Should I link my bank account to my credit report?

Well, the good news is that, yes, your bank account can, in fact, help to build your credit score. The amount it can help to improve your score is dependent on the features your banking provider can offer you, and what steps you’ve already taken to improve your score.

How trustworthy is Experian?

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Can I unlink my bank account in Experian?

When you log into your Experian account, you’ll see a field titled Connected Accounts at the bottom right of your screen. Simply click ‘disconnect’ to begin the process of disconnecting your bank account.

Does linking bank accounts affect credit score?

If one of you has a poor credit history, it’s not usually a good idea to open a joint account. As soon as you open an account together, you’ll be ‘co-scored’ and your credit ratings will become linked. This doesn’t happen by just living with someone – even if you’re married. You’ll lose some privacy.

Can Experian see my bank account?

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.

How does Experian know my income?

Experian uses advanced analytics to identify income streams, both active and inactive. Through our analytics we are able to rank income streams, assigning a confidence score. This makes it easy to validate and sort income quickly. Income is now identified in minutes through a detailed report.

Can Experian raise your credit score?

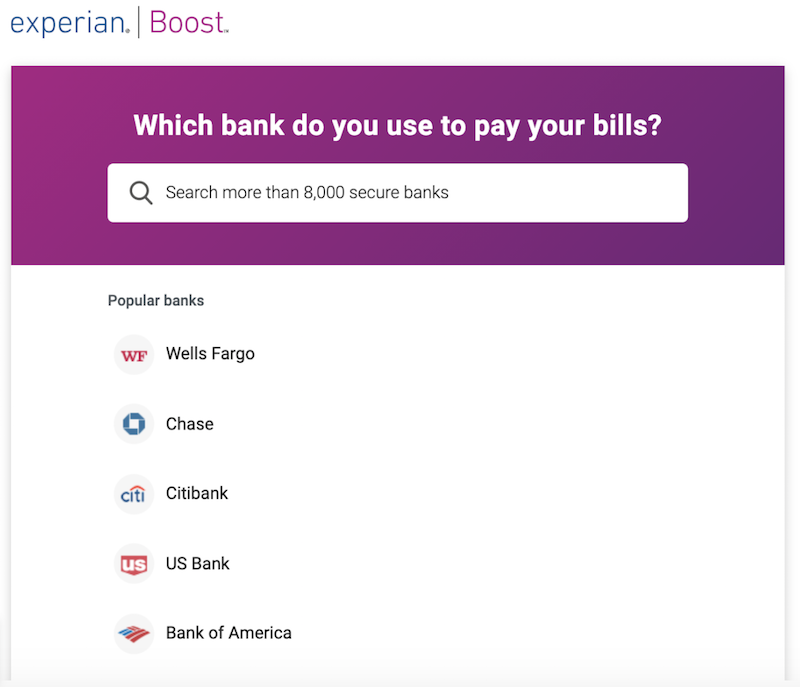

Experian Boost enables consumers who have been making utility, telecom, streaming and rent payments on time to factor those payments into their Experian credit file and, for most, instantly improve their credit scores.

Does Experian hit your credit?

If you obtain your own credit report or check your credit score using Experian’s services, it generally does not impact your credit score. However, when a lender or creditor pulls your credit report as part of a credit application, it may have a small, temporary impact on your score.

Should I link my bank account to my credit report

Well, the good news is that, yes, your bank account can, in fact, help to build your credit score. The amount it can help to improve your score is dependent on the features your banking provider can offer you, and what steps you've already taken to improve your score.

Cached

How trustworthy is Experian

Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the information provided to them by lenders and creditors. You can check your credit report to ensure the information is accurate.

Can I unlink my bank account in Experian

When you log into your Experian account, you'll see a field titled Connected Accounts at the bottom right of your screen. Simply click 'disconnect' to begin the process of disconnecting your bank account.

Cached

Does linking bank accounts affect credit score

If one of you has a poor credit history, it's not usually a good idea to open a joint account. As soon as you open an account together, you'll be 'co-scored' and your credit ratings will become linked. This doesn't happen by just living with someone – even if you're married. You'll lose some privacy.

Can Experian see my bank account

Bank transactions and account balances are not reported to the national credit bureaus and do not appear on your credit reports—but unpaid bank fees or penalties turned over to collection agencies will appear on your credit reports and hurt your credit scores.

How does Experian know my income

Experian uses advanced analytics to identify income streams, both active and inactive. Through our analytics we are able to rank income streams, assigning a confidence score. This makes it easy to validate and sort income quickly. Income is now identified in minutes through a detailed report.

Can Experian raise your credit score

Experian Boost enables consumers who have been making utility, telecom, streaming and rent payments on time to factor those payments into their Experian credit file and, for most, instantly improve their credit scores.

Does Experian hit your credit

If you obtain your own credit report or check your credit score using a credit monitoring service such as Experian's, that will generate a soft inquiry on your credit report. But, as with other soft inquiries, monitoring your own credit scores cannot hurt your credit.

Does checking your credit score on Experian lower it

Soft inquiries also occur when you check your own credit report or score or when you use credit monitoring services from Experian and other companies. These inquiries do not impact your credit score, and are listed in a separate section in your credit report from the ones that do.

Do bank accounts help build credit

No, bank accounts don't help you build credit, because deposit accounts—which include checking, savings, certificates of deposit and money market accounts—are not reported to credit bureaus.

Does having money in the bank improve credit score

Your bank account information doesn't show up on your credit report, nor does it impact your credit score. Yet lenders use information about your checking, savings and assets to determine whether you have the capacity to take on more debt.

Do banks look at Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Does Experian show bank accounts

While your credit report features plenty of financial information, it only includes financial information that's related to debt. Loan and credit card accounts will show up, but savings or checking account balances, investments or records of purchase transactions will not.

What makes Experian score go up

Common reasons for a score increase include: a reduction in credit card debt, the removal of old negative marks from your credit report and on-time payments being added to your report. The situations that lead to score increases correspond to the factors that determine your credit score.

How to raise credit score 100 points in 30 days

Quick checklist: how to raise your credit score in 30 daysMake sure your credit report is accurate.Sign up for Credit Karma.Pay bills on time.Use credit cards responsibly.Pay down a credit card or loan.Increase your credit limit on current cards.Make payments two times a month.Consolidate your debt.

How much does Experian boost your credit score

13 points

Most people get an instant increase in their FICO® Score with Experian Boost. People receiving a boost instantly raise their FICO® Score by an average of 13 points with Experian Boost.

Can Experian boost drop your score

Yes, Experian Boost is safe to use. Boost only adds on-time payments to your credit report, so it cannot hurt your credit score.

Which score is more accurate FICO or Experian

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

Why is my Experian credit score so much higher

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual.

What builds credit the fastest

Paying bills on time and paying down balances on your credit cards are the most powerful steps you can take to raise your credit. Issuers report your payment behavior to the credit bureaus every 30 days, so positive steps can help your credit quickly.

What is the fastest way to boost credit score

Steps to Improve Your Credit ScoresBuild Your Credit File.Don't Miss Payments.Catch Up On Past-Due Accounts.Pay Down Revolving Account Balances.Limit How Often You Apply for New Accounts.

What has biggest impact on credit score

Payment History

1. Payment History: 35% Your payment history carries the most weight in factors that affect your credit score, because it reveals whether you have a history of repaying funds that are loaned to you. This component of your score considers the following factors:3.

Which payment will actually improve your credit score

Only those monthly payments that are reported to the three national credit bureaus (Equifax, Experian and TransUnion) can do that. Typically, your car, mortgage and credit card payments count toward your credit score, while bills that charge you for a service or utility typically don't.

Do banks use Experian for credit score

Many lenders, credit providers and financial institutions use Experian for their decisions.

How can I raise my credit score 100 points overnight

How To Raise Your Credit Score by 100 Points OvernightGet Your Free Credit Report.Know How Your Credit Score Is Calculated.Improve Your Debt-to-Income Ratio.Keep Your Credit Information Up to Date.Don't Close Old Credit Accounts.Make Payments on Time.Monitor Your Credit Report.Keep Your Credit Balances Low.