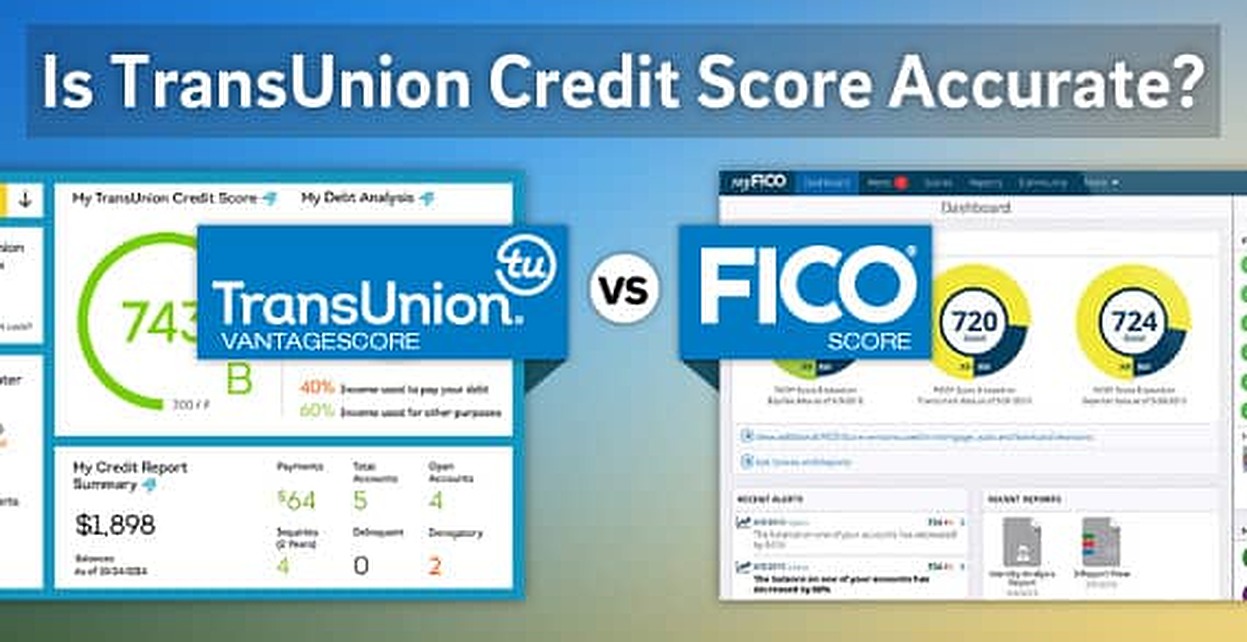

it comes to credit scores, however, the FICO Score is considered the most accurate and is used in 90% of lending decisions. Different types of credit scores exist, but when it comes to receiving your score from the major credit bureaus, there is no “more accurate” score.

To get a copy of your credit report, you can request a free report each year from the three credit reporting agencies: Equifax, Experian, and TransUnion. This is a legal requirement and allows you to review your credit information.

Here are some key points about credit reporting agencies and credit scores:

1. Equifax, Experian, and TransUnion are the three main credit reporting agencies (CRAs).

2. Each year, you can get a free credit report from these agencies by law.

3. No credit score from any one of the credit bureaus is more valuable or accurate than another.

4. Lenders may look at scores from all three credit bureaus or take the median score for qualification purposes.

5. Mortgage lenders typically look at your FICO score when you apply for a home loan.

6. Experian is the largest credit bureau in the U.S., but TransUnion and Equifax are as accurate and important.

7. The FICO Score is widely used in lending decisions and is considered highly accurate.

8. Different types of credit scores exist, but there is no “more accurate” score from the major credit bureaus.

9. A TransUnion score of 781-850 is considered excellent.

10. Credit scores should be seen as guides, not strict rules for what constitutes good credit.

Now, let’s dive into some detailed answers to unique questions based on the text:

1. What are the three main credit reporting agencies?

– The three main credit reporting agencies are Equifax, Experian, and TransUnion.

2. Which credit score matters more, TransUnion or Equifax?

– No credit score from any one of the credit bureaus is more valuable or accurate than another. Lenders may have a preference for one score over another, but that doesn’t mean it is better.

3. Do lenders look at Experian or TransUnion?

– When applying for a mortgage, lenders typically look at credit history reports from all three major credit bureaus: Experian, Equifax, and TransUnion. They often focus on your FICO score, which may have different scoring models.

4. Do companies look at TransUnion or Equifax?

– Lenders may look at credit scores from all three bureaus and take the median score for the qualification process. If they only consider two bureaus, they will likely use the lower of the two scores. When co-borrowing a loan, the lowest median of the two parties is taken into account.

5. Which credit bureau is considered the most accurate?

– While Experian is the largest credit bureau in the U.S., TransUnion and Equifax are also widely considered to be accurate and important. However, in terms of credit scores, the FICO Score is used in 90% of lending decisions and is highly regarded.

6. What is an excellent TransUnion score?

– An excellent TransUnion score falls within the range of 781-850. A fair score is between 661-720. It’s important to remember that these ranges are guides, and different individuals may have different goals, such as aiming for a perfect score of 850.

Overall, understanding the credit reporting agencies and credit scores is crucial for managing your financial health. Regularly checking your credit reports and knowing your scores can help you make informed decisions and improve your credit standing.

What are the 3 main credit reporting agencies

How to get a copy of your credit report. By law, you can get a free credit report each year from the three credit reporting agencies (CRAs). These agencies include Equifax, Experian, and TransUnion.

CachedSimilar

Which credit score matters more TransUnion or Equifax

No credit score from any one of the credit bureaus is more valuable or more accurate than another. It's possible that a lender may gravitate toward one score over another, but that doesn't necessarily mean that score is better.

Cached

Do lenders look at Experian or TransUnion

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion. In most cases, mortgage lenders will look at your FICO score. There are different FICO scoring models.

Do companies look at TransUnion or Equifax

Lenders may look at your scores from all three credit bureaus and take the median score for the qualification process. If they only look at two of the three bureaus, they'll likely take the lower of the two scores. If you're co-borrowing a loan, lenders will take the lowest median of the two parties.

Cached

Which credit bureau is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Which credit score is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

What is an excellent TransUnion score

781 – 850

A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. Some people want to achieve a score of 850, the highest credit score possible.

What is the most accurate credit bureau

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Which is more accurate TransUnion or Experian

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Which score is more accurate TransUnion or Experian

With multiple options available, you may be wondering which of these sources is the most accurate. Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus. In this article, you will learn: Different types of credit scores.

What is an excellent credit score with TransUnion

781 – 850

A score of 661 – 720 is fair. And an excellent score is in the range of 781 – 850. Think of these rankings and ranges as guides, not hard-and-fast rules for what good credit is. Some people want to achieve a score of 850, the highest credit score possible.

Is Equifax Experian or TransUnion better

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Which of the 3 credit scores is usually the highest

Which credit score matters the most While there's no exact answer to which credit score matters most, lenders have a clear favorite: FICO® Scores are used in over 90% of lending decisions.

Is TransUnion always the lowest score

Is TransUnion always the lowest score No, TransUnion credit scores are not always the lowest score. However, as users report, it is often lower than most other credit scores they have. Depending on the credit bureau and the scoring algorithm, your credit scores may change.

Why is TransUnion score higher than FICO

When the scores are significantly different across bureaus, it is likely the underlying data in the credit bureaus is different and thus driving that observed score difference.

Which credit bureau do most lenders use

Two popular credit-scoring companies are FICO and VantageScore. Originally named Fair Isaac Corporation, FICO developed the modern credit-scoring model in 1989. To this day, its scores are some of the most widely used credit scores. FICO claims its scores are used by 90% of top lenders.

What lenders use TransUnion only

Which Banks Pull TransUnion OnlyAvianca.Apple Card – Goldman Sachs Bank.Barclays.Capital One.Synchrony Bank.U.S Bank.

Why is my TransUnion score so much higher than Experian

Lenders report credit information to the credit bureaus at different times, often resulting in one agency having more up-to-date information than another. The credit bureaus may record, display or store the same information in different ways.

Does FICO matter more than TransUnion

The Three Bureaus and FICO

For example, an apartment manager who checks your credit may only look at Experian while a credit card company might only look at TransUnion. FICO was developed as an alternative to these bureaus. Many lenders prefer FICO because it paints a more holistic picture of the potential borrower.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Which score is better Experian or TransUnion

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Can I trust TransUnion credit score

Is TransUnion legitimate Yes. TransUnion is a legitimate credit bureau, and its credit reports are used by lenders to judge things like loan and credit applications.

Which credit score is the most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Which credit score is the hardest

Here are FICO's basic credit score ranges:Exceptional Credit: 800 to 850.Very Good Credit: 740 to 799.Good Credit: 670 to 739.Fair Credit: 580 to 669.Poor Credit: Under 580.

What’s the difference between FICO and TransUnion

The Bottom Line. FICO provides a single-number credit score, while major credit bureaus like Equifax, Experian, and TransUnion (not covered in this article) offer a more detailed look at an individual's credit history along with the score.