Summary of the Article:

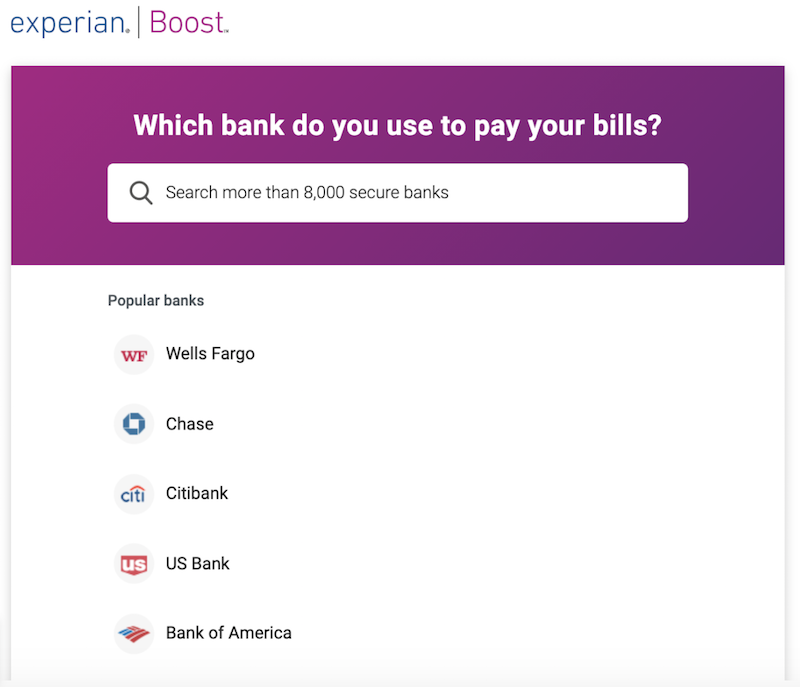

1. Connecting Your Bank with Experian Boost: It is recommended to keep your bank accounts connected to Experian when applying for new credit. This helps lenders see your boosted credit scores on your Experian report. Disconnecting your bank or credit card accounts from Experian Boost will result in your credit scores being calculated without that additional information.

2. Linking Your Bank Account to Your Credit Report: Yes, linking your bank account can help build your credit score. The extent of improvement depends on the features offered by your banking provider and the steps you have already taken to improve your score.

3. Trustworthiness of Experian: Credit scores from Experian, Equifax, and TransUnion are considered accurate. The accuracy of the scores relies on the information provided by lenders and creditors. You can check your credit report to ensure the accuracy of the information.

4. Unlinking Your Bank Account in Experian: To unlink your bank account in Experian, log into your account and click on the “disconnect” option in the “Connected Accounts” section at the bottom right of the screen.

5. Banks and Credit Reports: When applying for a mortgage, lenders typically examine credit history reports from the three major credit bureaus, including Experian, Equifax, and TransUnion.

6. Use of Experian by Banks: Many lenders, credit providers, and financial institutions utilize Experian for their decision-making processes.

7. Impact of Experian on Credit Score: Soft inquiries, such as checking your own credit report or score and using credit monitoring services from Experian, do not affect your credit score. They are listed separately from inquiries that do impact your score.

8. Experian’s Knowledge of Income: Experian uses advanced analytics to identify income streams, both active and inactive. They assign a confidence score to rank and validate income quickly.

Questions and Answers:

1. Is it beneficial to connect your bank with Experian?

Yes, connecting your bank accounts with Experian when applying for new credit can help lenders see your boosted credit scores on your Experian report.

2. Can linking your bank account improve your credit score?

Linking your bank account can improve your credit score, but to what extent depends on the features offered by your banking provider and your existing efforts to enhance your score.

3. Can Experian’s accuracy be trusted?

Experian’s credit scores are generally considered accurate, contingent upon the information provided by lenders and creditors. You can verify the accuracy by checking your credit report.

4. How can you unlink your bank account in Experian?

To unlink your bank account in Experian, log into your account and click on the “disconnect” option in the “Connected Accounts” section at the bottom right of the screen.

5. Which credit history reports do banks consider?

When applying for a mortgage, lenders typically review credit history reports from the three major credit bureaus, including Experian, Equifax, and TransUnion.

6. Do banks use Experian for credit scoring?

Yes, many lenders, credit providers, and financial institutions rely on Experian for their decision-making processes.

7. Does Experian’s information impact your credit score?

Soft inquiries, such as checking your own credit report or score and using credit monitoring services from Experian, do not impact your credit score. They are listed separately in your credit report.

8. How does Experian determine income?

Experian employs advanced analytics to identify income streams, assigning a confidence score to rank and sort income quickly. They can determine income within minutes through a detailed report.

Is it good to connect your bank with Experian

Make sure to keep your accounts connected when applying for new credit so lenders can see your boosted credit scores on your Experian report. If you disconnect your bank or credit card accounts from Experian Boost, your credit scores will be calculated without that additional information.

Should I link my bank account to my credit report

Well, the good news is that, yes, your bank account can, in fact, help to build your credit score. The amount it can help to improve your score is dependent on the features your banking provider can offer you, and what steps you've already taken to improve your score.

Cached

Can Experian be trusted

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Can I unlink my bank account in Experian

When you log into your Experian account, you'll see a field titled Connected Accounts at the bottom right of your screen. Simply click 'disconnect' to begin the process of disconnecting your bank account.

Cached

Do banks look at Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Do banks use Experian for credit score

Many lenders, credit providers and financial institutions use Experian for their decisions.

Does Experian affect your credit score

Soft inquiries also occur when you check your own credit report or score or when you use credit monitoring services from Experian and other companies. These inquiries do not impact your credit score, and are listed in a separate section in your credit report from the ones that do.

How does Experian know my income

Experian uses advanced analytics to identify income streams, both active and inactive. Through our analytics we are able to rank income streams, assigning a confidence score. This makes it easy to validate and sort income quickly. Income is now identified in minutes through a detailed report.

Can Experian give out my details

The personal information you provide to us in connection with ordering your credit report and/or score online will not be shared with any third parties, except as permitted by law.

Can Experian raise your credit score

Experian Boost enables consumers who have been making utility, telecom, streaming and rent payments on time to factor those payments into their Experian credit file and, for most, instantly improve their credit scores.

What happens when you unlink a bank account

Once your bank is unlinked all of the transactions related to that account will be gone!

Does Experian show bank accounts

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

Do banks use Experian or TransUnion

When you apply for a new line of credit, banks and credit card companies can pay to access your credit report from Equifax, Experian or TransUnion.

Is Experian your real FICO score

Experian and FICO aren't the same thing. Experian is a credit reporting agency that also offers consumer credit monitoring products. FICO is a scoring model. A service called myFICO offers similar consumer credit monitoring products to Experian.

Does checking your credit with Experian lower it

Soft inquiries also occur when you check your own credit report or score or when you use credit monitoring services from Experian and other companies. These inquiries do not impact your credit score, and are listed in a separate section in your credit report from the ones that do.

Is Experian worth paying for

We think the Premium plan is definitely worth the extra $10 a month or $100 a year, but both plans provide excellent and comprehensive identity monitoring coverage. For one adult, a 30-day free trial is available, so we recommend signing up for Premium to try out all the features available.

Does Experian share your personal information

We also share personal information with non-affiliated third parties as follows: Business Partners: We share your personal information with companies that we have partnered with to offer products that may be of interest to you. We also share your information to provide you with products and services that you request.

Why does Experian need my bank details

We look for payments into savings and investment accounts, Council Tax payments, digital entertainment payments, and the total amount paid in and out. We then use this information to determine if your score could get a Boost. You'll be able to see your Boost and a consolidated view of the transactions we've used.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

Can my credit score go up 200 points in a month

There are several actions you may take that can provide you a quick boost to your credit score in a short length of time, even though there are no short cuts to developing a strong credit history and score. In fact, some individuals' credit scores may increase by as much as 200 points in just 30 days.

Can someone drain your bank account with your account number

If fraudsters can combine your bank details and other easy-to-find information — such as your Social Security number (SSN), ABA or routing number, checking account number, address, or name — they can easily begin to steal money from your account.

What happens when you link banks

Linking bank accounts can serve multiple purposes, whether it's allowing you to fund overdrafts with another account, waiving certain fees or making it easier to transfer money between the accounts.

Which is more accurate TransUnion or Experian

Of the three main credit bureaus (Equifax, Experian, and TransUnion), none is considered better than the others. A lender may rely on a report from one bureau or all three bureaus to make its decisions about approving your loan.

Is Experian the most accurate credit score

While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each of these bureaus could be the same, depending on which scoring model they use.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.