Summary of the Article: Disputing Items on Your Credit Report

1. The Fair Credit Reporting Act allows consumers to challenge information on their credit reports.

2. Disputing information on your credit report is not prohibited by law.

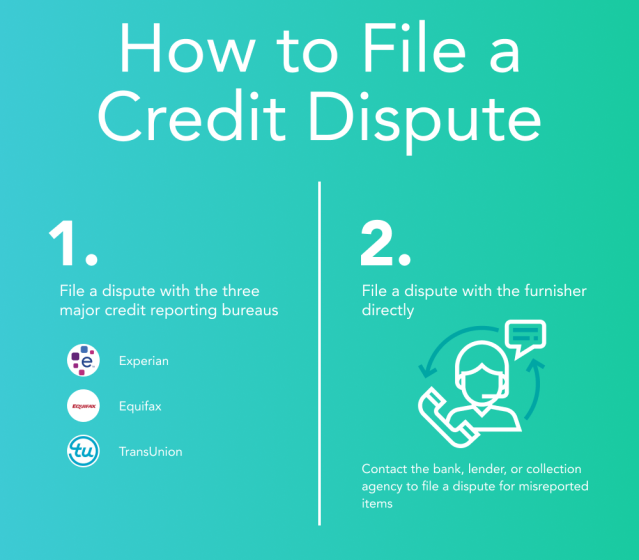

3. If you find an error on your credit report, you can contact the credit bureaus to dispute it.

4. Credit bureaus have 30 days to investigate your dispute, but the process can take up to 45 days in certain circumstances.

5. There are various reasons for disputing credit, such as accounts that aren’t yours or inaccurate account balances.

6. Filing a dispute will not affect your credit score; it’s important to correct any misinformation to avoid future harm to your score.

7. If you dispute a collection, the debt collection activities must be halted until the dispute is resolved.

8. When disputing errors on your credit report, include your complete name and address, details of the inaccurate information, and supporting documents.

9. To win a credit report dispute, fill out a dispute form and provide evidence supporting your claim.

10. Follow up with the credit bureau and the business that provided the incorrect information to ensure the necessary updates are made.

Key Questions on Disputing Credit Reports:

1. Can I get in trouble for disputing items on my credit report?

Answer: The Fair Credit Reporting Act gives consumers the right to challenge information on their credit reports, so disputing items is allowed and not punishable.

2. How long should I wait to dispute a credit report?

Answer: It is advisable to contact the credit bureaus as soon as you discover an error. The investigation process may take up to 30 days, but can sometimes extend to 45 days.

3. What reasons can I use for disputing credit?

Answer: You can dispute credit for accounts that aren’t yours, inaccurate credit limits/loan amounts, incorrect creditors, or inaccurate account status (e.g., reported as past due when it is current).

4. Will removing disputes harm my credit?

Answer: No, correcting or removing disputes is beneficial for your credit score. It is essential to get misinformation corrected to prevent future negative impacts on your score.

5. What happens if I dispute a collection on my credit report?

Answer: If you send a written dispute about a debt to a debt collector, they must pause all collection activities until they provide verification of the debt, usually within 30 days.

6. What should I include in my credit report dispute letter?

Answer: Your dispute letter should contain your complete name and address, details of the erroneous information, and copies (not originals) of supporting documents.

7. How can I win a credit report dispute?

Answer: Fill out a dispute form and provide supporting documentation to prove the error. Ensure the credit bureau and the business responsible for the incorrect information update their records accordingly.

Can you get in trouble for disputing items on your credit report

Can I get in trouble” Answer: First things first, the Fair Credit Reporting Act gives each of us the right to challenge information on our credit reports with which we don't agree. There's nothing in that law that prohibits consumers from disputing information on their credit reports for any reason.

How long should I wait to dispute a credit report

If you find an error on your credit report, you can contact the credit bureaus to dispute that inaccurate information. In most cases, the credit bureau has 30 days from the date of filing to investigate your claim, though an investigation can take up to 45 days in some circumstances.

What reason should I put for disputing credit

Accounts that aren't yours. Inaccurate credit limit/loan amount or account balance. Inaccurate creditor. Inaccurate account status, for example, an account status reported as past due when the account is actually current.

Cached

Can removing disputes hurt your credit

Filing a Dispute Will Not Affect Your Score

In fact, it's important that you get the misinformation corrected or removed so that it doesn't affect your score down the road. If you are correcting identification or contact information, the change will not affect your score.

What happens if I dispute a collection

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

What should I say when disputing my credit

The letter should say you're disputing errors and should include: your complete name and address; each bit of inaccurate information that you want fixed, and why; and copies (not originals) of documents that support your request. Many businesses want disputes sent to a particular address.

How do I dispute a credit report and win it

You'll likely need to fill out a dispute form and provide supporting documentation that helps prove an error was made. If your dispute is accepted, follow up to make sure the credit bureau and the business that supplied the incorrect information update their records accordingly.

How often should I dispute my credit report

How Many Times Can You Dispute a Collection or Inaccurate Credit Item There's no limit to how many times a consumer can dispute an item on their credit report, according to National Consumer Law Center attorney Chi Chi Wu. “In some cases, it will take several disputes to resolve a matter.

Is it worth it to dispute a collection

You can get ready by understanding your rights as a consumer. You have the right to stop harassment by a debt collector and you have the right to dispute the debt they claim you owe. In fact, I recommend that you exercise your right to dispute in almost every situation. It can't hurt—and it may save you time and money!

What happens after a credit dispute

After completing its investigation, the lender or creditor may provide its response, along with any information updates, to the credit bureau with which you initiated your dispute. That bureau will then notify you of the investigation response within 30 days of your dispute request.

How can I get a collection removed without paying

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

How do I dispute a collection and win

How to Dispute a Debt and WinAssemble all documentation about the debt. Your first step is to assemble all evidence you have concerning the debt.Review the debt collection letter for mistakes.Determine your response to the debt collection agency.Wait for a response from the debt collection agency.

How do I remove bad debt from my credit report

Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years. Lenders use your credit reports to scrutinize your past debt payment behavior and make informed decisions about whether to extend you credit and under what terms.

How do I get a collection removed

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

Can disputed collections come back

A debt collector must stop all collection activity on a debt if you send them a written dispute about the debt, generally within 30 days after your initial communication with them. Collection activities can restart, though, after the debt collector sends verification responding to the dispute.

Is it better to dispute or pay a collection

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

How many times do you have to dispute credit report

How Many Times Can You Dispute a Collection or Inaccurate Credit Item There's no limit to how many times a consumer can dispute an item on their credit report, according to National Consumer Law Center attorney Chi Chi Wu. “In some cases, it will take several disputes to resolve a matter.

How many points will credit go up if I pay off collections

With most of the current standard credit scoring models, paying a collection account off likely won't increase your credit score since the item will remain on your credit report. It will show up as “paid” instead of “unpaid,” which might positively influence a lender's opinion.

Can you legally erase bad credit

Can debt collectors remove negative information from my reports Unfortunately, negative information that is accurate cannot be removed and will generally remain on your credit reports for around seven years.

Can a paid debt be removed from credit report

Once you've paid off an account in collections, it will eventually fall off your credit report. If you'd like to expedite the process, you can request a goodwill removal. Removing a paid collection account is up to the discretion of your original creditor, who doesn't have to agree to your request.

How do I get a collection removed from my credit report

Successfully disputing inaccurate information is the only surefire way to get collections removed from your credit report. If you've repaid a debt and the collection account remains on your credit report, you can request a goodwill deletion from your creditor, though there's no guarantee they'll grant your request.

How do I delete a collection without paying it

You can ask the creditor — either the original creditor or a debt collector — for what's called a “goodwill deletion.” Write the collector a letter explaining your circumstances and why you would like the debt removed, such as if you're about to apply for a mortgage.

Is it good to dispute collections

If you believe any account information is incorrect, you should dispute the information to have it either removed or corrected. If, for example, you have a collection or multiple collections appearing on your credit reports and those debts do not belong to you, you can dispute them and have them removed.

Does it hurt to dispute a collection

Does Filing a Dispute Hurt Your Credit Filing a dispute has no impact on credit scores. But if certain information on your credit report changes as a result of your dispute, your credit score can change.

What happens after you dispute a collection

Once you dispute the debt, the debt collector must stop all debt collection activities until it sends you verification of the debt. You can also use the sample dispute letter to discover the name and address of the original creditor. As with all dispute letters, you should keep a copy of the letter for your records.