“`html

Summary

1. Is TransUnion safe to check credit score? Checking your own credit report won’t hurt your score because it’s considered a soft inquiry.

2. How much does TransUnion credit monitoring cost? Subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

3. Should I trust Equifax or TransUnion? Neither score is more or less accurate than the other; they’re only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

4. What are the cons of credit monitoring services?

- It costs money.

- Paid credit monitoring often costs between $10 and $30 a month—money that you’d probably prefer to save or spend on take-out or a streaming service subscription.

- It doesn’t stop fraud or identity theft.

- It won’t tell you everything.

- It can’t fix mistakes.

5. What is the safest site to check your credit score? Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

6. Which score is better Experian or TransUnion? Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

7. What is the safest website to check credit score? Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

8. What is TransUnion $24.95 charge? With TransUnion’s credit monitoring services, you can have unlimited credit report and score access, and you can receive alerts to changes in your TransUnion, Equifax, and Experian credit reports. This service costs $24.95 per month.

Questions:

- Is TransUnion safe for checking credit scores?

Answer: Checking your own credit report is considered a soft inquiry and won’t hurt your score. - How much does TransUnion credit monitoring cost?

Answer: The subscription price for TransUnion credit monitoring is $29.95 per month, with the option to cancel anytime. - Can Equifax or TransUnion be trusted?

Answer: Both Equifax and TransUnion provide accurate credit scores, calculated from slightly different sources. A “fair” score from TransUnion is generally consistent across the board. - What are the drawbacks of credit monitoring services?

Answer: Cons of paid credit monitoring include the cost (usually between $10 and $30 per month), inability to stop fraud or identity theft, not providing comprehensive information, and inability to fix mistakes. - Which website is the safest for checking credit scores?

Answer: Credit Karma is generally considered the best site for getting free credit scores and reports without providing credit card information. - Is Experian or TransUnion a better credit score provider?

Answer: None of the three main credit bureaus (Equifax, Experian, and TransUnion) are considered better than the others. Lenders may rely on one or multiple bureaus to make loan decisions. - What is the safest website for checking credit scores?

Answer: Credit Karma is regarded as the overall best site for obtaining free credit scores and reports without providing credit card details. - What does the $24.95 charge from TransUnion entail?

Answer: With TransUnion’s credit monitoring services, you gain unlimited access to credit reports and scores, as well as alerts for changes in all three major credit reports (TransUnion, Equifax, and Experian). The cost of this service is $24.95 per month.

“`

Is TransUnion safe to check credit score

Answer: Checking your own credit report won't hurt your score because it's considered a soft inquiry.

How much does TransUnion credit monitoring cost

Subscription price is $29.95 per month (plus tax where applicable). Cancel anytime.

Should I trust Equifax or TransUnion

Neither score is more or less accurate than the other; they're only being calculated from slightly differing sources. Your Equifax credit score is more likely to appear lower than your TransUnion one because of the reporting differences, but a “fair” score from TransUnion is typically “fair” across the board.

Cached

What are the cons of credit monitoring services

Cons of paid credit monitoringIt costs money. Paid credit monitoring often costs between $10 and $30 a month—money that you'd probably prefer to save or spend on take-out or a streaming service subscription.It doesn't stop fraud or identity theft.It won't tell you everything.It can't fix mistakes.

What is the safest site to check your credit score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

Which score is better Experian or TransUnion

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

What is the safest website to check credit score

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

What is TransUnion $24.95 charge

With TransUnion's credit monitoring services, you can have unlimited credit report and score access, and you can receive alerts to changes in your TransUnion, Equifax, and Experian credit reports. This service costs $24.95 per month.

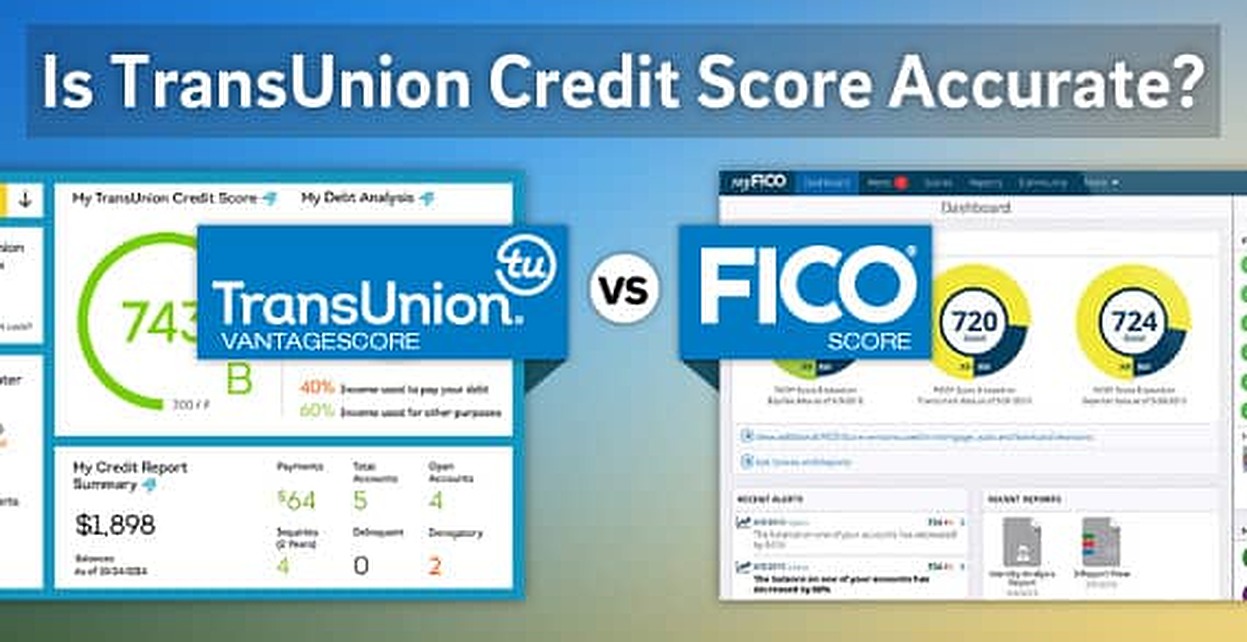

Is FICO or TransUnion more accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is Experian or TransUnion better

Which of the three credit bureaus is the best Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Does credit monitoring hurt your score

Credit Monitoring Doesn't Affect Credit Scores

Credit scoring systems such as the FICO® Score☉ and VantageScore® use credit report data for their calculations but ignore soft inquiries, which means they have no effect on your scores.

Is TransUnion legitimate

TransUnion is a legitimate credit bureau, and its credit reports are used by lenders to judge things like loan and credit applications.

How can I check my credit score without ruining it

Best ways to get a free credit score without hurting itAnnual Credit Report.com or call (877) 322-8228.Equifax: Credit Report Assistance.TransUnion: Free Credit Report.Experian: Free Credit Report | Free Credit Score.

Do banks use Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Do banks use TransUnion or Equifax

In conclusion. Credit card issuers and lenders may use one or more of the three major credit bureaus—Experian, TransUnion and Equifax—to help determine your eligibility for new credit card accounts, loans and more.

Who is the most accurate credit score

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

How do I avoid TransUnion charging

To cancel your Products or subscriptions, please go to Contact Us or call toll-free at (855) 681-3196 and contact our Customer Service Team.

How do I stop being charged by TransUnion

How can I cancel my membership The easiest way to terminate your membership is through our online process, just click here. You may also terminate your membership by talking to a Customer Service Team Member at (833) 598-0673. Customer Service is available: 8AM – 6PM Eastern Time Monday-Friday.

Do lenders use FICO or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

What hurts credit score the most

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you.

What is the safest credit score check

Generally, Credit Karma is the overall best site in terms of getting free credit scores and free credit reports. It provides free weekly scores and reports from Transunion and Equifax that are available without having to provide your credit card first.

Do credit lenders use TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

What is the most reliable way to check credit score

Here are a few ways:Check your credit card, financial institution or loan statement.Purchase credit scores directly from one of the three major credit bureaus or other provider, such as FICO.Use a credit score service or free credit scoring site.

What is the safest way to check your credit score

There are a few ways to check your credit scores:Visit a free credit scoring website. Numerous websites offer free credit scores; just pay attention to the terms before you sign up.Check with your credit card issuer or lender.Visit a nonprofit credit counselor.

Do banks use TransUnion

In conclusion. Credit card issuers and lenders may use one or more of the three major credit bureaus—Experian, TransUnion and Equifax—to help determine your eligibility for new credit card accounts, loans and more.