Summary of the Article

Credit monitoring services notify you of changes made to your credit reports so you can take action against potential misuse of your personal information.

There are three major consumer credit bureaus: Equifax, Experian, and TransUnion.

FICO is not a credit monitoring service: While there are free credit monitoring services available, FICO charges for each of its plans. The costs are as follows: Basic – $19.95 per month, Advanced – $29.95 per month.

The best 3 bureau credit report: Equifax, Experian, and TransUnion are the top three U.S. credit bureaus that collect and sell credit information on individual consumers to lenders and others.

There are three credit monitoring services: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, credit utilization, and other inquiries and information.

Equifax was the credit monitoring service that was hacked: A few days after the hack was uncovered internally, Equifax’s CFO, president of workforce solutions, and president of U.S. information solutions sold their Equifax shares.

The three major credit reporting systems in the U.S. are: TransUnion, Equifax, and Experian.

To get all three of your credit reports: You have the right to request one free copy of your credit report each year from Equifax, Experian, and TransUnion by visiting AnnualCreditReport.com. You may also be able to view free reports more frequently online.

The difference between FICO and Credit Karma: FICO is a model used to create a credit score by looking at your files from the three major credit reporting bureaus, while Credit Karma’s VantageScore follows a similar process.

Questions and Answers

1. What are credit monitoring services?

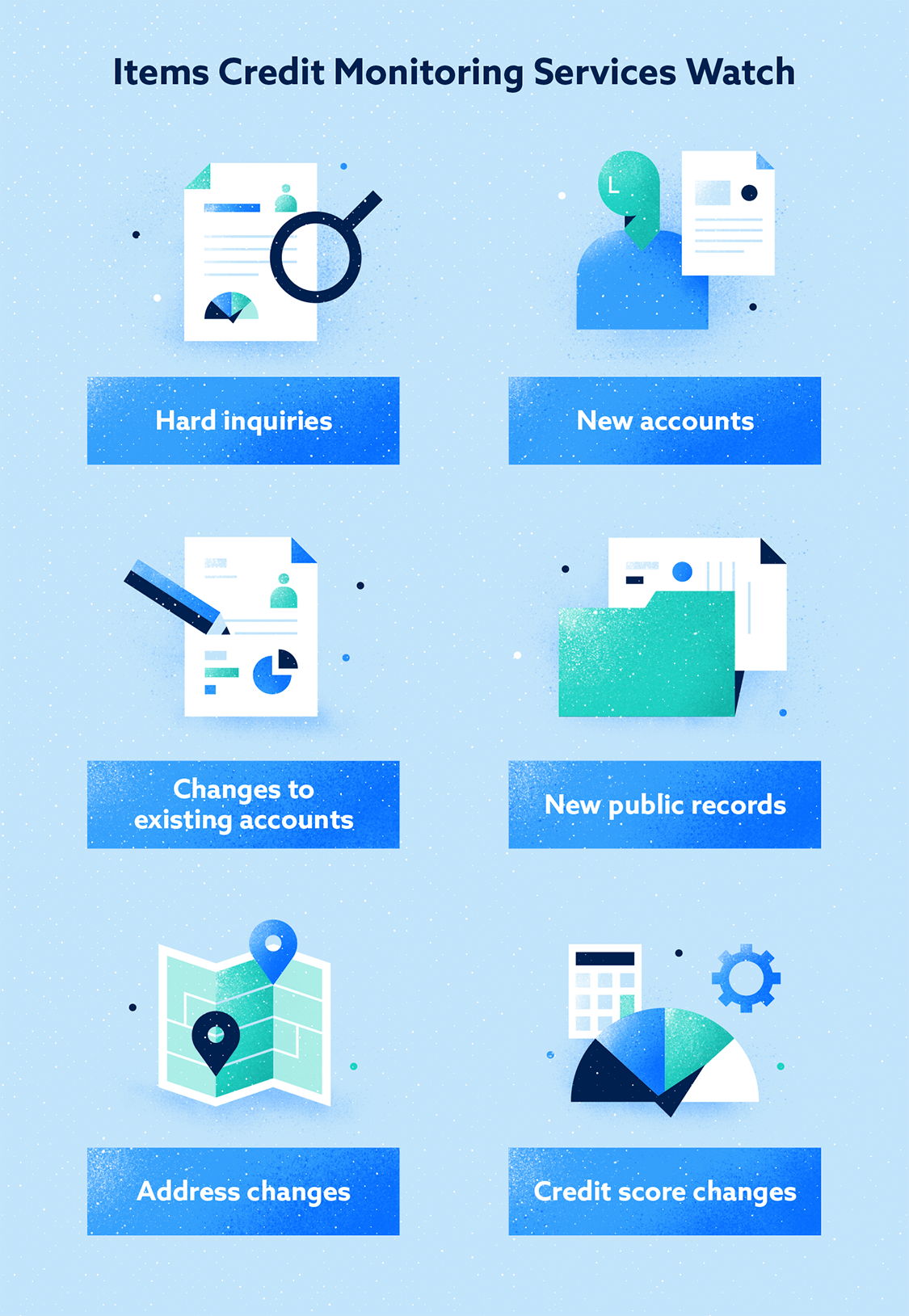

Credit monitoring services notify you of changes made to your credit reports so you can take action against potential misuse of your personal information.

2. How many credit reporting agencies are there?

There are three major consumer credit bureaus: Equifax, Experian, and TransUnion.

3. Is FICO a credit monitoring service?

No, FICO is not a credit monitoring service. While there are free credit monitoring services available, FICO charges for its plans.

4. What is the best 3 bureau credit report?

The best 3 bureau credit report includes information from Equifax, Experian, and TransUnion, the top three U.S. credit bureaus.

5. How many credit monitoring services are there?

There are three credit monitoring services: Equifax, TransUnion, and Experian.

6. Which credit monitoring service was hacked?

Equifax was the credit monitoring service that was hacked. After the hack was discovered internally, top executives sold their shares in the company.

7. What are the three major credit reporting systems in the U.S.?

The three major credit reporting systems in the U.S. are TransUnion, Equifax, and Experian.

8. How can I get all three of my credit reports?

You can request one free copy of your credit report each year from Equifax, Experian, and TransUnion by visiting AnnualCreditReport.com. You may also be able to view free reports more frequently online.

9. What’s the difference between FICO and Credit Karma?

The difference between FICO and Credit Karma is that FICO is a credit scoring model that looks at your files from the three major credit reporting bureaus, while Credit Karma uses VantageScore, which follows a similar process.

What are the credit monitoring services

Credit monitoring services notify you of changes made to your credit reports so you can take action against potential misuse of your personal information.

Are there only 3 credit reporting agencies

There are three major consumer credit bureaus: Equifax, Experian and TransUnion.

Is FICO a credit monitoring service

While there are free credit monitoring services available, FICO charges for each of its plans. Here are the costs: Basic: $19.95 per month. Advanced: $29.95 per month.

What is the best 3 bureau credit report

Equifax, Experian, and TransUnion, the top three U.S. credit bureaus, are private companies that collect and sell credit information on individual consumers to lenders and others.

How many credit monitoring services are there

three

There are three big nationwide providers of consumer reports: Equifax, TransUnion, and Experian. Their reports contain information about your payment history, how much credit you have and use, and other inquiries and information.

Which credit monitoring service was hacked

Equifax

A few days after the company uncovered the hack internally – and before the breach was revealed to the public – Equifax's chief financial officer John Gamble, its president of workforce solutions Rodolfo Ploder, and its president of U.S. information solutions Joseph Loughran sold their Equifax shares.

What are the three major credit reporting systems in the US

There are three credit agencies: TransUnion, Equifax, and Experian.

How do I get all 3 of my credit reports

You have the right to request one free copy of your credit report each year from each of the three major consumer reporting companies (Equifax, Experian and TransUnion) by visiting AnnualCreditReport.com. You may also be able to view free reports more frequently online.

What’s the difference between FICO and Credit Karma

FICO is a model used to create a score by looking at your files from the three major credit reporting bureaus. Credit Karma's VantageScore follows much the same process, except that its scoring model was actually created by the credit bureaus.

What is FICO vs Experian

Experian and FICO aren't the same thing. Experian is a credit reporting agency that also offers consumer credit monitoring products. FICO is a scoring model. A service called myFICO offers similar consumer credit monitoring products to Experian.

Do banks use TransUnion or Equifax

In conclusion. Credit card issuers and lenders may use one or more of the three major credit bureaus—Experian, TransUnion and Equifax—to help determine your eligibility for new credit card accounts, loans and more.

What is the best service to check credit score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

How do you know if your checking account has been hacked

Signs your bank account has been hackedStrange purchases. Seeing activity that's out of the ordinary may be the first clue that a hacker has infiltrated your account.Unfamiliar transactions.Blocked login.Phone call from your bank.Closed or emptied account.Denied card.

How do you check if my credit has been hacked

Check your credit reports.

Request copies of your credit report from all three nationwide credit bureaus – Equifax, Experian and TransUnion — and keep an eye out for any information that's inaccurate or incomplete, or unfamiliar accounts and addresses.

What is the difference between the 3 credit reporting agencies

While all three credit bureaus generally collect similar types of information and provide similar services (such as identity monitoring, financial tools and credit scores), they differ slightly. The main differences come down to the credit score calculations used and how they process information.

What are the three types of credit reports

There are three main credit bureaus: Experian, Equifax and TransUnion. CNBC Select reviews common questions about them so you can better understand how they work.

Does Credit Karma report to all three credit bureaus

Here's the short answer: The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus.

Does Credit Karma check all three credit bureaus

Credit Karma works with Equifax and TransUnion, two of the three major consumer credit bureaus, to give you access to your free credit scores and free credit reports. (Experian is the third major consumer credit bureau.) Credit Karma can offer free credit scores and reports because we make money in other ways.

Who is more accurate Experian or Credit Karma

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Is Experian better than FICO

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Is Experian your real FICO score

Experian and FICO aren't the same thing. Experian is a credit reporting agency that also offers consumer credit monitoring products. FICO is a scoring model. A service called myFICO offers similar consumer credit monitoring products to Experian.

Which is more accurate Experian or Credit Karma

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Which credit score is usually higher TransUnion or Equifax

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which is more credible TransUnion or Equifax

4. Is Equifax more accurate than TransUnion Scores from Equifax and TransUnion are equally accurate as they both use their own scoring systems. Both credit agencies provide accurate scores, and whichever your lender opts for will provide suitable information.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.