Summary of the article: How to Protect Your Bank Account from Creditors

1. Use an exempt bank account: Open a bank account that is exempt from creditor garnishment.

2. Establish a bank account in a state that prohibits garnishments: Choose a state where the laws protect your funds from being garnished.

3. Open an offshore bank account: Consider opening a bank account in an offshore jurisdiction where your funds are protected.

4. Maintain a wage or government benefits account: Keep your funds in a separate account specifically for your wages or government benefits.

5. Use direct deposit: Opt for direct deposit of exempt funds to easily verify and protect them.

6. Use a separate account: Keep your exempt funds separate from other funds by using a separate bank account.

7. Don’t deposit checks: Avoid depositing checks into your bank account to protect your funds from being garnished.

8. Joint account garnishment: Creditors can garnish a joint bank account if you own it with someone else who is not your spouse.

9. Creditor’s ability to take all money: If a debt collector has a court judgment, they may have the ability to garnish your bank account or wages.

10. Protected bank accounts: Some IRS-designated trust accounts, such as IRAs, pension accounts, and annuity accounts, may be protected from creditor garnishment.

11. Secret bank accounts: It is possible to have a bank account that only you and the bank know about.

12. Getting around bank garnishment: Options include paying off debts, setting up a payment plan, challenging the garnishment, not depositing money into a bank account, settling the debt, or considering bankruptcy.

Questions and Answers:

- Q: How do I hide my bank account from creditors?

- Q: How do I protect my bank account from a judgement?

- Q: Can my joint bank account be garnished by creditors?

- Q: Can a creditor take all the money in my bank account?

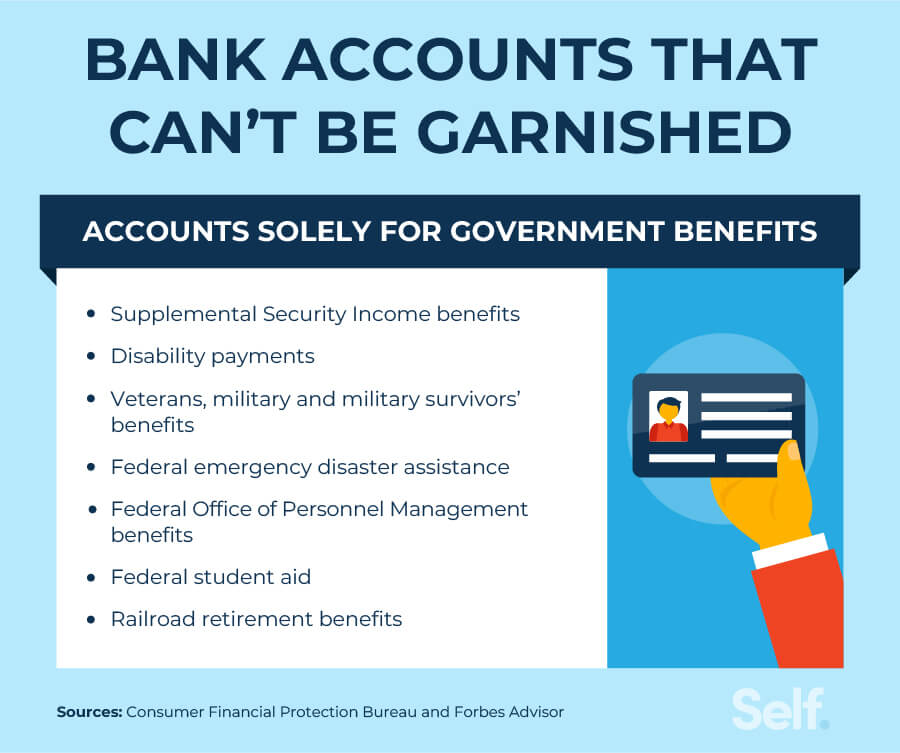

- Q: What type of bank accounts are protected from creditors?

- Q: Can you keep a bank account secret?

- Q: How do you get around a bank garnishment?

A: There are four ways to open a bank account that no creditor can touch. These include using an exempt bank account, establishing a bank account in a state that prohibits garnishments, opening an offshore bank account, or maintaining a wage or government benefits account.

A: To protect funds from creditors, you can use direct deposit, maintain a separate account for exempt funds, and avoid depositing checks.

A: Yes, creditors can garnish a bank account that you own jointly with someone who is not your spouse.

A: If a debt collector has a court judgment, they may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

A: In many states, certain IRS-designated trust accounts, such as IRAs, pension accounts, and annuity accounts, may be exempt from creditor garnishment. Assets held in an irrevocable living trust are also protected.

A: It is possible to have a bank account that only you and the bank know about.

A: Options include paying off debts, setting up a payment plan, challenging the garnishment, not depositing money into a bank account, settling the debt, or considering bankruptcy.

How do I hide my bank account from creditors

There are four ways to open a bank account that no creditor can touch: (1) use an exempt bank account, (2) establish a bank account in a state that prohibits garnishments, (3) open an offshore bank account, or (4) maintain a wage or government benefits account.

Cached

How do I protect my bank account from a Judgement

How To Protect These Funds From CreditorsUse direct deposit. If you receive exempt funds via direct deposit, it will be easier to verify what money is exempt.Use a separate account. Using a separate account can help you to keep funds separate in the first place.Don't deposit checks.

Cached

Can my bank account be garnished if it’s a joint account

Creditors may be able to garnish a bank account (also referred to as levying the funds in a bank account) that you own jointly with someone else who is not your spouse. A creditor can take money from your joint savings or checking account even if you don't owe the debt.

Cached

Can a creditor take all the money in your bank account

If a debt collector has a court judgment, then it may be able to garnish your bank account or wages. Certain debts owed to the government may also result in garnishment, even without a judgment.

Cached

What type of bank accounts are protected from creditors

In many states, some IRS-designated trust accounts may be exempt from creditor garnishment. This includes individual retirement accounts (IRAs), pension accounts and annuity accounts. Assets (including bank accounts) held in what's known as an irrevocable living trust cannot be accessed by creditors.

Can you keep a bank account secret

That's right: A bank account that only you and the bank know about. The reasons to hide your savings aren't always sinister — and sometimes they are! With some care planning and well-thought out moves, it is entirely possible to have an entire bank account that no on know about other than you.

How do you get around a bank garnishment

Pay your debts if you can afford it. Make a plan to reduce your debt.If you cannot afford to pay your debt, see if you can set up a payment plan with your creditor.Challenge the garnishment.Do no put money into an account at a bank or credit union.See if you can settle your debt.Consider bankruptcy.

How do I protect my savings account from a lawsuit

Seven Ways to Protect Your Assets from Litigation and CreditorsPurchase Insurance. Insurance is crucial as a first line of protection against speculative claims that could endanger your assets.Transfer Assets.Re-Title Assets.Make Retirement Plan Contributions.Create an LLC or FLP.Set Up a DAPT.Create an Offshore Trust.

Can you get in trouble for using money on a joint account

Liability for Misuse of Funds

When one account owner withdraws or spends joint account funds without the joint owner's knowledge or consent, he may be liable to the owner for misusing those funds.

Can you get in trouble for taking money from a joint account

Either party may withdraw all the money from a joint account. The other party may sue in small claims court to get some money back. The amount awarded can vary, depending on issues such as whether joint bills were paid from the account or how much each party contributed to the account.

Can multiple bank accounts be garnished

There are many times when a debtor does not have enough funds in a bank account to cover the entirety of a debt to a creditor. When a debt is not paid through a single bank levy, a creditor is allowed to place more than one bank levy on an account or on multiple accounts of a single debtor.

How long can a creditor put a hold on your bank account

There is no set time limit. Some judgment creditors try to seize funds right away, and others never actually take funds at all.

Can you hide money from debt collectors

You have to answer all questions asked of you during a judgment debtor exam honestly and accurately. This is why it's virtually impossible to hide your assets from a creditor with a judgment against you. U.S. courts will not hand over your assets to a creditor on a silver platter.

How do you know if a bank is asset or liability sensitive

When a bank has a positive gap, it is said to be asset sensitive. Should market interest rates decrease, a positive gap indicates that net interest income would likely also decrease. If rates increase, a positive gap indicates that net interest income may also increase.

What kind of bank account is untraceable

An anonymous bank account also referred to as a “numbered account,” is a bank account where the identity of the account holder is replaced with a multi-digit number or code.

What bank account details should you never give out

Also, you should never share your personal banking details, such as PIN, card number, card expiry date and CVV number (that's the three digit number, which, in Starling's case can be found on the right side of the signature strip).

What prepaid cards Cannot be garnished

Pre-paid debit cards are different than gift cards. Gift cards, even the Visa or MasterCard gift cards, do not require personally identifying information. So, gift cards cannot be garnished by sending a garnishment order to the issuer.

How do creditors find your bank accounts

Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, skip tracers, and information subpoenas. Most of the time, the creditor must obtain a court order before garnishing your bank accounts, but this isn't the case for some government entities.

Can debt collectors see your savings account

Collection agencies can access your bank account, but only after a court judgment. A judgment, which typically follows a lawsuit, may permit a bank account or wage garnishment, meaning the collector can take money directly out of your account or from your wages to pay off your debt.

What assets Cannot be taken in a lawsuit

Unless you take steps to protect them, most assets are not protected in a lawsuit. One of the few exceptions to this is your employer-sponsored IRA, 401(k), or another retirement account. At Bratton Estate and Elder Care Attorneys, our lawyers recommend putting an asset protection plan in place before you need it.

How much money is protected in a joint bank account

The best way to work out the protection that applies is to know that the FSCS considers that half the money in the account belongs to each person.

How do I protect money in a joint account

Ask your bank to change the way any joint account is set up so that both of you have to agree to any money being withdrawn, or to freeze it. Be aware that if you freeze the account, both of you have to agree to 'unfreeze' it.

How many times can a bank account be levied

The bank only takes out money one time for each levy. They do this when they get the levy. If you want to try to take money again you'll need to do another levy.

What happens if you take all the money from a joint account

Either party may withdraw all the money from a joint account. The other party may sue in small claims court to get some money back. The amount awarded can vary, depending on issues such as whether joint bills were paid from the account or how much each party contributed to the account.

Can a bank remove a hold on your account

Removing a hold on a bank account

When figuring out how to remove a hold on a bank account, you can often contact your bank and find out what caused the hold. If it was a pre-authorization hold placed by a merchant on a debit card transaction, you might be able to contact them directly and have them remove it.