Here are three fees that can be charged at a bank:

1. Monthly maintenance fee: This is a fee that banks charge on a monthly basis to maintain your account. It can be avoided by keeping a minimum daily or average daily balance, making a certain number of purchases with your debit card, or having a certain amount in direct deposits.

2. Out-of-network ATM fee: If you use an ATM that is not affiliated with your bank, you may be charged a fee for the transaction. To avoid this fee, use only your bank’s ATMs or look for fee-free networks.

3. Overdraft fee: If you spend more money than you have in your account and your bank covers the transaction, they may charge you an overdraft fee. To avoid this fee, make sure to keep track of your account balance and set up alerts to notify you of low balances.

-strong-Can I avoid banking fees?

What are some ways you can avoid banking fees

Here are some proven tips:Utilize free checking and savings accounts. Many banks still offer them.Sign up for direct deposit.Keep a minimum balance.Keep multiple accounts at your bank.Use only your bank's ATMs.Don't spend more money than you have.Sign Up for Email or Text Alerts.

What are two fees that banks typically charge on checking accounts how can you avoid these fees

Monthly maintenance/service fee. Many banks charge by the month for you to keep your money in an account with them.Out-of-network ATM fee.Excessive transactions fee.Overdraft fee.Insufficient fund fee.Wire transfer fee.Early account closing fee.Bottom line.

What is one way that you can avoid monthly maintenance fees on your checking account that is an option for each type of account

You could waive the fee if you keep a minimum daily balance or an average daily balance over the course of the month. Some checking accounts let you waive the charge if you make a minimum number of purchases with your debit card each month. Others waive it if you make a certain amount in direct deposits.

Which fees can be avoided

14 fees you should never pay — & how to avoid themATM fees.Foreign transaction fees.Check-your-credit report/score fees.Dealer prep fees.Mutual fund sales load fees.Card payment fees.Late fees.Credit card cash advance fees.

What are 3 common bank fees

7 Common Bank Fees and How to Avoid ThemMonthly maintenance fee.Out-of-network ATM fee.Overdraft fee.Nonsufficient funds fee.Stop payment fee.Check fees.Inactivity fee.

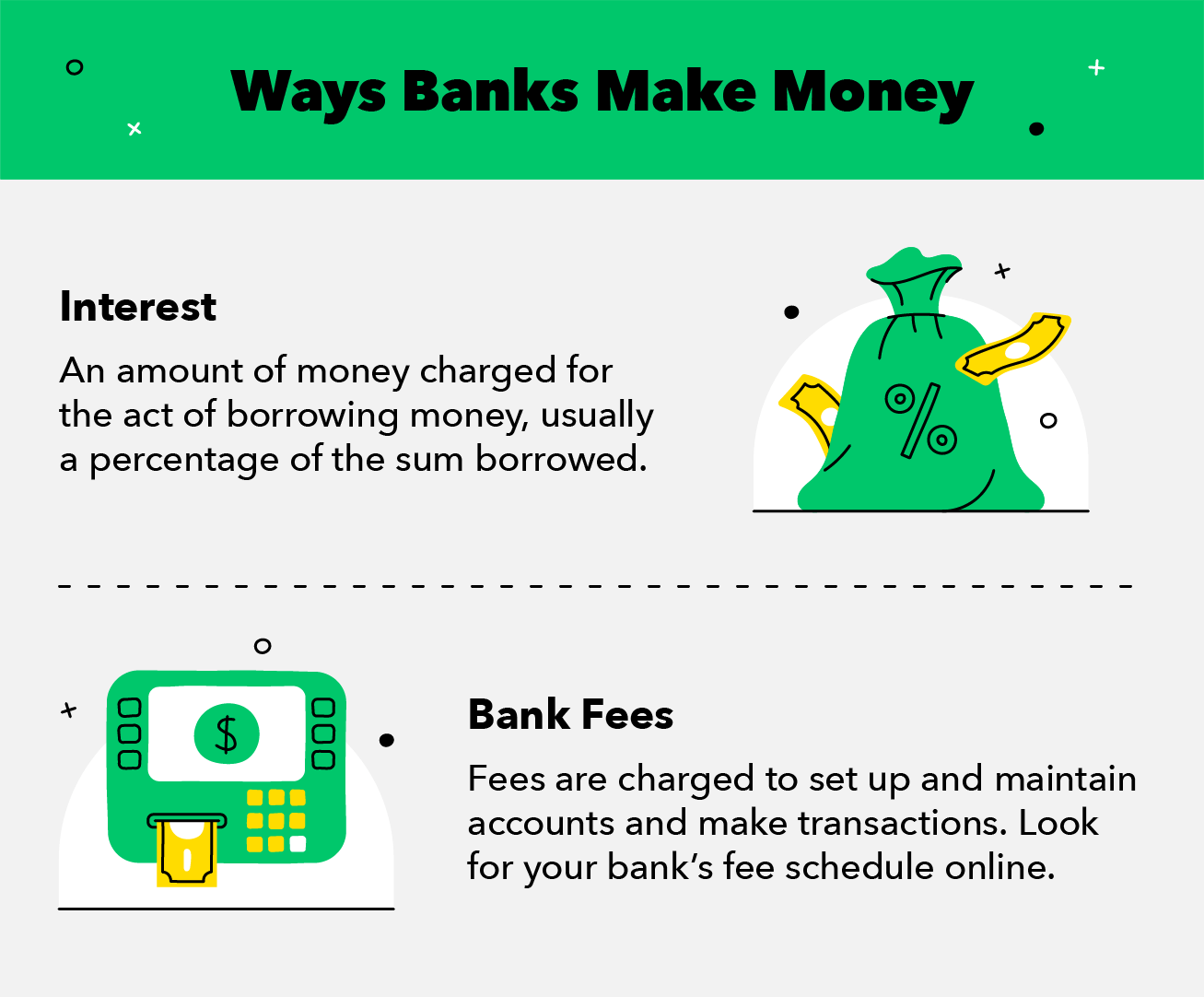

How do banks without fees make money

Any type of loan comes with interest, and this is how the bank makes its revenue. The amount of interest that the bank gets from their loans will always be greater than the interest that is paid back to you for keeping money in your checking account.

What are the three types of bank fees

Here are seven common banking fees and how to avoid them.Monthly Maintenance Fee. Some banks, credit unions and other financial institutions charge a monthly maintenance or service fee to keep your accounts open.Out-of-Network ATM Fee.Overdraft Fees.Nonsufficient Funds Fee.Stop Payment Fee.Check Fees.Inactivity Fee.

What are 3 fees that can be charged at a bank

Here are the most common fees banks charge—and how to avoid paying them:Monthly maintenance/service fee.Out-of-network ATM fees.Overdraft fees.Insufficient funds fees.Paper statement fees.Wire transfer fees.Account closing fees.Dormancy fees.

What is often the requirement to avoid a monthly service fee on your checking account

Monthly service fees

Often, a bank will waive this fee if you keep at least a set minimum balance in your account.

What are some ways a client can avoid the monthly maintenance fee on a Bank of America Advantage savings account

You can avoid the Monthly Maintenance Fee when you meet ONE of the following requirements during each statement cycle: • Maintain a minimum daily balance of $500 or more, OR • Link your account to your Bank of America Advantage Relationship Banking®, Bank of America Advantage® with Tiered Interest Checking or Bank of …

What are 3 fees associated with a checking account

Checking account fees to watch out for include overdraft fees, ATM fees and monthly service fees. Here we'll take a look at these fees in more depth, including the average amount banks charge for each and the best ways to avoid having to pay them.

What is the most frequently charged fee on bank accounts

Here are the most common fees banks charge—and how to avoid paying them:Monthly maintenance/service fee.Out-of-network ATM fees.Overdraft fees.Insufficient funds fees.Paper statement fees.Wire transfer fees.Account closing fees.Dormancy fees.

Do you have to pay bank fees

Some banks won't charge a monthly fee at all or will waive it if you maintain a certain balance in your account. Others may charge as little as a few dollars, or upward of $15. Keep in mind that opting for a low or no-fee account could help you save more money—but it may come with its own set of limitations.

Why do banks charge fees for everything

Banks charge fees to help make a profit. Bank fees allow financial institutions to recoup operating expenses. Banks also make money on loans, via interest and other fees.

What are the different types of fees based

Fee Based Banking ServicesCards. Credit cards and debit cards have been new addition to the banks portfolios.Commissions.Capital Market Advisory.Demand Drafts and Pay Orders.Guarantees.Account Related Fees.Lockers.

What are the three types of fees

Understanding the Three Fee Types and How They Are AppliedAmortizing Fees. Amortizing fees, also known as deferred fees, are applied when the loan is originally opened.Miscellaneous Fees. Miscellaneous fees are applied after a loan is opened when certain actions take place on the account.Maintenance Fees (P/I Fee)

What are fees types

Fees are applied in a variety of ways such as costs, charges, commissions, and penalties. Fees are most commonly found in heavily transactional services and are paid in lieu of a wage or salary.

What is often the requirement to avoid a monthly service fee on your checking account quizlet

when a minimum balance is not maintained in a checking account, the bank will usually waive a service charge.

How can you avoid a monthly maintenance fee quizlet

How do you avoid a monthly maintenance/service fee – Account holders can tend to get out of their monthly fees by opening both a checking and a savings account at the same bank or by maintaining a minimum balance in your account.

How to avoid Bank of America savings account fees

You can avoid the Monthly Maintenance Fee when you meet ONE of the following requirements during each statement cycle: • Maintain a minimum daily balance of $500 or more, OR • Link your account to your Bank of America Advantage Relationship Banking®, Bank of America Advantage® with Tiered Interest Checking or Bank of …

What are 2 examples of fees

Most often, fees are the payment one makes for service, both basic—mowing a lawn, for example, and complex—like drafting a will or preparing your taxes. Sometimes there is more than one fee charged for a service (i.e., buying a plane ticket for X amount of money, but getting hit with luggage fees and travel fees).

What are the 2 types of cost

There are two kinds of costs, fixed and variable. Fixed and variable costs impact the business in different ways but both are important in making the business profitable.

How do I avoid monthly maintenance fee chase

Monthly Service Fee — $0 or $5A balance at the beginning of each day of $300 or more in this account.OR, $25 or more in total Autosave or other repeating automatic transfers from your personal Chase checking account (available only through chase.com or Chase Mobile® app)

How can you avoid a monthly maintenance

How can I avoid monthly maintenance feesKeep enough money in the account.Accept monthly direct deposits.Have other products or accounts from the same bank.Are of a certain age or attend school.

What type of savings account requires a balance to avoid fees

Money market account

Money market account: Money market accounts are similar to savings accounts, but they typically require you to maintain a higher balance to avoid a monthly service fee.