nd income. Then you allocate those amounts to different virtual envelopes for different expense categories. It’s a great option if you prefer the control of manually inputting your financial information without linking your bank accounts.[/wpremark]

What is the best financial app for iPhone The best budgeting apps

Mint: Best Overall.

PocketGuard: Best Budgeting App for Monitoring Cash Flow.

You Need a Budget: Best App for Debt Management.

Personal Capital: Best App for Investors.

Simplifi: Best. 11 Best Budgeting Apps for 2021: A Few You Haven’t .

Why is linking bank account safe While linking your bank account to a finance app may seem like a security risk, it’s actually quite safe. These apps use bank-level security measures to encrypt your information and keep it secure. Additionally, they often have strict privacy policies in place to protect your data. As long as you choose a reputable finance app, linking your bank account should not pose a significant security risk.

Can budgeting apps steal your money Budgeting apps are designed to help you track your spending and manage your finances, not steal your money. However, it’s important to be cautious when choosing a budgeting app and only select reputable ones with strong security measures in place. It’s also crucial to regularly monitor your accounts and report any suspicious activity immediately.

How do I keep track of my spending without a budget app If you prefer not to use a budget app, you can still keep track of your spending by using a pen and paper or a spreadsheet. Set up categories for your expenses and track how much you spend in each category. You can also use a spending tracker template or create your own. The key is to make a habit of recording your expenses regularly and reviewing your spending patterns to make adjustments as needed.

What is the best free budget app PocketGuard is the best free budget app. It offers a comprehensive suite of budgeting tools and features while remaining completely free to use. With PocketGuard, you can track your spending, set savings goals, and get personalized insights and recommendations to help you improve your financial health. It’s a great option for individuals and families looking to take control of their finances without breaking the bank.

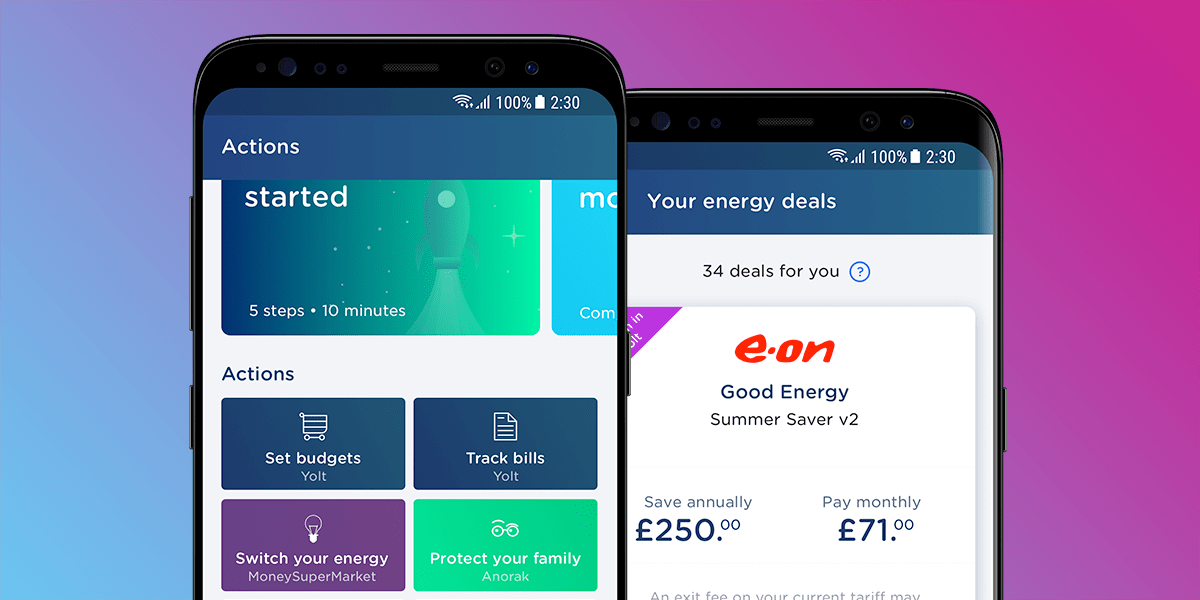

Can I use Yolt on my computer Yes, you can use Yolt on your computer by accessing the Yolt web app. Simply visit the Yolt website and sign in with your Yolt account credentials. The web app offers the same features and functionality as the mobile app, allowing you to manage your finances and track your spending from the convenience of your computer.

Is Yolt safe to link bank accounts Yes, Yolt is safe to link bank accounts. Yolt uses bank-level security measures to encrypt your financial information and keep it secure. They also adhere to strict privacy policies to protect your data. However, it’s important to always exercise caution when linking your bank accounts to any third-party app or service. Make sure to choose reputable apps and regularly monitor your accounts for any unauthorized activity.

Is there a limit to how many accounts I can link to Yolt No, there is no limit to how many accounts you can link to Yolt. You can connect multiple bank accounts and credit cards to Yolt, allowing you to view all your financial information in one place. This makes it easy to track your spending and manage your money across all your accounts.

What happened to Yolt

In a wildcard move, our much-loved smart money app YOLT has decided to close the curtains. They say that their mission is to “give everyone the power to be smart with their money”, but it seems they will now be taking that vision in a new direction.

Cached

What is a Yolt account

Yolt is a banking app with a prepaid debit card that tracks your account and spending using open banking, a practice that allows you to share your financial information with third-parties.

What app stops me from spending money

Compare the Best Budgeting Apps

| App | Free Trial | Price |

|---|---|---|

| You Need a Budget (YNAB): Best Overall | 34 days | $99 per year |

| Mint: Best Free Budgeting App | N/A | Free |

| Simplifi by Quicken: Best for Cash Flow | 30 days | $47.99 per year |

| PocketGuard: Best for Overspenders | Free version available, no free trial of paid version | Free / $39.99 per year |

What is similar to Yolt

A comprehensive list of competitors and best alternatives to Yolt.Emma.Money Dashboard.Mint.You Need A Budget.Albert.Goodbudget.Spendee.Emma.

Do mortgage lenders use open banking

Open banking also helps lenders to assess the risk associated with a mortgage loan more accurately. By analysing a borrower's financial data, lenders can better determine the borrower's ability to repay the loan. This leads to more accurate loan decisions, which benefit both the borrower and the lender.

Are free budgeting apps safe

Further, avoid using third-party money management tools, like budgeting apps, on public WiFi networks, as they tend to be less secure and could put you at risk for hacking. When using any kind of third-party tool, be sure to treat account security as a continuous and necessary step in your financial journey.

How do I stop apps from taking money off my card

Tap on any app you no longer want to pay for, scroll to the bottom and hit Cancel Subscription. (On newer Android devices, go to Settings -> Google -> Manage Google Accounts -> Payments and Subscriptions -> Manage Subscriptions.)

What is the best budgeting app that does not link to bank account

Goodbudget, for hands-on envelope budgeting

This app doesn't connect your bank accounts. You manually add account balances (that you can pull from your bank's website), as well as cash amounts, debts and income. Then you assign money toward envelopes. You can access the app from your phone and the web.

Which budget app is best without sync with bank

Goodbudget, for hands-on envelope budgeting

This app doesn't connect your bank accounts. You manually add account balances (that you can pull from your bank's website), as well as cash amounts, debts and income. Then you assign money toward envelopes. You can access the app from your phone and the web.

What is the cutest budgeting app

Fleur is a cute and simple budget planner and tracker app. The app allows you to easily add daily expenses and income. You can also set a monthly budget, create multiple accounts and track your debt.

Why not to use open banking

Open Banking is a great alternative to the current financial system. It offers many advantages, but it also has some disadvantages, being the security risks of sharing data the most important drawback.

Is it better to use an online mortgage lender or bank

You May Get Lower Rates and Fees

Unlike a brick-and-mortar bank, online mortgage lenders often operate without having to cover a lot of overhead. As a result, they might be able to pass the savings to their customers in the form of lower interest rates or lower fees.

What is the best free budget app not linked to bank account

Goodbudget, for hands-on envelope budgeting

This app doesn't connect your bank accounts. You manually add account balances (that you can pull from your bank's website), as well as cash amounts, debts and income. Then you assign money toward envelopes. You can access the app from your phone and the web.

How can apps afford to be free

Free apps are monetized through various means, including advertising, in-app purchases, sponsorship, and affiliate marketing.

Does deleting an app stop charges

Tip: If you have a subscription with an app and the app gets removed from Google Play, your future subscription will be canceled.

Does uninstalling an app cancel subscription

Cancel a subscription on the Google Play app

Note: Uninstalling the app will not cancel your subscription. On your Android phone or tablet, open the Google Play Store. Check to make sure you're signed in to the correct Google Account. Tap Menu > Subscriptions.

What budget app doesn t require bank info

Fudget is a free manual budgeting app that doesn't require you to sync your bank accounts to use. The app features a simple, easy-to-use interface. Fudget has a free version and a paid Pro version with a $3.99 one-time fee.

Is there a money app that doesn t require a bank account

Send via mobile wallet

There are plenty of popular apps like Venmo, Cash App, Google Pay and similar services. Mobile wallets can often be created without a bank account, and some of them even allow you to access your funds through a debit card that connects directly to your account balance.

Is it worth it to pay for a budgeting app

They keep you more accountable than a bank account alone. With a budget app, you'll see every transaction and it's total amount, and you can categorize your payments into different types such as groceries, recreation, bills and more. This way, you can more easily see where the bulk of your money goes.

What bank apps are like one finance

Top 6 ONE competitorsChime.Current.Aspiration.Wells Fargo & Company.Varo Bank.Zeta.

Are budgeting apps worth the money

No Accountability. Budgeting apps give you the tools you need to manage your money. But they don't enforce any consequences if you don't use those tools. At the end of the day, it's up to you to analyze your spending and figure out where your money's going and what you might need to change to improve your finances.

What are the drawbacks of open banking

Some of the drawbacks of Open Banking are: Low customer credibility: until now there has been an apathy or lack of credibility on the part of customers towards Open Banking. It is partly due to the fear of sharing their data, as well as to their lack of knowledge of how it works.

What are the disadvantages of open banking for banks

Disadvantages of Open BankingRisk of Data Leakage: Open banking relies on the extensive transfer of banking data across various information channels.Ambiguity About Ownership of Transactions: Also, when it comes to open banking, there is ambiguity about who really owns the data of the customer.

What are some cons of using an online lender

The Cons of Getting a Mortgage OnlineGetting Help May Be Harder. If you're applying for a mortgage through a local bank or a broker, you'll probably be able to call them at any time within business hours to get answers to your questions.Rates Aren't Guaranteed.

Why does my realtor want me to use a local lender

Some realtors will have a preferred lender that they can recommend to you. They might prefer that lender because they've built a good working relationship with the lending team.