Summary of Article: Is it dumb to put 20% down on a house?

A 20% down payment provides a comfortable equity cushion and may not be necessary if the housing market is rapidly appreciating in value. However, it is generally recommended to put 20% down on a house if affordable. This avoids paying for private mortgage insurance, lowers the loan amount, and reduces monthly payments. Approximately 44% of homebuyers put less than 20% down, according to a National Association of Realtors survey.

15 Questions about Putting 20% Down on a House:

1. Is it worth putting 20% down on a house?

If you can easily afford it, putting 20% down is recommended. It helps avoid private mortgage insurance and lowers monthly payments, leading to long-term savings.

2. How often do people put 20% down on a house?

While 20% down is not a requirement, 44% of homebuyers put less than 20% down, as reported by the National Association of Realtors.

3. Why do sellers prefer 20% down?

A higher down payment shows the seller that the buyer is motivated, reliable, and less likely to ask for assistance with closing costs or negotiate prices.

4. How much is a down payment on a $400,000 house?

For a $400,000 house, a 10% down payment would require $55,600 in cash. Additionally, the borrower should have a monthly income of at least $8200 and existing monthly debt payments below $981.

5. Why do sellers want 20% down?

A 20% down payment makes the buyer stand out in a competitive market and instills confidence in the seller. It portrays the buyer as a stronger candidate for financing.

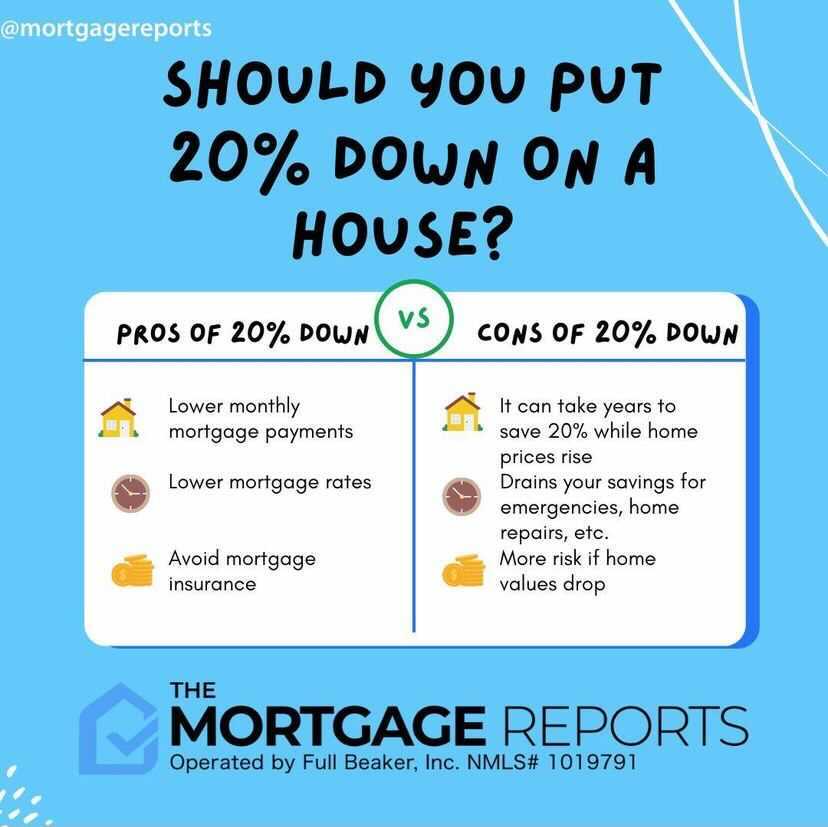

6. What are the disadvantages of a large down payment?

Drawbacks include reduced liquidity in finances, inability to invest the money elsewhere, inconvenience if not planning to stay in the house long-term, potential loss if home value depreciates, and lack of available funds initially.

7. Why not put 20% down?

Calculating the pros and cons is essential. Homebuyers who put at least 20% down can avoid paying private mortgage insurance, but there may be other financial factors to consider.

8. Is putting 20% down on a house financially advantageous?

While putting 20% down has its benefits, it ultimately depends on an individual’s financial situation, housing market conditions, and personal goals.

9. Can putting 20% down help with loan approval?

A larger down payment can increase the chances of loan approval as it reduces the loan-to-value ratio and shows financial stability to lenders.

10. How does a smaller down payment impact monthly payments?

A smaller down payment means higher loan amount and monthly mortgage payments. It also usually results in the need for private mortgage insurance.

11. What alternatives are there to a 20% down payment?

Alternatives include government-backed loans with lower down payment requirements, such as FHA loans (typically requiring 3.5% down) or VA loans (for eligible veterans with no down payment requirement).

12. Can a lower down payment affect the interest rate?

A lower down payment may lead to higher interest rates and potentially extend the repayment period, increasing the overall cost of the mortgage.

13. What factors should be considered when deciding on the down payment amount?

Factors include current financial standing, affordability, housing market conditions, potential for a higher return on investment elsewhere, and long-term financial goals.

14. Are there any tax benefits to putting 20% down?

There are no specific tax benefits associated with a 20% down payment. However, homeownership can offer potential tax advantages, such as deducting mortgage interest and property taxes.

15. Can a smaller down payment impact the ability to refinance?

A smaller down payment may lead to less favorable refinancing options, as lenders typically prefer borrowers with more equity in their homes.

Is it dumb to put 20 down on a house

A 20% down payment (or more) gives you a comfortable equity cushion. But if you're in a housing market that's seeing values rise quickly, there's less need to have a large equity position.

Is 20% down on a house worth it

If you can easily afford it, you should probably put 20% down on a house. You'll avoid paying for private mortgage insurance, and you'll have a lower loan amount and smaller monthly payments to worry about. You could save a lot of money in the long run.

Cached

How often do people put 20% down on a house

In reality, however, a 20% down isn't a requirement. It's merely a goal, and it's one not all homeowners reach. In fact, 44% of homebuyers put less than 20% down, according to an April 2022 confidence index survey from the National Association of Realtors (NAR).

Why do sellers prefer 20% down

A higher down payment shows the seller you are motivated—you will cover the closing costs without asking the seller for assistance and are less likely to haggle. You are a more competitive buyer because it shows the seller you are more reliable.

How much is a downpayment on a 400k house

What income is required for a 400k mortgage To afford a $400,000 house, borrowers need $55,600 in cash to put 10 percent down. With a 30-year mortgage, your monthly income should be at least $8200 and your monthly payments on existing debt should not exceed $981. (This is an estimated example.)

Why do sellers want 20% down

Your offer will stand out in a competitive market. In a market where many buyers are competing for the same home, sellers like to see offers come in with 20% or larger down payments. The seller gains the same confidence as the lender in this scenario. With a larger down payment, you are seen as a stronger buyer.

What are the disadvantages of a large down payment

Drawbacks of a Large Down PaymentYou will lose liquidity in your finances.The money cannot be invested elsewhere.It is inconvenient if you will not be in the house for long.If the home loses value, so does your investment.You might not have the money to begin with.

Why not to put 20% down

Calculating the Pros and Cons

Homebuyers who put at least 20% down don't have to pay PMI, and they'll save on interest over the life of the loan. Putting 20% down is likely not in your best interest if it would leave you in a compromised financial position with no financial cushion.

Can I afford a 300K house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

Can I afford a 500k house on 100K salary

A 100K salary means you can afford a $350,000 to $500,000 house, assuming you stick with the 28% rule that most experts recommend. This would mean you would spend around $2,300 per month on your house and have a down payment of 5% to 20%.

Is it smart to put a big down payment on a house

A larger down payment means it's more likely you'll receive a mortgage since you are less risk to a lender. It also means you will own more of the value of your home, and a lower loan-to-value ratio (LTV) may help you qualify for lower interest rates and fewer fees.

What is the best amount to put down on a house

20%

A 20% down payment is widely considered the ideal down payment amount for most loan types and lenders. If you can put 20% down on your home, you'll reap the following key benefits.

How much do you have to make a year to afford a $400000 house

$105,864 each year

Assuming a 30-year fixed conventional mortgage and a 20 percent down payment of $80,000, with a high 6.88 percent interest rate, borrowers must earn a minimum of $105,864 each year to afford a home priced at $400,000. Based on these numbers, your monthly mortgage payment would be around $2,470.

Can I afford a $300 K house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.

How much income do you need to buy a $650000 house

Based on the current average for a down payment, and the current U.S. average interest rate on a 30-year fixed mortgage you would need to be earning $126,479 per year before taxes to be able to afford a $650,000 home.

Do sellers like bigger down payments

In short, yes, you can get the attention of the seller with a higher down payment. In a hot market, there are a lot of buyers making offers, and higher offers don't guarantee you'll beat out the competition. However, demonstrating your ability to obtain a mortgage can be more attractive.

Is it smart to put a lot down on a house

A larger down payment means it's more likely you'll receive a mortgage since you are less risk to a lender. It also means you will own more of the value of your home, and a lower loan-to-value ratio (LTV) may help you qualify for lower interest rates and fewer fees.

How much income do you need to buy a 600k house

What income is required for a 600k mortgage To afford a house that costs $600,000 with a 20 percent down payment (equal to $120,000), you will need to earn just under $90,000 per year before tax. The monthly mortgage payment would be approximately $2,089 in this scenario. (This is an estimated example.)

What salary do you need for a 400k house

$106,000

The primary factor is your income — a $400,000 purchase typically requires a salary of at least $106,000. Other important considerations include your credit score, the size of your down payment and the details of your mortgage loan, including the interest rate.

Can I afford a 300k house on a $70 K salary

Home buying with a $70K salary

If you're an aspiring homeowner, you may be asking yourself, “I make $70,000 a year: how much house can I afford” If you make $70K a year, you can likely afford a home between $290,000 and $360,000*.