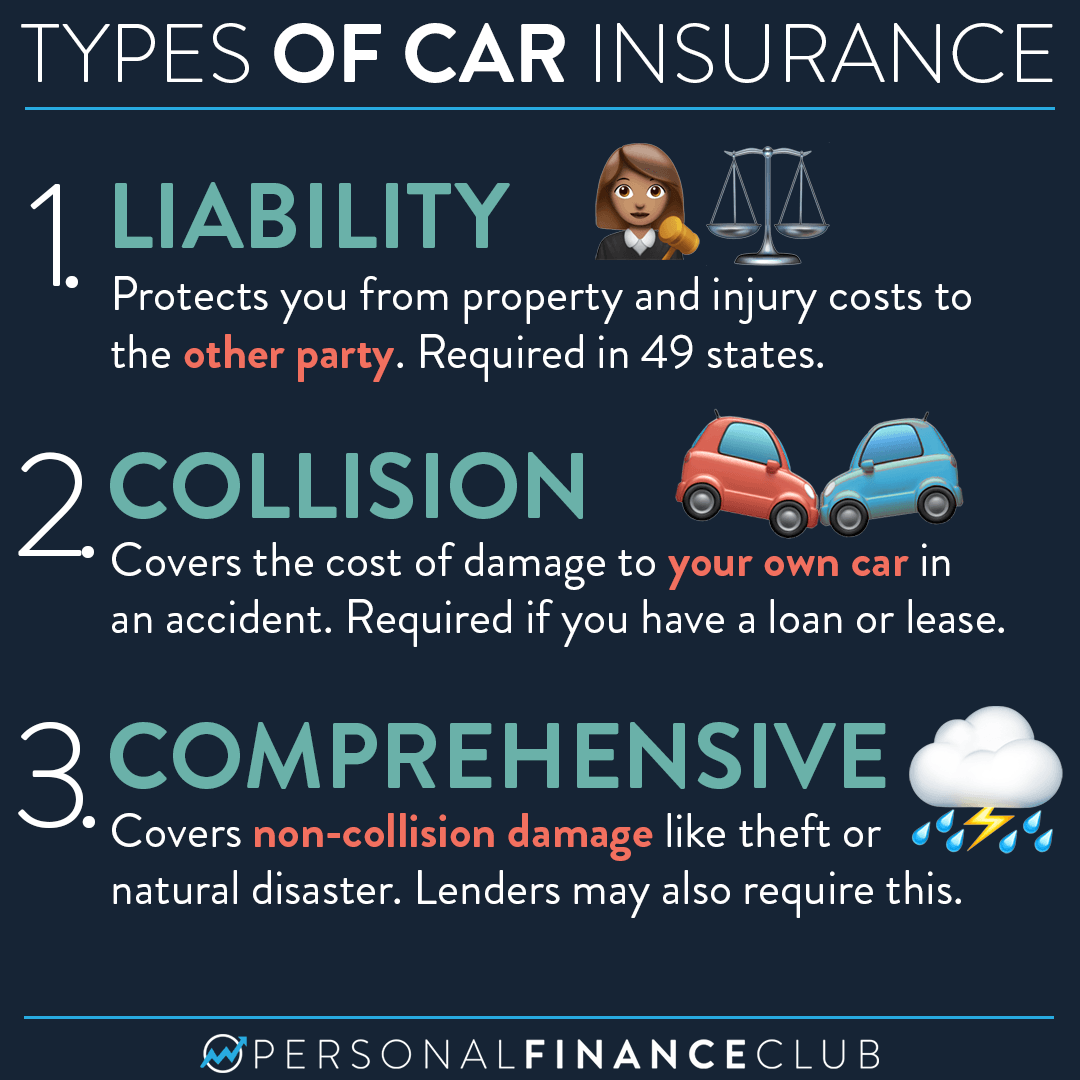

Another vehicle or object, while comprehensive insurance covers damage to your car from non-collision incidents like theft, vandalism, or natural disasters.

What are the three 3 main types of insurance

Health insurance. It allows the insured to cover up medical expenses while visiting a doctor and other major costs usually involved during surgeries.Life insurance.Rental or property insurance.

What is the most basic form of car insurance

You can buy many different types of car insurance policies. However, most basic car insurance includes liability protection. In fact, most states require a certain limit for these policies. They may also want you to have uninsured/underinsured protection and comprehensive coverage.

What are 3 components of auto insurance

Auto Insurance BasicsProperty coverage pays for damage to, or theft of, the car.Liability coverage pays for the policyholder's legal responsibility to others for bodily injury or property damage.Medical coverage pays for the cost of treating injuries, rehabilitation and sometimes lost wages and funeral expenses.

Cached

Which type of car insurance is best

Comprehensive Car Insurance. This type of car insurance provides the most protection because it covers third-party liability, damage to one's own car, personal accident coverage, and all non-collision damage such as storms, floods, fire, and theft.

What is a 3 insurance called

A homeowners insurance (HO-3) policy is a coverage plan that covers your home's structure, your personal belongings and liability in the event of damage or injury. Typically, an HO-3 policy will also cover additional living expenses and protection for other structures on your property.

What are the 2 major types of insurance

What are the four most common types of insurance According to experts, four types of insurance are considered essential: life insurance, health insurance, long-term disability insurance, and auto insurance.

What is the lowest form of car insurance

Liability car insurance only includes the minimum coverage required by your state, which is why it's the cheapest kind of car insurance. It's a good option for drivers who have an older car or who can afford to repair or replace their car.

What is the difference between collision coverage and comprehensive coverage

They differ in the types of incidents they cover. Collision insurance helps cover repairs if you collide with another vehicle or object. Comprehensive covers repairs that do not result from collisions – for instance, theft, vandalism, animal damage, fires, and more.

What is the difference between collision and liability insurance

Collision coverage helps pay to repair or replace your vehicle if it's damaged or destroyed in an accident with another car, regardless of who is at fault. That's different from liability coverage, which helps pay for damage to another person's car from an accident you cause.

What are the 5 main insurance

Home or property insurance, life insurance, disability insurance, health insurance, and automobile insurance are five types that everyone should have.

What types of insurance are not recommended

15 Insurance Policies You Don't NeedPrivate Mortgage Insurance.Extended Warranties.Automobile Collision Insurance.Rental Car Insurance.Car Rental Damage Insurance.Flight Insurance.Water Line Coverage.Life Insurance for Children.

What are the 4 main insurances

Four types of insurance that most financial experts recommend include life, health, auto, and long-term disability.

What is DP3 insurance

A DP3 policy covers the structure, loss of use or rental coverage, and usually personal liability. If you are renting out your property, it's a good practice to require your renters or tenants to have renter's insurance (HO4), because a DP3 policy offers limited coverage for their personal property.

What is the most popular type of insurance

Health insurance is the single most important type of insurance you'll ever buy. That's because if you don't have health insurance and something goes wrong, it's not just your money at risk — it's your life. Health insurance is intended to pay for the costs of medical care.

Who is cheaper Geico or Progressive

Is Progressive Cheaper Than Geico Both Geico and Progressive offer cheap car insurance to drivers across the country. Geico's rates are typically lower overall, but Progressive tends to offer better prices to high-risk drivers.

What is the most expensive form of car insurance

The most expensive type of auto insurance coverage is usually collision. This covers the damage to or replacement of your car if you're involved in a collision generally with another car. If you look at what each insurance types covers, you might expect comprehensive coverage to be pricier.

Is full coverage both comprehensive and collision

So what does full coverage car insurance cover In most cases, it includes liability, comprehensive, and collision coverage. Collision and comprehensive will protect you and your vehicle if you get into an accident.

What is comprehensive coverage good for

Comprehensive insurance coverage is defined as an optional coverage that protects against damage to your vehicle caused by non-collision events that are outside of your control. This includes theft, vandalism, glass and windshield damage, fire, accidents with animals, weather, or other acts of nature.

What’s the difference between comprehensive and full coverage

Full Coverage Insurance. The difference between full coverage and comprehensive insurance is that a full-coverage insurance policy includes liability, comprehensive and collision coverage. Comprehensive insurance covers damage to a car from things other than road accidents.

What is car insurance collision vs comprehensive vs liability

Comprehensive and collision are separate physical damage coverage options, which usually include separate deductibles. This differs from liability insurance, which has no deductibles for either party when a claim is filed. The deductible is the amount you must pay out of pocket after filing a claim.

What is the most important insurance to have

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.

What is the most necessary insurance

Most experts agree that life, health, long-term disability, and auto insurance are the four types of insurance you must have.

What type of insurance is most important

Health insurance

Health insurance is arguably the most important type of insurance.

What are the 5 most common types of insurance

Home or property insurance, life insurance, disability insurance, health insurance, and automobile insurance are five types that everyone should have.

What is DP2 vs DP3 coverage

The DP3 is the most extensive landlord insurance policy, providing the broadest and deepest coverage. The DP 2 is considered a middle-of-the-road landlord insurance Page 3 policy, providing coverage that fits somewhere between the DP 1 and the DP 3. It is not the most basic insurance, but it's not the best.