Summary of the Article:

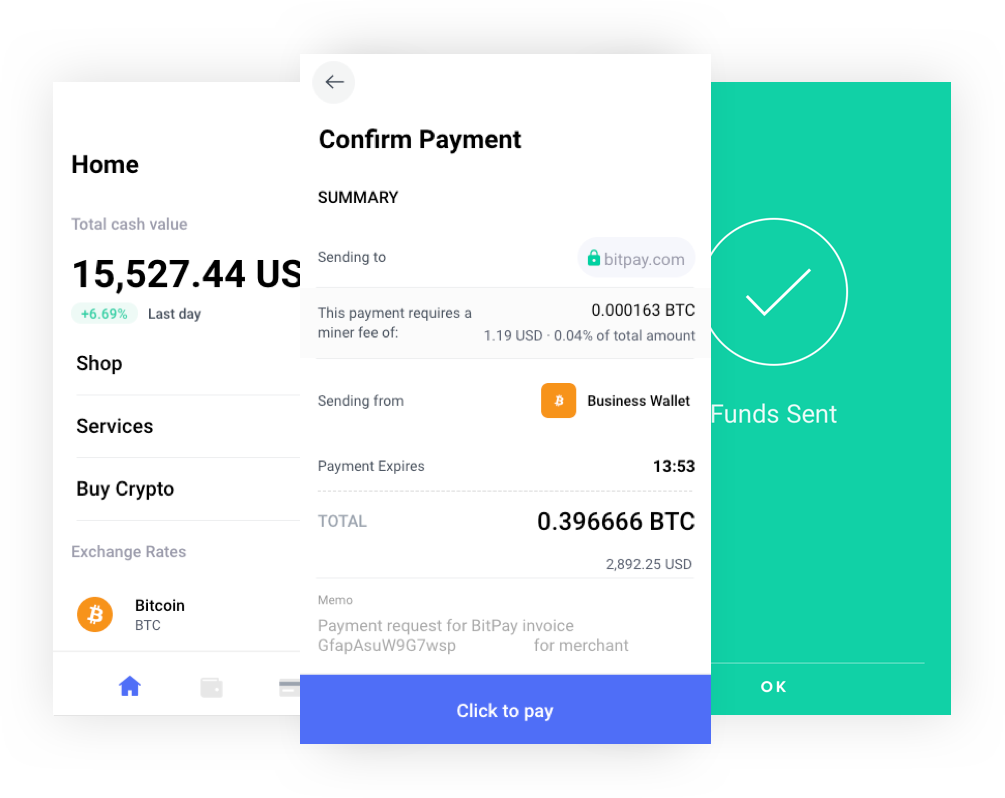

1. BitPay is a trustworthy payment processing system that provides easy and secure transactions with Bitcoin and other cryptocurrencies.

2. Users appreciate the simplicity of BitPay and the convenience of having a debit card for transactions instead of always having to transfer funds to a bank account.

3. BitPay is legal in the USA and is registered as a Money Service Business with the Financial Crime Enforcement Network of the U.S. Department of the Treasury.

4. BitPay is a licensed money transmitter in states where applicable laws require licensing.

5. BitPay complies with IRS requirements and provides information through Form 1099-K reporting.

6. Users can cash out on BitPay by selling their funds on an exchange, converting them into fiat money, and then withdrawing to a bank account.

7. To use BitPay, users need to provide identity verification information, such as a Social Security Number for US residents or a Passport number for non-US residents.

8. BitPay charges a fixed fee of 25 cents per transaction, regardless of the transaction rate.

9. Users can link their bank accounts to BitPay through the merchant dashboard and select the percentage of cryptocurrency and local currency they want to receive in settlements.

10. The IRS can track cryptocurrency wallets, including Bitcoin, by collecting KYC data from centralized exchanges.

Questions:

1. How trustworthy is BitPay?

BitPay is an excellent payment processing system that ensures secure transactions with utmost ease of use. Users appreciate the convenience of having a debit card instead of constantly transferring funds to a bank account.

2. Is BitPay legal in the USA?

Yes, BitPay is a registered Money Service Business with the Financial Crime Enforcement Network of the U.S. Department of the Treasury and is licensed as a money transmitter in states where it is required.

3. Does BitPay report to the IRS?

Yes, BitPay complies with IRS requirements and provides information to the IRS through Form 1099-K reporting.

4. Can you cash out on BitPay?

To cash out on BitPay, you need to go to the wallet where your funds are, sell them on an exchange, convert them into fiat money, and then withdraw to your bank account.

5. Does BitPay require a Social Security Number?

Yes, BitPay requires identity verification information such as a Social Security Number for US residents or a Passport number for non-US residents.

6. Does BitPay charge a fee?

Yes, BitPay charges a fixed fee of 25 cents per transaction, regardless of the transaction rate.

7. Can I link my bank account to BitPay?

Yes, you can link your bank account to BitPay through the merchant dashboard and select the percentage of cryptocurrency and local currency you want to receive in settlements.

8. Can the IRS see my crypto wallet?

Yes, the IRS can track cryptocurrencies, including Bitcoin, by collecting KYC data from centralized exchanges.

9. Does the IRS know if I sold Bitcoin?

The IRS can track Bitcoin transactions and will have knowledge if you sold Bitcoin based on the information collected from centralized exchanges.

How trustworthy is BitPay

"An excellent payment processing system that allows you buy or sell Bitcoin amongst other cryptocurrencies with ease and utmost security." "What I like the most about bitpay is how simple it is to use. I love that I get a debit card to use instead of having to always send money over to my bank account."

Is BitPay legal in USA

BitPay, Inc. is also a registered Money Service Business with the Financial Crime Enforcement Network of the U.S. Department of the Treasury (FinCEN) and is a licensed money transmitter in the U.S. states where applicable law requires it to be licensed.

Does BitPay report to IRS

BitPay complies with the requirements of Section 6050W of the Internal Revenue Code. This Section requires payment processors to provide information to the IRS through Form 1099-K reporting.

Can you cash out on BitPay

To withdraw funds to a bank account you will typically go to the wallet (on the exchange) that has the funds, sell the funds/convert them into fiat money, and will have a Withdraw option that will let you withdraw the funds to a bank account.

Does BitPay require SSN

This will take you through a quick process of providing identity verification information such as: Social Security Number (for US residents) Passport number (for non-US residents) Picture of an approved photo ID.

Does BitPay charge a fee

BitPay charges a 25¢ fixed fee per transaction regardless of the rate at which the transaction is charged.

Can I link my bank account to BitPay

You can log into your BitPay merchant dashboard to set up the bank account and cryptocurrency address you want to use to receive settlement from BitPay. You can also select the percentage of cryptocurrency and local currency you wish to receive in your settlements from BitPay.

Can the IRS see my crypto wallet

Yes, the IRS can track cryptocurrency, including Bitcoin, Ether and a huge variety of other cryptocurrencies. The IRS does this by collecting KYC data from centralized exchanges.

Does the IRS know I sold Bitcoin

Yes, the IRS can track crypto as the agency has ordered crypto exchanges and trading platforms to report tax forms such as 1099-B and 1099-K to them. Also, in recent years, several exchanges have received several subpoenas directing them to reveal some of the user accounts.

What bank does BitPay use

The BitPay Prepaid Mastercard is issued in the United States by Metropolitan Commercial Bank. The card is available and supported in all 50 US states.

Is there a way to buy crypto without SSN

Yes, you can purchase bitcoin without turning over your Social Security Number in the process. When you buy or sell bitcoin at an ATM, it will not be necessary to produce your SSN.

How much does BitPay charge to withdraw money

BitPay charges no transaction fees for purchases made within the U.S. but does charge 3% to cardholders traveling abroad to cover the cost of currency conversion. There is also a $2.50 fee to withdraw cash from an ATM.

What is the minimum transfer for BitPay

For Bitcoin (BTC) or Bitcoin Cash (BCH), the settlement minimum is 0.01 BTC or 0.01 BCH. For Gemini Dollars and USD Coin by CENTRE (USDC) the settlement minimum is 20 GUSD or 20 USDC. If you are settled via wire transfer, the settlement minimum is 10,000 USD/EUR.

What is the maximum deposit for BitPay

Adding Funds to Your Card Account.

loading” or “loading”) at any time. The maximum load amount is $10,000. Note: Some reload locations may have additional limits on the minimum amount you may load to your Card. The maximum aggregate value of funds in your Card Account(s) may not exceed $25,000 at any time.

How does IRS know if I sold crypto

Yes, the IRS can track crypto as the agency has ordered crypto exchanges and trading platforms to report tax forms such as 1099-B and 1099-K to them. Also, in recent years, several exchanges have received several subpoenas directing them to reveal some of the user accounts.

What crypto wallet does not report to IRS

Which crypto exchanges do not report to the IRS Currently, centralized exchanges like KuCoin and decentralized exchanges like Uniswap do not collect KYC (Know Your Customer) information from users.

How do I cash out crypto without paying taxes USA

Take out a cryptocurrency loan

Instead of cashing out your cryptocurrency, consider taking out a cryptocurrency loan. In general, loans are considered tax-free. If you need liquidity immediately, you should consider using your cryptocurrency as collateral to take a loan through a decentralized protocol.

What happens if I don’t report Bitcoin on taxes

Taxpayers are required to report all cryptocurrency transactions, including buying, selling, and trading, on their tax returns. Failure to report these transactions can result in penalties and interest.

What is the best crypto wallet without verification

11 Places To Buy Bitcoin Anonymously [Without ID Verification]Comparison of Platforms to Buy Bitcoin Without ID.#1) Pionex.#2) eToro.#3) CoinSmart.#4) Crypto.com.#5) Coinmama.#6) Binance.#7) Coingate.

What is the most anonymous crypto wallet

ZenGo- ZenGo is one of the top anonymous cryptocurrency wallets. The most secure non-custodial wallet in Web3 is thought to be ZenGo. It is simple to use and reduces private critical vulnerability. Users can send, receive, send, and keep cryptocurrency.

What is the minimum payment on BitPay

Settlement is paid daily to your cryptocurrency address on file. The minimum settlement is 0.01 BTC, 0.001 BCH, 1000 DOGE, 0.001 LTC, 0.2 ETH, 200 GUSD, 200 USDC, 200 PAX, 200 DAI, 0.01 WBTC, 10000000 SHIB, 20 XRP, 50 APE, or 200 EUROC.

Will IRS come after me for crypto

If you buy, sell or exchange crypto in a non-retirement account, you'll face capital gains or losses. Like other investments taxed by the IRS, your gain or loss may be short-term or long-term, depending on how long you held the cryptocurrency before selling or exchanging it.

Can the IRS see your crypto wallet

Blockchain transactions are recorded on a public, distributed ledger. This makes all transactions open to the public – and any interested government agency. Centralised crypto exchanges share customer data – including wallet addresses and personal data – with the IRS and other agencies.

How can I avoid IRS with crypto

9 Ways to Legally Avoid Paying Crypto TaxesBuy Items on Crypto Emporium.Invest Using an IRA.Have a Long-Term Investment Horizon.Gift Crypto to Family Members.Relocate to a Different Country.Donate Crypto to Charity.Offset Gains with Appropriate Losses.Sell Crypto During Low-Income Periods.

What happens if I don’t claim crypto on taxes

Investors must report crypto gains, losses and income in their annual tax return on Form 8940 & Schedule D. Evading crypto taxes is a federal offence. Penalties for tax evasion are up to 75% of the tax due (maximum $100,000) and 5 years in jail.