Summary of the article:

1. Contact the three major credit bureaus: Immediately contact the fraud departments of Equifax, Experian, and TransUnion to report identity theft.

2. Removing fraudulent information: If you’ve been a victim of identity theft, you can request credit reporting companies to remove fraudulent information and debts from your credit report.

3. Disputing identity theft on your credit report: Create an identity theft report through the FTC’s website and prepare a dispute letter to mail to Experian, Equifax, and TransUnion to request the removal of fraudulent accounts.

4. Monitoring your credit history: Regularly monitor your credit history by obtaining one free credit report every year from each of the three national credit bureaus.

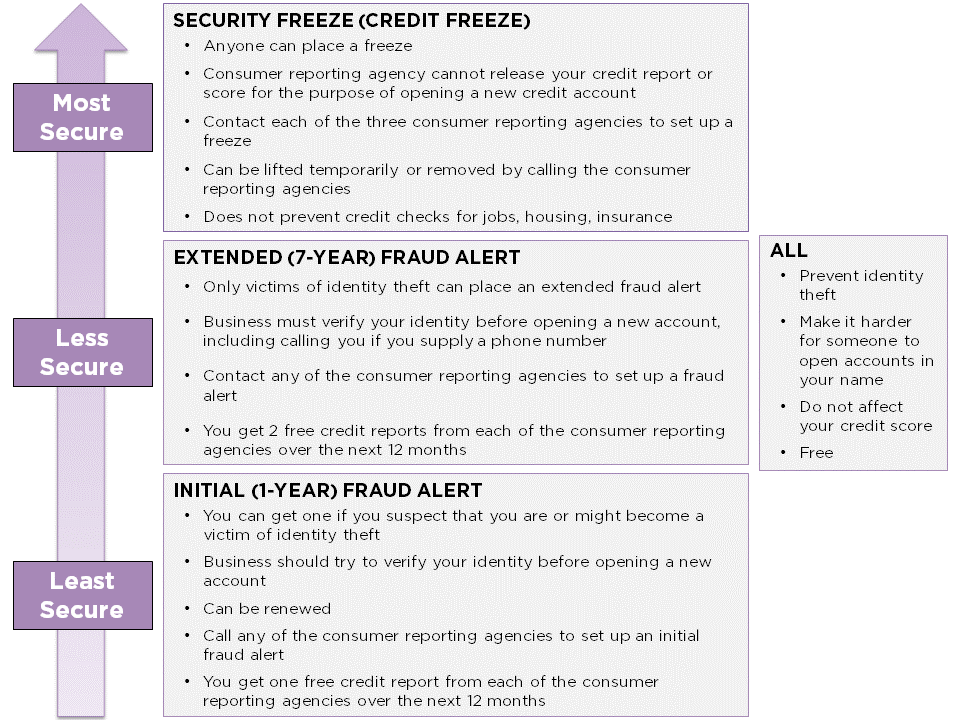

5. Taking steps after identity theft: Contact your local police department to report the crime and obtain a police report. Consider placing a security freeze on your credit report.

6. Time to fix credit after identity theft: The recovery timeline varies for each case of identity theft and can take days, months, or even years depending on the type of identity theft.

7. Banks’ investigation of credit card fraud: How banks investigate identity theft and fraud is not mentioned in the article.

Questions based on the text:

- What are the 3 credit bureaus to report identity theft?

- Will the credit bureau remove identity theft?

- How do I dispute identity theft on my credit report?

- What is the most important way to fight identity theft?

- What are 3 steps to take after identity has been stolen?

- How long does it take to fix credit after identity theft?

- How do credit card companies investigate identity theft?

The three credit bureaus to contact for reporting identity theft are Equifax, Experian, and TransUnion.

If you’ve been a victim of identity theft, credit reporting companies can remove fraudulent information and debts from your credit report through a process called blocking. You need to provide them with an identity theft report, which can be done through IdentityTheft.gov.

To dispute identity theft on your credit report, create an identity theft report through the FTC’s website and send a dispute letter to Experian, Equifax, and TransUnion requesting the removal of fraudulent accounts.

One of the most effective ways to protect against identity theft is to regularly monitor your credit history. You can request a free credit report every year from Equifax, Experian, and TransUnion to keep track of any suspicious activities.

After your identity has been stolen, it is important to contact your local police department, report the crime, and obtain a police report. You should also consider placing a security freeze on your credit report.

The time it takes to fix credit after identity theft can vary significantly. It can take days, months, or even years, depending on various factors such as the type of identity theft that occurred.

The article does not provide information on how credit card companies investigate identity theft.

What are the 3 credit bureaus to report identity theft

Immediately contact the fraud departments of the three major credit bureaus (Equifax, Experian, and Trans Union) to let them know about your situation.

Cached

Will the credit bureau remove identity theft

If you've been a victim of identity theft, you can also get credit reporting companies to remove fraudulent information and debts from your credit report, which is called blocking. To do this, you must send the credit reporting companies: An identity theft report, which can be done through IdentityTheft.gov.

Cached

How do I dispute identity theft on my credit report

The best way to do this is to go to the police with an "identity theft report" that you have already prepared. You can create an identity theft report through the FTC's website. Prepare a dispute letter to mail to Experian, Equifax & TransUnion requesting the fraudulent account(s) be removed from your credit reports.

What is the most important way to fight identity theft

One of the best ways to protect against identity theft is to monitor your credit history. You can get one free credit report every year from each of the three national credit bureaus: Equifax, Experian and TransUnion. Request all three reports at once, or be your own no-cost credit-monitoring service.

What are 3 steps to take after identity has been stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

How long does it take to fix credit after identity theft

"It can take days, months, or even years to untangle identity theft," says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

How long does it take to fix your credit after identity theft

"It can take days, months, or even years to untangle identity theft," says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

How do credit card companies investigate identity theft

How Do Banks Investigate Fraud Bank investigators will usually start with the transaction data and look for likely indicators of fraud. Time stamps, location data, IP addresses, and other elements can be used to prove whether or not the cardholder was involved in the transaction.

How long does it take to dispute identity theft

"It can take days, months, or even years to untangle identity theft," says Tolmachoff. This is because each case of identity theft is unique, and the recovery timeline can depend on many factors, including the type of identity theft that took place.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What 4 things you do if you are a victim of identity theft

How to report ID theftThe Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338.The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.The fraud department at your credit card issuers, bank, and other places where you have accounts.

What three actions should you take if you are a victim of identity theft

Steps for Victims of Identity Theft or FraudPlace a fraud alert on your credit report.Close out accounts that have been tampered with or opened fraudulently.Report the identity theft to the Federal Trade Commission.File a report with your local police department.

What are 2 things you should do if your identity is stolen

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information. Contact your police department, report the crime and obtain a police report.

Do credit card companies investigate identity theft

Credit card companies dedicate millions of dollars annually to catching and preventing fraudulent transactions in their customers' accounts. Credit card companies investigate fraudulent activity and may forward the results of their investigation to the closest law enforcement agency.

What to do immediately after identity theft

The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts. The fraud department at your credit card issuers, bank, and other places where you have accounts.

Can you fully recover from identity theft

The wide-range of identity theft-related crimes makes it hard to put a clear timeframe on recovery. However, on average, it can take over six months and 100–200 hours of your time to discover, resolve, and recover from the effects of identity theft [*]. But that's just the average.

How long does credit card theft investigation take

Typically bank fraud investigations take up to 45 days.

Do credit card companies prosecute identity theft

Credit card fraud can be prosecuted at either the state or federal level. Most credit card fraud cases that lead to criminal charges are handled at the state and local levels.

What is the investigation process of identity theft

INVESTIGATING IDENTITY THEFT

Law enforcement must accept the complaint, prepare a police report and provide the complainant with a copy, and investigate the alleged violation and coordinate the investigation with other law enforcement agencies if necessary (CGS § 54-1n).

How do I check to see if someone is using my Social Security number

Review the earnings posted to your record on your Social Security Statement and report any inconsistencies to us. Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes.

How do I freeze my Social Security number

This is done by calling our National 800 number (Toll Free 1-800-772-1213 or at our TTY number at 1-800-325-0778). Once requested, any automated telephone and electronic access to your Social Security record is blocked.

What are the first two things you need to do if your identity is stolen

How to report ID theftThe Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338.The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.The fraud department at your credit card issuers, bank, and other places where you have accounts.

What happens if someone fraudulently uses your credit card

Notify Your Credit Card Issuer

Some issuers allow for fraud reporting in their app or on their website, though you may need to call the number on the back of your card. If fraud is confirmed, the issuer will likely cancel that card and issue you a new one with different numbers.

How long does it take to resolve identity theft

The wide-range of identity theft-related crimes makes it hard to put a clear timeframe on recovery. However, on average, it can take over six months and 100–200 hours of your time to discover, resolve, and recover from the effects of identity theft [*]. But that's just the average.

How long does it take for identity theft to be resolved

The wide-range of identity theft-related crimes makes it hard to put a clear timeframe on recovery. However, on average, it can take over six months and 100–200 hours of your time to discover, resolve, and recover from the effects of identity theft [*]. But that's just the average.