but some credit card issuers may have their own age requirements. By adding your child as an authorized user, their credit activity on the card will be reported to the credit bureaus, helping them build a credit history at a young age.

How can I build my credit at 16?

To build credit at 16, here are some steps you can take:

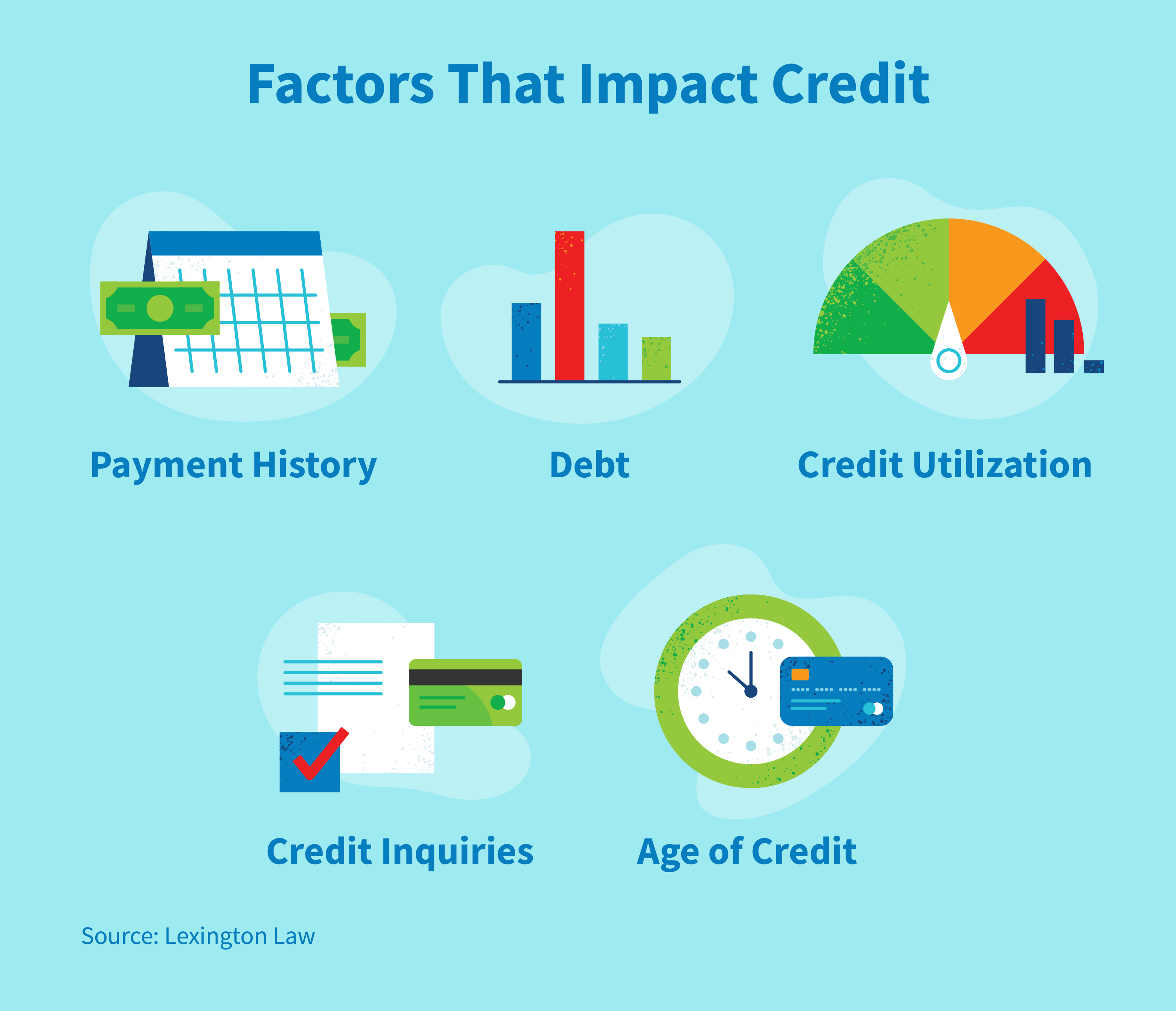

1. Educate yourself about credit basics: Understand how credit works, what factors affect your credit score, and how to manage credit responsibly.

2. Consider becoming an authorized user on your parent’s credit card: This allows you to piggyback on their good credit history and can help you start building your own credit.

3. Open a checking or savings account: Having a bank account and managing it responsibly can also contribute to building your credit.

4. Get a job: Having a steady income can show lenders that you’re financially responsible and capable of repaying debts.

5. Pay your bills on time: This includes any bills you may have in your name, such as a cell phone bill or a subscription service.

6. Obtain a secured credit card: A secured credit card requires a cash deposit as collateral and can help you build credit by making regular on-time payments.

7. Explore student credit cards: Some credit card issuers offer credit cards specifically designed for students, often with lower credit limits and tailored benefits.

8. Look into a credit-builder loan: This type of loan allows you to build credit by making small monthly payments that are reported to the credit bureaus.

9. Use credit responsibly: Once you have access to credit, make sure to use it responsibly by keeping your balances low and paying off your debts on time.

10. Monitor your credit: Regularly check your credit reports to ensure accuracy and identify any areas for improvement.

Can a 16-year-old have a credit score?

According to the Consumer Financial Protection Bureau (CFPB), there is no designated age for officially establishing a credit file. However, a 16-year-old can start building credit by becoming an authorized user on someone else’s credit card or by opening a secured credit card in their own name.

Can my 3-year-old start building credit?

In general, a child needs to be at least 13 to 15 years old to qualify as an authorized user on a credit card and start building credit. However, some credit card issuers do not have a minimum age requirement for adding authorized users. It’s worthwhile to check with individual card issuers to see if they allow adding young children as authorized users.

Is there a way to build credit at 17?

Yes, one way to help build credit for a 17-year-old is by adding them as an authorized user on your credit cards. As long as the card issuer reports the information to the credit bureaus and the credit bureaus include that information on credit reports, it can help your teen build their credit before turning 18.

Can a 16-year-old have a 700 credit score?

Regardless of age, those who are starting to build their credit score can begin with a range of 500 to 700. The average credit score for individuals in their 20s is around 660.

What credit score do you start with?

There is no specific “starting credit score.” Each individual begins with their own unique credit score that is based on how they use credit. Some people may start with a score of zero, while others may start with a higher score if they have a pre-existing credit history.

Can I get a credit card in my child’s name to build credit?

While not all credit issuers report authorized user activity to the credit bureaus, adding your child as an authorized user on your credit card can still help them build a credit history. This can be valuable for them in the future when they need to apply for credit on their own.

Can I build my baby’s credit?

If you’re interested in building your child’s credit before they turn 18, you can explore adding them as an authorized user on one or more of your credit cards. There is no legal minimum age for adding a child as an authorized user, although some credit card issuers may have their own age requirements.

Remember, building credit takes time and responsible credit management. Starting early and establishing good credit habits can set a strong foundation for your child’s financial future.

How can I build my credit at 16

How to build credit for teensEducate about credit basics.Consider authorized users on your credit card.Open a checking or savings account.Get a job.Pay bills on time.Obtain a secured credit card.Explore student credit cards.Look into a credit-builder loan.

Cached

Can a 16 year old have a credit score

Keep in mind that there's no designated age for officially establishing a credit file, according to the Consumer Financial Protection Bureau (CFB ).

Can my 3 year old start building credit

A child generally only needs to be 13 to 15 years old to qualify as an authorized user and start building credit, while some card issuers have no minimum age requirement at all (read about the minimum ages for each card issuer).

Is there a way to build credit at 17

Add your teen as an authorized user

You may be able to help your teen build their credit before they're 18 by adding them as an authorized user on your credit cards. That's if the card issuer reports information to the credit bureaus and the credit bureaus include that information on credit reports.

Cached

Can a 16 year old have a 700 credit score

Regardless of your age, those who are initially building their credit score can start from 500 to 700, with those in their 20s having an average score of 660.

What credit score do you start with

zero

Some people wonder whether the starting credit score is zero, for example, or whether we all start with a credit score of 300 (the lowest possible FICO score). The truth is that there's no such thing as a “starting credit score.” We each build our own unique credit score based on the way we use credit.

Can I get a credit card in my child’s name to build credit

Build credit

While not all credit issuers report authorized user activity to the credit bureaus, there's a good chance adding your child as an authorized user on your credit card could help them build a valuable credit history they'll need later in life.

Can I build my baby’s credit

If you're interested in building your child's credit before they turn 18, you can explore adding them as an authorized user to one or more of your credit cards. There is no legal minimum age for adding a child as an authorized user, however you should check your credit card issuer's policies.

Can a 2 year old get a credit card

Note, however, that kids cannot open their own credit card account. Anyone under the age of 18 can only be added as an authorized user on an adult's credit card account, which doesn't come with the exact same privileges — or the liability.

How to get a 700 credit score at 18

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

What is your credit score when you turn 18

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

Is 750 a good credit score at 18

Scores between 661 and 780 are considered good credit scores. Anything over 780 is excellent.

How good is a 800 credit score

A FICO® Score of 800 is well above the average credit score of 714. It's nearly as good as credit scores can get, but you still may be able to improve it a bit. More importantly, your score is on the low end of the Exceptional range and fairly close to the Very Good credit score range (740-799).

How long does it take to get a 700 credit score from 0

Depending on how well you utilize your credit, your credit score may get to anywhere from 500 to 700 within the first six months. Going forward, getting to an excellent credit score of over 800 generally takes years since the average age of credit factors into your score.

How much credit do you start with at 18

The credit history you start with at 18 is a blank slate. Your credit score doesn't exist until you start building credit. To begin your credit-building journey, consider opening a secured credit card or ask a family member to add you as an authorized user on their account.

Can I add my 5 year old to my credit card

Most credit card issuers allow children under 18 years to be added as authorized users on a credit card and some don't have any age restrictions whatsoever. Adding your kids as authorized users on your credit cards may seem counterintuitive to the concept of financial independence.

How do I start my child’s credit

If you're interested in building your child's credit before they turn 18, you can explore adding them as an authorized user to one or more of your credit cards. There is no legal minimum age for adding a child as an authorized user, however you should check your credit card issuer's policies.

Can I run my child’s credit

Checking the Credit of a Child Who Is 13 or Older

By visiting AnnualCreditReport.com – the only website federally authorized to provide credit reports from Experian, Equifax and TransUnion for free – your child can enter his or her personal information to receive a copy of each report.

Can I add my minor child to my credit card

If you're interested in building your child's credit before they turn 18, you can explore adding them as an authorized user to one or more of your credit cards. There is no legal minimum age for adding a child as an authorized user, however you should check your credit card issuer's policies.

Can I open a line of credit for my child

Add your child as an authorized user on your credit card

The easiest way to give your child a line of credit is to add them as an authorized user on your credit card. Your child will receive a credit card of their own, but it'll be linked to your credit card account—which means you'll be able to review their charges.

Is a 650 credit score good at 18

A 650 credit score is not a good credit score, unfortunately, as you need a score of at least 700 to have “good” credit.

What is a normal credit score at 18

roughly 679

What's the average credit score by age 18 According to Experian, the average credit score for 18 year olds is roughly 679.

How long does it take to get a 700 credit score from 500

6-18 months

The credit-building journey is different for each person, but prudent money management can get you from a 500 credit score to 700 within 6-18 months. It can take multiple years to go from a 500 credit score to an excellent score, but most loans become available before you reach a 700 credit score.

How does an 18 year old with no credit build credit

How to start building credit at age 18Understand the basics of credit.Become an authorized user on a parent's credit card.Get a starter credit card.Build credit by making payments on time.Keep your credit utilization ratio low.Take out a student loan.Keep tabs on your credit report and score.

What should a 22 year olds credit score be

So, given the fact that the average credit score for people in their 20s is 630 and a “good” credit score is typically around 700, it's safe to say a good credit score in your 20s is in the high 600s or low 700s.