Summary of the Article:

1. Unless your bank requires a minimum balance, you don’t need to worry about certain thresholds. It is recommended to keep no more than two months of living expenses in your checking account.

2. If you have more than 250k in the bank, you can consider opening an account at a different bank, adding a joint owner, getting an account in a different ownership category, joining a credit union, using IntraFi Network Deposits, opening a cash management account, or opting for an account with both FDIC and DIF insurance.

3. Depositing a check over $10,000 only results in an IRS form being filed by the bank. Unless suspected of fraud or money laundering, you won’t usually have to explain it.

4. If you’re looking to pay for everyday expenses, a checking account is recommended. If you want to grow your money, a savings account is a better fit.

5. High net worth individuals often keep millions of dollars in their checking accounts to cover expenses, even if it exceeds the FDIC insured limit.

6. The general rule of thumb is to have one or two months’ of living expenses in your checking account. Some experts recommend adding a 30 percent cushion to this number.

7. According to a survey, $100,000 is considered a financially healthy savings amount by 51% of Americans.

8. There is no maximum limit on how much money you can keep in your bank account, but your checking account balance is only FDIC insured up to $250,000.

Questions:

1. Is it OK to have a lot of money in a checking account?

2. What should I do if I have more than 250k in the bank?

3. What happens when I deposit a check over $10,000?

4. Is it better to keep money in checking or savings?

5. Do millionaires keep their money in a checking account?

6. What is the maximum amount I should keep in my checking account?

7. Is 100k in the bank too much?

8. What is the maximum amount of money I can keep in my bank account?

Answers:

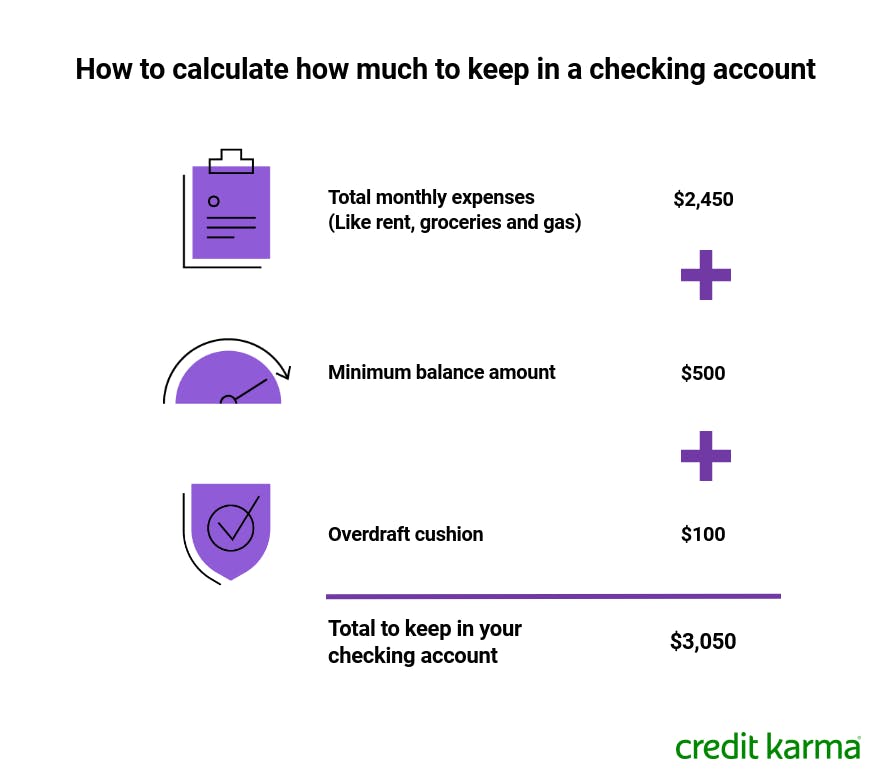

1. Unless your bank requires a minimum balance, you don’t need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, it is recommended to keep no more than two months of living expenses in your checking account.

2. If you have more than 250k in the bank, you can consider opening an account at a different bank, adding a joint owner, getting an account in a different ownership category, joining a credit union, using IntraFi Network Deposits, opening a cash management account, or opting for an account with both FDIC and DIF insurance.

3. Depositing over $10k only results in an IRS form being filed by the bank. You often won’t have to do anything to explain it unless you are suspected of fraud or money laundering.

4. If you’re just looking to pay for everyday expenses, a checking account is the way to go. If you’re focusing on growing your money, a savings account is a better fit. Regardless of the account type you choose, make sure you pick one suited to your financial needs and goals.

5. High net worth investors typically keep millions of dollars or even tens of millions in cash in their bank accounts to cover bills and unexpected expenses. Their balances are often way above the $250,000 FDIC insured limit.

6. The general rule of thumb is to try to have one or two months’ of living expenses in your checking account at all times. Some experts recommend adding 30 percent to this number as an extra cushion.

7. In fact, a good 51% of Americans say $100,000 is the savings amount needed to be financially healthy, according to the 2022 Personal Capital Wealth and Wellness Index. But that’s a lot of money to keep locked away in savings.

8. There is no maximum limit, but your checking account balance is only FDIC insured up to $250,000. However, it makes sense to put excess funds in other types of accounts, such as savings accounts, investments, or other financial instruments for better diversification and potentially higher returns.

Is it OK to have a lot of money in checking account

Unless your bank requires a minimum balance, you don't need to worry about certain thresholds. On the other hand, if you are prone to overdraft fees, then add a little cushion for yourself. Even with a cushion, Cole recommends keeping no more than two months of living expenses in your checking account.

What to do if you have more than 250k in the bank

Open an account at a different bank.Add a joint owner.Get an account that's in a different ownership category.Join a credit union.Use IntraFi Network Deposits.Open a cash management account.Put your money in a MaxSafe account.Opt for an account with both FDIC and DIF insurance.

What happens when you deposit over $10000 check

Depositing over $10k only results in an IRS form being filed by the bank. You often won't have to do anything to explain it unless you are suspected of fraud or money laundering.

Is it better to keep money in checking or savings

If you're just looking to pay for everyday expenses, a checking account is the way to go. If you're focusing on growing your money, a savings account is a better fit. Regardless of the account type you choose, make sure you pick one suited to your financial needs and goals.

Do millionaires keep their money in checking account

High net worth investors typically keep millions of dollars or even tens of millions in cash in their bank accounts to cover bills and unexpected expenses. Their balances are often way above the $250,000 FDIC insured limit.

What is the maximum you should keep in your checking account

The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number as an extra cushion.

Is 100k in the bank too much

In fact, a good 51% of Americans say $100,000 is the savings amount needed to be financially healthy, according to the 2022 Personal Capital Wealth and Wellness Index. But that's a lot of money to keep locked away in savings.

What is the maximum amount of money I can keep in my bank account

There is no maximum limit, but your checking account balance is only FDIC insured up to $250,000. However, as we'll cover shortly, it makes sense to put extra cash somewhere it will earn interest.

How much money can I deposit at the bank without being flagged

Federal law governs how much cash you can deposit before a bank reports it. Dec. 19, 2022, at 1:15 p.m. Does a Bank Report Large Cash Deposits Depositing a big amount of cash that is $10,000 or more means your bank or credit union will report it to the federal government.

What is the $3000 rule

Rule. The requirement that financial institutions verify and record the identity of each cash purchaser of money orders and bank, cashier's, and traveler's checks in excess of $3,000. 40 Recommendations A set of guidelines issued by the FATF to assist countries in the fight against money. laundering.

What is the best amount of money to keep in checking

The general rule of thumb is to try to have one or two months' of living expenses in it at all times. Some experts recommend adding 30 percent to this number as an extra cushion. To determine your exact living expenses, track your spending over several months, including all bills and discretionary spending.

How much money can you have in your bank account without being taxed

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

How much money in your bank account is considered rich

You might need $5 million to $10 million to qualify as having a very high net worth while it may take $30 million or more to be considered ultra-high net worth. That's how financial advisors typically view wealth.

Where do wealthy people put their money if not in the bank

Examples of cash equivalents are money market mutual funds, certificates of deposit, commercial paper and Treasury bills. Some millionaires keep their cash in Treasury bills. They keep rolling them over to reinvest them and liquidate them when they need the cash.

How much money is too much to keep in one bank

$250,000

Anything over that amount would exceed the FDIC coverage limits. So if you keep more than $250,000 in cash at a single bank, then you run the risk of losing some of those funds if your bank fails.

What percentage of Americans have $100000 in their bank account

More than one in 10 Americans do not have any savings

Almost one in ten men have $100,000 or more in savings, but the figure falls by four percentage points for women (9% men vs.

Is 20k in the bank a lot

Is $20,000 a Good Amount of Savings Having $20,000 in a savings account is a good starting point if you want to create a sizable emergency fund. When the occasional rainy day comes along, you'll be financially prepared for it. Of course, $20,000 may only go so far if you find yourself in an extreme situation.

Can I deposit 20k in my bank account

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.

Can you have too much money in a bank account

In the long run, your cash loses its value and purchasing power. Another red flag that you have too much cash in your savings account is if you exceed the $250,000 limit set by the Federal Deposit Insurance Corporation (FDIC) — obviously not a concern for the average saver.

What happens if I deposit 5000 cash in bank

Depending on the situation, deposits smaller than $10,000 can also get the attention of the IRS. For example, if you usually have less than $1,000 in a checking account or savings account, and all of a sudden, you make bank deposits worth $5,000, the bank will likely file a suspicious activity report on your deposit.

Where can I cash a $20000 check without a bank account

Cash it at the issuing bank (this is the bank name that is pre-printed on the check) Cash a check at a retailer that cashes checks (discount department store, grocery stores, etc.) Cash the check at a check-cashing store. Deposit at an ATM onto a pre-paid card account or checkless debit card account.

How much cash can I deposit without being flagged

Banks must report cash deposits totaling $10,000 or more

When banks receive cash deposits of more than $10,000, they're required to report it by electronically filing a Currency Transaction Report (CTR). This federal requirement is outlined in the Bank Secrecy Act (BSA).

Is depositing 3000 cash suspicious

As mentioned, you can deposit large amounts of cash without raising suspicion as long as you have nothing to hide. The teller will take down your identification details and will use this information to file a Currency Transaction Report that will be sent to the IRS.

What is the maximum amount you can keep in a bank account

FDIC insurance makes sure that depositors can get their money back in full when insured banks fail, but there is a catch: FDIC insurance is limited to $250,000 per depositor, per financial institution. Note that this $250,000 limit applies across all your accounts at a given bank.

Can I deposit 9000 cash in my bank account

If you plan to deposit a large amount of cash, it may need to be reported to the government. Banks must report cash deposits totaling more than $10,000. Business owners are also responsible for reporting large cash payments of more than $10,000 to the IRS.