Summary of the article:

1. Can I get all three credit reports at once?

You can request all three reports at once or order one report at a time. By requesting the reports separately (e.g., one every four months), you can monitor your credit report throughout the year. After receiving your annual free credit report, you can still request additional reports.

2. Should I check all 3 credit reports?

The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health. However, in some situations (such as fraud or denied applications), checking all three credit reports at once can be helpful.

3. How many credit reports should I request?

To maximize your credit rating and improve your credit knowledge, the optimal strategy is to obtain all three credit reports simultaneously.

4. Why should you request 3 credit reports?

If you are thinking about buying something big soon, like a new car or a home, you may want to get all of your credit reports now. This way, you can correct any mistakes on all of them right away. If you are not planning a big purchase, requesting them over time might be a better choice.

5. What is the most accurate credit score?

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. However, FICO® Score is the clear winner when it comes to credit scores, as it is used in 90% of lending decisions.

6. What is the most accurate credit score website?

Generally, Credit Karma is the overall best site in terms of getting free credit scores and reports. It provides free weekly scores and reports from Transunion and Equifax without having to provide your credit card details.

7. Which of the 3 credit reports is most accurate?

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

8. Can too many credit checks hurt your credit?

However, multiple hard inquiries can deplete your score by as much as 10 points each time. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That’s way more inquiries than most.

Questions:

- Can I get all three credit reports at once?

Yes, you can request all three credit reports at once. - Should I check all 3 credit reports?

It is best to stagger checking the reports from each of the three credit bureaus, but checking all three at once can be helpful in certain situations. - How many credit reports should I request?

It is recommended to obtain all three credit reports simultaneously. - Why should you request 3 credit reports?

Requesting all three credit reports can help identify and correct any mistakes on all reports, especially if you are planning a big purchase. - What is the most accurate credit score?

FICO® Score is considered the most accurate credit score and is used in most lending decisions. - What is the most accurate credit score website?

Credit Karma is generally regarded as the best website for obtaining free credit scores and reports. - Which of the 3 credit reports is most accurate?

There is no significant difference in accuracy between the three credit reports obtained from the major credit bureaus. - Can too many credit checks hurt your credit?

Multiple hard inquiries can negatively impact your credit score, potentially leading to a higher risk of bankruptcy.

Can I get all three credit reports at once

You can request all three reports at once or you can order one report at a time. By requesting the reports separately (for example, one every four months) you can monitor your credit report throughout the year. Once you've received your annual free credit report, you can still request additional reports.

Should I check all 3 credit reports

The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health. However, in some situations (such as fraud or denied applications), checking all three credit reports at once can be helpful.

Cached

How many credit reports should I request

But to maximize your credit rating and to improve your credit knowledge, the optimal strategy is to obtain all three credit reports simultaneously.

Cached

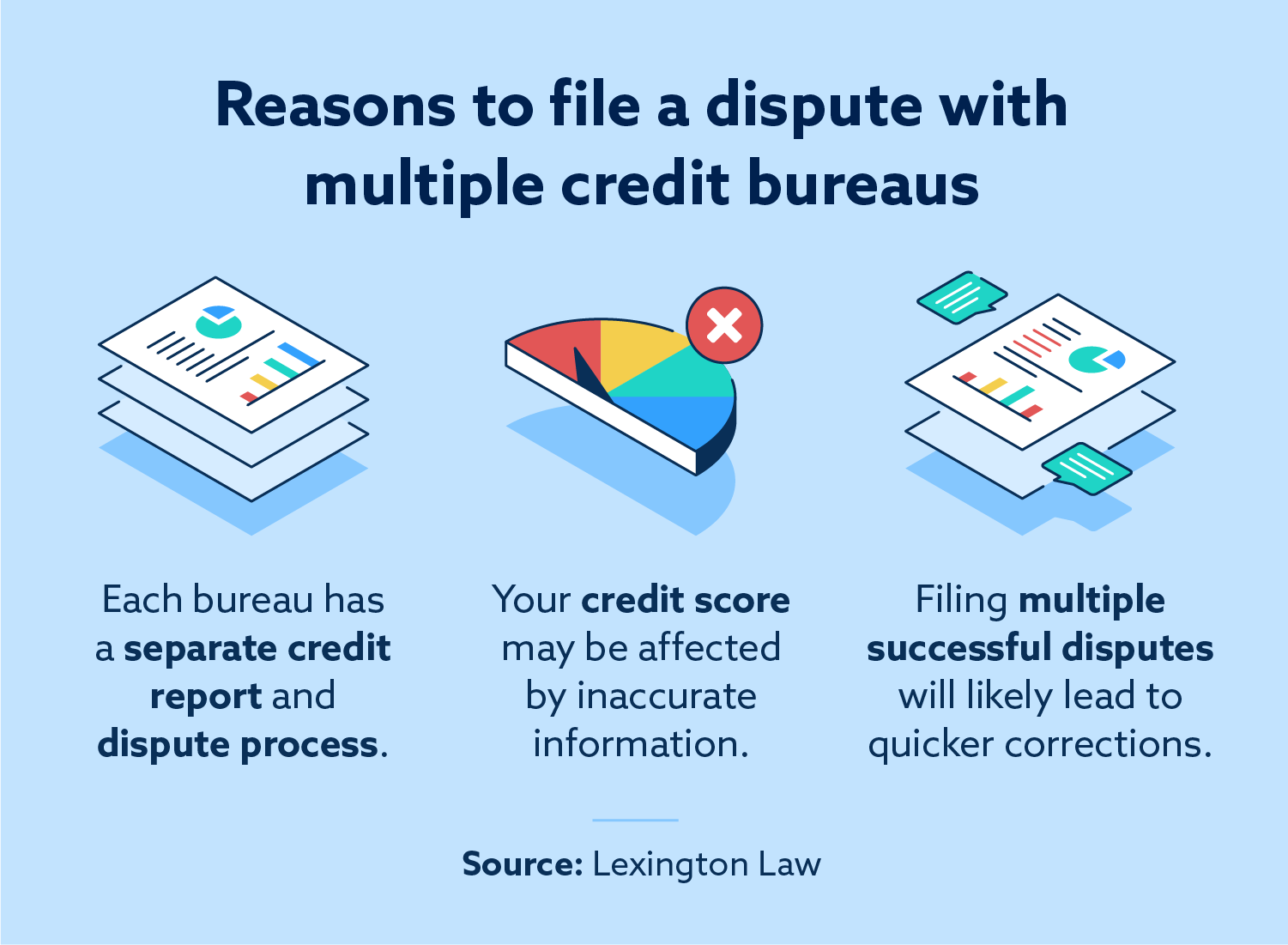

Why should you request 3 credit reports

If you are thinking about buying something big soon a new car or even a home you may want to get all of your credit reports now. That way you can correct any mistakes on all of them right away. If you are not planning a big purchase, requesting them over time might be a better choice.

Cached

What is the most accurate credit score

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

What is the most accurate credit score website

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

Which of the 3 credit report is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Can too many credit checks hurt your credit

However, multiple hard inquiries can deplete your score by as much as 10 points each time they happen. People with six or more recent hard inquiries are eight times as likely to file for bankruptcy than those with none. That's way more inquiries than most of us need to find a good deal on a car loan or credit card.

Which credit report is most important

What credit score do lenders use FICO scores are generally known to be the most widely used by lenders.

Does requesting credit reports affect credit score

No, requesting your credit report will not hurt your credit score. Checking your own credit report is not an inquiry about new credit, so it has no effect on your score.

Which of the 3 credit reports is best

It's important to note that all three bureaus are used widely in the U.S. None of them are more “important” than the others. There is no “best” credit bureau—all three bureaus can offer helpful information and tools to help you make financial decisions.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

What matters more Equifax or TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which credit report is usually highest

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

How to get 800 credit score in 45 days

Here are 10 ways to increase your credit score by 100 points – most often this can be done within 45 days.Check your credit report.Pay your bills on time.Pay off any collections.Get caught up on past-due bills.Keep balances low on your credit cards.Pay off debt rather than continually transferring it.

Do multiple hard credit inquiries in 30 days count as one

If you're shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time. The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days.

Do multiple hard inquiries count as one

If you're shopping for a new auto or mortgage loan or a new utility provider, the multiple inquiries are generally counted as one inquiry for a given period of time. The period of time may vary depending on the credit scoring model used, but it's typically from 14 to 45 days.

Does TransUnion or Equifax matter more

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Is FICO score more accurate than Credit Karma

Your Credit Karma score should be the same or close to your FICO score, which is what any prospective lender will probably check. The range of your credit score (such as "good" or "very good") is more important than the precise number, which will vary by source and edge up or down often.

Do lenders look at Equifax or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

What is the most accurate credit bureau

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

How long does it take to go from 720 to 800 credit score

Depending on where you're starting from, It can take several years or more to build an 800 credit score. You need to have a few years of only positive payment history and a good mix of credit accounts showing you have experience managing different types of credit cards and loans.

How hard is it to get a 750 credit score

To get a 750 credit score, you need to pay all bills on time, have an open credit card account that's in good standing, and maintain low credit utilization for months or years, depending on the starting point. The key to reaching a 750 credit score is adding lots of positive information to your credit reports.

Is 3 hard inquiries too much

There's no such thing as “too many” hard credit inquiries, but multiple applications for new credit accounts within a short time frame could point to a risky borrower. Rate shopping for a particular loan, however, may be treated as a single inquiry and have minimal impact on your creditworthiness.