. You may also consider trading in your vehicle for a different car, though that can lead to additional auto loan debt if you're rolling the original loan balance over.

Does negative equity hurt your credit score

What happens when you have negative equity If you're going to stay in your home long-term and can keep making on-time mortgage payments, negative equity shouldn't impact your credit or affect your finances in any way, really. But if you need to sell your home, it could put you at an economic disadvantage.

Why is gap insurance a good idea

Gap insurance, guaranteed auto protection, reimburses a car owner when the payment for a total loss is less than the outstanding loan or lease balance. Gap insurance makes sense for people who put no money down and choose a long payoff period since they may owe more than the car's current value.

Should I drop my gap insurance

You probably don't need to carry gap insurance forever. Once you pay down the loan to the point where it's worth more than you owe, you should remove gap coverage, as long as the terms of your lease allow it. In the event your car experiences a total loss, having gap insurance would not result in any extra payment.

Is a car totalled if the transmission goes out

Depending on how extensive the damage is, the claim could quickly become expensive. Replacing a transmission is costly. If you have an older vehicle, the cost to replace the transmission may be higher than your vehicle's value. If this occurs, your insurance company would declare your vehicle to be a total loss.

Do you get money back from Gap

What Is a GAP Insurance Refund When you cancel your GAP policy early, you'll receive a GAP insurance refund reimbursing you with a portion of your unused premiums. This usually occurs after you repay your loan, or if you sell or trade in your vehicle before you pay off your loan.

How much money will I get back from my gap insurance

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.

How do you cash out equity on a car

You can take equity out of your car in the form of a cash-out auto refinance loan that's up to the current value of your vehicle. You'll get cash back as a lump sum over the amount of your original loan balance.

How to trade-in a car that is not paid off with positive equity

A: If you still owe money on the car, you can trade it in for a cheaper one. If, for example, you owe $15,000 and the car is worth $20,000, the dealer can purchase the car as a trade-in, pay off the loan, and put the $5,000 toward your new auto loan as equity.

How do you get rid of negative equity fast

The faster you pay down your loan, the faster you'll eliminate the negative equity. This can also reduce the amount you pay in interest. Just make sure extra payments go toward your principal. Refinance with a shorter loan term.

Why is it bad to have a gap in car insurance

Depending on how long you've gone without coverage, insurance providers may consider you a high-risk driver. Premiums for high-risk drivers are much more expensive than the premiums available to average drivers and not every insurance provider may be willing to cover you.

How do you get your gap money back

Typically, if you cancel your insurance within 30 days after the policy's start date, you can get a full refund (including GAP insurance costs). If you cancel your insurance after 30 days, your refund will be prorated. Check with your insurance provider for your policy details.

Does full coverage cover blown transmission

For the cost of your transmission repairs to be covered, you usually must meet one of these requirements: You have mechanical coverage. You can prove the damage is due to a recent accident, and you have full coverage. You have a warranty that covers the damage.

How much refund should I expect from gap insurance

If you already paid for gap insurance, you can cancel it and request a refund from your car insurance company for any unused portion of the coverage. For example, if you have six months of coverage left on a 12-month gap insurance policy and you cancel, you can be reimbursed for the unused six months minus any fees.