“

Summary of the Article:

1. Can TransUnion be trusted?

TransUnion is a legitimate credit bureau that provides credit reports for lenders to assess loan and credit applications.

2. What is the rating of TransUnion company?

Based on over 1,915 anonymous employee reviews, TransUnion has an overall rating of 3.9 out of 5.

3. Is TransUnion or Equifax more important?

There is no significant difference in importance between TransUnion and Equifax. Lenders may prefer one score over the other, but it doesn’t mean one is better or more accurate.

4. Is it worth paying TransUnion?

If you want an additional layer of identity protection, TransUnion’s credit monitoring service may be worth the cost. However, it’s essential to consider other options and compare them.

5. Which is better, Experian or TransUnion?

No credit bureau is considered better than the others. Lenders may rely on one or all three bureaus when making loan approval decisions.

6. Do banks use TransUnion or Equifax?

Credit card issuers and lenders may use Experian, TransUnion, and Equifax to determine eligibility for new credit accounts and loans.

7. Why is TransUnion’s score often higher than Equifax’s?

The main difference is that TransUnion’s score includes employment history and personal information, while Equifax only reports the employer’s name.

8. Do banks consider TransUnion or Equifax?

When applying for a mortgage, lenders typically review credit history reports from all three major bureaus—Experian, Equifax, and TransUnion.

Questions:

1. Can TransUnion be trusted?

Yes, TransUnion is a legitimate credit bureau used by lenders to assess credit applications.

2. What is the rating of TransUnion company?

Based on over 1,915 anonymous employee reviews, TransUnion has an overall rating of 3.9 out of 5.

3. Which credit bureau is more important, TransUnion or Equifax?

Both TransUnion and Equifax hold equal importance. Lenders may have a preference but it does not indicate one is better or more accurate than the other.

4. Is TransUnion’s credit monitoring service worth the cost?

If you want an extra layer of identity protection, TransUnion’s credit monitoring service may be beneficial. However, it’s crucial to consider other options and compare prices.

5. Among Experian, TransUnion, and Equifax, which credit bureau is the best?

No credit bureau is considered the best as lenders may use reports from any or all three bureaus to make loan approval decisions.

6. Do banks use TransUnion or Equifax?

Yes, banks and lenders may use all three major bureaus, including TransUnion and Equifax, to determine eligibility for credit accounts and loans.

7. Why is TransUnion’s credit score often higher than Equifax’s?

One key difference is that TransUnion’s score includes employment history and personal information, while Equifax only provides the employer’s name.

8. Do banks consider TransUnion or Equifax for mortgages?

Banks typically review credit history reports from all three major bureaus—Experian, Equifax, and TransUnion—when assessing mortgage applications.

“

Can TransUnion be trusted

TransUnion is a legitimate credit bureau, and its credit reports are used by lenders to judge things like loan and credit applications.

Cached

What is the rating of TransUnion company

TransUnion has an overall rating of 3.9 out of 5, based on over 1,915 reviews left anonymously by employees.

Is TransUnion or Equifax more important

TransUnion vs. Equifax: Which is most accurate No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Cached

Is it worth paying TransUnion

TransUnion's credit monitoring service isn't cheap, but if you want an additional layer of identity protection, it may be worth the cost to you. It's important to weigh your options when selecting a credit score service.

Cached

Which is better Experian or TransUnion

Which of the three credit bureaus is the best Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Do banks use TransUnion or Equifax

In conclusion. Credit card issuers and lenders may use one or more of the three major credit bureaus—Experian, TransUnion and Equifax—to help determine your eligibility for new credit card accounts, loans and more.

Why is TransUnion so much higher than Equifax

The biggest difference between your TransUnion credit report and Equifax credit score is that the TransUnion credit score reports your employment history and personal information. The other two credit reporting agencies or credit bureaus report only the name of your employer.

Do banks look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

What is the most accurate credit bureau

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

How accurate is Experian vs TransUnion

We're here to help!

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Do banks use Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Do lenders use FICO or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Do credit cards look at Equifax or TransUnion

The three main credit bureaus (also called credit reporting agencies) in the U.S. — Experian™, Equifax® and TransUnion® — are all used widely by credit card issuers , lenders and consumers for a variety of purposes.

Do lenders look at TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Is Experian or TransUnion better

Which of the three credit bureaus is the best Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

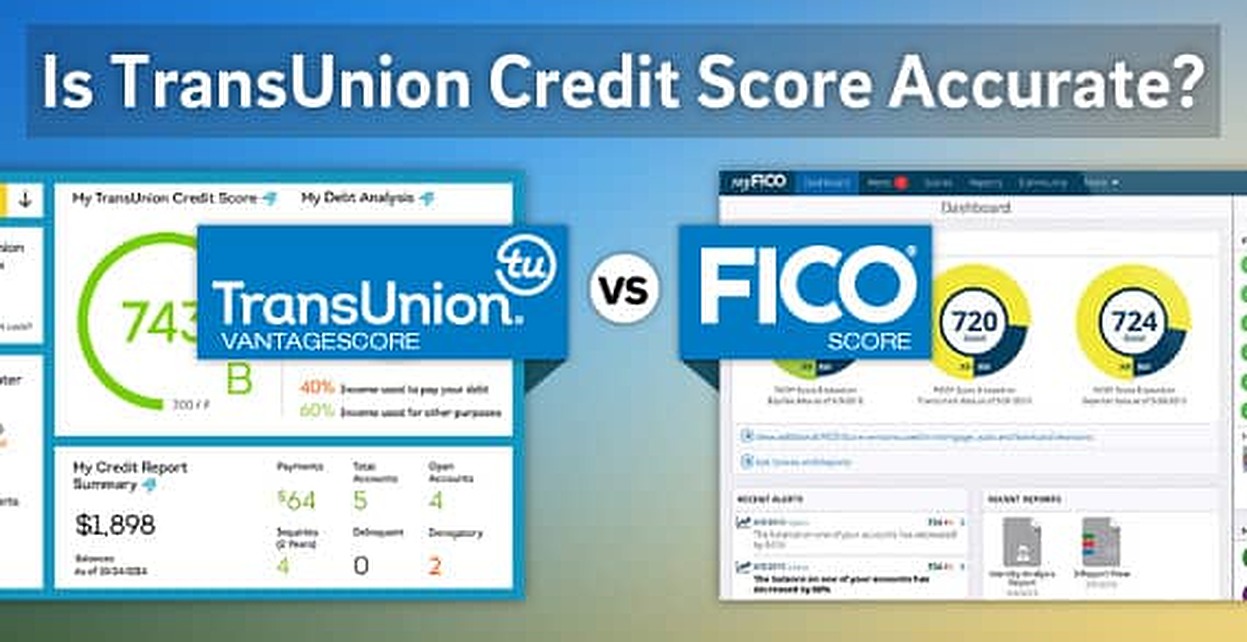

Is FICO or TransUnion more accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Do lenders look at Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Which is more accurate TransUnion or Experian

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Do lenders look at Equifax or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Do banks go by TransUnion or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

What is an excellent credit score with TransUnion

781 – 850

A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. Some people want to achieve a score of 850, the highest credit score possible.