Summary of the Article

1. Is it safe to send your credit report?

Yes. The site’s security protocols and measures protect the personal information you provide. You must enter your Social Security Number to receive a free credit report through AnnualCreditReport.com.

2. Can someone steal your identity with your credit report?

Yes, your credit report contains a lot of personal information, so it’s a goldmine for identity thieves. With a copy of your report in hand, a potential fraudster might be able to see your full name and other sensitive details.

3. What can someone do with your credit report?

Being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name and fail to pay the bills.

4. What is the safest way to get a credit report?

You may request your reports:

- Online by visiting AnnualCreditReport.com.

- By calling 1-877-322-8228 (TTY: 1-800-821-7232)

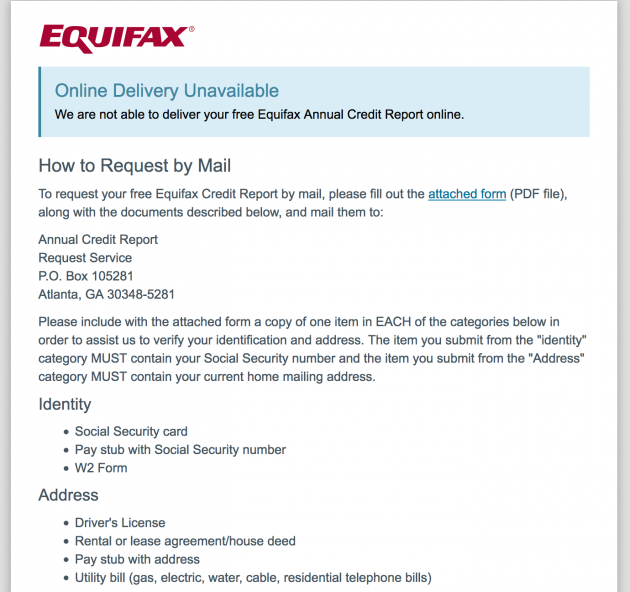

- By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service, PO Box 105281, Atlanta, GA 30348-5281.

5. Is my credit report confidential?

The average person is not privy to your credit information. For the most part, your score and report remain confidential, and only select parties and companies can see it. Here’s who can access your credit report, who can’t, and why.

6. Is it illegal to share a credit report with someone else?

Your credit report can’t be obtained by just anyone. The FCRA lays out the situations in which a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

7. How do you check if your SSN is being used?

To see if someone’s using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Alternatively, you can call their phone number at 1-877-322-8228 to request your free copy.

8. What are three steps you should take if you believe your identity has been compromised?

First, contact your police department, report the crime, and obtain a police report. Then, decide whether you want to place a security freeze on your credit report.

Questions

1. Is it safe to send your credit report?

Yes, it is safe to send your credit report. The website AnnualCreditReport.com has security protocols in place to protect your personal information.

2. Can someone steal your identity with your credit report?

Yes, someone can potentially steal your identity with your credit report. Your credit report contains a lot of personal information that can be used for fraudulent activities.

3. What can someone do with your credit report?

If someone has access to your credit report, they can open new lines of credit or credit cards in your name and potentially cause financial harm.

4. What is the safest way to get a credit report?

The safest way to get a credit report is to visit AnnualCreditReport.com, call their phone number, or fill out the Annual Credit Report request form and mail it to the specified address.

5. Is my credit report confidential?

Yes, your credit report is confidential and can only be accessed by select parties and companies with a valid reason.

6. Is it illegal to share a credit report with someone else?

Yes, it is illegal to share a credit report with someone who does not have a legally permissible reason to access it.

7. How do you check if your SSN is being used?

You can check if your SSN is being used by reviewing your credit report. AnnualCreditReport.com provides authorized access to free credit reports.

8. What are three steps you should take if you believe your identity has been compromised?

If you believe your identity has been compromised, you should contact your local police department, report the crime, and obtain a police report. Additionally, consider placing a security freeze on your credit report.

9. Can someone steal your identity with your credit report?

Yes, someone can potentially steal your identity with your credit report. Your credit report contains a lot of personal information that can be used for fraudulent activities.

10. What is the safest way to get a credit report?

The safest way to get a credit report is to visit AnnualCreditReport.com, call their phone number, or fill out the Annual Credit Report request form and mail it to the specified address.

11. Is my credit report confidential?

Yes, your credit report is confidential and can only be accessed by select parties and companies with a valid reason.

12. Is it illegal to share a credit report with someone else?

Yes, it is illegal to share a credit report with someone who does not have a legally permissible reason to access it.

13. How do you check if your SSN is being used?

You can check if your SSN is being used by reviewing your credit report. AnnualCreditReport.com provides authorized access to free credit reports.

14. What are three steps you should take if you believe your identity has been compromised?

If you believe your identity has been compromised, you should contact your local police department, report the crime, and obtain a police report. Additionally, consider placing a security freeze on your credit report.

15. Can someone steal your identity with your credit report?

Yes, someone can potentially steal your identity with your credit report. Your credit report contains a lot of personal information that can be used for fraudulent activities.

Is it safe to send your credit report

Yes. The site's security protocols and measures protect the personal information you provide. You must enter your Social Security Number to receive a free credit report through AnnualCreditReport.com.

Can someone steal identity with credit report

Can Someone Steal Your Identity with Your Credit Report Your credit report contains a lot of personal information, so it's a goldmine for identity thieves. With a copy of your report in hand, a potential fraudster might be able to see: Full name.

What can someone do with my credit report

Unfortunately, being a victim of identity theft means your credit scores may be negatively impacted. Thieves could open new lines of credit or credit cards in your name — and fail to pay the bills.

What is the safest way to get a credit report

You may request your reports:Online by visiting AnnualCreditReport.com.By calling 1-877-322-8228 (TTY: 1-800-821-7232)By filling out the Annual Credit Report request form and mailing it to: Annual Credit Report Request Service. PO Box 105281. Atlanta, GA 30348-5281.

CachedSimilar

Is my credit report confidential

The average person is not privy to your credit information. For the most part, your score and report remain confidential, and only select parties and companies can see it. Here's who can access your credit report, who can't, and why.

Is it illegal to share a credit report with someone else

Your credit report can't be obtained by just anyone. The FCRA lays out in what situations a credit reporting agency can provide others access to your report. Even those who want access to your report can only ask for it if they have a legally permissible reason to do so.

How do you check if my SSN is being used

To see if someone's using your SSN, check your credit report. You can check it online through AnnualCreditReport.com, the only authorized website for free credit reports. Or you can call their phone number at 1-877-322-8228 to request your free copy.

What are 3 steps you should take if you believe your identity has been compromised

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

What is the most trusted credit report

FICO scores are used in over 90% of lending decisions making the FICO® Basic, Advanced and Premier services the most accurate for credit score updates.

What is the most damaging thing you can do to hurt your credit score

Highlights: Even one late payment can cause credit scores to drop. Carrying high balances may also impact credit scores. Closing a credit card account may impact your debt to credit utilization ratio.

Can someone access my credit report without permission

Now, the good news is that lenders can't just access your credit report without your consent. The Fair Credit Reporting Act states that only businesses with a legitimate reason to check your credit report can do so, and generally, you have to consent in writing to having your credit report pulled.

Can a credit report be shared

Under the law, credit bureaus and other CRAs can release your information only to those third parties that have certified that they have a purpose permitted by the law to obtain your consumer report, such as to evaluate your application for credit, insurance, or employment, or to rent you an apartment.

Who is legally allowed to check a person’s credit report

While the general public can't see your credit report, some groups have legal access to that personal information. Those groups include lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers.

How do I check to see if my identity has been stolen

What you can do to detect identity theftTrack what bills you owe and when they're due. If you stop getting a bill, that could be a sign that someone changed your billing address.Review your bills.Check your bank account statement.Get and review your credit reports.

How do I stop my SSN from being used

There are measures you can take to help prevent further unauthorized use of your SSN and other personal information. You can lock your SSN by calling the Social Security Administration or by creating an E-Verify account. Also, you can contact all three of the nationwide CRAs to place a freeze on your credit reports.

What is the most common method used to steal your identity

Physical Theft: examples of this would be dumpster diving, mail theft, skimming, change of address, reshipping, government records, identity consolidation. Technology-Based: examples of this are phishing, pharming, DNS Cache Poisoning, wardriving, spyware, malware and viruses.

What are the first two things you need to do if your identity is stolen

Contact your police department, report the crime and obtain a police report. Decide whether you want to place a security freeze on your credit report.

Which of the 3 credit scores is most accurate

Simply put, there is no “more accurate” score when it comes down to receiving your score from the major credit bureaus.

Is Experian or Credit Karma more accurate

Experian vs. Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

What three moves can sabotage your credit score

3 Ways People Destroy Their Credit ScoreMaking Late Payments That Show For Years On Your Credit Report.Maxing Out Your Credit Cards.Not Paying Your Debts or Declaring Bankruptcy.

What brings your credit score down the most

5 Things That May Hurt Your Credit ScoresHighlights: Even one late payment can cause credit scores to drop.Making a late payment.Having a high debt to credit utilization ratio.Applying for a lot of credit at once.Closing a credit card account.Stopping your credit-related activities for an extended period.

How do I stop someone from accessing my credit report

A credit freeze, or security freeze, blocks access to your credit reports, protecting against scammers' attempts to access your credit reports and open fraudulent accounts. When someone applies for credit using your personal information, a lender or card issuer typically checks your credit before making a decision.

Is it illegal to request someone else’s credit report

The Fair Credit Reporting Act (FCRA) is a federal statute that defines and limits who can receive credit-related information. The act lists legal reasons why someone's credit can be checked; therefore, it is illegal for an individual or organization to check someone's credit report for any other purpose.

Is it illegal to check someone else’s credit report

The short answer is yes. With the proper authority, anyone can obtain a copy of another person's credit report. The key here, though, is having what the Fair Credit Reporting Act refers to as “permissible purpose” to access the report.

How do I check someone else’s credit report

You can access someone else's credit report by directly contacting one of the credit bureaus (TransUnion, Equifax, and Experian). Each of these bureaus technically gives their ratings independently, but all three of the scores should be quite similar for the same person.