What is the minimum credit score for a Discover it card?

The Discover it Secured Credit Card is a no-annual fee secured credit card for people looking to either improve their credit or build their credit history. Therefore, there is no minimum credit score required to qualify for the card.

What credit score does Discover use?

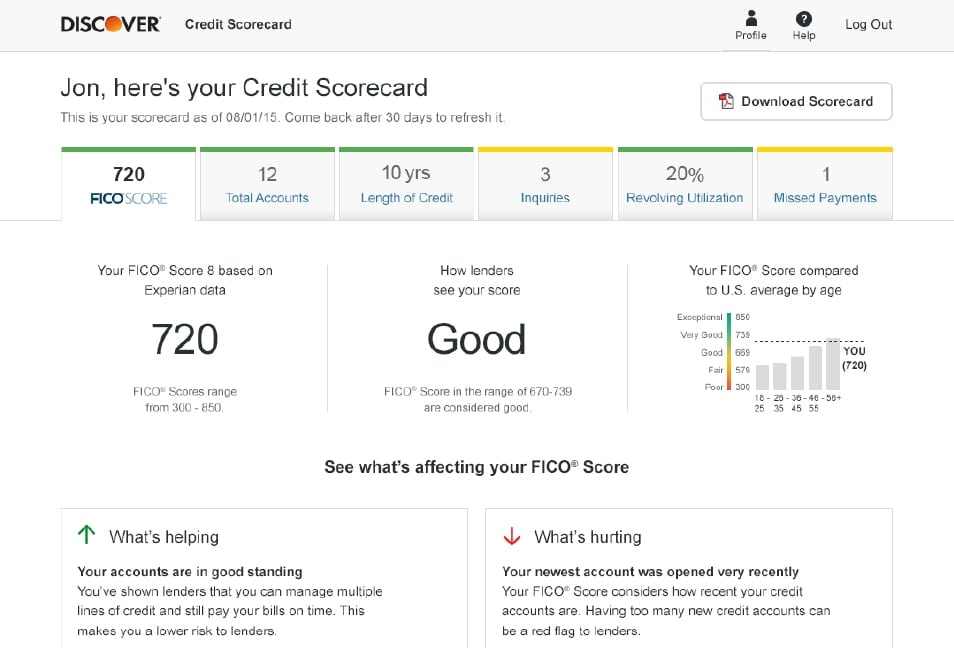

90% of top lenders use FICO® Credit Scores, including Discover. That’s why Discover provides a FICO® Score instead of any other type of credit score.

Do you need a good credit score for Discover Card?

You’ll likely qualify for any Discover card if you have good or excellent credit. To clarify, a good credit score is a FICO® Score of 670 or above.

Does everyone get approved for a Discover credit card?

With a high credit score, you’ll have a good chance of approval for a Discover credit card. But that won’t matter if you run afoul of Discover’s application rules. If you haven’t, but your application was still denied, then it’s a good idea to see if Discover will reconsider.

What is the easiest Discover card to get approved for?

If you have a low credit score or limited credit history, a secured card (like the Discover Secured Credit Card) may be a good option for you. The minimum credit score needed for a secured card is lower than the minimum score you need to qualify for an unsecured credit card.

Can you get a Discover card with a 650 credit score?

A 700+ credit score is needed to get most Discover credit cards, but there’s no minimum credit score needed for a few Discover cards. You can get the Discover it® Secured Credit Card with a bad credit score (below 640).

Which Discover card is easiest to get?

If you have a low credit score or limited credit history, a secured card (like the Discover Secured Credit Card) may be a good option for you. The minimum credit score needed for a secured card is lower than the minimum score you need to qualify for an unsecured credit card.

Does Discover do a hard credit check?

While some credit card issuers may run a hard inquiry on your credit reports when you request an increase to your credit line, Discover doesn’t do that. As a result, you can submit your request without worrying about risking an impact on your credit scores.

Why did Discover card deny me?

Common reasons applicants are denied credit cards include low credit scores, no credit history, inadequate ratio of income vs. expenses, and not meeting minimum age requirements.

Is Discover card a hard pull?

It is likely Discover will make a hard inquiry on at least one of your credit reports. To get a good idea of whether or not you should risk a hard inquiry, it’s worth trying Discover’s preapproval process. A preapproval will not typically result in a hard inquiry against your credit.

What is the average Discover card limit?

In general, the average Discover it® cardholder received an initial limit of around $3,000, with higher limits going to those with exceptional credit and/or particularly high incomes.

What is the minimum credit score for a Discover it card

The Discover it Secured Credit Card is a no-annual fee secured credit card for people looking to either improve their credit or build their credit history. Therefore, there is no minimum credit score required to qualify for the card.

What credit score does Discover use

90% of top lenders use FICO® Credit Scores2, including Discover. That's why Discover provides a FICO® Score instead of any other type of credit score.

Do you need a good credit score for Discover Card

You'll likely qualify for any Discover card if you have good or excellent credit. To clarify, a good credit score is a FICO® Score of 670 or above.

Cached

Does everyone get approved for a Discover credit card

With a high credit score, you'll have a good chance of approval for a Discover credit card. But that won't matter if you run afoul of Discover's application rules. If you haven't but your application was still denied, then it's a good idea to see if Discover will reconsider.

What is the easiest Discover card to get approved for

If you have a low credit score or limited credit history, a secured card (like the Discover Secured Credit Card) may be a good option for you. The minimum credit score needed for a secured card is lower than the minimum score you need to qualify for an unsecured credit card.

Can you get a Discover card with a 650 credit score

A 700+ credit score is needed to get most Discover credit cards, but there's no minimum credit score needed for a few Discover cards. You can get the Discover it® Secured Credit Card with a bad credit score (below 640).

Which Discover card is easiest to get

If you have a low credit score or limited credit history, a secured card (like the Discover Secured Credit Card) may be a good option for you. The minimum credit score needed for a secured card is lower than the minimum score you need to qualify for an unsecured credit card.

Does Discover do a hard credit check

While some credit card issuers may run a hard inquiry on your credit reports when you request an increase to your credit line, Discover doesn't do that. As a result, you can submit your request without worrying about risking an impact on your credit scores.

Why did Discover card deny me

Common reasons applicants are denied credit cards include low credit scores, no credit history, inadequate ratio of income vs. expenses, and not meeting minimum age requirements.

Is Discover card a hard pull

Does Discover make a hard inquiry It is likely Discover will make a hard inquiry on at least one of your credit reports. To get a good idea of whether or not you should risk a hard inquiry, it's worth trying Discover's preapproval process. A preapproval will not typically result in a hard inquiry against your credit.

What is the average Discover card limit

In general, the average Discover it® cardholder received an initial limit of around $3,000, with higher limits going to those with exceptional credit and/or particularly high incomes.

Can I get an Amex card with a 650 credit score

Although American Express doesn't specify any minimum credit score requirements, you'll need good credit (or better) to qualify, which means a FICO score of at least 670. A premium Amex card — say, the American Express Gold Card — likely requires a “very good” FICO score, somewhere in the range of 740 and above.

What is the highest credit limit on a Discover card

The highest credit card limit we've come across for the Discover it® Cash Back is $56,500. That's much higher than the minimum starting credit limit of $500. The card has a 0% intro APR on new purchases and balance transfers. Once the introductory period ends, the regular interest rates apply.

How bad is getting rejected for a credit card

Being denied for a credit card doesn't hurt your credit score. But the hard inquiry from submitting an application can cause your score to decrease. Submitting a credit card application and receiving notice that you're denied is a disappointment, especially if your credit score drops after applying.

Can you apply for a Discover it card with a poor approval

Lower credit score requirements

No credit score is required to apply for Discover it® Student Cash Back, Discover it® Student Chrome, and Discover it® Secured Credit Card. Discover will consider information you include on your application and provided by others to determine your eligibility.

Why did discover card deny me

Common reasons applicants are denied credit cards include low credit scores, no credit history, inadequate ratio of income vs. expenses, and not meeting minimum age requirements.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

How much should I spend if my credit limit is $5000

This means you should take care not to spend more than 30% of your available credit at any given time. For instance, let's say you had a $5,000 monthly credit limit on your credit card. According to the 30% rule, you'd want to be sure you didn't spend more than $1,500 per month, or 30%.

What credit cards can I get with a 590 score

Popular Credit Cards for a 590 Credit ScoreBest Overall: Discover it® Secured Credit Card.No Credit Check: OpenSky® Secured Visa® Credit Card.Unsecured: Credit One Bank® Platinum Visa® for Rebuilding Credit.Rewards & No Annual Fee: Capital One Quicksilver Secured Cash Rewards Credit Card.

What is the average starting credit line for Discover it card

Discover it® Secured Credit Card

No Annual Fee. Use your tax refund to fund your security deposit and start building your credit history. Your credit line will equal your deposit amount, starting at $200. Bank information must be provided when submitting your deposit.

What disqualifies you from getting a credit card

If you don't have a substantial source of income — or none at all — you may struggle to be approved for a credit card. Having poor payment history is an indicator that you may not be able to repay the credit lenders extend. Lenders may not look favorably upon applicants who are carrying debt.

Is discover card a hard inquiry

Does Discover make a hard inquiry It is likely Discover will make a hard inquiry on at least one of your credit reports. To get a good idea of whether or not you should risk a hard inquiry, it's worth trying Discover's preapproval process. A preapproval will not typically result in a hard inquiry against your credit.

What is the easiest card to get with bad credit

Best Credit Cards For Bad CreditNavy FCU nRewards® Secured Credit Card * [ jump to details ]Tomo Credit Card * [ jump to details ]OpenSky® Secured Visa® Credit Card.Discover it® Secured Credit Card.Credit One Bank® Platinum Visa® for Rebuilding Credit *Bank of America® Customized Cash Rewards Secured Credit Card *

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.

What credit limit can I get with a 800 credit score

Despite those high balances, it's equally important to note that those with high credit scores also have high credit card limits. For those with 800-plus scores, their average credit card limits are $69,346. That's up from the $58,514 average we found in May 2021.