Summary of the Article:

AT&T bills are typically due on the same date every month. However, you may have a grace period of up to 14 days after the due date before late fees will apply.

There is no set time for how long your AT&T bill can be past due. It depends on your credit and payment history. Service could be suspended within a day of being past due or may take weeks. If you are a month past due and haven’t been suspended yet, it means you have a good payment history.

If you pay your AT&T bill after the due date, late fees will apply. Your service may also be suspended until the balance is paid. A convenience fee will be charged if you call or chat with AT&T to make or schedule a payment arrangement. If you don’t pay by the agreed-upon date and your service is suspended, you’ll owe a reconnection fee.

AT&T does not allow skipping a payment. The amount you commit to pay must be posted to your account by the agreed-upon date. If you don’t pay on time, your service may be suspended immediately and a reconnection or restoral fee may be charged. Some payment methods may not be available depending on your payment history.

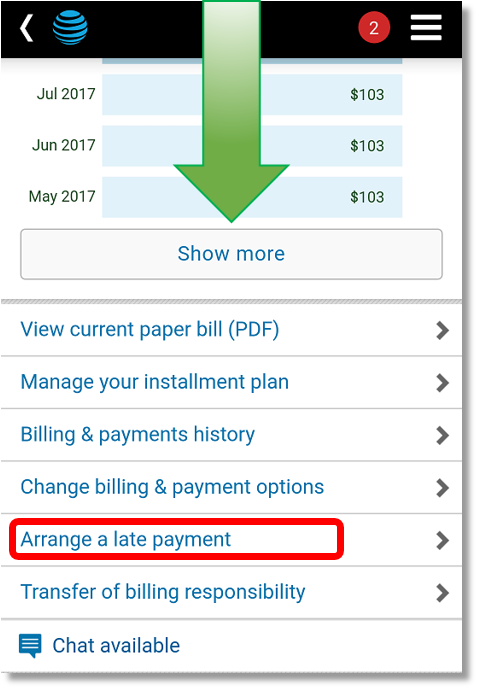

If you can’t pay your bill by the due date, you can set up a payment arrangement to delay your payment. This keeps your service active while letting AT&T know when and how you’ll pay your balance. You can make a payment arrangement by logging into your account with the myAT&T app or on att.com.

By making a late payment arrangement, you commit to paying your bill after the due date. A late fee may apply, and you may receive collection notices. If you don’t pay as agreed, your wireless service may be suspended immediately, and a reconnection fee may be charged.

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won’t appear on your credit reports until at least 30 days after you miss the payment. Late fees may be applied after the payment due date.

Questions:

- How many days does AT&T allow as a grace period?

AT&T allows a grace period of up to 14 days after the due date before late fees apply. - What happens if I pay my AT&T bill 3 days late?

If you pay your AT&T bill 3 days late, AT&T may charge a late fee and suspend your service until the balance is paid. - How long can your AT&T bill be past due?

There is no set time for how long your AT&T bill can be past due. It depends on your credit and payment history. Service could be suspended within a day of being past due or may take weeks. If you are a month past due and haven’t been suspended yet, it means you have a good payment history. - What happens if my AT&T bill is late?

If your AT&T bill is late, late fees will apply. AT&T may also charge a convenience fee if you call or chat to make or schedule a payment arrangement. If you don’t pay by the agreed-upon date and your service is suspended, you’ll owe a reconnection fee. - Will AT&T let you skip a payment?

AT&T does not allow skipping a payment. The amount you commit to pay must be posted to your account by the agreed-upon date. If you don’t pay on time, your service may be suspended immediately, and a reconnection or restoral fee may be charged. Some payment methods may not be available depending on your payment history. - Does AT&T do extensions?

AT&T offers payment arrangements to delay your payment if you can’t pay your bill by the due date. This keeps your service active while letting AT&T know when and how you’ll pay your balance. You can make a payment arrangement through the myAT&T app or on att.com. - What happens if I pay my phone bill 5 days late?

By making a late payment arrangement, you commit to paying your bill after the due date. A late fee may apply, and you may receive collection notices. If you don’t pay as agreed, your wireless service may be suspended immediately, and a reconnection fee may be charged. - What happens if you pay a bill 2 days late?

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won’t appear on your credit reports until at least 30 days after you miss the payment. Late fees may be applied after the payment due date.

How many days does AT&T allow as a grace

Share. Watch on. AT&T bills are typically due on the same date every month. However, you may have a grace period of up to 14 days after the due date before late fees will apply.

What happens if I pay my AT&T bill 3 days late

We may charge a late fee and suspend your service until your balance is paid.

Cached

How long can your AT&T bill be past due

There is no set time. It all depends on your credit and payment history. Service could be suspended within a day of being past due to weeks. You must have a good payment history if you are a month past due and haven't been suspended yet.

Cached

What happens if my ATT bill is late

Late fees apply if you pay your bill after the due date. We charge a convenience fee if you call or chat with us to make or schedule a payment arrangement. You'll owe a reconnection fee if you don't pay by the date you agreed to and we suspend your service.

Cached

Will AT&T let you skip a payment

The amount you commit to pay must be posted to your account by the agreed-upon date. If you don't pay on the date you've agreed, your service may be suspended immediately, and a reconnection or restoral fee may be charged. Depending on your payment history, some payment methods may not be available.

Does AT&T do extension

A payment arrangement (PA) is a way to delay your payment if you can't pay your bill by your due date. A payment arrangement keeps your service active while letting us know when and how you'll pay your balance. To make a payment arrangement: Log into your account with myAT&T app or at att.com.

What happens if I pay my phone bill 5 days late

By making a late payment arrangement, you commit to paying your bill after your due date. A late fee may apply, and you may receive collection notices. If you don't pay on the date you've agreed, your wireless service may be suspended immediately, and a reconnection fee may be charged.

What happens if you pay a bill 2 days late

Even a single late or missed payment may impact credit reports and credit scores. Late payments generally won't end up on your credit reports for at least 30 days after you miss the payment. Late fees may quickly be applied after the payment due date.

What happens if I pay my phone bill a few days late

Can a Late Mobile Phone Payment Hurt My Credit Score With most credit scoring models, late mobile payments won't have an impact on your credit score unless the account goes to collections or the service provider charges off the debt. Depending on the provider, this likely won't happen if you miss just one payment.

How much is AT&T late fee

Late Payment Fee Up to $6.50 $9 If you don't pay your bill by the due date. Non-Return Equipment Fee N/A $150 If you fail to return your equipment after canceling service.

How many payments can you miss before

And here, the answer is more complex, as it hangs on your relationship building with the lender. Most won't begin repossession until you miss three or more payments, but, as mentioned, they have the right to act after the first instance.

How many phone payments can you miss

Most utility companies won't disconnect your service after a single late payment. However, if you miss more than one payment, your services are at risk of being disconnected.

Does AT&T disconnect on weekends

No problem. If you cancel on a holiday, we'll take care of it the next regular business day. If you cancel during the weekend, we'll take care of it during our weekend operation hours that vary by region.

How many days can I go without paying my phone bill

Some utility providers will terminate service as early as one week after the bill's due date and require a hefty amount of money to restore these services. Other companies, like phone providers, may shut off service anywhere between 45 to 60 days after the bill is due.

Does a 5 day late payment affect credit score

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

What happens if I can’t pay my bills on time

Late payments can remain on your credit report for up to seven years, dragging down your credit score. Your assets may be seized. If you have a secured loan or credit card, the lender may seize any assets you put up as collateral, such as your car, home or bank account funds. You may be taken to court.

How many days can you go without paying your phone bill

Some utility providers will terminate service as early as one week after the bill's due date and require a hefty amount of money to restore these services. Other companies, like phone providers, may shut off service anywhere between 45 to 60 days after the bill is due.

Does a 7 day late payment affect credit score

Even a single late or missed payment may impact credit reports and credit scores. But the short answer is: late payments generally won't end up on your credit reports for at least 30 days after the date you miss the payment, although you may still incur late fees.

How bad will 1 late payment affect credit

Once a late payment hits your credit reports, your credit score can drop as much as 180 points. Consumers with high credit scores may see a bigger drop than those with low scores. Some lenders don't report a payment late until it's 60 days past due, but you shouldn't count on this when planning your payment.

Is a 30 day late payment bad

If you have otherwise spotless credit, a payment that's more than 30 days past due can knock as many as 100 points off your credit score. If your score is already low, it won't hurt it as much but will still do damage.

Why can’t I make a payment arrangement with AT&T

You can only set up a payment arrangement if you are bill is not yet due. If you are already past your due date it's too late at A T and T won't accept anything other than full payments to prevent suspension. If your due date has not yet arrived, you must pick from the available due dates.

How long does 1 late payment affect credit score

How long does a late payment affect credit A late payment will typically fall off your credit reports seven years from the original delinquency date.

How much does 1 late payment affect credit score

Your credit score can drop by as much as 100+ points if one late payment appears on your credit report, but the impact will vary depending on the scoring model and your overall financial profile.

Will a 2 week late payment affect credit score

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

How much does 1 30 day late affect your credit

A late payment can drop your credit score by as much as 180 points and may stay on your credit reports for up to seven years. However, lenders typically report late payments to the credit bureaus once you're 30 days past due, meaning your credit score won't be damaged if you pay within those 30 days.