Summary of the Article: How Fast Does Discover Card Take to Arrive

1. Applying and getting approved for a Discover credit card can happen within minutes.

2. However, receiving your card in the mail can take 7-10 business days.

Key Points:

- Discover card application process can be done quickly.

- Receiving the physical card may take longer.

15 Questions about Discover Card Arrival and Usage

1. How can I track when my Discover card will arrive?

Answer: You can check your Discover card application status online or over the phone by calling (800) 347-3085.

2. How do I know if my Discover card has arrived?

Answer: You can check your status by phone and call Discover’s customer service at (800) 347-2683.

3. If my Discover card doesn’t arrive, what should I do?

Answer: If you haven’t received your replacement Discover card in 7 business days, call (800) 347-2683 to check on it.

4. Is it recommended to have multiple credit cards?

Answer: It’s generally recommended to have two to three credit card accounts at a time, considering your credit scores and ability to manage monthly payments.

5. How are Discover cards delivered?

Answer: New Discover credit cards are sent via priority mail, usually taking 5 to 7 days to be delivered.

6. What is the highest credit limit on Discover it?

Answer: The highest credit card limit for the Discover it® Cash Back is $56,500, with a minimum starting limit of $500.

7. What is the average Discover card limit?

Answer: On average, Discover it® cardholders receive an initial credit limit of around $3,000.

8. Can I withdraw cash from my Discover card?

Answer: Yes, you can withdraw cash from your Discover credit card, but it is subject to cash advance fees and interest charges.

9. What are the benefits of using a Discover card?

Answer: Discover card benefits include cashback rewards, a 0% intro APR, fraud protection, and various perks depending on the specific card.

10. Can I transfer balances to a Discover card?

Answer: Yes, Discover cardholders can transfer balances from other credit cards, usually with a promotional 0% intro APR for balance transfers.

11. How can I increase my Discover credit limit?

Answer: You can request a credit limit increase online or by phone, based on your payment history, credit score, and income.

12. Are Discover cards widely accepted?

Answer: Discover cards are accepted at most major retailers and online merchants, but acceptance may vary internationally.

13. What is the customer service number for Discover?

Answer: The customer service number for Discover is (800) 347-2683.

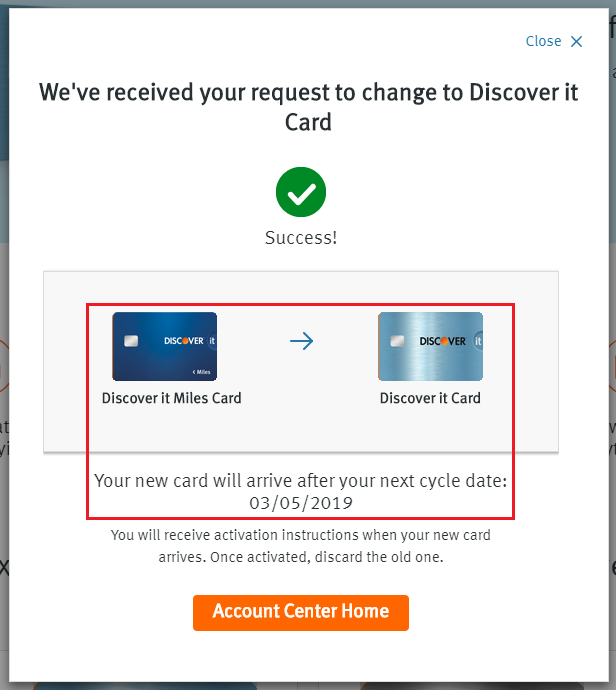

14. How can I activate my Discover card?

Answer: You can activate your Discover card online or by calling the customer service number listed on the card.

15. Are there any annual fees for Discover cards?

Answer: Many Discover credit cards do not have annual fees, but some may have specific benefits that come with an annual fee.

How fast does Discover card take to arrive

You can apply and get approved for a credit card within minutes. However, receiving your card in the mail can take 7-10 business days.

Cached

Can I track when my Discover card will arrive

How can I check my Discover card application status You can check your Discover card application status online or over the phone: (800) 347-3085.

How do I know if my Discover card arrived

Checking Your Status by Phone

If you prefer to check your status by phone, you can call Discover's customer service phone number at (800) 347-2683. The line is available at all times, and a real person should take your call.

Cached

Why hasn’t my Discover card come in the mail

If you're referring to a replacement Discover card, it should reach you in 4 to 6 business days. If it's been longer than 7 business days but you still haven't received your card, you should call (800) 347-2683 to check on it.

Cached

Should I have 3 credit cards

It's generally recommended that you have two to three credit card accounts at a time, in addition to other types of credit. Remember that your total available credit and your debt to credit ratio can impact your credit scores. If you have more than three credit cards, it may be hard to keep track of monthly payments.

How are Discover cards delivered

New Discover credit cards are always sent via priority mail, meaning that it would take 5 to 7 days to get your hands on a new card. That's free and it's way better than what other issuers offer – up to 10 business days by default.

What is the highest credit limit on Discover it

The highest credit card limit we've come across for the Discover it® Cash Back is $56,500. That's much higher than the minimum starting credit limit of $500. The card has a 0% intro APR on new purchases and balance transfers.

What is the average Discover card limit

In general, the average Discover it® cardholder received an initial limit of around $3,000, with higher limits going to those with exceptional credit and/or particularly high incomes.

How long does it take to receive credit card in mail

If you're approved for a new credit card, most companies say that your card will arrive within seven to 10 business days. That's just an estimate and consumers usually don't have to wait that long to get their credit cards. In many cases, you can receive your new card in the mail in five business days or less.

How do I find my Discover card number without my card

Your Discover credit card account number is the same as your Discover credit card number on the front of your card. If your physical card is not available, you can find your account number by logging in to your online Discover account, or by finding your latest paper statement.

Is 20 credit cards too many

There's no such thing as a bad number of credit cards to have, but having more cards than you can successfully manage may do more harm than good. On the positive side, having different cards can prevent you from overspending on a single card—and help you save money, earn rewards, and lower your credit utilization.

Is 21 credit cards too much

How many credit cards is too many or too few Credit scoring formulas don't punish you for having too many credit accounts, but you can have too few. Credit bureaus suggest that five or more accounts — which can be a mix of cards and loans — is a reasonable number to build toward over time.

How long does it take to get credit card in mail

Getting approved and getting your credit card are two different things, though. After you're approved, receiving the card in the mail can take from seven to 10 business days, depending on the issuer. Some credit card companies offer expedited delivery, either free or for a fee.

What is the credit limit for 50000 salary

What will be my credit limit for a salary of ₹50,000 Typically, your credit limit is 2 or 3 times of your current salary. So, if your salary is ₹50,000, you can expect your credit limit to be anywhere between ₹1 lakh and ₹1.5 lakh.

How much should I spend if my credit limit is $5000

This means you should take care not to spend more than 30% of your available credit at any given time. For instance, let's say you had a $5,000 monthly credit limit on your credit card. According to the 30% rule, you'd want to be sure you didn't spend more than $1,500 per month, or 30%.

Can I use my credit card before it arrives

What Is an Instant-Use Credit Card Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. Rewards, travel and store cards may all offer instant-use capabilities, but the specifics depend on the issuers' policies.

Can you track when your credit card is coming in the mail

The ways you can track the delivery of your new credit card depend on the issuer. Some credit card companies like Chase and Citi allow you to keep track of your credit card, while others like PNC and Wells Fargo don't.

Can I use my Discover card without the card

Yes, you can still insert or swipe when you need to. Your contactless Discover® card works just like you're used to in stores, in apps, online and for over-the-phone purchases. Plus it gives you the option to make contactless payments.

How do I get my credit card number before it arrives

You may also try signing in to your online banking account to search for your credit card number in your account information. Note that some issuers will only show you the virtual card number, not the one on the physical card. Calling your card's customer service phone number may also work.

Is it bad to have $2,000 on credit card

Editorial and user-generated content is not provided, reviewed or endorsed by any company. Yes, a $2,000 credit limit is ok, if you take into consideration that the median credit line is $5,394, according to TransUnion data from 2021.

How many people have $20,000 in credit card debt

Just as disturbing, 1 in 5 Americans have more than $20,000 in credit card debt. And 33% expect to spend at least two years paying it off, and 3% believe that they won't ever erase it.

Is a 750 credit limit good

So, if you're assigned a credit limit of $750, that's probably a pretty good limit. If you applied for a regular cash back rewards card, however, that same $750 limit could be considered a low credit limit. That's because the best cash back cards often have starting limits in the $1,500 to $2,500 range.

Is using 40% of credit card bad

Most credit experts advise keeping your credit utilization below 30 percent, especially if you want to maintain a good credit score. This means if you have $10,000 in available credit, your outstanding balances should not exceed $3,000.

Can I use a credit card before it arrives

What Is an Instant-Use Credit Card Instant use is a feature available on some credit cards that allows cardholders to use their credit card account before a physical card arrives in the mail. Rewards, travel and store cards may all offer instant-use capabilities, but the specifics depend on the issuers' policies.

What credit limit can I get with a 750 credit score

The credit limit you can get with a 750 credit score is likely in the $1,000-$15,000 range, but a higher limit is possible. The reason for the big range is that credit limits aren't solely determined by your credit score.