Summary of the Article: Credit Score and Loan Approval Amounts

1. Despite high credit card balances, individuals with high credit scores (800+) have average credit card limits of $69,346.

2. Individuals with an 800 credit score may qualify for a personal loan up to $100,000, but lenders may consider factors like debt and debt-to-income ratio.

3. To qualify for a $100,000 personal loan, a credit score of at least 720 is recommended, and a score of 750 or above is ideal.

4. Consumers with exceptional credit scores have an average mortgage loan amount of $208,617 and average auto-loan debt of $17,030.

5. Achieving a perfect 850 credit score is rare but not impossible, with approximately 1.3% of consumers having one.

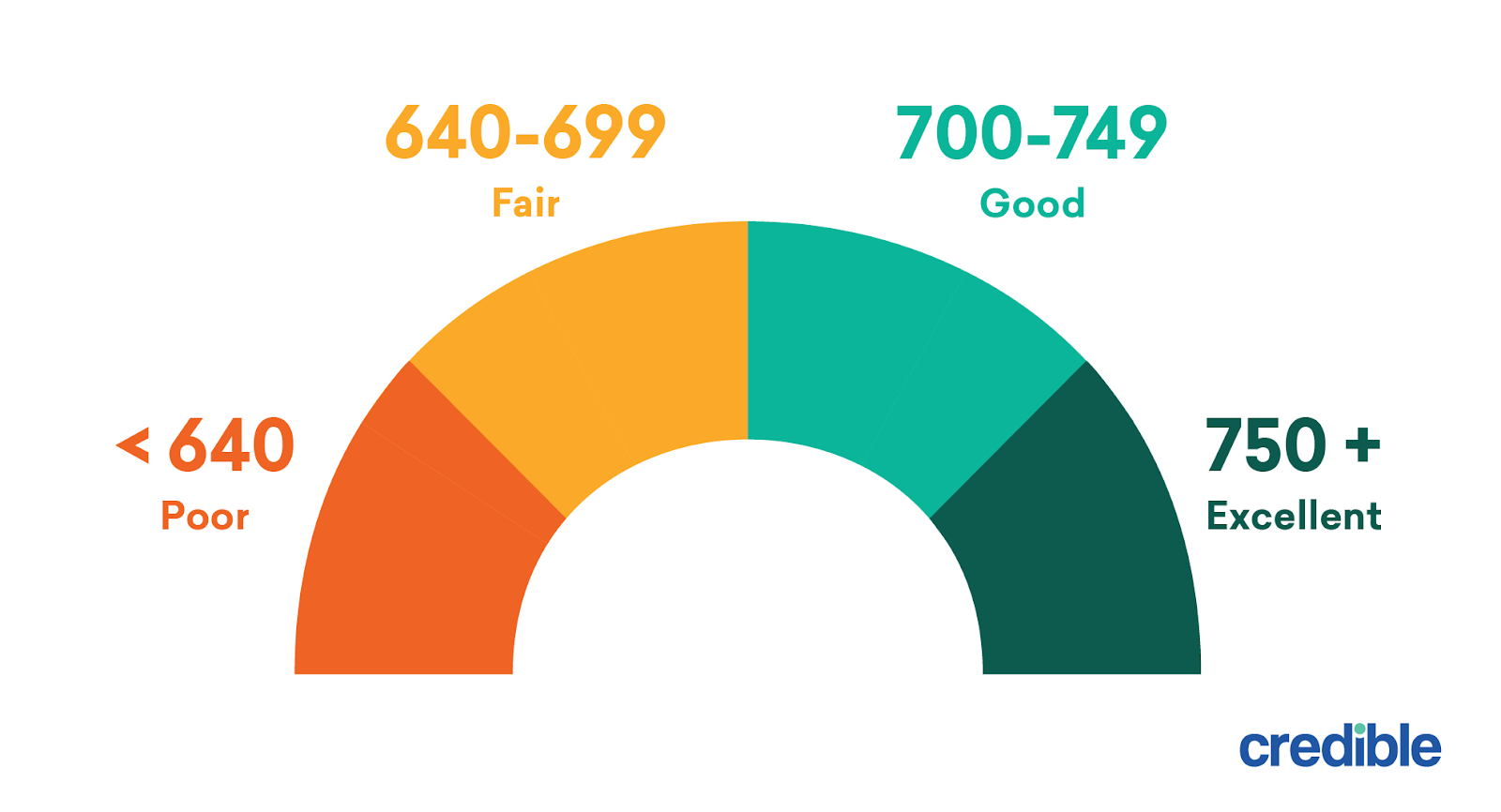

6. Credit scores ranging from 580 to 669 are considered fair, 670 to 739 are considered good, 740 to 799 are considered very good, and 800 and above are considered excellent.

7. To qualify for a $50,000 personal loan, a minimum credit score of 660 is typically required, along with sufficient income to afford the monthly payments.

8. A credit score of 640 or higher is recommended to qualify for a $20,000 personal loan.

Questions:

- How much can you get approved for with an 800 credit score?

- How much money can I borrow with an 800 credit score for a personal loan?

- Can I get a $100,000 loan with an 800 credit score?

- What is the loan amount for an 850 credit score?

- How rare is an 850 credit score?

- Is a 900 credit score considered good?

- Can I get a $50,000 personal loan with a 700 credit score?

- Can I get a $20,000 loan with a 750 credit score?

Answers:

- With an 800 credit score, the average credit card limits are $69,346.

- Individuals with an 800 credit score may qualify for a personal loan up to $100,000, but it depends on various factors such as debt and debt-to-income ratio.

- To qualify for a $100,000 personal loan, a credit score of at least 720 is recommended, and a score of 750 or above is ideal.

- Consumers with an 850 credit score have an average mortgage loan amount of $208,617 and an average auto-loan debt of $17,030.

- While achieving a perfect 850 credit score is rare, it’s not impossible, with approximately 1.3% of consumers having one.

- A credit score of 900 is considered excellent.

- To get a $50,000 personal loan, a minimum credit score of 660 is typically required, along with sufficient income to afford the monthly payments.

- A credit score of 750 or higher is recommended to qualify for a $20,000 personal loan.

How much can you get approved for with 800 credit score

Despite those high balances, it's equally important to note that those with high credit scores also have high credit card limits. For those with 800-plus scores, their average credit card limits are $69,346. That's up from the $58,514 average we found in May 2021.

Cached

How much money can I borrow with a 800 credit score personal loan

$100,000

With an 800 credit score you may qualify for a personal loan up to $100,000. However, if you have a lot of debt or an unfavorable debt-to-income ratio, some lenders may limit how much they are willing to loan. Most lenders use a variety of factors to qualify borrowers for a loan.

Cached

Can I get a 100k loan with 800 credit score

Check Your Credit Score

To qualify for a $100,000 personal loan, you should have a score of at least 720, though a score of 750 or above is ideal. Before you apply for a large personal loan, check your credit score so you know what kind of loan terms you're likely to qualify for.

How much of a loan can I get with an 850 credit score

The average mortgage loan amount for consumers with Exceptional credit scores is $208,617. People with FICO® Scores of 850 have an average auto-loan debt of $17,030.

How rare is a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

Is A 900 credit score good

Although ranges vary depending on the credit scoring model, generally credit scores from 580 to 669 are considered fair; 670 to 739 are considered good; 740 to 799 are considered very good; and 800 and up are considered excellent.

Can I get a $50,000 personal loan with 700 credit score

You will likely need a minimum credit score of 660 for a $50,000 personal loan. Most lenders that offer personal loans of $50,000 or more require fair credit or better for approval, along with enough income to afford the monthly payments.

Can I get a 20k loan with 750 credit score

You should have a 640 or higher credit score in order to qualify for a $20,000 personal loan. If you have bad or fair credit you may not qualify for the lowest rates. However, in order to rebuild your credit you may have to pay higher interest rates and make on-time payments.

What credit score do I need to get a 100k car

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.

Does anyone have 900 credit score

A 900 credit score may be the highest on some scoring models, but this number isn't always possible. Only 1% of the population can achieve a credit score of 850, so there's a certain point where trying to get the highest possible credit score isn't realistic at all.

How rare is 900 credit score

What percentage of the population has a credit score over 900 Only about 1% of people have a credit score of 850. A 900 credit score can be thought of as fairly unrealistic.

What credit score is needed for a $35000 personal loan

620

In order to qualify for a $35,000 loan, borrowers are generally required to have a credit score of at least 620. A good to excellent credit score not only gives you more options in terms of lenders, but it also improves your chances of approval and gives you access to the most flexible terms and lowest interest rates.

What do I need to get a 200k loan

What income is required for a 200k mortgage To be approved for a $200,000 mortgage with a minimum down payment of 3.5 percent, you will need an approximate income of $62,000 annually. (This is an estimated example.)

What credit score do I need to buy a $70000 car

To get an auto loan without a high interest rate, our research shows you'll want a credit score of 700 or above on the 300- to 850-point scale. That's considered prime credit, and lenders don't have to price much risk into their rates.

What credit score do I need to buy a $40000 car

A target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.40% or better, or a used-car loan around 8.75% or lower. Superprime: 781-850.

Is 800 credit score rare

According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Is 850 credit score rare

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

Has anyone gotten a 850 credit score

While achieving a perfect 850 credit score is rare, it's not impossible. About 1.3% of consumers have one, according to Experian's latest data. FICO scores can range anywhere from 300 to 850. The average score was 714, as of 2021.

Who has 850 credit score

The vast majority of consumers with an 850 FICO® Score are of the older generations, baby boomers and the silent generation.

What credit score do I need for a $70000 loan

670

If you have bad credit, your options for getting a $70,000 personal loan are more limited. Most lenders require a credit score of at least 670, and criteria may be strict for this large loan amount. That doesn't mean you're out of options.

How much do you have to make to qualify for a $300 000 loan

between $50,000 and $74,500 a year

To purchase a $300K house, you may need to make between $50,000 and $74,500 a year. This is a rule of thumb, and the specific salary will vary depending on your credit score, debt-to-income ratio, type of home loan, loan term, and mortgage rate.

How much do I need to make to buy a 400k house

The primary factor is your income — a $400,000 purchase typically requires a salary of at least $106,000. Other important considerations include your credit score, the size of your down payment and the details of your mortgage loan, including the interest rate.

What credit score do you need to buy a 100k car

To get an auto loan without a high interest rate, our research shows you'll want a credit score of 700 or above on the 300- to 850-point scale. That's considered prime credit, and lenders don't have to price much risk into their rates.

What credit score do I need to buy a $20000 car

Key Takeaways. Your credit score is a major factor in whether you'll be approved for a car loan. Some lenders use specialized credit scores, such as a FICO Auto Score. In general, you'll need at least prime credit, meaning a credit score of 661 or up, to get a loan at a good interest rate.

What credit score do you need for a $60000 car loan

In general, lenders look for borrowers in the prime range or better, so you will need a score of 661 or higher to qualify for most conventional car loans.