Summary:

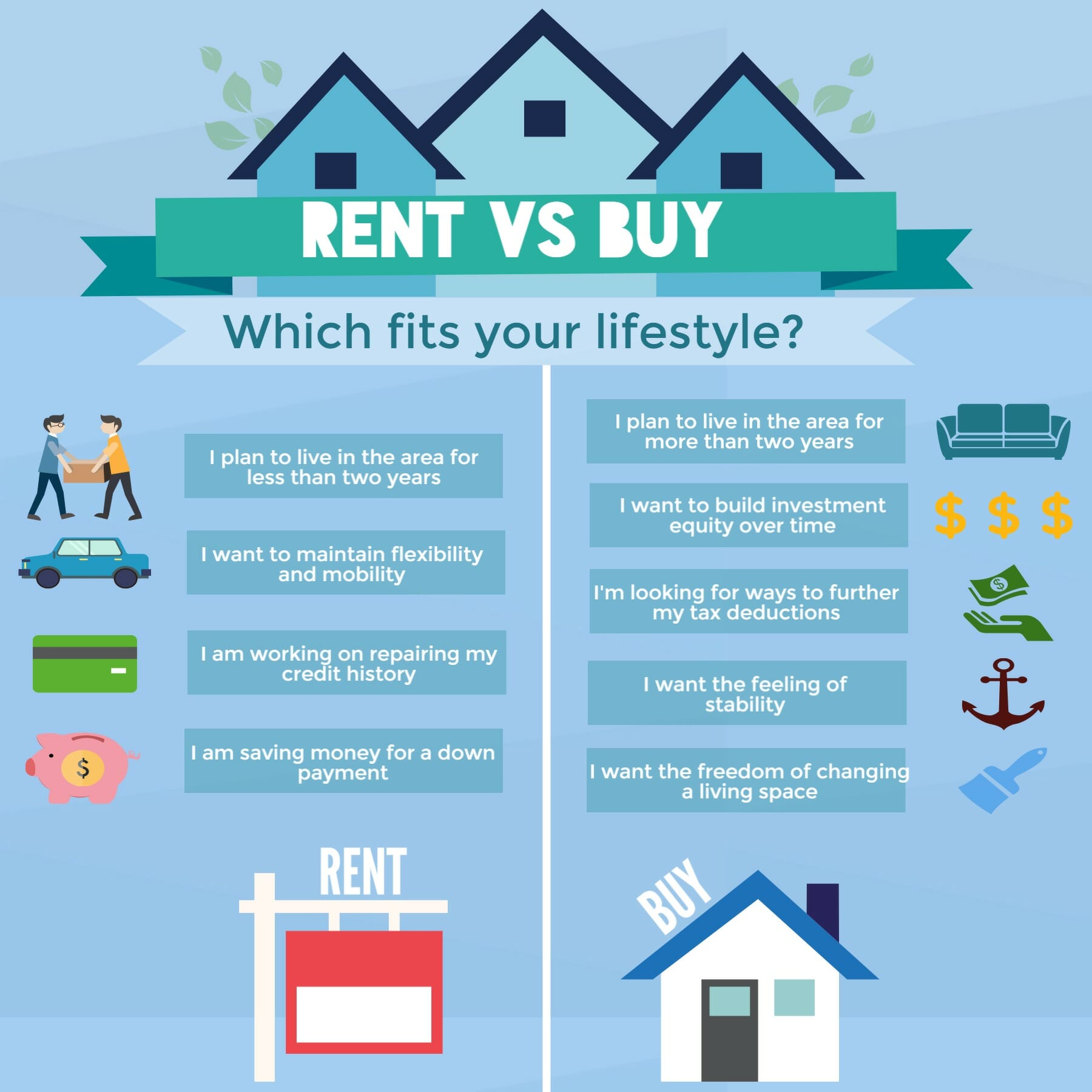

When comparing the cost of renting versus buying a home, it is generally found that the overall cost of homeownership tends to be higher than renting. This is because homeowners have additional expenses such as property taxes and trash pickup. While buying a house gives ownership and home equity, there are also expensive repairs, taxes, interest, and insurance to consider. On the other hand, renting a home or apartment is lower maintenance and offers more flexibility. However, there may be rent increases, noisy neighbors, or an uncooperative landlord to deal with.

Key Points:

1. The cost of homeownership is generally higher than renting.

2. Homeowners have to pay property taxes and trash pickup expenses.

3. Renting offers lower maintenance and more flexibility to move.

4. Renting may come with rent increases and noisy neighbors.

5. Buying a house provides ownership and home equity.

6. Expensive repairs, taxes, interest, and insurance are associated with homeownership.

7. Renting doesn’t help build equity like a mortgage loan does.

8. The decision between renting and buying depends on the duration of stay.

9. Renting to own may result in the loss of a down payment if the home is not purchased.

10. Some sellers may make it difficult or unappealing to purchase the home to keep the down payment.

Questions:

- Is renting or buying cheaper?

- Is it better to rent or to buy?

- What is the 5% rule when comparing renting vs buying?

- Why is renting sometimes better than buying?

- Is it smarter to rent or buy first?

- Is renting really throwing money away?

- What is the main reason to avoid renting to own?

The overall cost of homeownership tends to be higher than renting. Even if your mortgage payment is lower than the rent, you’ll be spending additional money as a homeowner on expenses such as property taxes and trash pickup.

Buying a house gives you ownership, privacy, and home equity. However, expensive repairs, taxes, interest, and insurance can add up. Renting a home or apartment is lower maintenance and provides more flexibility to move. However, you may have to deal with rent increases, noisy neighbors, or an uncooperative landlord.

The 5% rule involves multiplying the value of the home by 5% and then dividing that number by 12 to determine the breakeven point. If the monthly rent on a comparable home is below the breakeven point, it makes financial sense to rent. If the monthly rent is higher, it makes financial sense to buy.

One major benefit of renting versus owning is that renters do not have to pay property taxes. This can be a significant burden for homeowners and can amount to thousands of dollars each year, varying by county.

The decision of whether to rent or buy first depends on how long you plan to settle down. If you’re only planning to live in a place for a year or two, renting makes more sense. However, if you’re going to stay for three years or more, buying would be a good idea and becomes an even better idea the longer you stay.

Renting is often referred to as throwing away money because, unlike with a mortgage loan, it doesn’t help you build equity. However, renting may still be a suitable choice for some individuals depending on their circumstances.

A major disadvantage of renting to own is that renters can lose their down payment and other non-refundable charges if they decide not to purchase the home. Some sellers may even make it difficult or unappealing to purchase the home with the goal of keeping the down payment.

Is renting or buying cheaper

The overall cost of homeownership tends to be higher than renting even if your mortgage payment is lower than the rent. Here are some expenses you'll be spending money on as a homeowner that you generally do not have to pay as a renter: Property taxes. Trash pickup (some landlords require renters to pay this)

Cached

Is it better to rent or to buy

Buying a house gives you ownership, privacy and home equity, but the expensive repairs, taxes, interest and insurance can really get you. Renting a home or apartment is lower maintenance and gives you more flexibility to move. But you may have to deal with rent increases, loud neighbors or a grumpy landlord.

Cached

What is the 5% rule when comparing renting vs buying

Multiply the value of the home by 5%, then divide that number by 12 to get your breakeven point. If the monthly rent on a comparable home is below the breakeven point, it makes financial sense to rent. If the monthly rent is higher than the breakeven point, it makes financial sense to buy.

Why is renting sometimes better than buying

One of the major benefits of renting versus owning is that renters don't have to pay property taxes. Real estate taxes can be a hefty burden for homeowners and vary by county. In some areas, the costs associated with property taxes can amount to thousands of dollars each year.

Is it smarter to rent or buy first

How long are you planning to settle down If you're only going to live in a place for only a year or two, renting makes more sense. However, if you're going to stay there for three years or more, then buying would be a good idea and it becomes a better idea the longer you stay.

Is renting really throwing money away

Key points. Renting a property is often referred to as throwing away money. That's because, unlike with a mortgage loan, renting doesn't help you build equity. Renting isn't necessarily the wrong move for everyone though.

What is the main reason to avoid renting to own

A major disadvantage of renting to own is that renters lose their down payment and other non-refundable charges if they decide not to purchase the home. Some sellers may even take advantage of renters by making it difficult or unappealing to purchase the home — with the goal of keeping the down payment.

What is the biggest advantage to buying a home as opposed to renting

Owning vs. Renting

| Own Or Rent | Advantages |

|---|---|

| Homeownership | Privacy Usually a good investment More stable housing costs from year to year Pride in ownership and strong community ties Tax incentives Equity buildup (savings) |

| Renting | Lower housing costs Shorter-term commitment No/minimal maintenance and repair costs |

Mar 12, 2023

How do you get around the 3x rent rule

If you don't make 3 times the rent, you can still try to get the apartment by putting up a larger security deposit, finding a guarantor, or demonstrating your fiscal responsibility by showing your potential landlord bank statements that show you being responsible with your money and discretionary spending.

Why the rich are renting instead of buying

RentCafe chalked it up to a matter of “comfort and smart investing.” Owning a home can come with more than its fair share of maintenance and costly repairs and upkeep. Then there's the flexibility renting offers one to move from city to city for career opportunities.

What are two disadvantages of renting

Cons of Renting:Your landlord can increase the rent at any time.You cannot build equity if you're renting a property.There are no tax benefits to renting a property.You cannot make any changes to your house or your apartment without your landlord's approval.Many houses available for rent have a “No Pets” policy.

Is it better to rent or buy in your 20s

Renting and buying both have their pros and cons for young professionals. Renting allows you to avoid certain costs, such as making repairs and upgrades, property taxes and homeowner's insurance, but depending on where you live, owning a home may be the more affordable option.

Does renting save you money

Renting Provides Flexibility

Although renting does not build equity, it can save you a considerable amount of money when you consider the cost of buying and then selling a home within a one – three year period.

Is it OK to live in an apartment forever

If you found an apartment you love, you are probably wondering if you can stay in it forever. In theory, yes you can – as long as your lease continues to be renewed. If you want to stay in an apartment forever. You are not alone.

Is it better to rent or pay a mortgage

While paying rent may save on short-term costs, using a mortgage to purchase a home is a long-term investment in the future of your financial security and independence. There are a myriad of practical reasons why you should consider the long-term benefits of investing in a home with a mortgage.

What are three disadvantages of renting

Cons of Renting:Your landlord can increase the rent at any time.You cannot build equity if you're renting a property.There are no tax benefits to renting a property.You cannot make any changes to your house or your apartment without your landlord's approval.Many houses available for rent have a “No Pets” policy.

What are 3 advantages of rent-to-own

Let's take a look at some of the benefits of rent-to-own homes:It allows you to save money for a down payment. Renting-to-own can be a great way to save money for a down payment and give that home a test drive to make sure you like it.You can save on repair costs.It offers you the option to buy or move.

Why 3 times the rent

By requiring that a tenant's income is at least three times the rent, the landlord can have confidence that the tenant will be able to afford the rent and may be less likely to default on their lease. Some landlords may be more flexible with their income requirements, while others may have stricter guidelines.

How should rent be split between 3 people

If an apartment with two rooms is rented to three people (with two sharing one room, the other remaining single occupancy), rent can be split 50/50 between the roommates sharing a room, while each of the three housemates pays an equal sum for the common areas.

Do millionaires rent or buy homes

The number of millionaire renters has tripled in the past five years. More and more millionaires are stepping on the everyman's corner and renting apartments rather than putting down roots and money to become homeowners.

Why millionaires are renting

Even millionaires may not be able to afford to buy luxury real estate, especially in major cities like New York or San Francisco. “High real estate prices can make purchasing a home less appealing for some millionaires, leading them to opt to rent instead,” Galstyan said. Some may simply not want the hassle.

What are 5 advantages of renting

Benefits of renting often include:Rent payments tend to be lower than a comparable house payment.Utility costs may be included in rental fee, creating additional savings.Relocation is easier.Maintenance and repairs are not your responsibility.Credit requirements are less strict.

What is the biggest monthly expense as a tenant

Landlords usually consider little more than your monthly income and employment longevity. Renters' most significant expenses are rent, insurance, and utilities. Homeowners have housing expenses that are much higher and include items that should be considered.

Is it smart to buy a house at 21

There's no right or wrong age to buy a house — just the right or wrong time. Be sure to consider your financial situation, your employment, the local housing market, and your future goals and plans. Consult a real estate agent or loan officer for professional advice if you're unsure.

What are three cons to renting

Cons of Renting:Your landlord can increase the rent at any time.You cannot build equity if you're renting a property.There are no tax benefits to renting a property.You cannot make any changes to your house or your apartment without your landlord's approval.Many houses available for rent have a “No Pets” policy.