1. Is Experian the most accurate credit score?

In terms of accuracy, Experian is not necessarily more accurate than other credit bureaus. The credit scores you receive from each of these bureaus could be the same, depending on the scoring model they use.

2. Which credit score is most accurate?

While Experian is the largest credit bureau in the U.S., TransUnion and Equifax are also widely considered to be just as accurate and important. However, when it comes to credit scores, the FICO® Score is typically seen as the clear winner, as it is used in 90% of lending decisions.

3. Is Experian more accurate than FICO?

Experian’s advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. This means that two borrowers could have the same FICO Scores but vastly different credit histories.

4. How valid is Experian credit score?

Experian is a popular Credit Information Company that is approved by the Securities and Exchange Board of India (SEBI). It is a well-known organization that provides credit score information.

5. Why is my Experian score so much higher than FICO?

The credit scores you see on services like Experian may differ from the FICO scores that lenders see when checking your credit. This discrepancy can occur because lenders may be using a FICO score based on data from a different credit bureau.

6. How accurate is Experian vs Credit Karma?

Both Experian and Credit Karma are considered accurate for your credit scores. However, there are differences between the two companies in terms of how they obtain your credit scores. Additionally, it’s important to note that you may have more than one credit score due to various factors.

7. Why is my Experian score so much higher?

There are several factors that can contribute to your Experian score being significantly higher than others. These factors include different credit score brands, score variations, and score generations in commercial use at any given time.

8. Why is Experian score so much lower?

One possible reason for your Experian score being lower could be due to the different updating times of credit bureaus. Each bureau updates their information at different intervals, so there may be differences in the data they have on file.

9. How can I improve my Experian credit score?

To improve your Experian credit score, you can focus on making all of your payments on time, keeping your credit utilization low, and avoiding opening too many new credit accounts. Additionally, regularly checking your credit report for errors and disputing any inaccuracies can also help improve your score.

10. Are Experian credit scores reliable for lenders?

Experian credit scores are generally reliable for lenders, as they provide detailed and comprehensive information about an individual’s credit history. However, it’s important to remember that each lender may have their own criteria and preferences when it comes to evaluating creditworthiness.

Is Experian the most accurate credit score

While Experian is the largest bureau in the U.S., it's not necessarily more accurate than the other credit bureaus. The credit scores that you receive from each of these bureaus could be the same, depending on which scoring model they use.

Cached

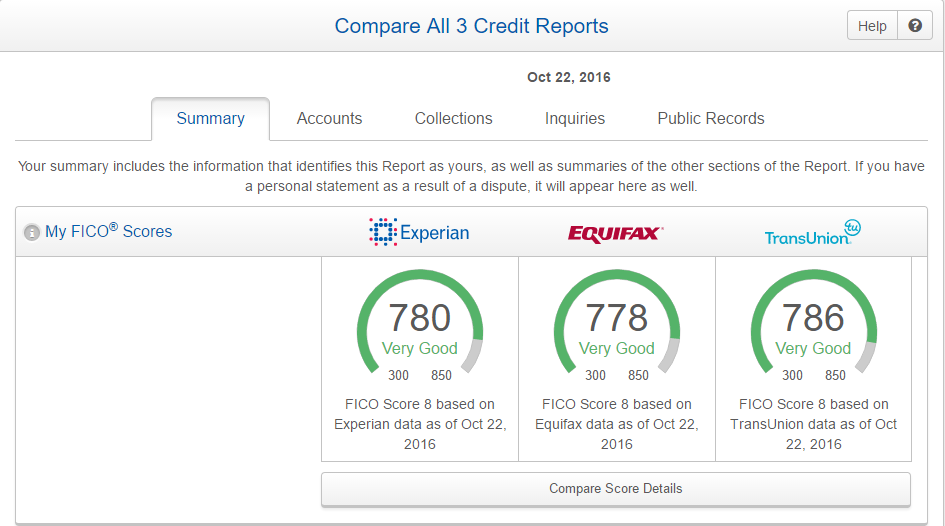

Which credit score is most accurate

Although Experian is the largest credit bureau in the U.S., TransUnion and Equifax are widely considered to be just as accurate and important. When it comes to credit scores, however, there is a clear winner: FICO® Score is used in 90% of lending decisions.

Is Experian more accurate than FICO

Experian's advantage over FICO is that the information it provides is far more detailed and thorough than a simple number. A pair of borrowers could both have 700 FICO Scores but vastly different credit histories.

How valid is Experian credit score

Experian Credit Score

A popular Credit Information Company, Experian is a well-known organisation that is approved by the Securities and Exchange Board of India (SEBI).

Why is my Experian score so much higher than FICO

Why is my Experian credit score different from FICO The credit scores you see when you check a service like Experian may differ from the FICO scores a lender sees when checking your credit. That's because the lender may be using a FICO score based on data from a different credit bureau.

How accurate is Experian vs Credit Karma

Credit Karma: Which is more accurate for your credit scores You may be surprised to know that the simple answer is that both are accurate. Read on to find out what's different between the two companies, how they get your credit scores, and why you have more than one credit score to begin with.

Why is my Experian score so much higher

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual.

Why is Experian score so much lower

Updating times. In addition to data differences, credit bureaus update their information at different intervals. For example, TransUnion may update its information every 30 days, whereas Experian may update information every 60 days. That time difference can lead to different scores.

Why is my Experian score so much lower than FICO

This is due to a variety of factors, such as the many different credit score brands, score variations and score generations in commercial use at any given time. These factors are likely to yield different credit scores, even if your credit reports are identical across the three credit bureaus—which is also unusual.

Do lenders use Experian credit score

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Which is better Equifax or Experian

More companies use Experian for credit reporting than use Equifax. This alone does not make Experian better, but it does indicate that any particular debt is more likely to appear on an Experian reports.

Is Experian score lower than FICO

Your Experian score may be higher than what another credit bureau shows because Experian calculates credit scores using its own unique scoring model.

Why is my Experian score 100 points higher than Credit Karma

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don't all receive the same information about your credit accounts.

Do I go by Credit Karma or Experian

Credit Karma is different from Experian. While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion.

Why is my Experian score so much higher than Credit Karma

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don't all receive the same information about your credit accounts.

Why is my Experian score 100 points higher than Equifax

Some lenders report to all three major credit bureaus, but others report to only one or two. Because of this difference in reporting, each of the three credit bureaus may have slightly different credit report information for you and you may see different scores as a result.

Is Experian usually the lowest score

Which Credit Bureau has the Lowest Score The credit bureau that gives the lowest FICO or Vantage score tends to be the one that lenders use the most in your geographic area. Lenders typically slice the pie (between Equifax, Experian, and TransUnion) at the three-digit zip code level.

Do companies look at Experian or Equifax

More companies use Experian for credit reporting than use Equifax. This alone does not make Experian better, but it does indicate that any particular debt is more likely to appear on an Experian reports.

Do banks look at Experian or Equifax

When you are applying for a mortgage to buy a home, lenders will typically look at all of your credit history reports from the three major credit bureaus – Experian, Equifax, and TransUnion.

Why is Experian so much higher than Equifax

Which is why Experian has a slight edge over Equifax, as it tends to track recent credit searches more thoroughly. For example, Experian includes the following information in a credit report: Personal information – any piece of information that can be used to identify you.

How far off is Credit Karma

Well, the credit score and report information on Credit Karma is accurate, as two of the three credit agencies are reporting it. Equifax and TransUnion are the ones giving the reports and scores. Credit Karma also offers VantageScores, but they are separate from the other two credit bureaus.

How many points is Credit Karma off

In some cases, as seen in an example below, Credit Karma may be off by 20 to 25 points.

Why is my Experian score 100 points lower than Credit Karma

This is mainly because of two reasons: For one, lenders may pull your credit from different credit bureaus, whether it is Experian, Equifax or TransUnion. Your score can then differ based on what bureau your credit report is pulled from since they don't all receive the same information about your credit accounts.

What score is more important Equifax or Experian

Experian gives a more detailed picture of a person's financial history, including payment timeliness and debt utilization. TransUnion offers more insight into a person's job history, whereas Equifax provides more information about mortgage history.

Is Experian usually higher or lower than Equifax

The main difference is Experian grades it between 0 – 1000, while Equifax grades the score between 0 – 1200. This means that there is not only a clear 200 point difference between these two bureaus but the “perfect scores” are also different, which is 1000 as reported by Experian and 1200 as reported by Equifax.