Summary of the Article:

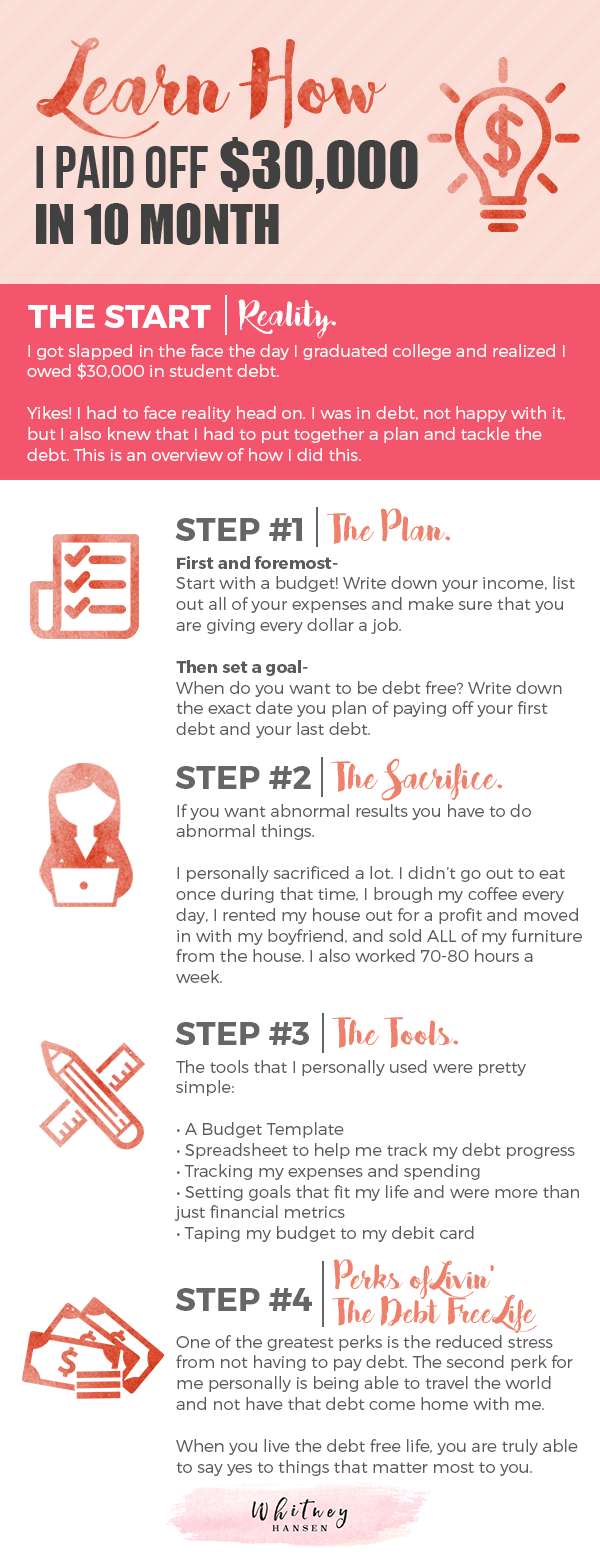

1. How to pay off a $30,000 loan fast: The article suggests five ways to pay off a loan early. These include making bi-weekly payments, rounding up your monthly payments, making one extra payment each year, refinancing, and boosting your income and putting all extra money towards the loan.

2. How to pay $30,000 debt in one year: The article presents a 6-step method that helped a 34-year-old person pay off $30,000 of credit card debt in 1 year. The steps include surveying the land, limiting and leveraging, automating minimum payments, paying extra and often, evaluating the plan often, and ramping up when ready.

3. Is 30k a lot of debt: While $30,000 may feel like a considerable amount of money, it is possible to pay off this debt with careful planning and calculated actions. The article suggests following certain steps to get started on the debt-payoff journey.

4. How to get out of 30k of debt: The article advises focusing on one debt at a time and making minimum payments on the others. It also suggests options like consolidating credit card debts, using a balance transfer credit card, and making a budget to prevent future overspending.

5. How much is a 60 month payment on a $30,000 loan: According to the article, the monthly payment for a $30,000 loan over 60 months would be $552.50.

6. How to pay off a $30,000 mortgage in 5 years: The article presents tips on paying off a $30,000 mortgage in 5 years or less. These include creating a monthly budget, purchasing a home within your means, making a large down payment, downsizing to a smaller home, paying off other debts first, living off less than your income, and considering a refinance.

7. How to pay off 20k in 6 months: The article shares personal experience on how the author paid off $20,000 in debt in 6 months. The steps include making a budget and sticking to it, cutting unnecessary spending, selling extra items, making more money, and being content with what you have.

8. Is $20,000 a lot of debt: The author explains that the best balance transfer and personal loan terms are often offered to individuals with strong credit scores. Although $20,000 is a significant credit card debt, there are ways to manage it.

Questions:

1. What are five ways to pay off a $30,000 loan early?

The five ways to pay off a $30,000 loan early are making bi-weekly payments, rounding up monthly payments, making an extra payment each year, refinancing, and increasing income to put towards the loan.

2. What is a 6-step method to pay off $30,000 of credit card debt in one year?

The 6-step method includes surveying the situation, limiting and leveraging, automating minimum payments, making extra payments frequently, evaluating the plan regularly, and ramping up efforts when ready.

3. Can $30,000 debt be paid off with careful planning and calculated actions?

Yes, with careful planning and calculated actions, it is possible to pay off $30,000 debt.

4. How can one get out of $30,000 debt?

One can get out of $30,000 debt by focusing on one debt at a time, consolidating credit card debts, using a balance transfer credit card, and making a budget to prevent overspending.

5. What is the monthly payment for a $30,000 loan over 60 months?

The monthly payment for a $30,000 loan over 60 months is $552.50.

6. How can one pay off a $30,000 mortgage in 5 years?

To pay off a $30,000 mortgage in 5 years, one can create a monthly budget, purchase a home within their means, make a large down payment, downsize to a smaller home, pay off other debts first, live off less than their income, and consider refinancing.

7. How did the author pay off $20,000 in debt in 6 months?

The author paid off $20,000 in debt in 6 months by making a budget and sticking to it, cutting unnecessary spending, selling extra belongings, increasing income, and being content with what they had.

8. Can $20,000 debt be managed?

Yes, although $20,000 is a significant credit card debt, it can be managed through options like balance transfers and personal loans, especially for individuals with strong credit scores.

How to pay off a $30,000 loan fast

5 Ways To Pay Off A Loan EarlyMake bi-weekly payments. Instead of making monthly payments toward your loan, submit half-payments every two weeks.Round up your monthly payments.Make one extra payment each year.Refinance.Boost your income and put all extra money toward the loan.

Cached

How to pay $30,000 debt in one year

The 6-step method that helped this 34-year-old pay off $30,000 of credit card debt in 1 yearStep 1: Survey the land.Step 2: Limit and leverage.Step 3: Automate your minimum payments.Step 4: Yes, you must pay extra and often.Step 5: Evaluate the plan often.Step 6: Ramp-up when you 're ready.

Is 30k a lot of debt

Many people would likely say $30,000 is a considerable amount of money. Paying off that much debt may feel overwhelming, but it is possible. With careful planning and calculated actions, you can slowly work toward paying off your debt. Follow these steps to get started on your debt-payoff journey.

How to get out of 30k of debt

Focus on one debt at a time. A good starting point is to focus your energy on paying down one debt at a time while only making minimum payments on the others.Consolidate your debts. Another option is to consolidate your credit card debts.Use a balance transfer credit card.Make a budget to prevent future overspending.

Cached

How much is a 60 month payment on a $30,000 loan

So, your monthly payment would be $552.50 ($30,000 + $3,150 ÷ 60 = $552.50).

How to pay off $30,000 mortgage in 5 years

How To Pay Off Your Mortgage In 5 Years (or less!)Create A Monthly Budget.Purchase A Home You Can Afford.Put Down A Large Down Payment.Downsize To A Smaller Home.Pay Off Your Other Debts First.Live Off Less Than You Make (live on 50% of income)Decide If A Refinance Is Right For You.

How to pay off 20k in 6 months

How I Paid Off $20,000 in Debt in 6 MonthsMake a Budget and Stick to It. You must know where your money goes each month, full stop.Cut Unnecessary Spending. Remember that budget I mentionedSell Your Extra Stuff.Make More Money.Be Happy With What You Have.Final Thoughts.

Is $20,000 a lot of debt

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

How much debt is unhealthy

Debt-to-income ratio targets

Generally speaking, a good debt-to-income ratio is anything less than or equal to 36%. Meanwhile, any ratio above 43% is considered too high.

What is an OK amount of debt

A common rule-of-thumb to calculate a reasonable debt load is the 28/36 rule. According to this rule, households should spend no more than 28% of their gross income on home-related expenses, including mortgage payments, homeowners insurance, and property taxes.

Is 20k in debt a lot

“That's because the best balance transfer and personal loan terms are reserved for people with strong credit scores. $20,000 is a lot of credit card debt and it sounds like you're having trouble making progress,” says Rossman.

How much is a 30K car payment for 72 months

The total interest amount on a $30,000, 72-month loan at 5% is $4,787—a savings of more than $1,000 versus the same loan at 6%. So it pays to shop around to find the best rate possible.

How much would a $30,000 car payment be

With a $1,000 down payment and an interest rate of 20% with a five year loan, your monthly payment will be $768.32/month.

Is it smart to pay off your house early

The Bottom Line

Paying off your mortgage early can save you a lot of money in the long run. Even a small extra monthly payment can allow you to own your home sooner. Make sure you have an emergency fund before you put your money toward your loan.

What happens if I pay an extra $100 a month on my mortgage

If you pay $100 extra each month towards principal, you can cut your loan term by more than 4.5 years and reduce the interest paid by more than $26,500. If you pay $200 extra a month towards principal, you can cut your loan term by more than 8 years and reduce the interest paid by more than $44,000.

What if I save $20 a week for 30 years

The Impact of Saving $20 per Week

| 5%* | 10%* | |

|---|---|---|

| 10 years | $13,700 | $18,200 |

| 20 years | $36,100 | $65,000 |

| 30 years | $72,600 | $188,200 |

| 40 years | $131,900 | $506,300 |

Is it possible to save $10,000 in 6 months

It's one thing to say you'd like to “save more money.” It's another thought process entirely to state a specific number and time frame, such as $10,000 in six months. Break it down, and that means you need to save $1,666.67 per month or roughly $417 per week.

What is considered high debt

Key Takeaways. Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%. Any debt-to-income ratio above 43% is considered to be too much debt.

How much debt is the average person in

The average American holds a debt balance of $96,371, according to 2021 Experian data, the latest data available.

How much is the average 25 year old in debt

Here's the average debt balances by age group: Gen Z (ages 18 to 23): $9,593. Millennials (ages 24 to 39): $78,396. Gen X (ages 40 to 55): $135,841.

How much would a 30K loan be a month

The monthly payment on a $30,000 loan will vary on your interest rate and repayment terms. For example, if your interest rate is 5% and your repayment terms are 4 years long, then your monthly payment would be approximately $690.

How much is a 30k car payment for 72 months

The total interest amount on a $30,000, 72-month loan at 5% is $4,787—a savings of more than $1,000 versus the same loan at 6%. So it pays to shop around to find the best rate possible.

What credit score do I need for a 30000 car loan

There's no set minimum credit score required to get an auto loan. It's possible to get approved for an auto loan with just about any credit score, but the better your credit history, the bigger your chances of getting approved with favorable terms.

At what age should my house be paid off

In fact, O'Leary insists that it's a good idea to be debt-free by age 45 — and that includes having your mortgage paid off. Of course, it's one thing to shed a credit card balance by age 45. But many people don't first buy a home until they reach their 30s.

What are 2 cons for paying off your mortgage early

Cons of Paying a Mortgage Off EarlyYou Lose Liquidity Paying Off a Mortgage.You Lose Access to Tax Deductions on Interest Payments.You Could Get a Small Knock on Your Credit Score.You Cannot Put The Money Towards Other Investments.You Might Not Be Able to Put as Much Away into a Retirement Account.