HTML:

Summary of the Article

The three main types of life insurance are whole life, universal life, and term life insurance.

If budgeting is your biggest concern, term life insurance may be the best choice. If you have many dependents, whole life insurance may be a better route. However, if financial planning and cash value are most important to you, universal life insurance may be a strong option.

The most common type of life insurance is term life insurance. It is the simplest and most affordable option, providing coverage for a specific period of time. If the policyholder dies during the policy term, their beneficiaries will receive a death benefit.

If you only need life insurance for a relatively short period of time, such as when you have minor children to raise, term life insurance may be better as the premiums are more affordable. If you need permanent coverage that lasts your entire life, whole life insurance is likely preferred.

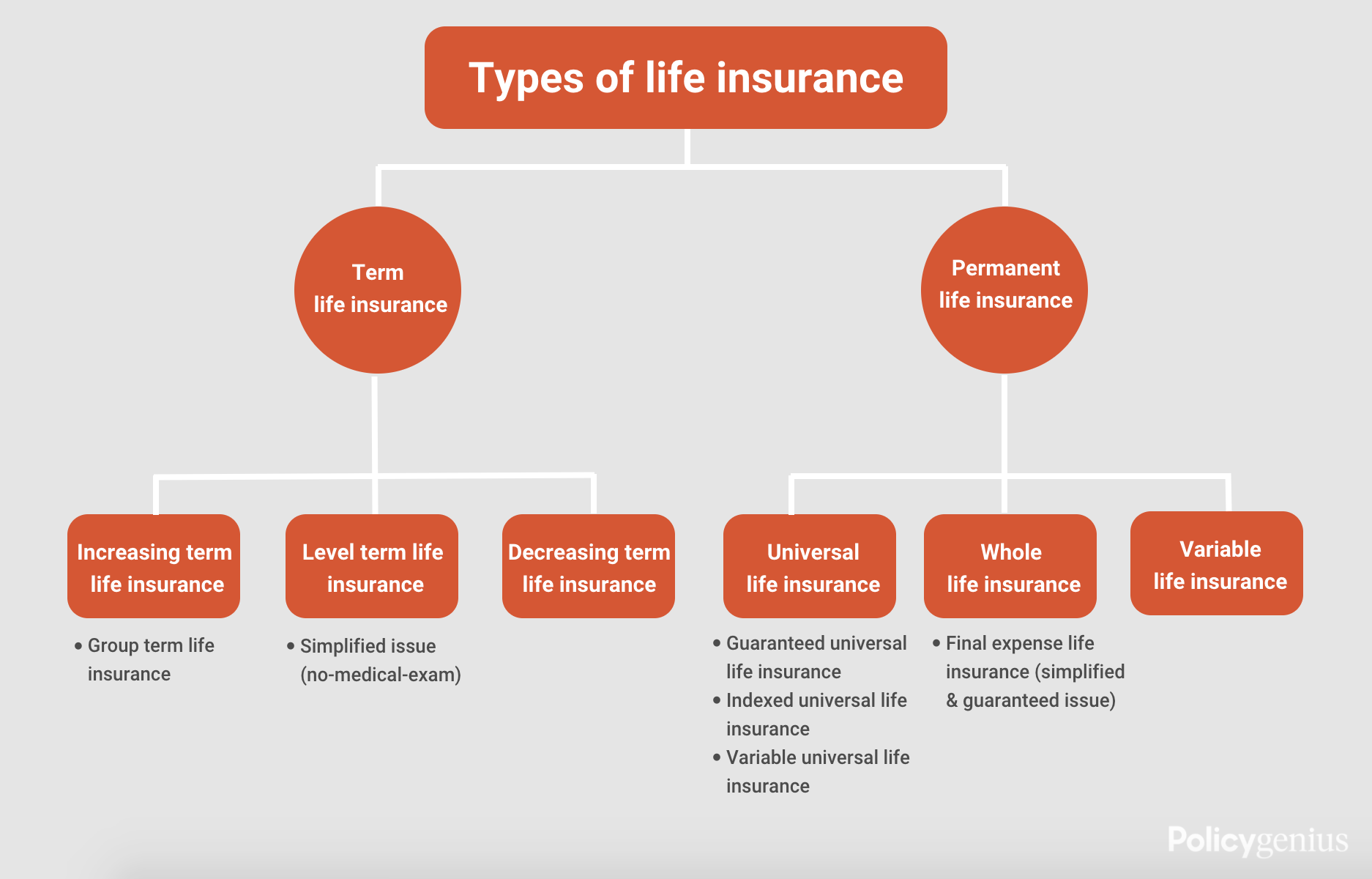

There are two primary categories of life insurance: term and permanent. Term life insurance lasts for a set timeframe, making it a more affordable option. Permanent life insurance lasts your entire lifetime.

Think of life insurance as a triangle with three parties involved: The owner, the insured, and the beneficiary. When each role is played by a different person, you’re faced with the “Unholy Trinity” of life insurance, which makes the policy’s death benefit subject to taxes.

Term life insurance is designed to cover you for a specified period and then end. It generally costs less than whole life policies but does not build cash value, so you cannot cash it out.

With whole life insurance, you can make limited withdrawals from the policy to access cash.

Questions:

- What are the three types of life insurance?

- What is the best type of life insurance to get?

- What is the most popular type of life insurance?

- Which is better whole life or term life insurance?

- What are the 2 most common types of life insurance?

- What is the life insurance rule of 3?

- Can you cash out term life insurance?

- Can you cash out whole life insurance?

The three main types are whole, universal, and term life insurance.

If budgeting is your biggest concern, term life insurance may be the best choice. If you have many dependents, whole life insurance may be a better route. However, if financial planning and cash value are most important to you, universal life insurance may be a strong option.

The most common type of life insurance is term life insurance.

If you only need life insurance for a relatively short period of time, term life may be better, as the premiums are more affordable. If you need permanent coverage that lasts your entire life, whole life is likely preferred.

There are two primary categories of life insurance: term and permanent. Term life insurance lasts for a set timeframe, making it a more affordable option, while permanent life insurance lasts your entire lifetime.

Think of life insurance as a triangle with three parties involved: The owner, the insured, and the beneficiary. When each role is played by a different person, you’re faced with the “Unholy Trinity” of life insurance, which makes the policy’s death benefit subject to taxes.

Term life insurance is designed to cover you for a specified period and then end. It generally costs less than whole life policies but does not build cash value, so you cannot cash it out.

With whole life insurance, you can make limited withdrawals from the policy to access cash.

What are the three types of life insurance

The three main types are whole, universal, and term life insurance.

Cached

What is the best type of life insurance to get

If budgeting is your biggest concern, term life insurance may be the best choice. If you have many dependents, whole life insurance may be a better route. However, if financial planning and cash value are most important to you, universal life insurance may be a strong option.

Cached

What is the most popular type of life insurance

term life insurance

The most common type of life insurance is term life insurance. Term life insurance is the simplest and most affordable type of life insurance. It provides coverage for a specific period of time, or “term.” If you die during the policy term, your beneficiaries will receive a death benefit.

Which is better whole life or term life insurance

If you only need life insurance for a relatively short period of time (such as only when you have minor children to raise), term life may be better, as the premiums are more affordable. If you need permanent coverage that lasts your entire life, whole life is likely preferred.

What are the 2 most common types of life insurance

Types of life insurance explained. There are two primary categories of life insurance: term and permanent. Term life insurance lasts for a set timeframe (usually 10 to 30 years), making it a more affordable option, while permanent life insurance lasts your entire lifetime.

What is the life insurance rule of 3

Think of life insurance as a triangle with three parties involved: The owner, the insured and the beneficiary. When each role is played by a different person, you're faced with the “Unholy Trinity” of life insurance, which makes the policy's death benefit subject to taxes.

Can you cash out term life insurance

Term life is designed to cover you for a specified period (say 10, 15 or 20 years) and then end. Because the number of years it covers are limited, it generally costs less than whole life policies. But term life policies typically don't build cash value. So, you can't cash out term life insurance.

Can you cash out whole life insurance

Make Withdrawals

Generally, you can withdraw a limited amount of cash from your whole life insurance policy. In fact, a whole life insurance cash-value withdrawal up to your policy basis, which is the amount of premiums you've paid into the policy, is typically non-taxable.

What is the most affordable form of life insurance

term life insurance

The cheapest type of life insurance is term life insurance. It is the most straightforward and affordable form of coverage. However, it is only in force for a certain period. If you want guaranteed death benefit coverage for a lifetime, whole life insurance is a better choice.

What is the hottest thing in life insurance

Indexed universal life is one of the insurance industry's hottest products. It accounted for a quarter of all individual life sales as measured by premium for the first nine months of 2019, according to research firm Limra, up from 20% in 2014.

Which life insurance has cash value

The cash value feature is included on permanent life insurance types like whole life and universal life. Since final expense life insurance is a type of whole life, it can also have cash value and can be a more affordable option for obtaining a policy with cash value.

How much is a whole life policy

Expect whole-life premiums to cost between $180 to $1,210 a month if you're young and healthy. That price increases significantly as you age. Since whole-life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

How much is a $10,000 life insurance policy worth

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value.

What are three things that are not covered by life insurance

What's NOT Covered By Life InsuranceDishonesty & Fraud.Your Term Expires.Lapsed Premium Payment.Act of War or Death in a Restricted Country.Suicide (Prior to two year mark)High-Risk or Illegal Activities.Death Within Contestability Period.Suicide (After two year mark)

What is the cash value of a $25000 life insurance policy

Example of Cash Value Life Insurance

Consider a policy with a $25,000 death benefit. The policy has no outstanding loans or prior cash withdrawals and an accumulated cash value of $5,000. Upon the death of the policyholder, the insurance company pays the full death benefit of $25,000.

What is the cash value of a $10000 life insurance policy

The $10,000 refers to the face value of the policy, otherwise known as the death benefit, and does not represent the cash value of life insurance policy. A $10,000 term life insurance policy has no cash value.

How much does whole life insurance cost per month

Expect whole-life premiums to cost between $180 to $1,210 a month if you're young and healthy. That price increases significantly as you age. Since whole-life policies offer lifelong coverage and build cash value, they're more expensive than term life insurance.

What life insurance do millionaires use

For many rich people, it makes sense to purchase whole life insurance, because this kind of policy can provide a death benefit to loved ones that is generally tax free. And this money can be used to pay estate or inheritance taxes, so that other estate assets do not have to be liquidated to cover this cost.

What life insurance never goes up

Whole life insurance policy benefits

Your premiums are fixed and will never go up, regardless of market conditions. You may be able to withdraw funds or take out a loan. Your death benefit is guaranteed as long as you make the required premium payments.

How much a month is a $500 000 whole life insurance policy

Frequently asked questions. How much does whole life insurance cost A 35-year-old with minimal health conditions can pay about $571 per month for a whole life insurance policy with a $500,000 death benefit coverage amount. Whole life is significantly more expensive than term life insurance on average.

How much is a 1 million dollar whole life insurance policy

The cost of a $1 million life insurance policy for a 10-year term is $32.05 per month on average. If you prefer a 20-year plan, you'll pay an average monthly premium of $46.65.

How much does a $500000 whole life policy cost

The cost of a $500,000 term life insurance policy depends on several factors, such as your age, health profile and policy details. On average, a 40-year-old with excellent health buying a $500,000 life insurance policy will pay $18.44 a month for a 10-year term and $24.82 a month for a 20-year term.

How much cash is a $100 000 life insurance policy worth

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.

What causes death not to be covered by life insurance

The five things not covered by life insurance are preexisting conditions, accidents that occur while under the influence of drugs or alcohol, suicide, criminal activity, and death due to a high-risk activity, such as skydiving, and war or acts of terrorism.

What conditions makes you uninsurable for life insurance

Obesity. Unfortunately in America, this has been a pretty big issue for a while.High Cholesterol. High cholesterol, lipids, and triglycerides may be a reason for the denial of your application.Diabetes.Chronic Illness.Age.Blood or Protein in Your Urine.Alcoholism.Hazardous Occupation.